Irs Rebates 2023 Web 30 ao 251 t 2023 nbsp 0183 32 The IRS exempted many state tax refunds and rebates from tax and expanded on guidance it gave in early 2023 about payments you need to include on your

Web 1 janv 2023 nbsp 0183 32 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for Web 17 avr 2023 nbsp 0183 32 A total of 14 states will include stimulus payments with residents tax returns this year Qualifying citizens in California Colorado Delaware Idaho Illinois Indiana

Irs Rebates 2023

Irs Rebates 2023

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/05/Federal-Tax-Rebate-2023.jpg?ssl=1

Missouri Renters Rebate 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/02/Missouri-Renters-Rebate-2023.jpg

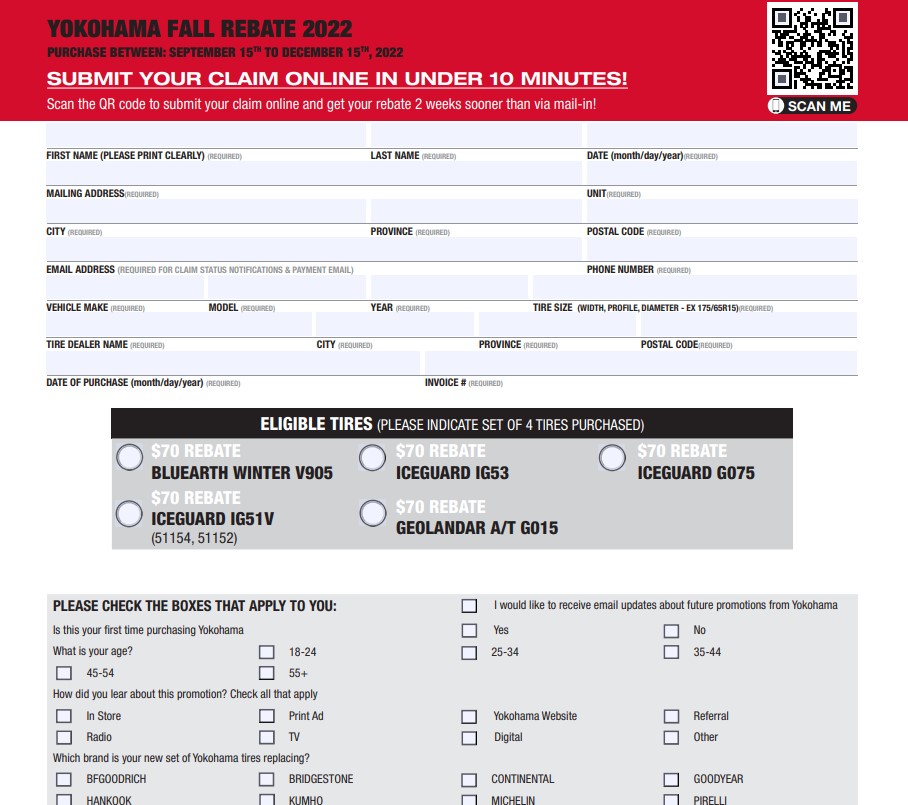

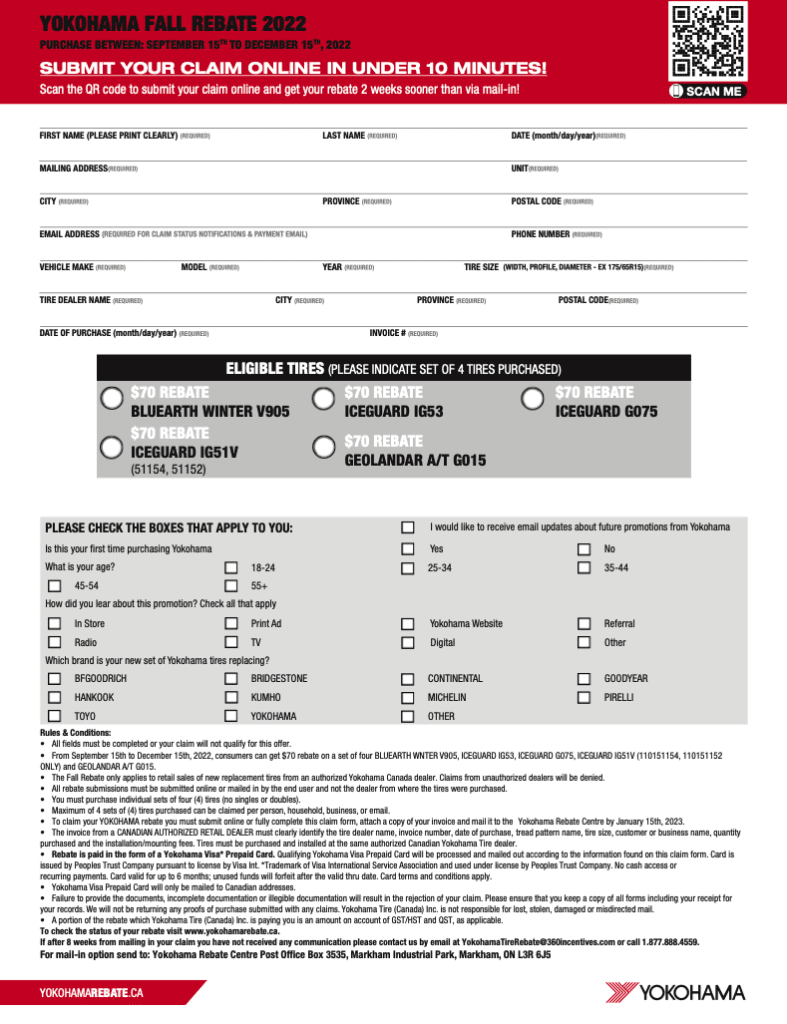

Yokohama Tire Rebate 2023 How To Qualify And Claim Your Rebate

https://www.tirerebate.org/wp-content/uploads/2023/03/Yokohama-Tire-Rebate-2023.jpg

Web 5 sept 2023 nbsp 0183 32 NEW For the 2023 tax year the IRS has announced that most state rebate payments won t be taxable on your federal return However there could be some exceptions in some state payments and Web 6 d 233 c 2022 nbsp 0183 32 Those who got 3 600 per dependent in 2021 for the CTC will if eligible get 2 000 for the 2022 tax year For the EITC eligible taxpayers with no children who

Web 10 f 233 vr 2023 nbsp 0183 32 IRS tells taxpayers in some states to delay filing returns 00 23 The IRS is asking millions of taxpayers more than 20 states including California Colorado and Web 14 juin 2023 nbsp 0183 32 IR 2023 116 June 14 2023 The Internal Revenue Service issued proposed regulations and frequently asked questions today describing rules for

Download Irs Rebates 2023

More picture related to Irs Rebates 2023

This Is An Attachment Of 2023 LG Rebates Printable Rebate Form From

https://www.freerebate.net/wp-content/uploads/2023/02/this-is-an-attachment-of-iowa-energy-rebates-printable-rebate-form-from-bayer-rebates-2023-post.png

2023 Elanco Rebates Maximize Your Savings With Animal Health Products

https://www.elancorebates.net/wp-content/uploads/2023/04/2023-Elanco-Rebates-768x434.png

Irs Cp11 Recovery Rebate Credit 2023 Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/irs-updates-recovery-rebate-credit-and-eip-guidance-scott-m-aber-cpa-pc-6.jpg

