Vehicle Purchase Tax Deduction 2022 Verkko 18 elok 2023 nbsp 0183 32 Is Buying a Car Tax Deductible in 2022 Is there such a thing as a car purchase tax deduction While new cars aren t fully

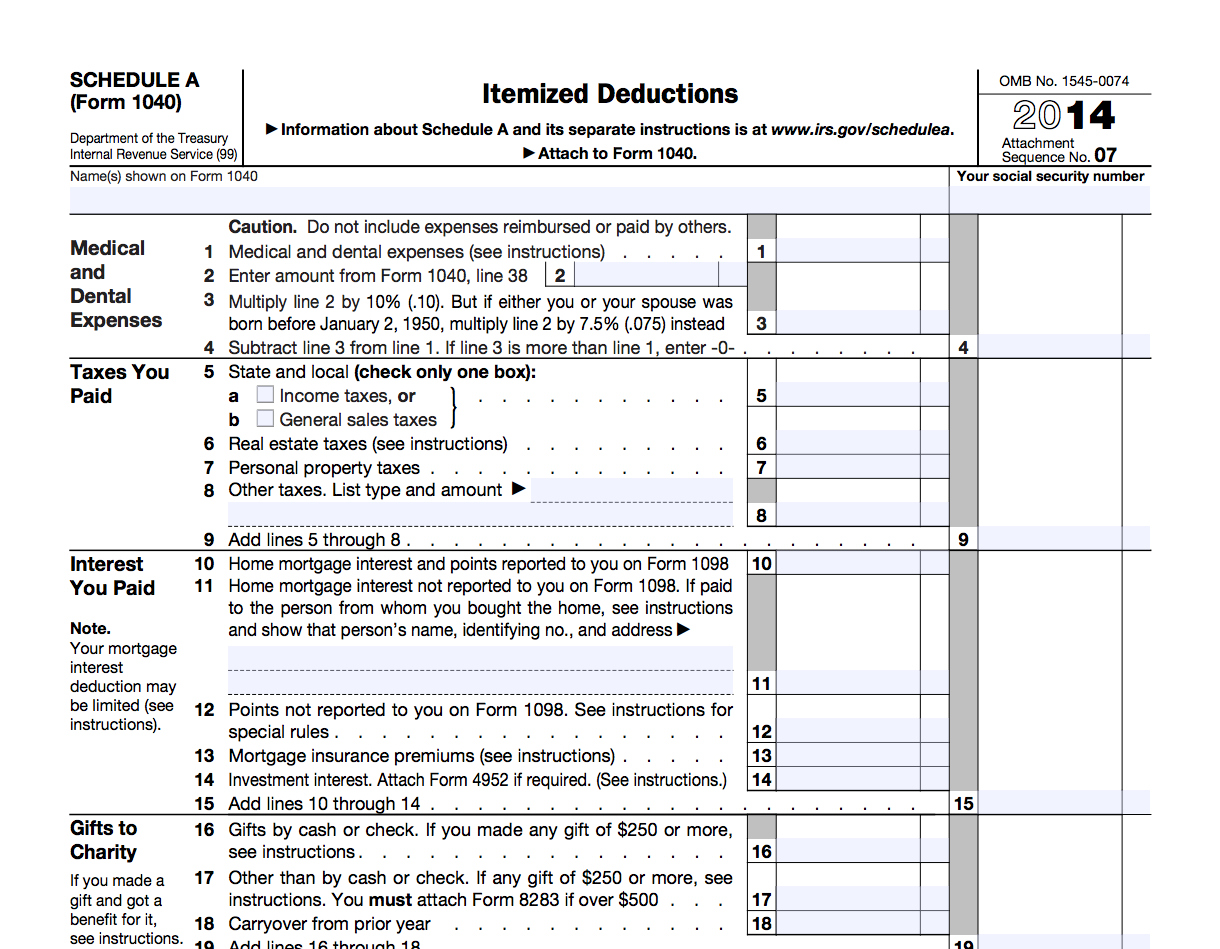

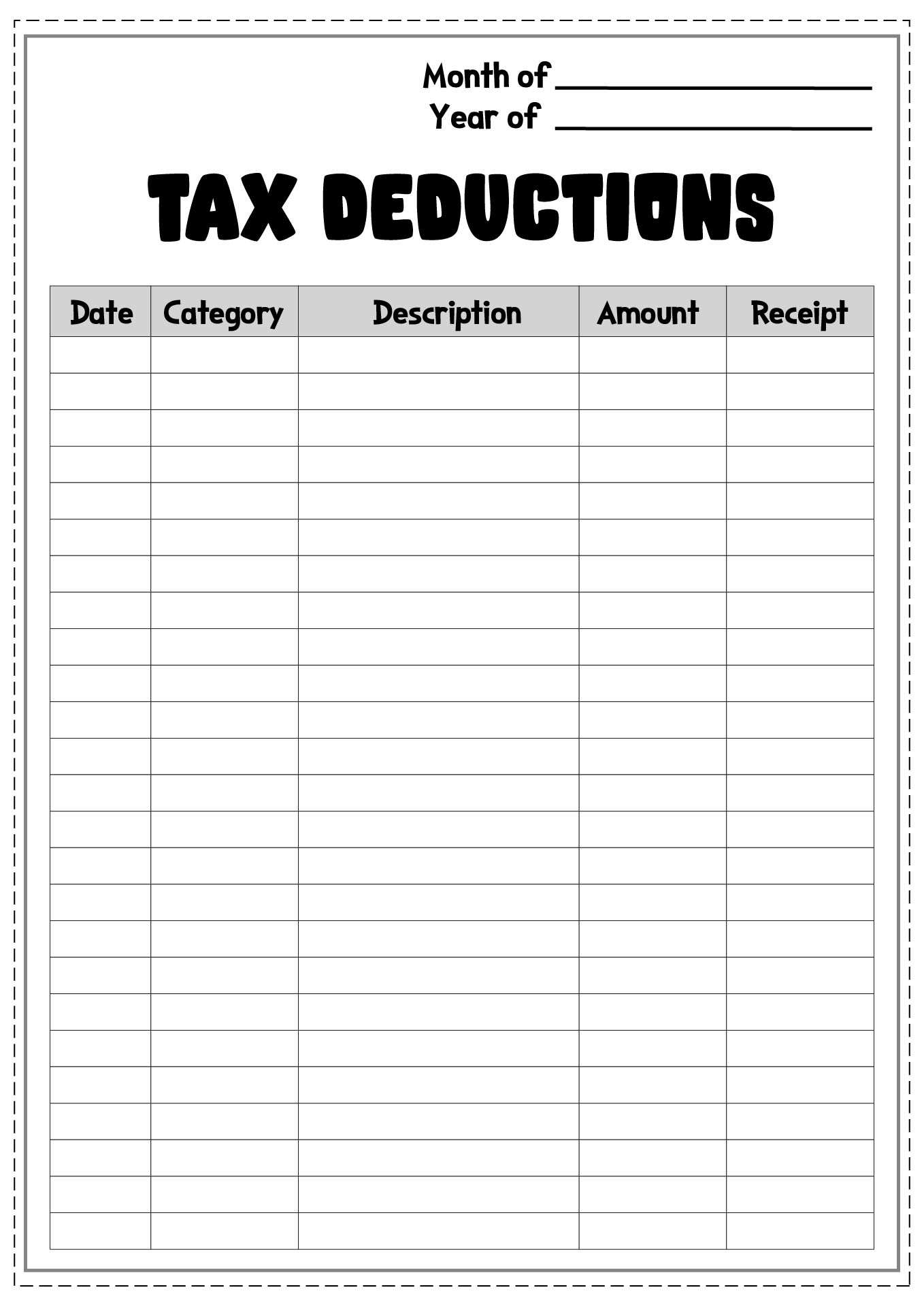

Verkko All vehicles new cars second hand cars passenger cars caravans commercial vehicles buses etc are subject to VAT Umsatzsteuer at a rate of 20 when the Verkko 22 tammik 2023 nbsp 0183 32 SALES TAX You can enter the sales tax you paid for the car you purchased in 2022 by going to Federal gt Deductions and Credits gt Estimates and Other

Vehicle Purchase Tax Deduction 2022

Vehicle Purchase Tax Deduction 2022

https://images.squarespace-cdn.com/content/v1/5a60cb144c0dbf811647fce8/80259db2-916f-487a-833e-88aead19febd/2022-standard-deduction+copy.jpg

