Tax Rebate Cares Act In response to the COVID 19 pandemic dramatic global reduction in economic activity occurred as a result of the social distancing measures meant to curb the virus These measures included working from home widespread cancellation of events cancellation of classes or moving in person to online classes reduction of travel and the closure of businesses In March it was predicted that without government intervention most airlines around the world

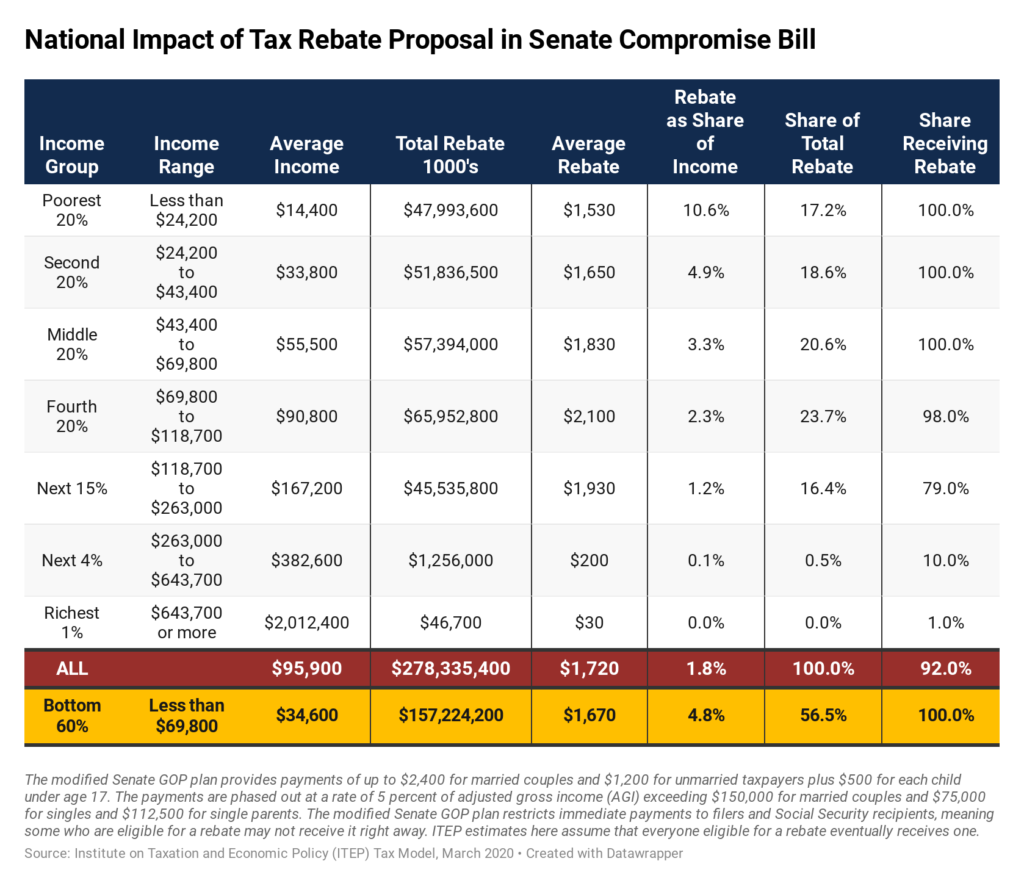

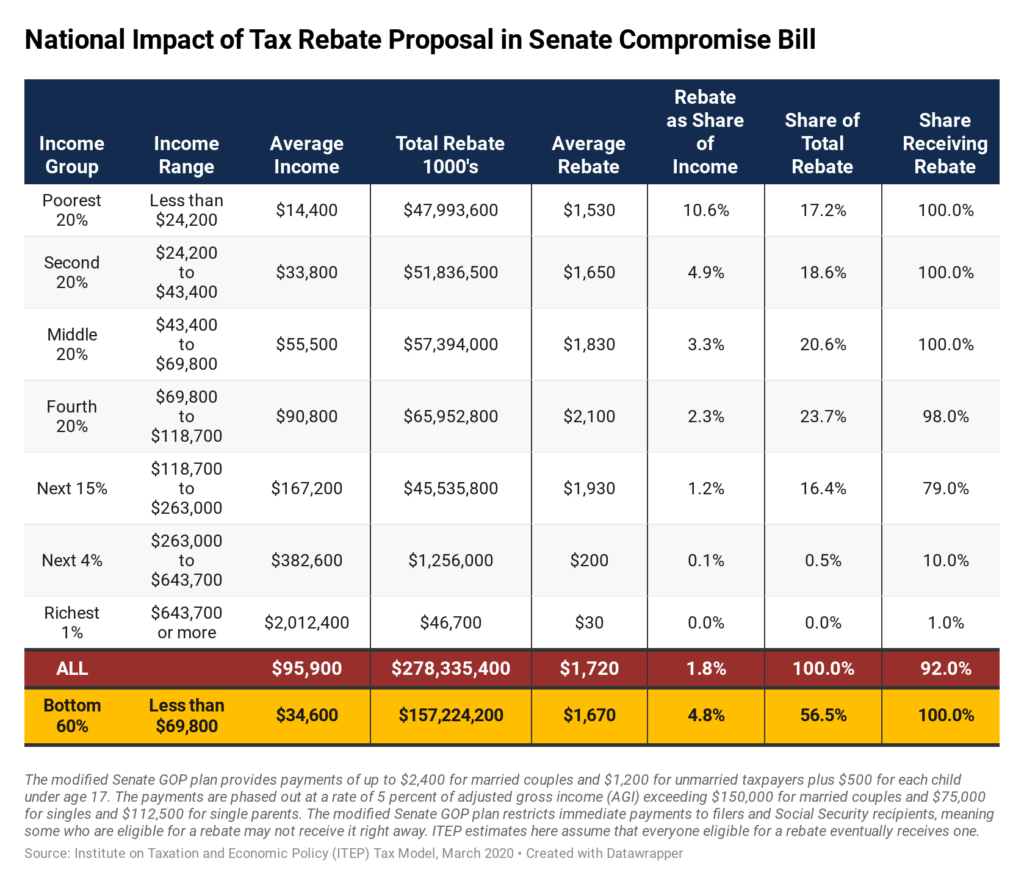

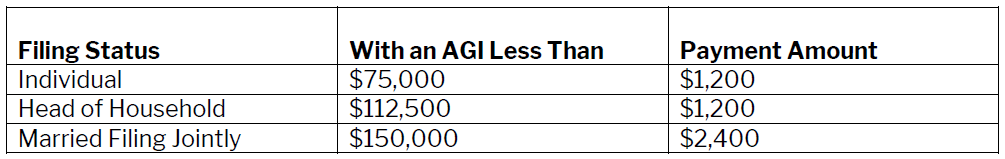

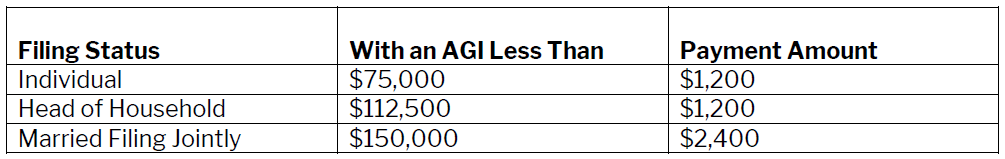

Web 30 mars 2020 nbsp 0183 32 Recovery Rebate for individual taxpayers The bill would provide a 1 200 refundable tax credit for individuals 2 400 for joint taxpayers Additionally taxpayers Web Get an overview of the COVID 19 related employee retention tax credits The Coronavirus Aid Relief and Economic Security Act CARES Act enacted on March 27 2020

Tax Rebate Cares Act

Tax Rebate Cares Act

https://www.carrebate.net/wp-content/uploads/2022/08/tax-rebates-in-the-federal-cares-act-itep.png

The CARES Act Recovery Rebates Fee Only Financial Advisor Deer Park

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/the-cares-act-recovery-rebates-fee-only-financial-advisor-deer-park-2.png?resize=1024%2C884&ssl=1

