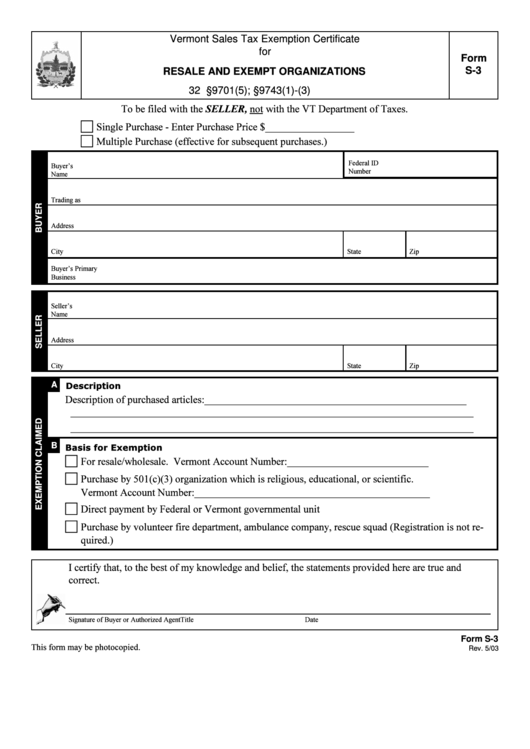

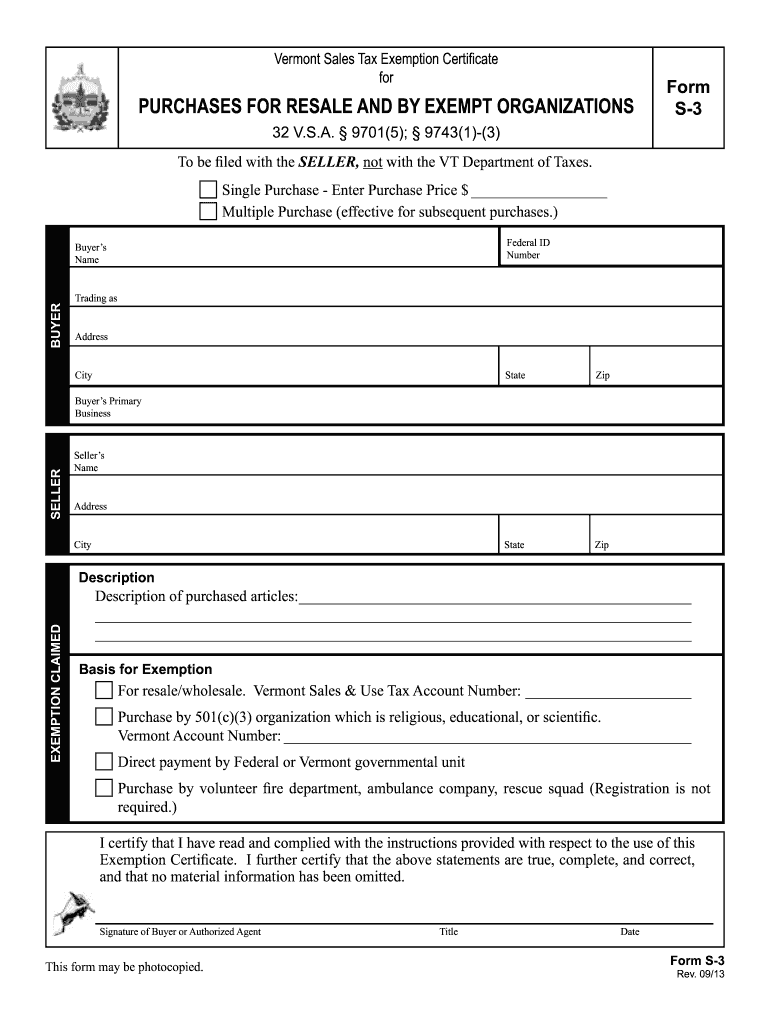

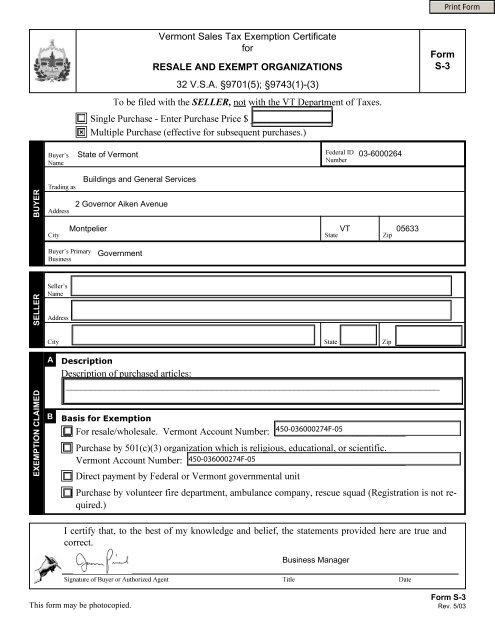

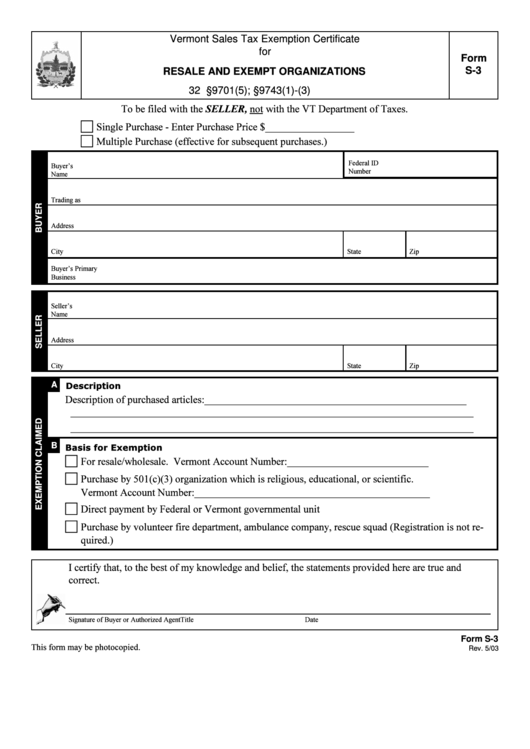

Vermont Tax Exemption Application for Refund of Vermont Sales and Use Tax Meals and Rooms Tax or Local Option Tax S 3 Vermont Sales Tax Exemption Certificate for Purchases For Resale

What purchases are exempt from the Vermont sales tax While the Vermont sales tax of 6 applies to most transactions there are certain items that may be exempt from Vermont tax on retirement benefits Social Security benefits are exempt for joint filers with an adjusted gross income AGI of 65 000 or less Additionally Vermont offers a

