Virginia Taxes Rebate Web 16 sept 2022 nbsp 0183 32 Here s a breakdown of what Virginia taxpayers can expect regarding the tax rebate Taxpayers must file taxes by Nov 1 2022 to qualify Taxpayers will need to have

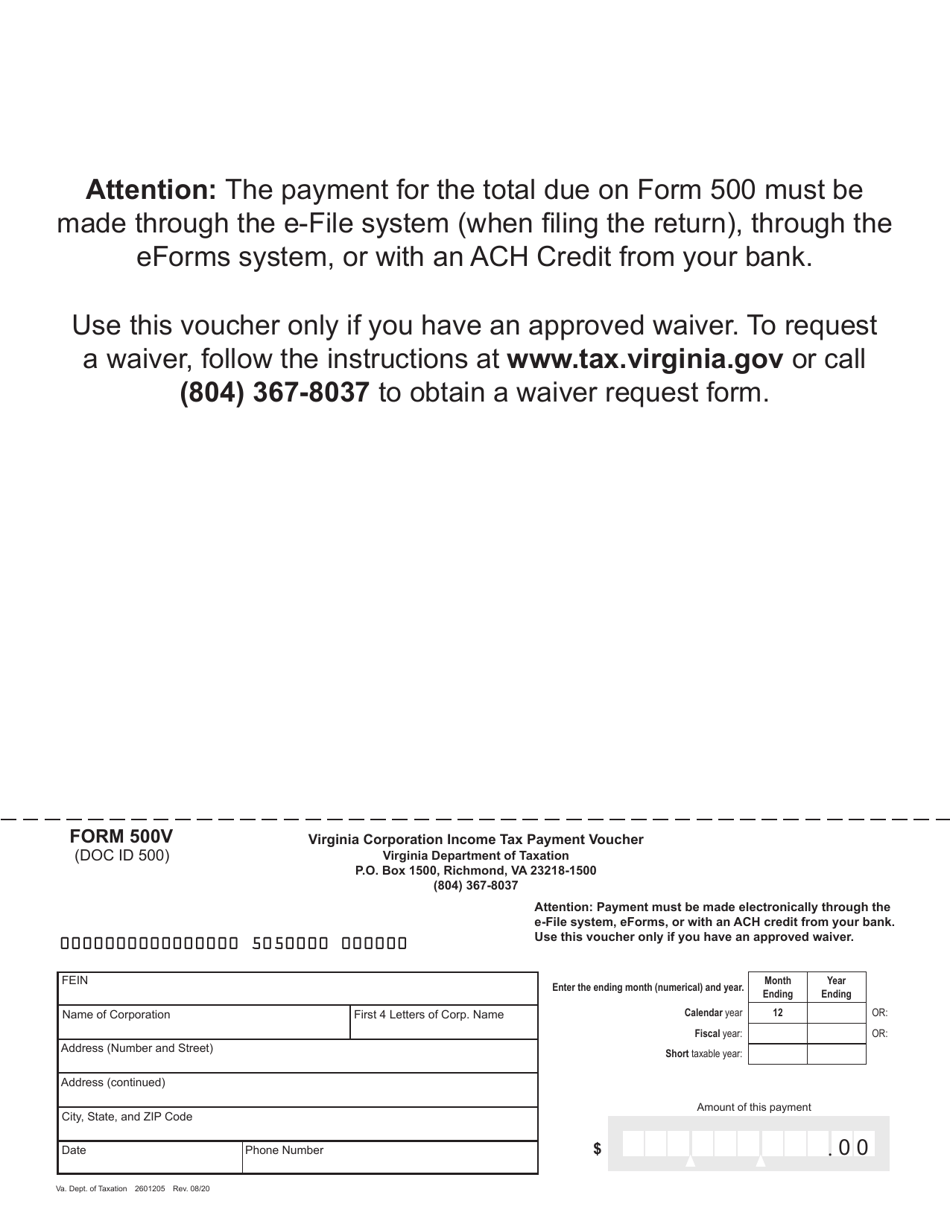

Web 9 sept 2023 nbsp 0183 32 The 2023 budget deal features tax cuts mostly new tax rebates to eligible Virginia residents and the return of a popular sales tax holiday Virginia Gov Glenn Web 8 f 233 vr 2023 nbsp 0183 32 That s because the Virginia General Assembly passed a law giving some Virginia taxpayers a 2022 tax quot stimulus quot rebate of up to 250 for individual filers and up to 500 for joint filers

