Payroll Tax Credit Cares Act 2021 Employers with fewer than 500 employees are required to provide paid sick or family leave to employees who are unable to work or telework due to certain circumstances related to COVID 19 These employers are entitled to refundable tax credits

The Employee Retention Credit is a refundable tax credit against certain employment taxes equal to 50 of the qualified wages an eligible employer pays to employees after March 12 2020 and before January 1 2021 The American Rescue Plan extends the availability of the Employee Retention Credit for small businesses through December 2021 and allows businesses to offset their current payroll tax liabilities by up to 7 000 per employee per quarter

Payroll Tax Credit Cares Act 2021

Payroll Tax Credit Cares Act 2021

https://info.ertcfiling.com/wp-content/uploads/2022/02/ERC-Colorado.jpg

CARES Act Payroll Tax Credit Wiebe Hinton Hambalek LLP

https://whhcpas.com/wp-content/uploads/2020/07/fi2.jpg

Cares Act Tax Benefits For Businesses And Employees In 2023

https://planning.net/wp-content/uploads/2023/02/cares-act-employee-retention-credit-800x400.jpg

Get paid back for keeping employees on payroll You kept employees on the payroll You may be eligible for 2021 employee retention tax credits of up to 28 000 per employee And the longer you keep your employees on payroll the more benefits you are eligible to receive How it works For 2020 the Employee Retention Credit ERC is a tax credit against certain payroll taxes including an employer s share of social security taxes for wages paid between March 12 2020 and December 31 2020 The tax credit is 50 of the wages paid up to 10 000 per employee capped at 5 000 per employee

This tax credit was introduced by the Coronavirus Aid Relief and Economic Security Act CARES in March 2020 and subsequently amended three times by the following laws the Consolidated Appropriations Act 2021 the American Rescue Plan Act ARPA and the Infrastructure Investment and Jobs Act The credit from the CARES Act is equal to 50 of payroll related costs over the eligible period up to a maximum credit of 5 000 per employee for 2020 Prior to enactment of the Consolidated Appropriations Act of 2021 CAA on Dec 27 2020 an employer was not eligible for the ERTC if it obtained a PPP loan