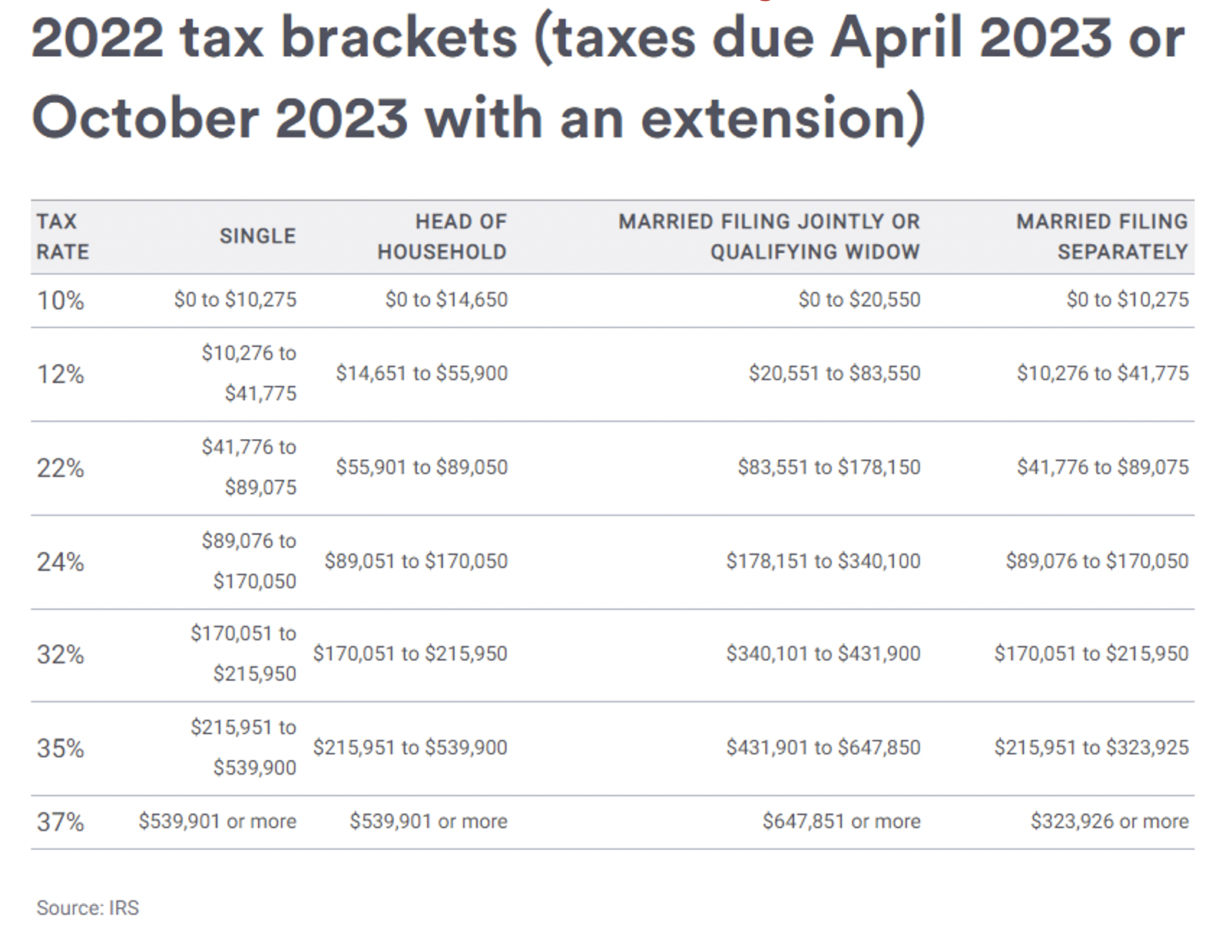

Should You Take The Standard Deduction On Your 2021 2022 Taxes

https://www.taxdefensenetwork.com/wp-content/uploads/2021/12/20212022-Standard-Deduction-.jpg

Sales Tax Deduction 2021

https://1044form.com/wp-content/uploads/2020/08/5-popular-itemized-deductions-8.jpg

Verkko The maximum amount you can elect to deduct for most section 179 property including cars trucks and vans you placed in service in tax years beginning in 2022 is 1 080 000 This limit is reduced by the Verkko 17 maalisk 2022 nbsp 0183 32 The IRS has announced the 2022 inflation adjusted Code 167 280F luxury automobile limits on certain deductions that may be taken by taxpayers using

Verkko 22 marrask 2022 nbsp 0183 32 Thanks to the Tax Cuts and Jobs Act TCJA you can write off the cost of a vehicle purchase in 2022 including in many cases up to 100 percent of the cost faster than ever before Verkko 2 p 228 iv 228 228 sitten nbsp 0183 32 Looking at the average annual tax revenue per motor vehicle in major EU markets it largely differed in 2022 Spain 1 148 collected the least tax per

Download Vehicle Purchase Tax Deduction 2022

More picture related to Vehicle Purchase Tax Deduction 2022

New Car Purchase Tax Deduction How Much Of A New Car Can You Write Off

https://phantom-marca.unidadeditorial.es/6935d35c15b4387c78a06b5c1e7e3ea6/crop/89x0/1156x711/f/jpg/assets/multimedia/imagenes/2023/02/19/16767981217503.png

Potentially Bigger Tax Breaks In 2023

https://static.fmgsuite.com/media/InlineContent/originalSize/984f6148-60aa-49b7-971c-fb3554606b40.jpg

11 MMajor Tax Changes For 2022 Pearson Co CPAs

https://www.pearsoncocpa.com/wp-content/uploads/2022/05/Screen-Shot-2022-05-17-at-11.22.53-PM.png