Virginia Taxes Rebate

Virginia Taxes Rebate

https://www.usmessageboard.com/attachments/f-001-3-jpg.701939/

Virginia Tax Rebate 2023

https://www.taxuni.com/wp-content/uploads/2023/01/Virginia-Tax-Rebate.jpg

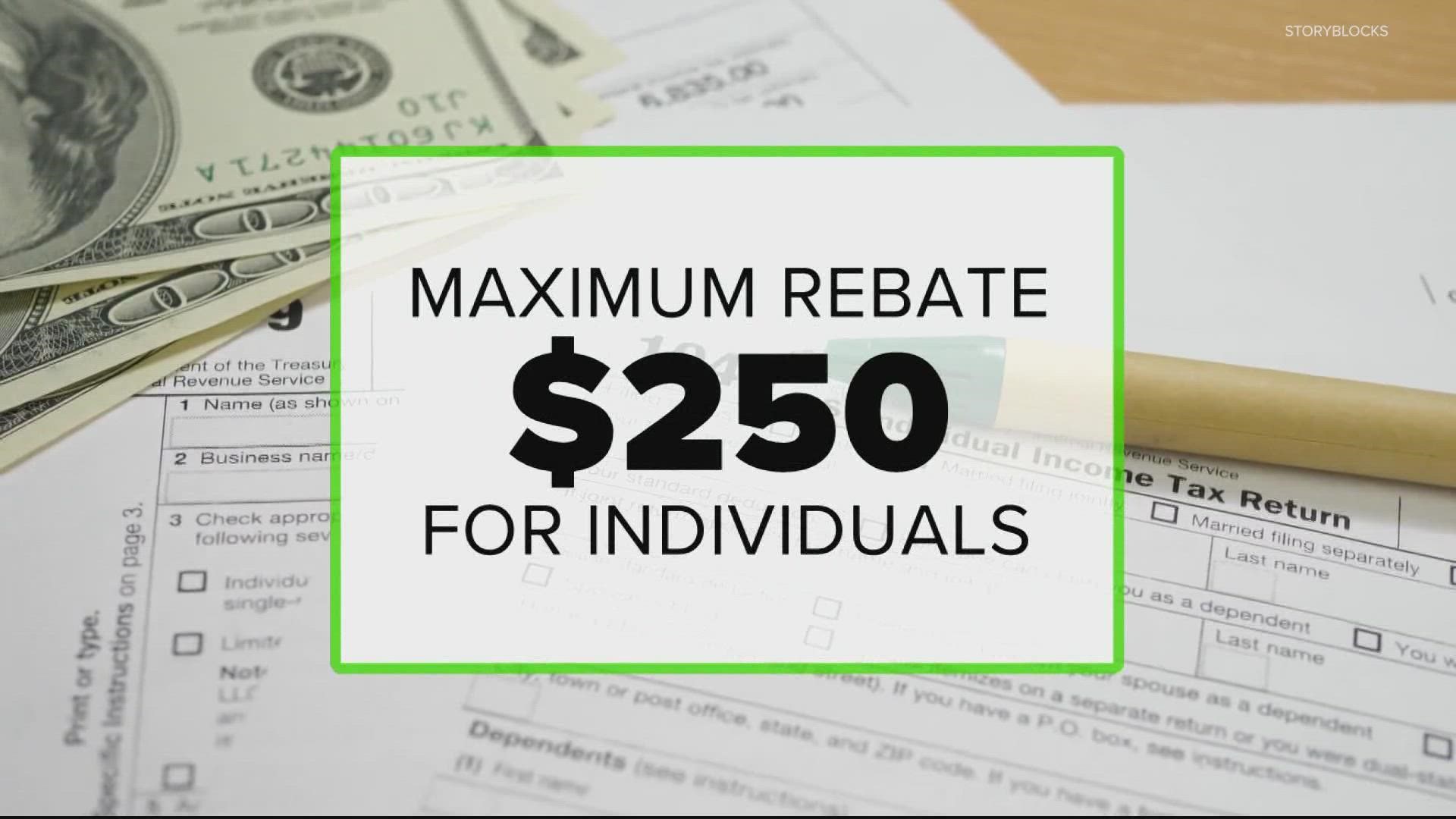

If You Haven t Yet Filed Your 2021 Income Taxes In Virginia A Deadline

https://wset.com/resources/media/2d83b333-1881-4cb5-a880-b8d4adc33736-large16x9_AP22172781631843.jpg?1655987737896