Vermont Tax Exemption

Vermont Tax Exemption

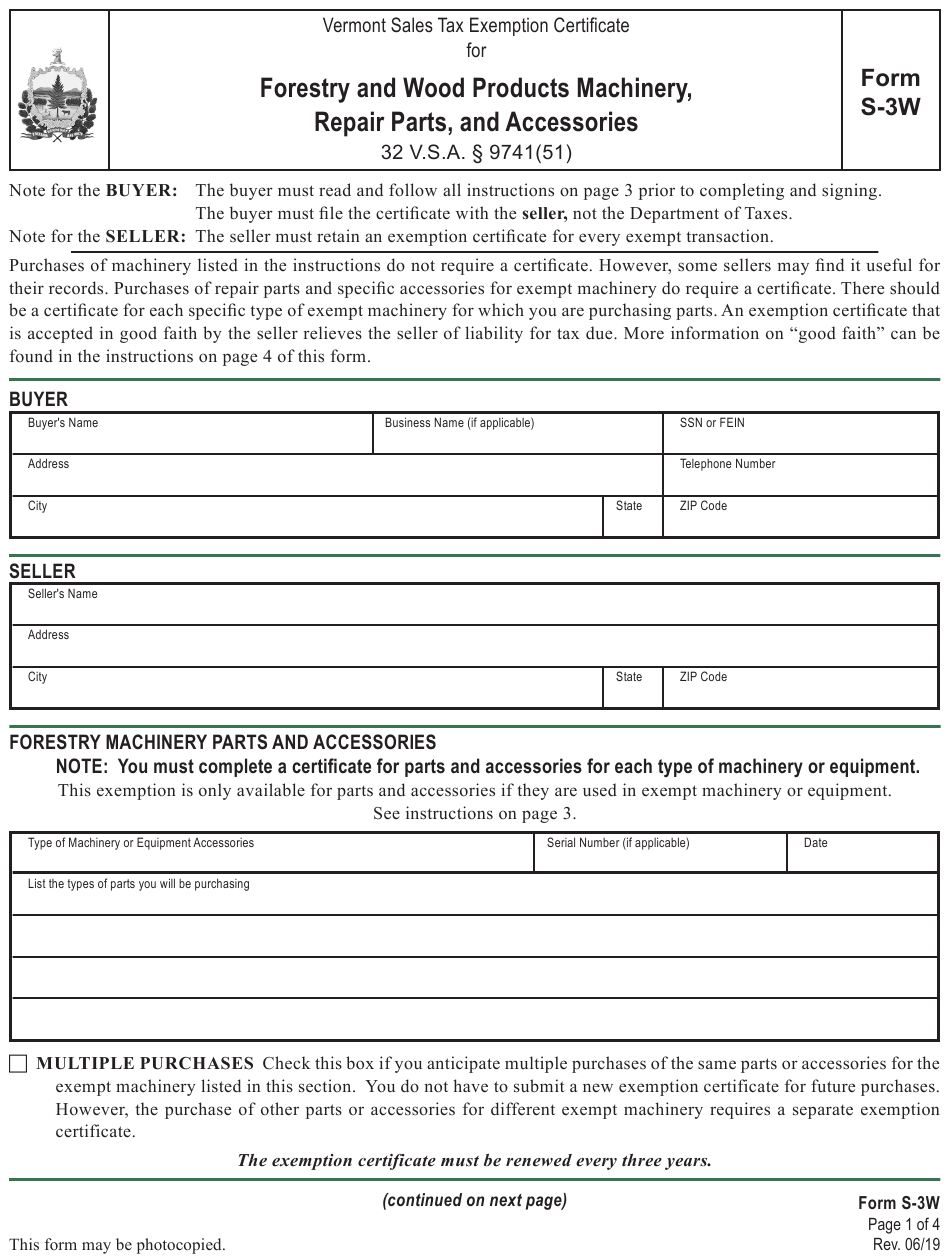

https://www.exemptform.com/wp-content/uploads/2022/08/form-s-3w-download-printable-pdf-or-fill-online-vermont-sales-tax.png

Revocation Of Federal Tax Exemption Grant Management Nonprofit Fund

https://mygrantmanagement.com/wp-content/uploads/2019/07/tax_exemption_1563850735.png

![]()

Optima Tax Relief Reviews Form 1023 Tax Exemption Revision

https://www.rebelliouspixels.com/wp-content/uploads/2020/03/tax_free_residency-1536x1066.jpg

We have two Vermont sales tax exemption forms available for you to print or save as a PDF file If any of these links are broken or you can t find the form you need please let us We last updated the Vermont Sales Tax Exemption Certificate for Purchases For Resale And By Exempt Organizations in February 2024 so this is the latest version of Form S

Vermont first adopted a general state sales tax in 1969 and since that time the rate has risen to 6 On top of the state sales tax there may be one or more local sales taxes Vermont guidance allows for exemption from state income tax for nonresidents in the state for a short duration The Vermont Department of Taxes has issued guidance on its

