Vpf Tax Benefit New Regime Effective 1 April if you are contributing more than Rs2 5 lakh in your Employee s Provident Fund EPF the interest earned on the same will be taxable under the newly notified rules of

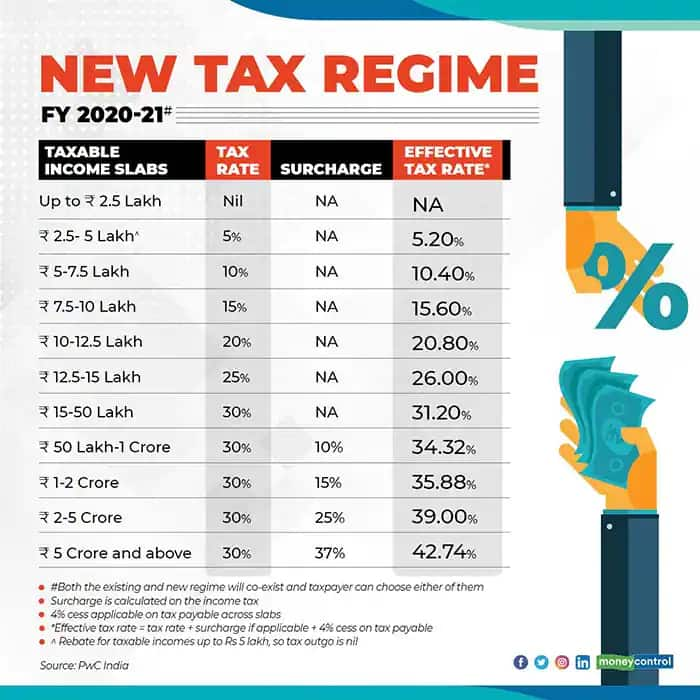

VPF can help you retire with tax free and guaranteed Rs 3 crore in 30 years Voluntary Provident Fund VPF calculation 2023 An employee can contribute up to Rs 2 5 lakh in a year towards New Tax Regime 2024 Check out here all the frequently asked questions about the new income tax regime for FY 2024 25 slabs calculator and deductions for salaried

Vpf Tax Benefit New Regime

Vpf Tax Benefit New Regime

https://images.moneycontrol.com/static-mcnews/2022/01/New-tax-regime-1.jpeg

VPF Voluntary Provident Fund Overview And Benefits

https://www.wealthzi.com/wp-content/uploads/2021/03/EPF.jpg

How To Select Mutual Funds India 5 Point Checklist

https://weinvestsmart.com/wp-content/uploads/2020/03/Mutual-funds.jpg

Voluntary Provident Fund VPF allows salaried employees to contribute voluntary amounts into their EPF account with a tax deduction of up to Rs 1 50 000 annually The interest rate for Learn about the Voluntary Provident Fund VPF and explore its benefits eligibility criteria required documents and withdrawal process Discover how VPF can enhance your

The interest rate on PF accumulation was 8 10 for FY22 8 15 for FY23 and 8 25 for FY24 Savings in EPF and VPF By investing Rs 20 833 per month in EPF and Please note that new tax regime is default regime for AY 2024 25 Any actions in any previous years with respect to choice of regimes will not be applicable from AY 2024 25