Web 6 sept 2023 nbsp 0183 32 RICHMOND Va The politically divided Virginia General Assembly approved long overdue budget legislation Wednesday voting in an unusually fast paced Web 25 ao 251 t 2023 nbsp 0183 32 Among the scant disclosures The deal would provide a one time rebate of 200 for individuals and 400 for joint filers and would increase the standard deduction

Web 9 sept 2023 nbsp 0183 32 The 2023 budget proposal includes about 1 05 billion in proposed tax reductions most of which will come from one time tax rebates to eligible Virginians Web 25 ao 251 t 2023 nbsp 0183 32 The budget deal includes a one time tax rebate of 200 for individuals and 400 for joint filers It also increases the standard deduction to 8 500 for single filers

Download Virginia Taxes Rebate

More picture related to Virginia Taxes Rebate

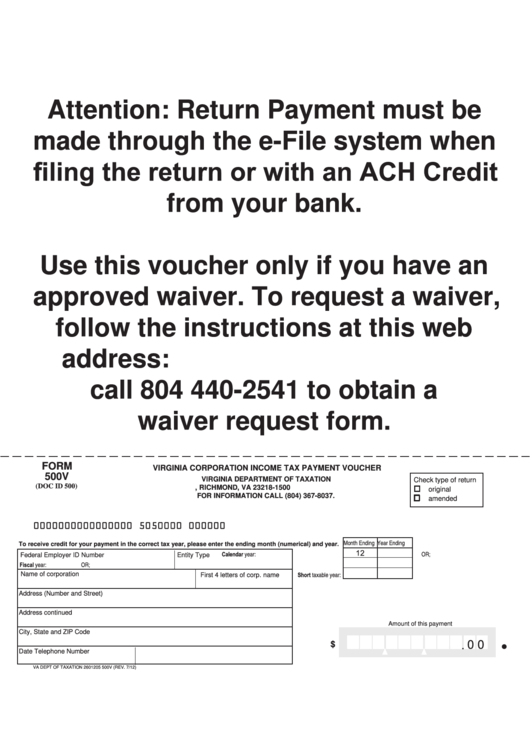

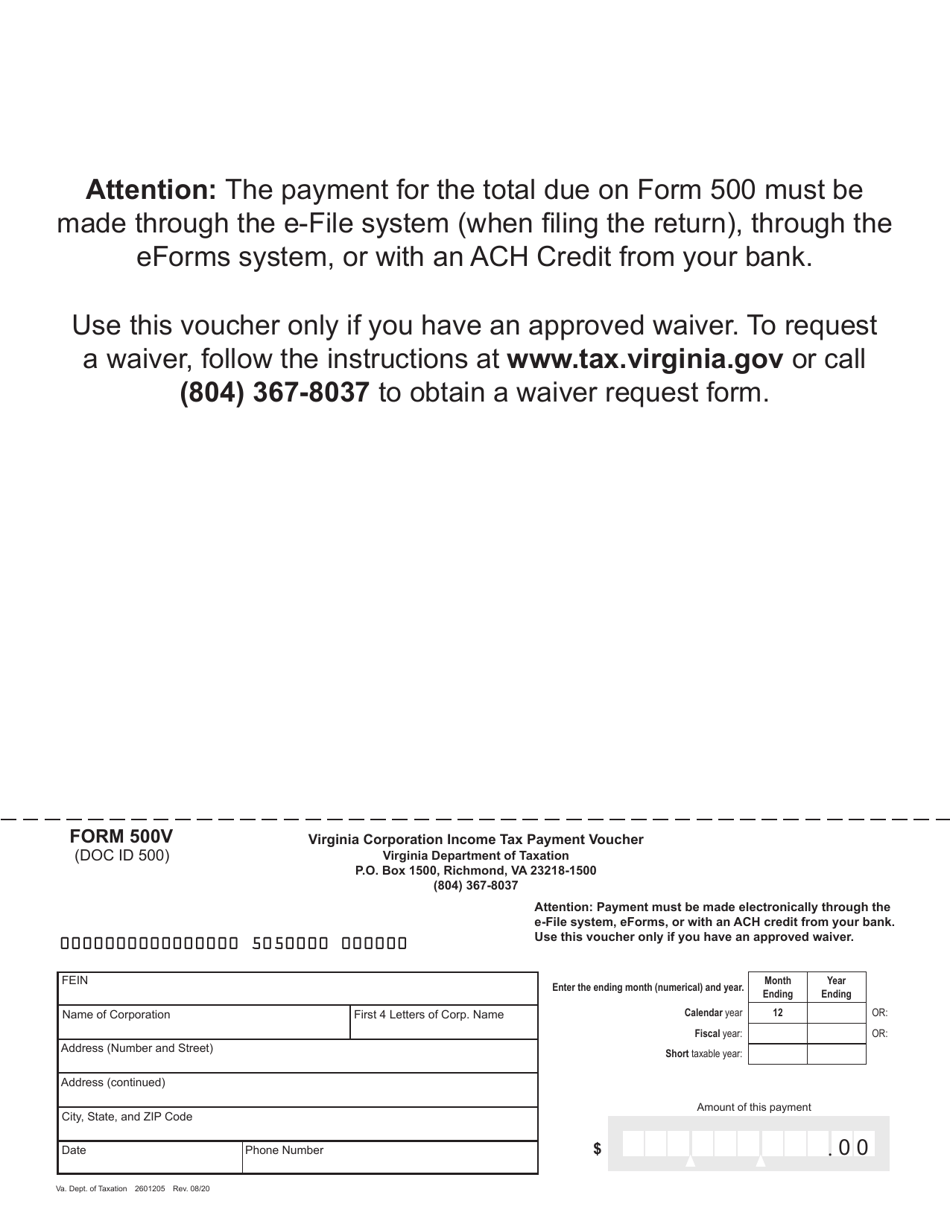

Fillable Form 500v Virginia Corporation Income Tax Payment Voucher

https://data.formsbank.com/pdf_docs_html/325/3258/325883/page_1_thumb_big.png