Web If you place in service a new plug in electric vehicle EV or fuel cell vehicle FCV in 2023 or after you may qualify for a clean vehicle tax credit Find information on credits for used Web 26 juil 2023 nbsp 0183 32 2023 through 2032 30 up to a maximum of 1 200 biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit Get details on the

Web 7 janv 2023 nbsp 0183 32 Cars that qualify for 7 500 right now may only get 3 250 or no credit at all come March And the IRS is clear When it comes to the timing of a purchase it doesn t matter when you pay for a Web 4 mai 2023 nbsp 0183 32 IRS Tax Rebate 2023 The IRS tax rebate is a refund that the government gives to taxpayers who have overpaid their taxes throughout the year The IRS tax

Ohio Tax Rebate 2023 Maximize Your Tax Savings Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/04/Ohio-Tax-Rebate-2023.png

Michigan Tax Rebate 2023 Eligibility Types Deadlines How To Claim

https://printablerebateform.net/wp-content/uploads/2023/04/Michigan-Tax-Rebate-2023-768x675.png

https://www.forbes.com/sites/robertwood/2023/08/30/irs-exempts-most...

Web 30 ao 251 t 2023 nbsp 0183 32 The IRS exempted many state tax refunds and rebates from tax and expanded on guidance it gave in early 2023 about payments you need to include on your

https://www.irs.gov/credits-deductions/energy-efficient-home...

Web 1 janv 2023 nbsp 0183 32 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for

Irs Rebate Checks 2023 RebateCheck

Ohio Tax Rebate 2023 Maximize Your Tax Savings Printable Rebate Form

2023 Recovery Rebate Form Recovery Rebate

Irs Tax Calendar 2023 Refund 2023 Get Calender 2023 Update Gambaran

Oral B Rebate 2023 Get Money Back On Your Toothbrush Purchase

Irs Tax Calendar 2023 Refund 2023 Get Calender 2023 Update Gambaran

Irs Tax Calendar 2023 Refund 2023 Get Calender 2023 Update Gambaran

Taxes 2023 IRS Says California Most State Tax Rebates Aren t

Yokohama Rebates 2023 Printable Rebate Form

Georgia Income Tax Rebate 2023 Printable Rebate Form

Irs Rebates 2023 - Web 2 sept 2023 nbsp 0183 32 Minnesota Folks from Minnesota will get a one time tax rebate due to a recent modification in the tax law This legislation was signed in the month of May and it