Download Vermont Tax Exemption

More picture related to Vermont Tax Exemption

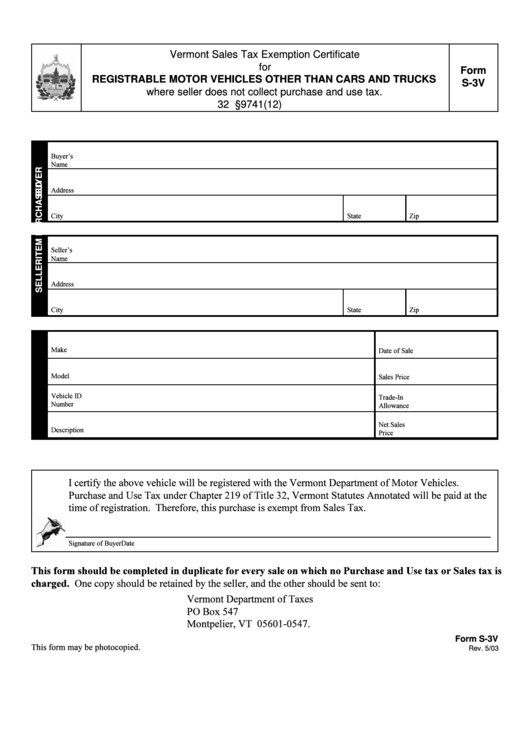

Form S 3v Vermont Sales Tax Exemption Certificate For Registrable

https://data.formsbank.com/pdf_docs_html/312/3123/312322/page_1_thumb_big.png

State Of Utah Tax Exempt Form Form Example Download

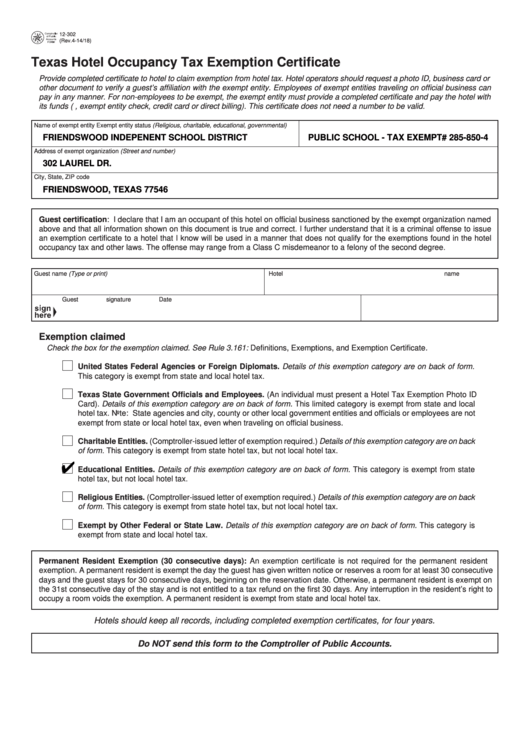

https://www.exemptform.com/wp-content/uploads/2022/08/fillable-form-12-302-hotel-occupancy-tax-exemption-certificate.png