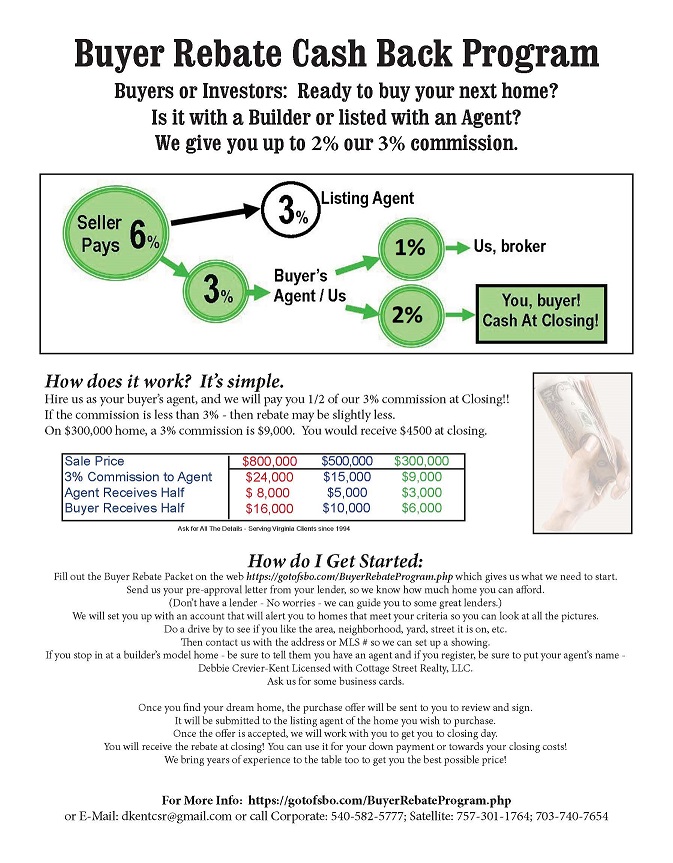

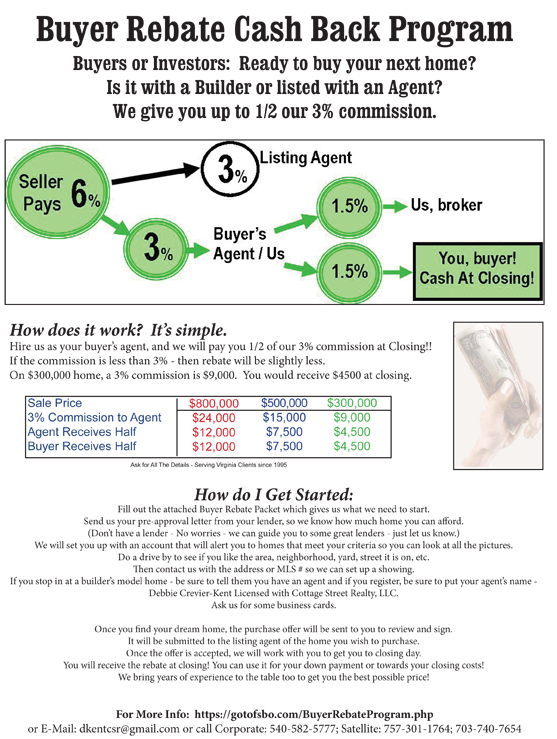

Flat Fee MLS Virginia Virginia Home Buyer Rebate 2 Cash Back Program

https://flatfeegroup.com/uploads/Buyer Rebate Flyer 2 Percent Cash Back 2020 small-5e95d93a61bf9.jpg

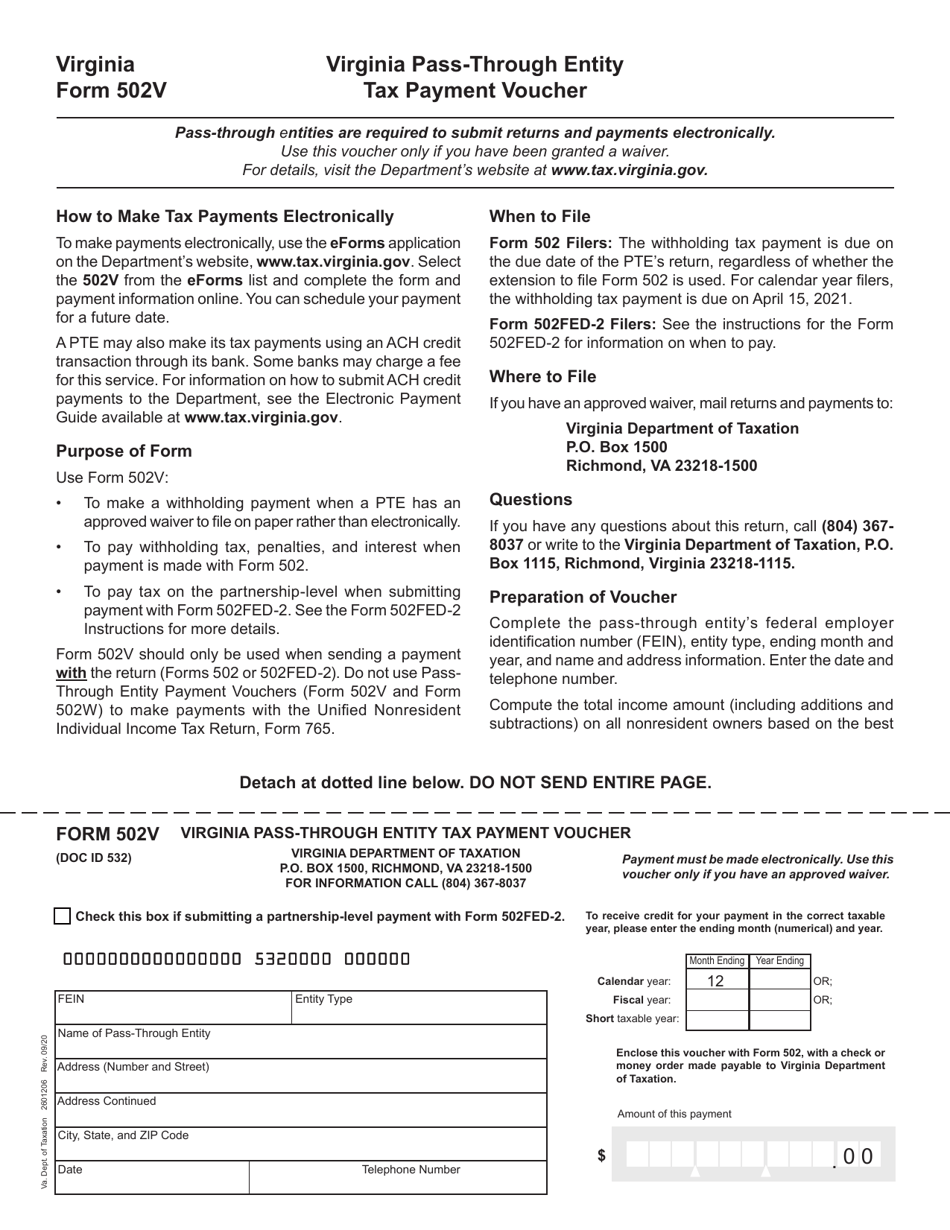

Form 502V Download Fillable PDF Or Fill Online Virginia Pass Through

https://data.templateroller.com/pdf_docs_html/2127/21277/2127705/form-502v-virginia-pass-through-entity-tax-payment-voucher-virginia_print_big.png