Download Payroll Tax Credit Cares Act 2021

More picture related to Payroll Tax Credit Cares Act 2021

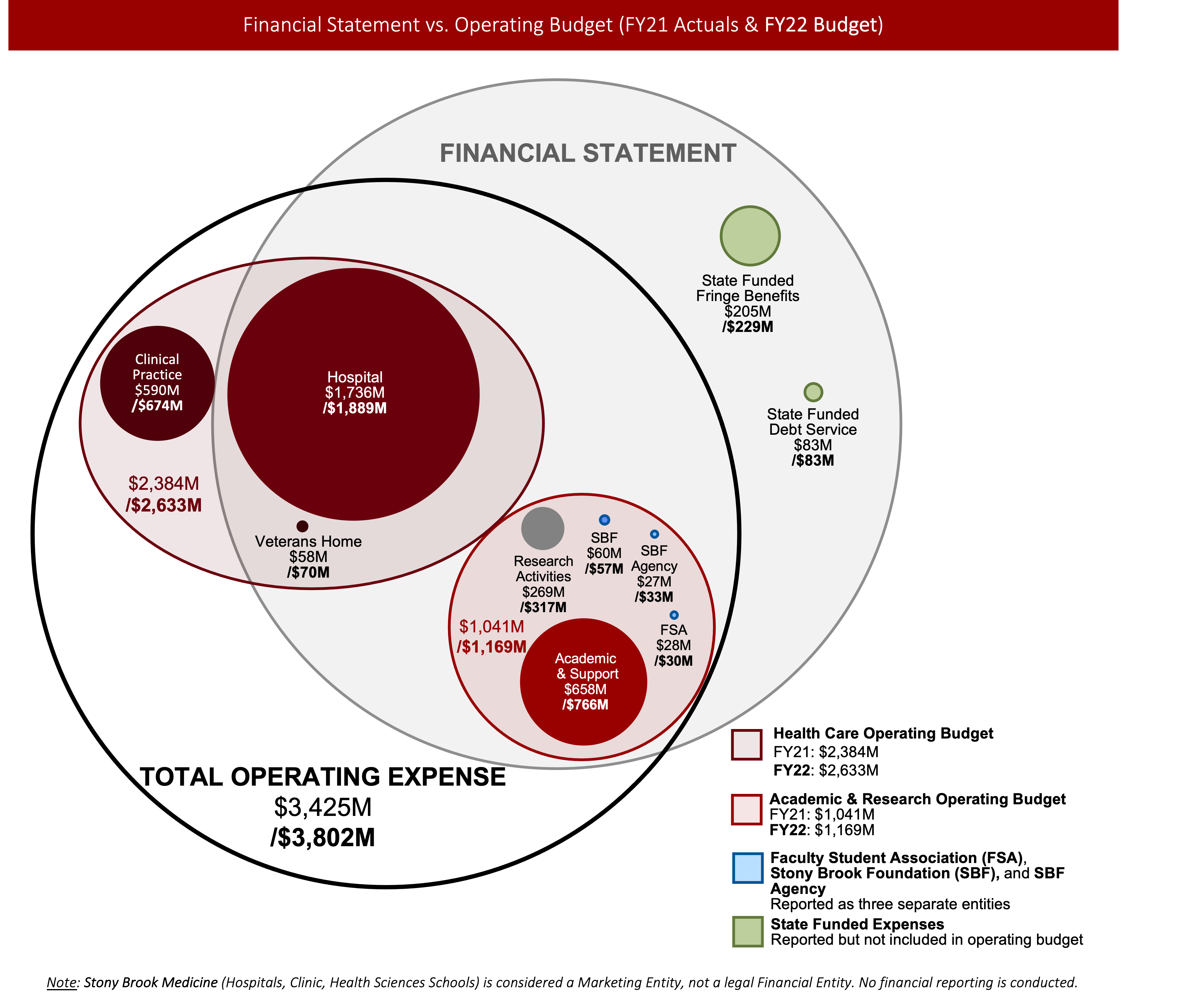

Costs Office Of Budget Financial Planning Analysis

https://www.stonybrook.edu/commcms/budgetoffice/_images/_fy21fy22/5CostsGeographic.png

IRS Employee Retention Tax Credit FAQ Live Rank Sniper

https://liveranksniper.com/wp-content/uploads/2022/04/employee-retention-tax-credit-overview-3-1256x1536.jpg

Documenting COVID 19 Employment Tax Credits

https://www.thetaxadviser.com/content/dam/tta/issues/2022/Jan/summary-key-elements-covid-19-employment-tax-credits.PNG

A federal tax credit helping financially impacted businesses pay employees via refundable employment tax credit The Coronavirus Aid Relief and Economic Security CARES Act includes several significant business tax and nontax provisions The Employee Retention Payroll Tax Credit is an incentive originally created within the CARES Act intended to encourage employers to keep employees on the payroll as they navigate the unprecedented effects of COVID 19