Vermont State Tax Exempt Form Trudie Cote

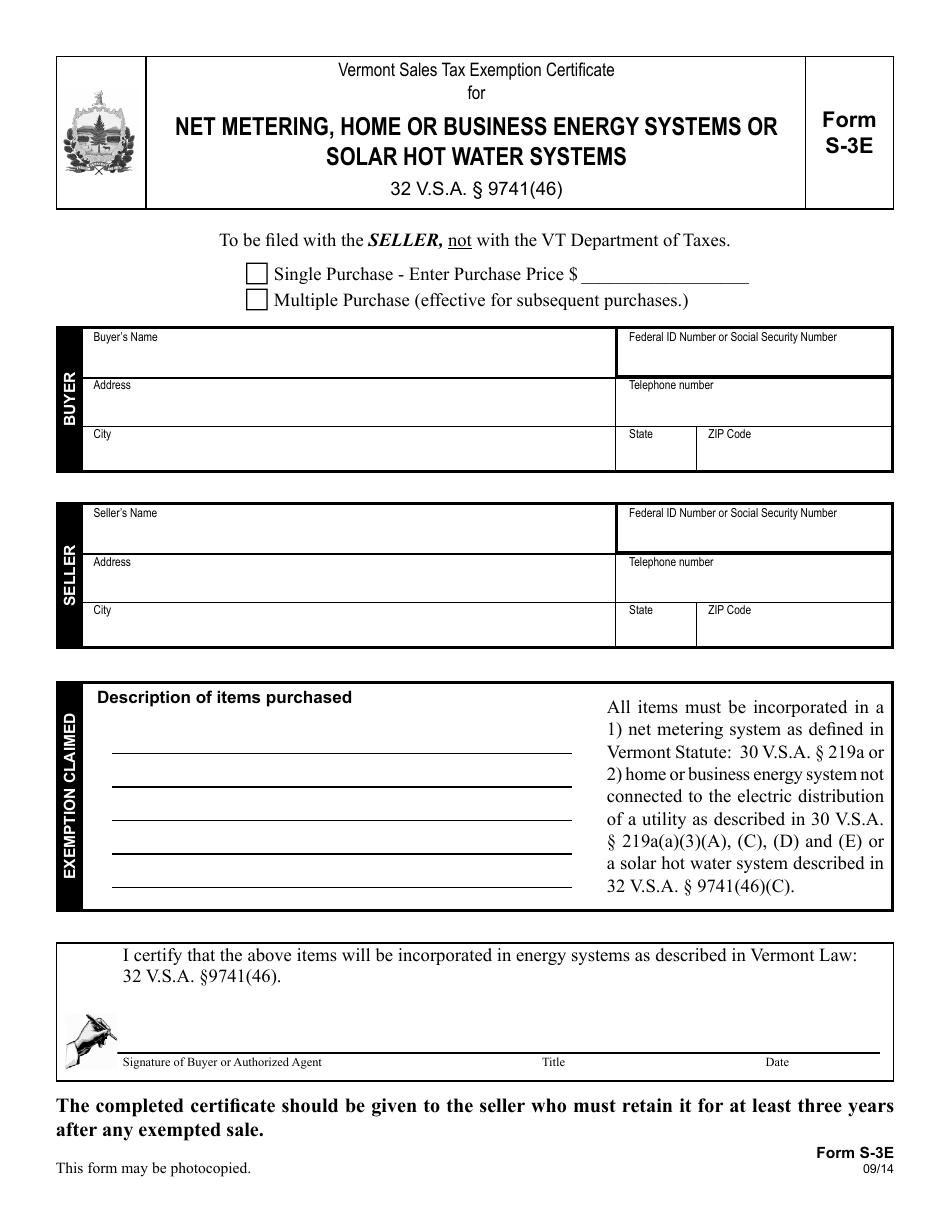

https://data.templateroller.com/pdf_docs_html/1736/17369/1736954/vt-form-s-3e-vermont-sales-tax-exemption-certificate-net-metering-home-or-business-energy-systems-or-solar-hot-water-systems-vermont_print_big.png

Vermont Sales Tax Exemption Certificate for Purchases for Resale by Exempt Organizations and by Direct Pay Permit This exemption certificate does not apply Exemptions The following is a list of conditions that will allow you to register your vehicle exempt from payment of the Vermont Purchase and Use Tax A vehicle owned or

By Calvin Cutler Published Jun 9 2022 at 4 57 PM EDT MONTPELIER Vt WCAX Tax relief is on the way for Vermont homeowners under a new bill passed by Vermont taxes most forms of retirement income at rates ranging from 3 35 to 8 75 This includes Social Security retirement benefits and income from most retirement accounts

Form S 3 Vermont Sales Tax Exemption Certificate For Resale And

https://data.formsbank.com/pdf_docs_html/125/1255/125579/page_1_thumb_big.png

S Vermont 2013 2024 Form Fill Out And Sign Printable PDF Template

https://www.signnow.com/preview/6/962/6962209/large.png

https://tax.vermont.gov/all-forms

Application for Refund of Vermont Sales and Use Tax Meals and Rooms Tax or Local Option Tax S 3 Vermont Sales Tax Exemption Certificate for Purchases For Resale

https://www.salestaxhandbook.com/vermont/sales-tax-exemptions

What purchases are exempt from the Vermont sales tax While the Vermont sales tax of 6 applies to most transactions there are certain items that may be exempt from