Top CARES Act Rebate CPA Firm For San Jose Restaurants Get ERTC Fast

https://i.pinimg.com/736x/7e/7c/a1/7e7ca1aca925ce12c1ad284eb5cfd024.jpg

Web Under the Coronavirus Aid Relief and Economic Security Act CARES Act as originally enacted March 27 2020 the Employee Retention Credit is a refundable tax credit Web 17 avr 2020 nbsp 0183 32 The Coronavirus Aid Relief and Economic Security Act CARES Act P L 116 136 which was signed into law by President Trump on March 27 2020 includes

Web 28 avr 2020 nbsp 0183 32 Tax relief for individuals and businesses in the CARES Act includes a one time rebate to taxpayers modification of the tax treatment of certain retirement fund Web 20 mars 2020 nbsp 0183 32 The Coronavirus Aid Relief and Economic Security CARES Act S 3548 as introduced on March 19 2020 proposes direct payments of up to 1 200 per

Download Tax Rebate Cares Act

More picture related to Tax Rebate Cares Act

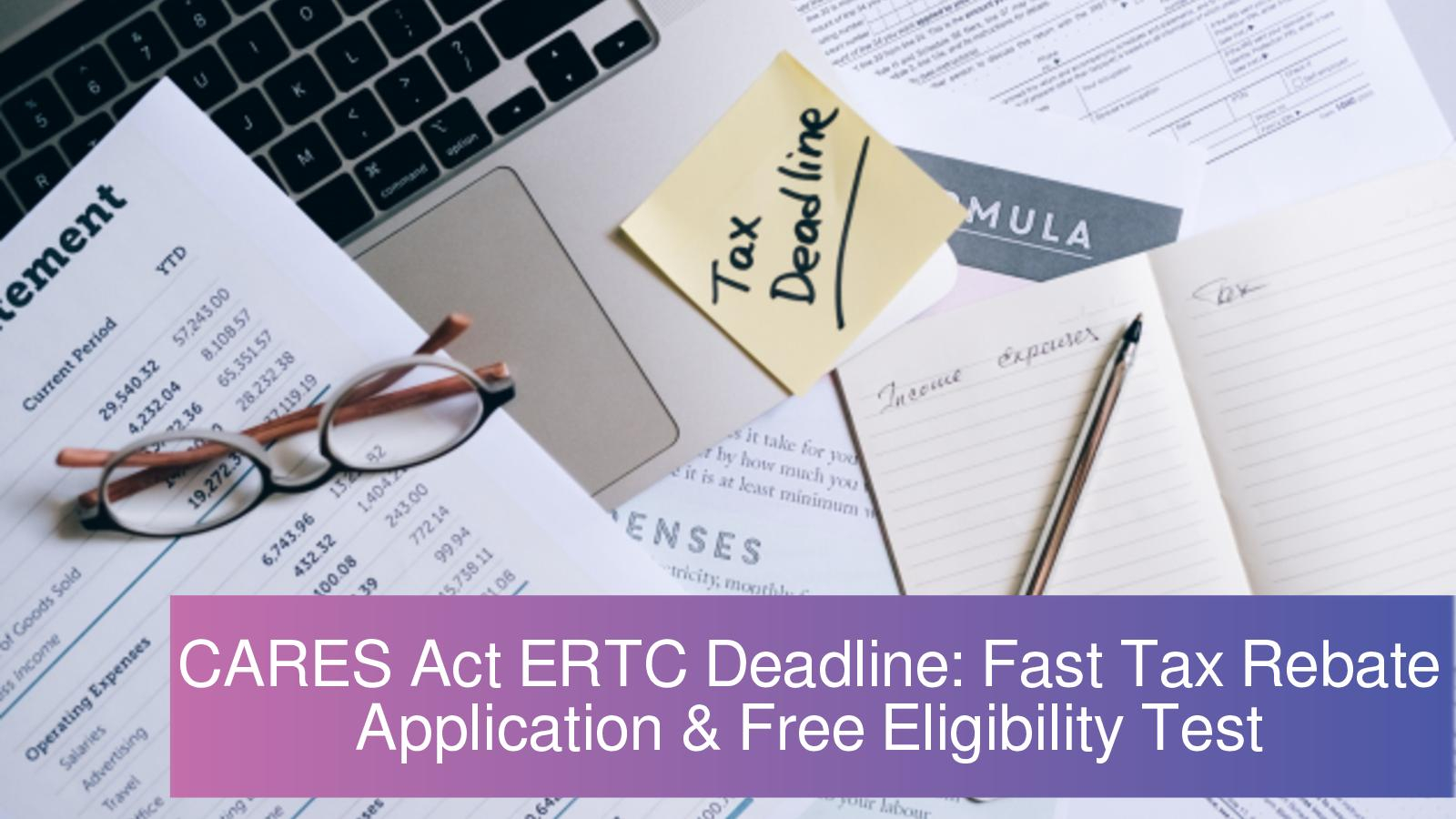

Calam o Get Fast ERTC Refund Take This Free CARES Act Rebate

https://p.calameoassets.com/220804122808-d58824bfe67a91ab06be411d93ef16ac/p1.jpg

Cares Act Recovery Rebate Credit Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/cares-act-recovery-rebates-distributions-rmd-waivers-student-loan.png

Free CARES Act Tax Credit Assessment Best ERC Rebate Eligibility Test

https://i.ytimg.com/vi/EzRWSPD0I8A/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGF4gXiheMA8=&rs=AOn4CLCF45wRoEF8yOmsSgEc-CqhiihUdg

Web The CARES Act provides that payments from the Fund may only be used to cover costs that Are necessary expenditures incurred due to the public health emergency with Web 2 avr 2021 nbsp 0183 32 IR 2021 74 April 2 2021 The Internal Revenue Service today issued guidance for employers claiming the Employee Retention Credit under the Coronavirus

Web 24 juil 2023 nbsp 0183 32 Due to a quirk of some state tax codes the recovery rebates in the CARES Act could increase your income tax liability in six states Alabama Iowa Louisiana Web 5 janv 2021 nbsp 0183 32 retroactively receive the CARES Act direct payment The amendment would allow these couples to receive a payment of 1 200 plus the additional 500 per