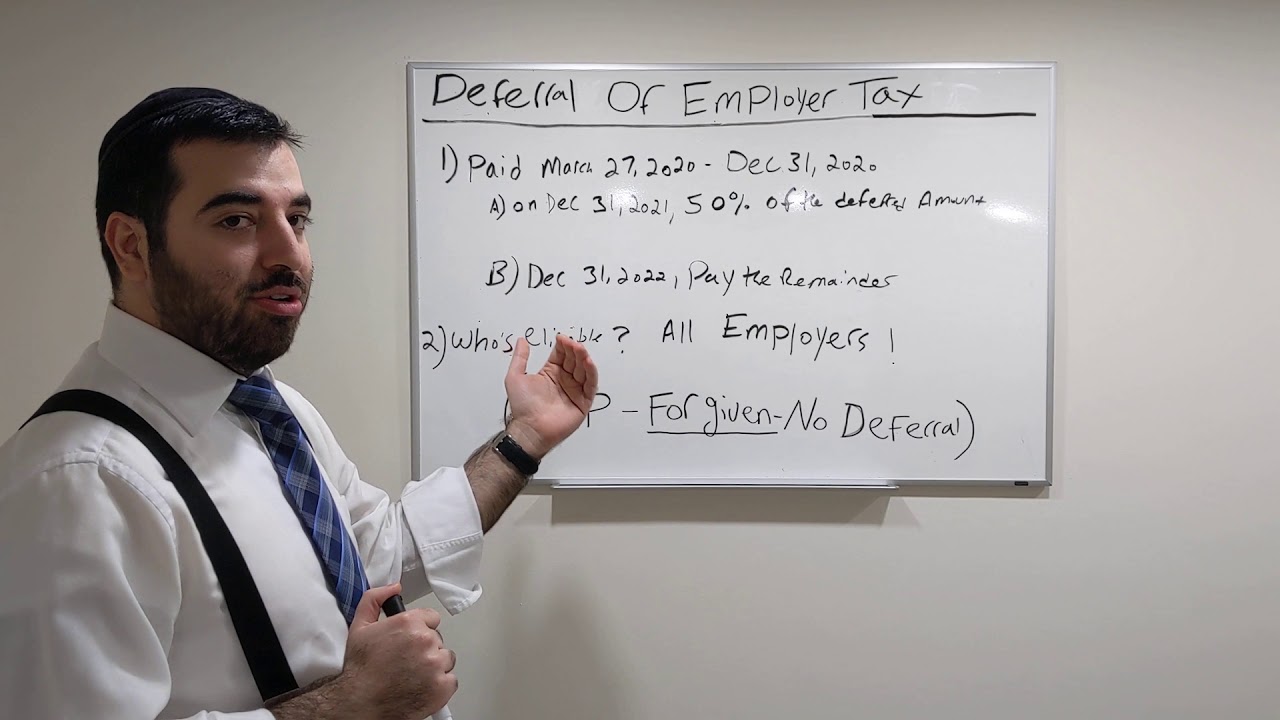

Under the CARES Act the ERTC could be taken for wages paid after March 12 2020 and before January 1 2021 Employers could claim a payroll tax credit of up to 5 000 Coronavirus Aid Relief and Economic Security CARES Act The CARES Act was signed into law on March 27 2020 It provided the following benefits Some of these benefits were modified or extended by the Consolidated Appropriations Act

Stimulus Bill Extends FFCRA Tax Credit Eligibility For Employers

https://www.smallbizdaily.com/wp-content/uploads/2021/01/shutterstock_1689432424-1.jpg

Paycheck Protection Program SBA Help For Small Business Owners In

https://cdn.abcotvs.com/dip/images/6103219_myerm007_CARES_act.jpg?w=1600

https://www.irs.gov/newsroom/covid-19-related...

Employers with fewer than 500 employees are required to provide paid sick or family leave to employees who are unable to work or telework due to certain circumstances related to COVID 19 These employers are entitled to refundable tax credits

https://www.irs.gov/coronavirus/employee-retention-credit

The Employee Retention Credit is a refundable tax credit against certain employment taxes equal to 50 of the qualified wages an eligible employer pays to employees after March 12 2020 and before January 1 2021

Employee Retention Credit For Employers Meadows Urquhart Acree And

Stimulus Bill Extends FFCRA Tax Credit Eligibility For Employers

CARES Act Payroll Tax Deferral YouTube

You May Qualify For A Payroll Tax Credit Bailey Scarano

Washington Employee Retention Tax Credit Washington Employee

Forging A Path Forward CARES Act Loan And Tax Benefit Guidance MGOCPA

Forging A Path Forward CARES Act Loan And Tax Benefit Guidance MGOCPA

Employee Retention Tax Credit Under The CARES Act The Gillespie Law Group

Employee Retention Credit ERC Payroll Tax Credit Cares Act By

IRS Clarifies Federal Credit Unions May Claim Employee Retention Credit

Payroll Tax Credit Cares Act 2021 - Section 2301 of the CARES Act as originally enacted provides for an employee retention credit for eligible employers including tax exempt organizations that pay qualified wages including certain health plan expenses to some or all employees after March 12 2020 and before January 1