Web 25 ao 251 t 2023 nbsp 0183 32 Most notably the deal will include a one time tax rebate of 200 for individuals and 400 for joint filers Earlier this week the three budget negotiators said Web 20 avr 2023 nbsp 0183 32 Qualifications for Virginia Tax Rebate Income requirements To qualify for Virginia s 2023 tax rebate you must have an adjusted gross income AGI of 75 000

Web 15 sept 2022 nbsp 0183 32 RICHMOND VA This fall approximately 3 2 million eligible taxpayers will receive one time tax rebates of up to 250 if they filed individually and up to 500 if they Web 5 sept 2023 nbsp 0183 32 Virginia s standard deduction a flat amount that filers who don t itemize their deductions can use to reduce their taxable income will increase in the 2024 and

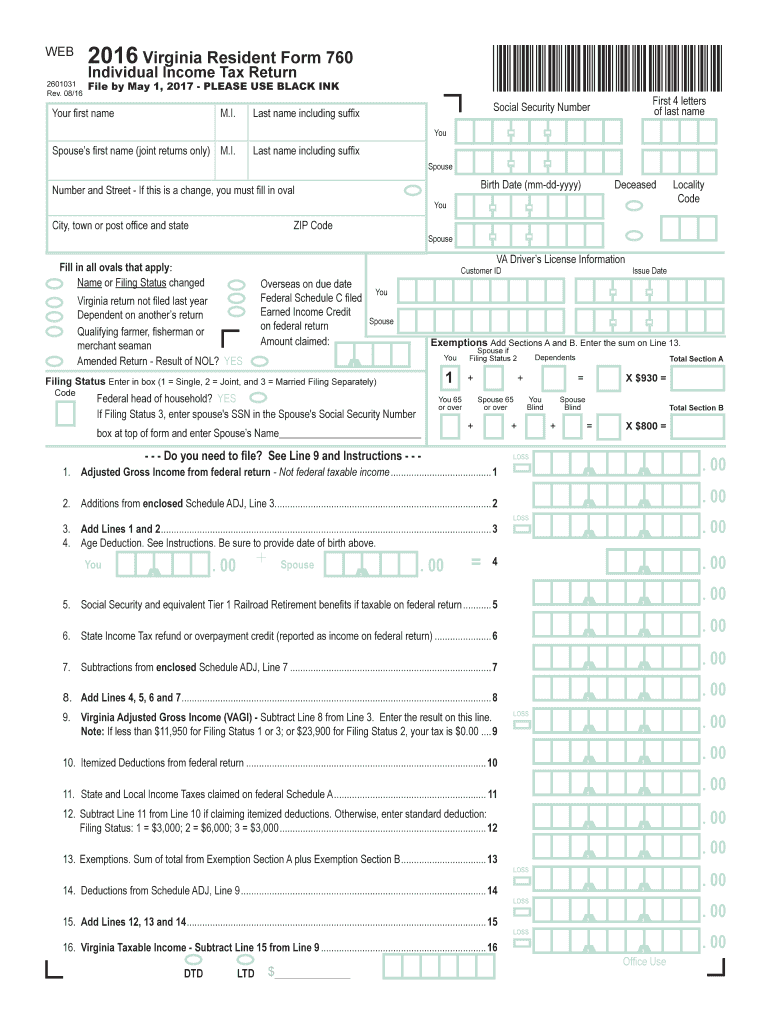

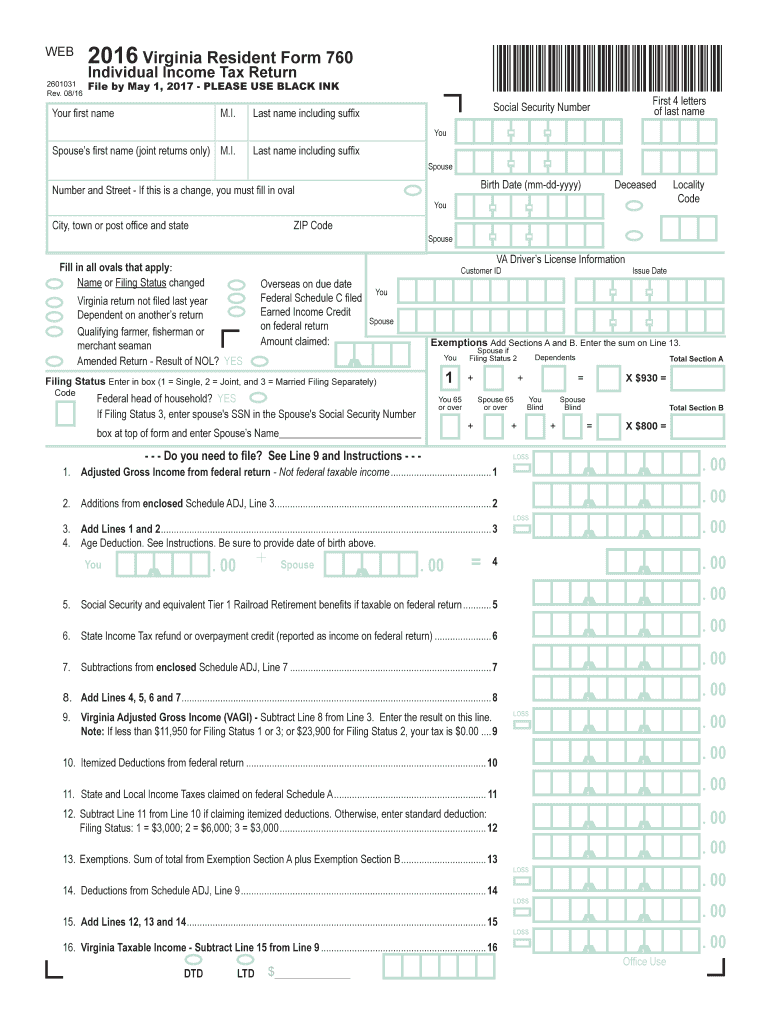

Free Printable Virginia State Tax Forms Printable Forms Free Online

https://www.printableform.net/wp-content/uploads/2021/07/2016-virginia-resident-form-760-fill-out-and-sign.png