Verkko 31 jouluk 2022 nbsp 0183 32 Thanks to the Tax Cuts and Jobs Act TCJA you can write off the cost of a vehicle purchase in 2022 including in many cases up to 100 percent of the Verkko 25 elok 2023 nbsp 0183 32 As noted earlier vehicles are classified as a five year property under MACRS Using the 200 declining rate you get to a 40 depreciation rate 200 5

Verkko The 2022 total deduction limit is higher at 1 080 000 with spending for equipment purchases capped at 2 700 000 These deductions reduce qualified expenditures on Verkko 2 hein 228 k 2022 nbsp 0183 32 The Maximum Section 179 deduction for heavy vehicles is 26 200 in 2022 The Section 179 is NOT the only way to write off heavy vehicles You can use

Budget 2022 Tax Deduction Hiked From 10 To 14 On NPS Accounts

https://resize.indiatvnews.com/en/resize/newbucket/715_-/2022/02/rupee-43955531920-909896-1604229961-1643698525.jpg

HMRC Company Car Tax Rates 2020 21 Explained

https://blog-media.vimcar.com/uk-blog/uploads/2021/04/21142208/Optimized-210419_car-taxes-1024x683.jpg

https://www.keepertax.com/posts/is-buying-…

Verkko 18 elok 2023 nbsp 0183 32 Is Buying a Car Tax Deductible in 2022 Is there such a thing as a car purchase tax deduction While new cars aren t fully

https://www.acea.auto/files/ACEA_Tax_Guide_2022.pdf

Verkko All vehicles new cars second hand cars passenger cars caravans commercial vehicles buses etc are subject to VAT Umsatzsteuer at a rate of 20 when the

Irs Introduces New Tax Brackets Standard Deductions For 2022 Wealthmd

Budget 2022 Tax Deduction Hiked From 10 To 14 On NPS Accounts

Tax Deductions Guide For 2022 For An Employer For Maximum Savings

Tax Rates Absolute Accounting Services

13 Car Expenses Worksheet Worksheeto

California Individual Tax Rate Table 2021 2022 Brokeasshome

California Individual Tax Rate Table 2021 2022 Brokeasshome

Tax Form Itemized Deduction Worksheet

8 Tax Preparation Organizer Worksheet Worksheeto

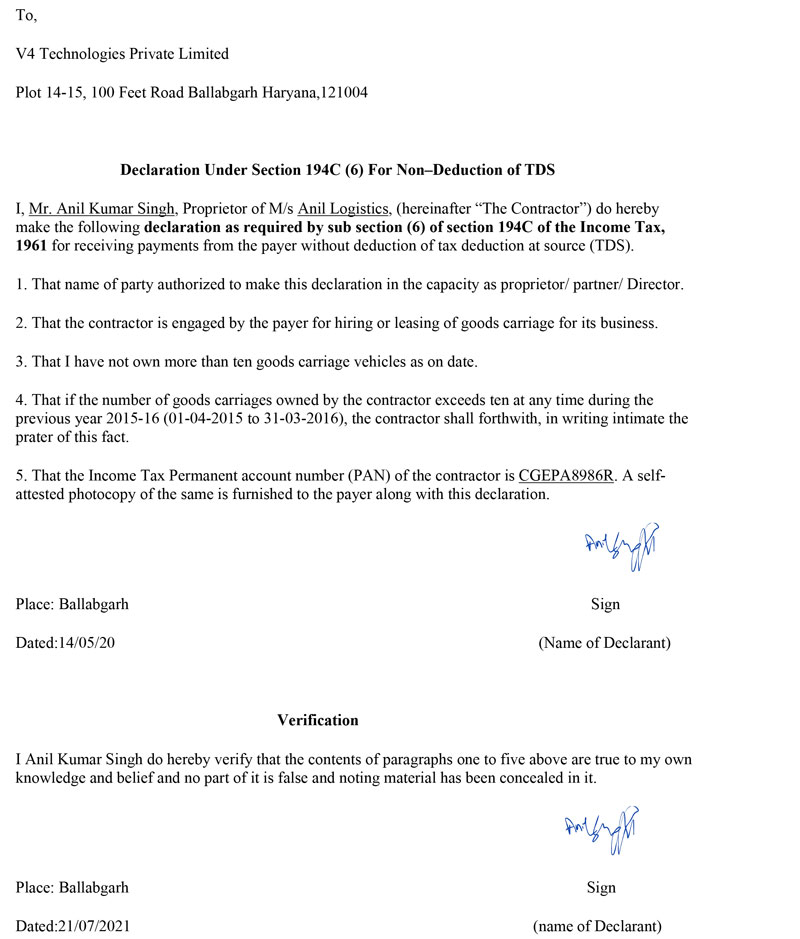

Transporters Declaration For Nondeduction Of Tds U S 194c Drafting

Vehicle Purchase Tax Deduction 2022 - Verkko March 30th 2022 Why use LendingTree Buying a car for personal or business use may have tax deductible benefits The IRS allows taxpayers to deduct either local and