Payroll Tax Credit Cares Act For 2020 the ERC is a tax credit against certain payroll taxes including an employer s share of social security taxes for wages paid between March 12 2020 and December

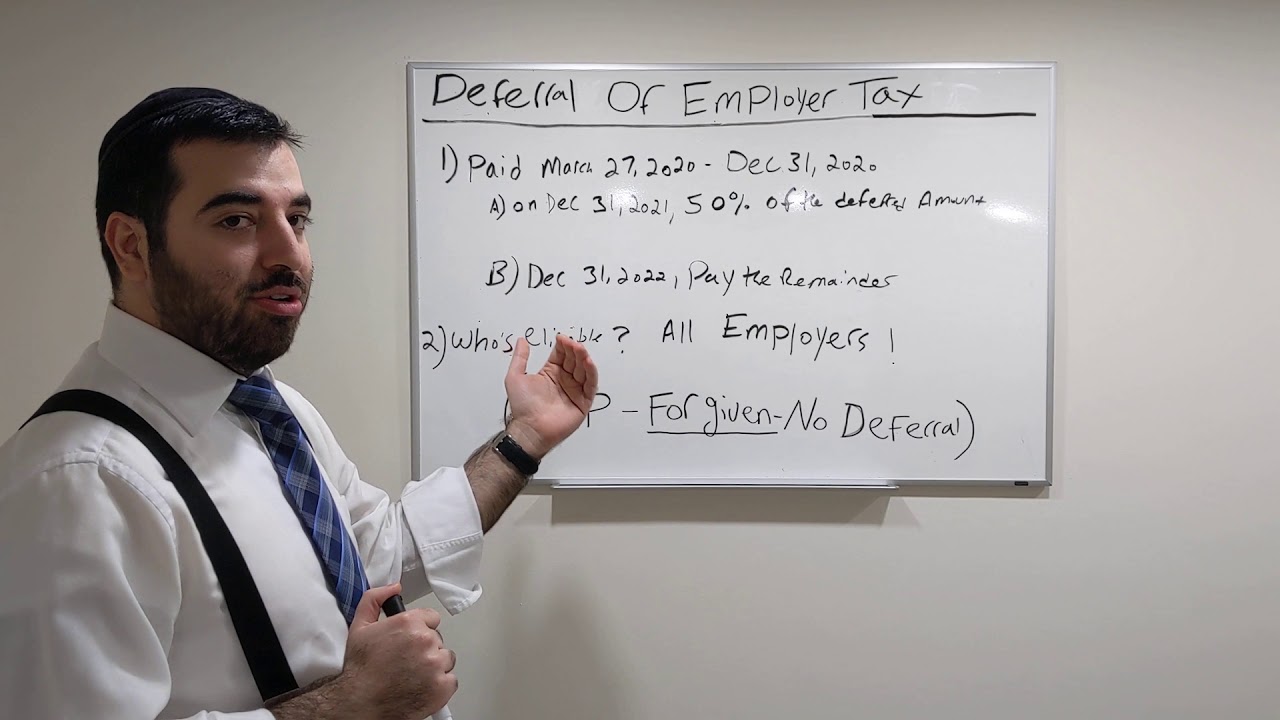

As a result of the changes made by the Relief Act eligible employers can now claim a refundable tax credit against the employer share of Social Security tax equal to The CARES Act payroll tax deferral provision essentially gives employers a two year interest free loan from the federal government of approximately 6 2 of an

Payroll Tax Credit Cares Act

Payroll Tax Credit Cares Act

https://whhcpas.com/wp-content/uploads/2020/07/fi2.jpg

Colorado Employee Retention Tax Credit Colorado Employee Retention

https://info.ertcfiling.com/wp-content/uploads/2022/02/ERC-Colorado.jpg

Get A Payroll Tax Refund Receive 26 000 Per Employee Even If You

https://go.asapfundr.com/hosted/images/d8/7c3f2e22dc4cdda3eb480169c621ab/image-1-.png

The tax credit may be claimed against the employer portion of employment taxes including Social Security and Railroad Retirement payroll taxes To the extent The employee retention tax credit ERTC is a refundable tax credit that reduces an employer s payroll taxes The credit can be claimed for wages paid after

Under the CARES Act an employer whose operations is fully or partially suspended may be eligible for a payroll tax credit up to 50 of the wages paid up to 10 000 between Introduced as part of the 2020 pandemic relief package known as the CARES Act the employee retention credit is a refundable payroll tax credit for employers

Download Payroll Tax Credit Cares Act

More picture related to Payroll Tax Credit Cares Act

Cares Act Tax Benefits For Businesses And Employees In 2023

https://planning.net/wp-content/uploads/2023/02/cares-act-employee-retention-credit-800x400.jpg

Forging A Path Forward CARES Act Loan And Tax Benefit Guidance MGOCPA

https://www.mgocpa.com/wp-content/uploads/2020/04/166_ForgingAPath-900x600.jpg

CARES Act Provides Significant Payroll Tax Changes

https://media.licdn.com/dms/image/C5612AQF-HcLbnd5kPw/article-cover_image-shrink_720_1280/0/1589903232846?e=2147483647&v=beta&t=ii0Pk-YlQErTIHVqe7d445nZaeU_sd6J47dXvxNley4

It is a tax credit based on payroll taxes employers previously remitted so employers do not have to pay back the funds they receive The employee retention credit ERC is a refundable credit that businesses Overview The employee retention tax credit is a broad based refundable tax credit designed to encourage employers to keep employees on their payroll The

Act Sec 2301 a of the Coronavirus Aid Relief and Economic Security Act CARES Act PL 116 136 created a refundable payroll tax credit the Employee Under the Coronavirus Aid Relief and Economic Security Act CARES Act as originally enacted March 27 2020 the Employee Retention Credit is a refundable tax credit

IRS Employee Retention Tax Credit FAQ Live Rank Sniper

https://liveranksniper.com/wp-content/uploads/2022/04/employee-retention-tax-credit-overview-3-1256x1536.jpg

CARES Act Payroll Tax Deferral What You Need To Know PEO Human

https://www.groupmgmt.com/media/articulate-import//2020/05/CARESActPayrollTaxDeferral-image.jpg

https://home.treasury.gov/.../small-business-tax-credit-programs

For 2020 the ERC is a tax credit against certain payroll taxes including an employer s share of social security taxes for wages paid between March 12 2020 and December

https://www.irs.gov/newsroom/irs-provides-guidance...

As a result of the changes made by the Relief Act eligible employers can now claim a refundable tax credit against the employer share of Social Security tax equal to

The CARES Act Business Tax Provisions C D LLP

IRS Employee Retention Tax Credit FAQ Live Rank Sniper

How Employee Retention Tax Credits Work In The CARES Act OnPay

CARES Act Paycheck Protection Program Employer FAQ Brinson Benefits

CARES Act Payroll Tax Deferral YouTube

Documenting COVID 19 Employment Tax Credits

Documenting COVID 19 Employment Tax Credits

You May Qualify For A Payroll Tax Credit Bailey Scarano

Paycheck Protection Program SBA Help For Small Business Owners In

New IRS Form 7200 FFCRA Leave Tax Credit CARES Act Employee Retention

Payroll Tax Credit Cares Act - The tax credit may be claimed against the employer portion of employment taxes including Social Security and Railroad Retirement payroll taxes To the extent