Vermont Sales Tax Exemption Certificate For Form S

Form S 3 Vermont Sales Tax Exemption Certificate For Resale And

Taxes Tippinsights

Tax Benefit

Home Department Of Taxes

Changes To Estate Tax Exemption Portability Finstream TV

Changes To Estate Tax Exemption Portability Finstream TV

Senators Propose Sweeping Changes To The Taxation Of Estates And

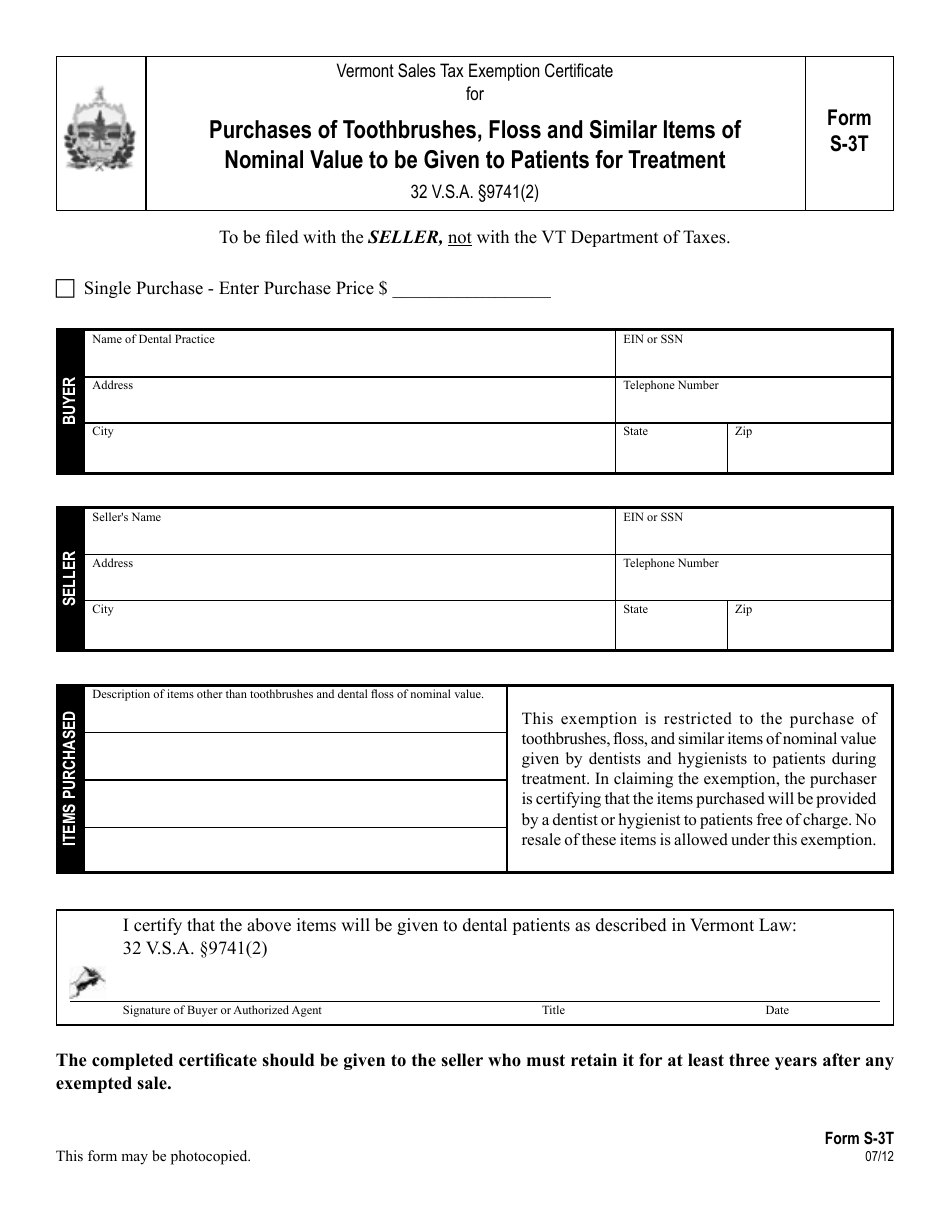