Download Vpf Tax Benefit New Regime

More picture related to Vpf Tax Benefit New Regime

VPF In Hindi

https://www.indiareviews.com/wp-content/uploads/2020/05/vpf-account.jpg

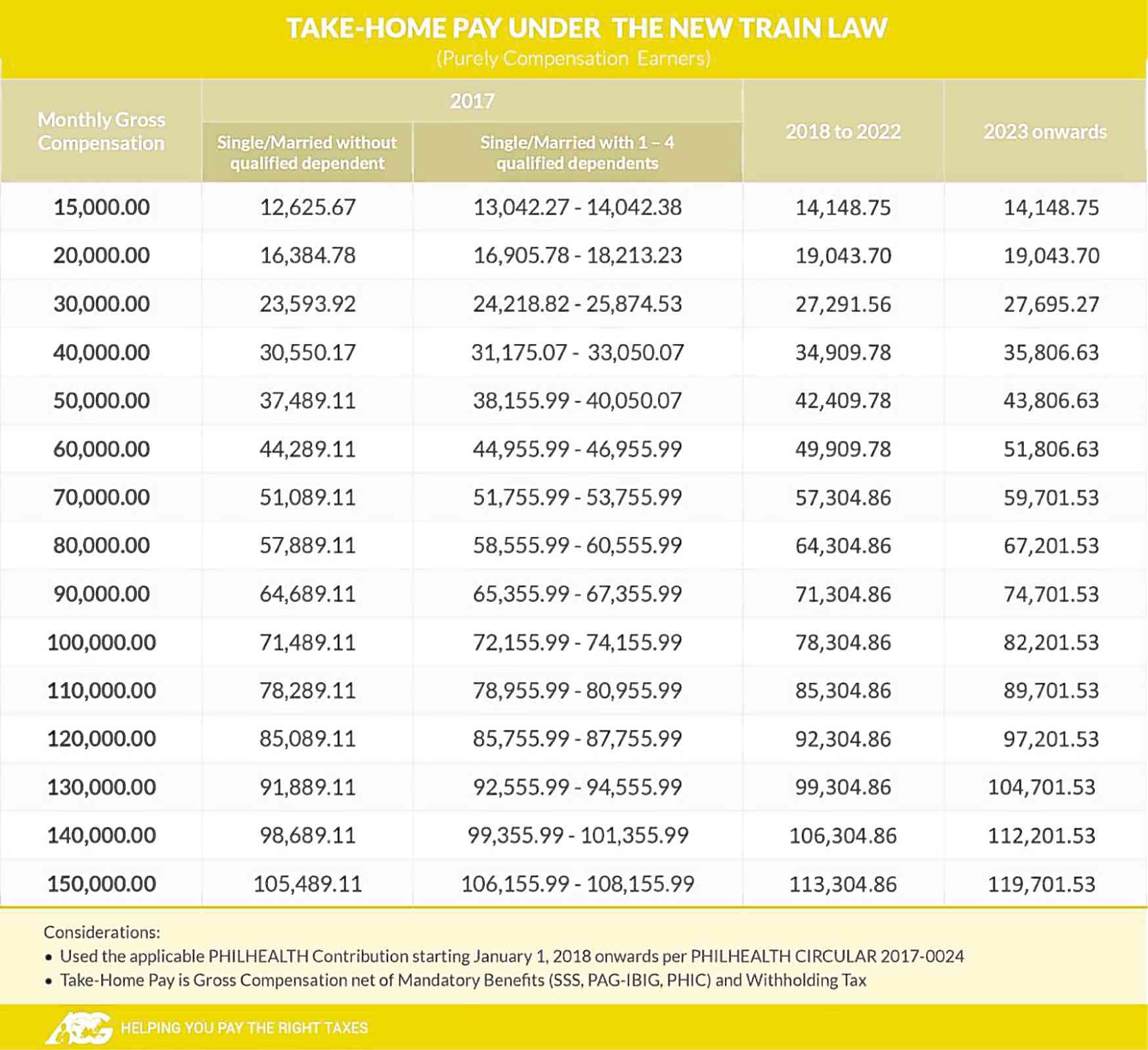

New Tax Regime For The New Year Inquirer Business

http://business.inquirer.net/files/2018/01/graph-2.jpg

Wordly Account Gallery Of Photos

https://www.marylandmatters.org/wp-content/uploads/2021/05/Gaines-editor-final-1.jpg

Will VPF remain attractive option after new tax rules From April 1 if the employee s contribution to PF statutory or voluntary exceeds Rs 2 5 lakh a year then the interest earned Finance Minister Nirmala Sitharaman has announced in the Union Budget 2021 22 to levy income tax on interest earned on employee s contribution towards the Employee Provident Fund or EPF if the sum is above Rs 2 5

Public Provident Fund PPF has been a go to option for traditional investors to save tax while planning for retirement However PPF interest rate is unchanged at 7 1 for The three major tax benefits of this scheme are that it is exempted from Contribution The principal Interest Along with the above mentioned 3 tax benefits there are

Budget 2023 Tax Saving Under New Tax Regime Vs Old Tax Regime For Rs 7

https://akm-img-a-in.tosshub.com/businesstoday/styles/medium_crop_simple/public/images/story/202302/illustration_1.jpg?itok=kH6KXKc9

New GDPR Regulations Billions At Stake For Unprepared Companies

https://www.mailguard.com.au/hubfs/Blog/Manny/locked-data.jpeg#keepProtocol

https://www.livemint.com › money › pers…

Effective 1 April if you are contributing more than Rs2 5 lakh in your Employee s Provident Fund EPF the interest earned on the same will be taxable under the newly notified rules of

https://www.financialexpress.com › money

VPF can help you retire with tax free and guaranteed Rs 3 crore in 30 years Voluntary Provident Fund VPF calculation 2023 An employee can contribute up to Rs 2 5 lakh in a year towards

Tax Reduction Company Inc

Budget 2023 Tax Saving Under New Tax Regime Vs Old Tax Regime For Rs 7

VPF Vs EPF In Hindi VPF Kya Hota Hai Vpf Voluntary Provident Fund

Expense Management Software Expense Reimbursements

Vescovo Principale Tigre Forfettari Obbligo Fattura Elettronica Dal

VPF Interest Rate Eligibility Withdrawal Rules And Tax Benefits

VPF Interest Rate Eligibility Withdrawal Rules And Tax Benefits

Tax benefit Reforms Microsimulation In Developing Countri Flickr

NTA Blog EITC Awareness Day Is January 27 The Earned Income Tax

What Is VPF Voluntary Provident Fund Tax Benefit In VPF VPF Vs EPF

Vpf Tax Benefit New Regime - Voluntary Provident Fund VPF allows salaried employees to contribute voluntary amounts into their EPF account with a tax deduction of up to Rs 1 50 000 annually The interest rate for