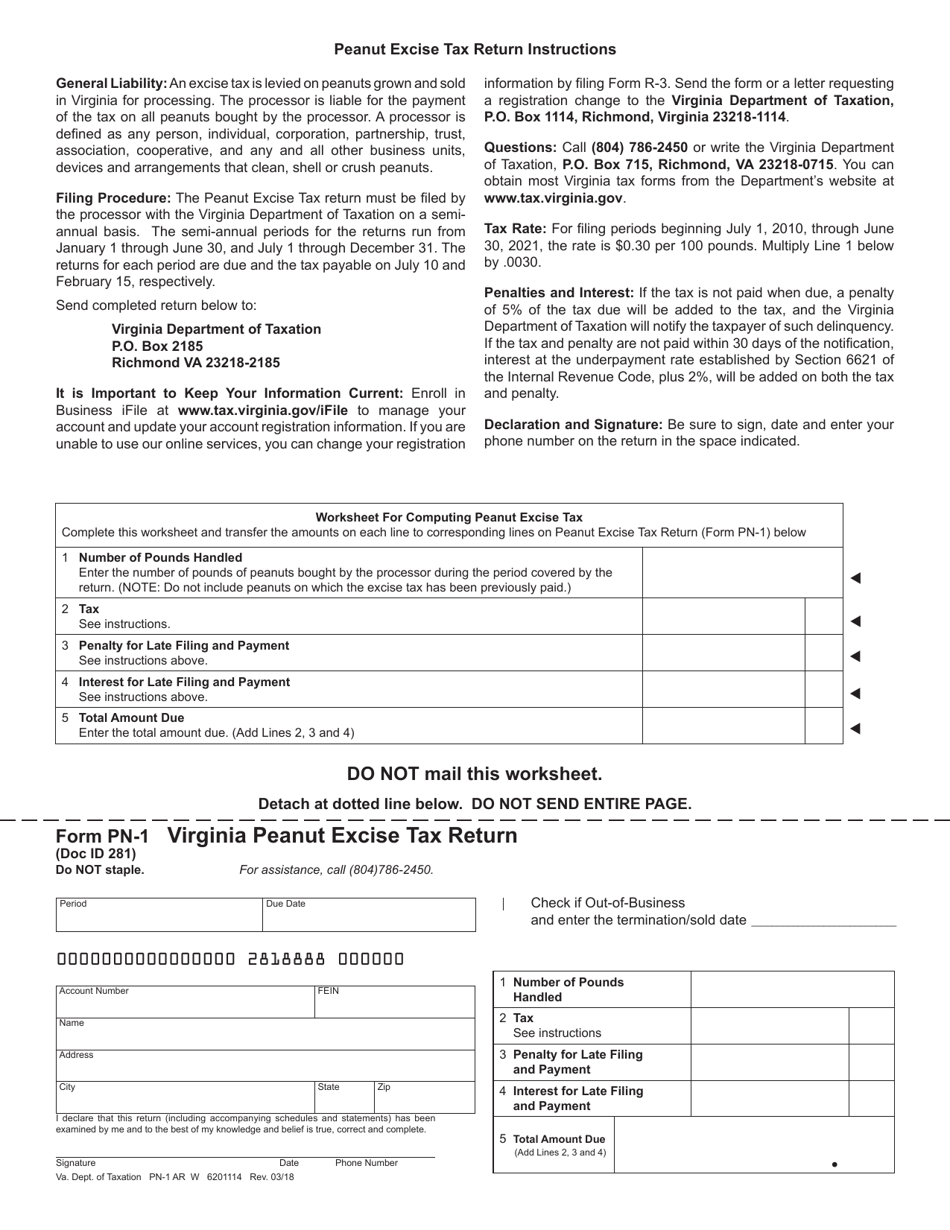

2023 Virginia Tax Rebate How To Claim Your State Tax Refund Tax

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/04/Tax-Rebate-Virginia-2023-1.jpg

https://www.wsls.com/news/virginia/2022/09/16/heres-how-to-check-if...

Web 16 sept 2022 nbsp 0183 32 Here s a breakdown of what Virginia taxpayers can expect regarding the tax rebate Taxpayers must file taxes by Nov 1 2022 to qualify Taxpayers will need to have

https://www.kiplinger.com/taxes/virginia-budget-tax-cuts

Web 9 sept 2023 nbsp 0183 32 The 2023 budget deal features tax cuts mostly new tax rebates to eligible Virginia residents and the return of a popular sales tax holiday Virginia Gov Glenn

2011 2022 Form VA DoT VA 4 Fill Online Printable Fillable Blank