Calam O CARES Act ERTC Deadline Fast Tax Rebate Application Free

https://www.propertyrebate.net/wp-content/uploads/2023/05/calam-o-cares-act-ertc-deadline-fast-tax-rebate-application-free.jpg

Calam o Get CARES Act Tax Credits Fast 2022 ERC Rebate Audit Proof

https://p.calameoassets.com/220323000115-95fe0e201abd4487ded1d8438ac4ae5a/p1.jpg

https://en.wikipedia.org/wiki/CARES_Act

In response to the COVID 19 pandemic dramatic global reduction in economic activity occurred as a result of the social distancing measures meant to curb the virus These measures included working from home widespread cancellation of events cancellation of classes or moving in person to online classes reduction of travel and the closure of businesses In March it was predicted that without government intervention most airlines around the world

https://taxfoundation.org/blog/cares-act-senate-coronavirus-bill...

Web 30 mars 2020 nbsp 0183 32 Recovery Rebate for individual taxpayers The bill would provide a 1 200 refundable tax credit for individuals 2 400 for joint taxpayers Additionally taxpayers

Claim CARES Act Tax Credits With PPP Loans In 2022 Guaranteed Maximum

Calam O CARES Act ERTC Deadline Fast Tax Rebate Application Free

Recovery Rebate Income Limits Recovery Rebate

Check Status Of Recovery Rebate Recovery Rebate

How Did The CARES Act Recovery Rebate Work

CARES Act Expanded Unemployment

CARES Act Expanded Unemployment

Calam o Top ERTC Expert Scott Duncan Guarantees Maximum CARES Act Tax

CARES Act And Rebate US TAX SERVICES AG US Tax Services In Zurich

Who Qualifies For ERTC Rebates 2022 Free CARES Act Tax Credit

Tax Rebate Cares Act - Web 28 avr 2020 nbsp 0183 32 Tax relief for individuals and businesses in the CARES Act includes a one time rebate to taxpayers modification of the tax treatment of certain retirement fund