VT Form S 3T Fill Out Sign Online And Download Printable PDF

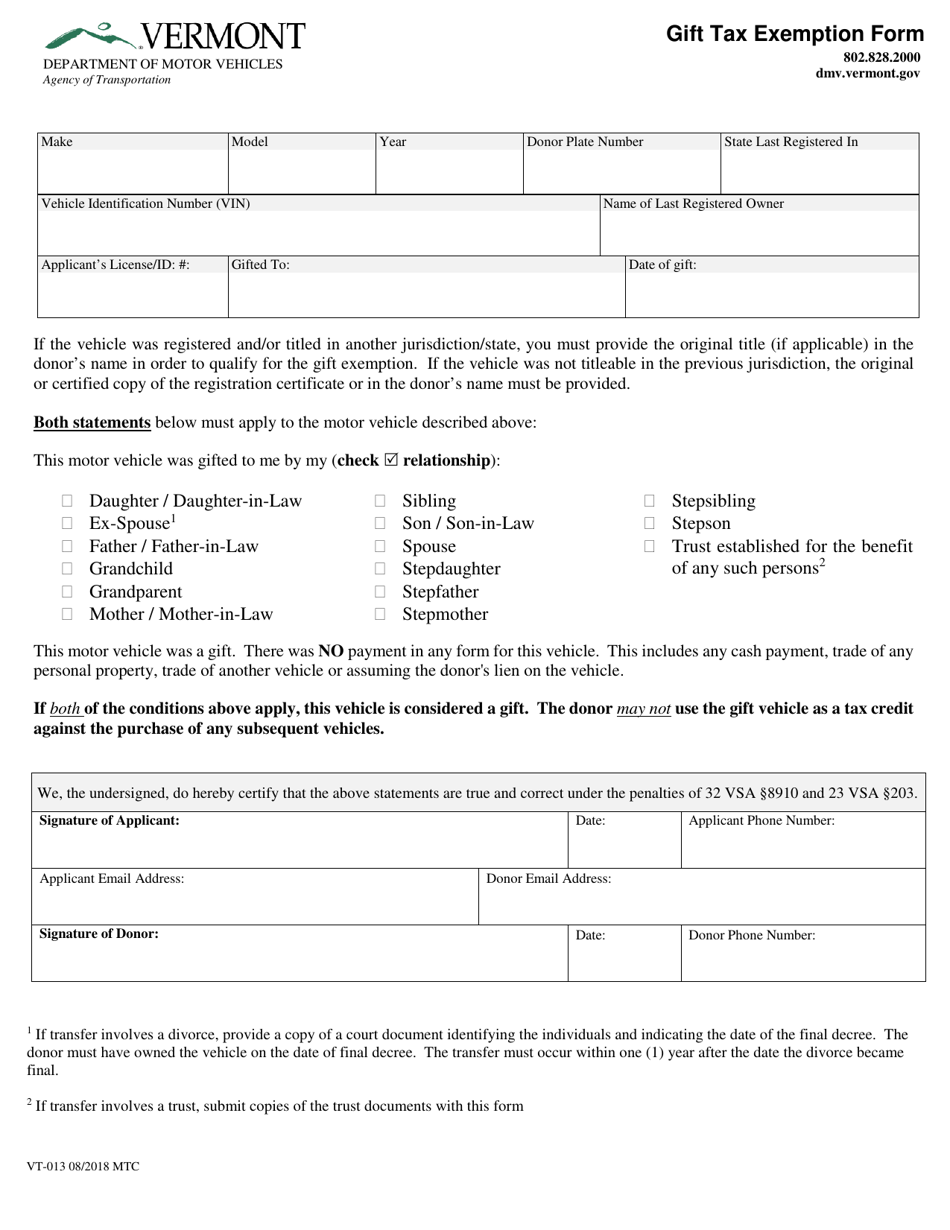

Form VT 013 Fill Out Sign Online And Download Fillable PDF Vermont

Vermont Tax Exemption - We last updated the Vermont Sales Tax Exemption Certificate for Purchases For Resale And By Exempt Organizations in February 2024 so this is the latest version of Form S