Free Printable Virginia State Tax Forms Printable Forms Free Online

2020 Form VA DoT 760ES Fill Online Printable Fillable Blank PdfFiller

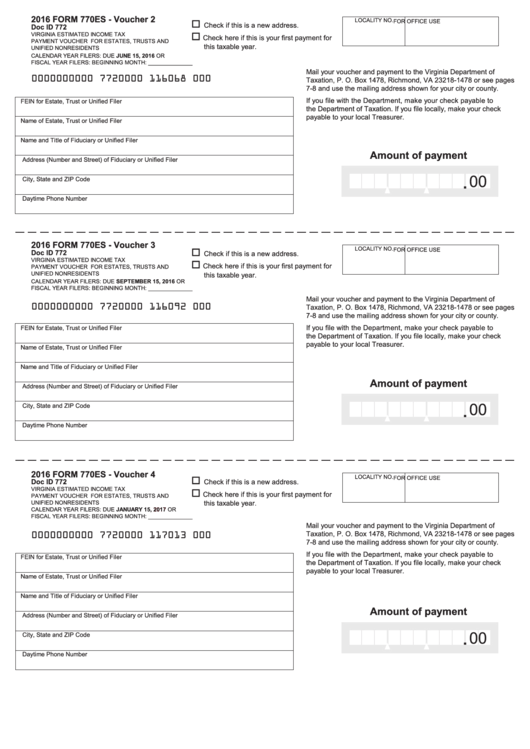

Fillable Form 770es Voucher 2 Virginia Estimated Income Tax Payment

Flat Fee MLS Virginia Buyer Rebate Cash Back Program Virginia

Form 500V Download Fillable PDF Or Fill Online Virginia Corporation

Form 500V Download Fillable PDF Or Fill Online Virginia Corporation

Virginia Tax Rebate Questions Answered Wusa9

Virginia Worksheet For Amended Returns

1099 G 1099 INTs Now Available Virginia Tax

Virginia Taxes Rebate - Web 23 ao 251 t 2023 nbsp 0183 32 Updated 5 43PM Glenn Youngkin FOX 5 DC Virginia taxpayers could get money back in 1B tax rebate Virginia Governor Glenn Youngkin said Wednesday that