Vt Property Tax Relief Homestead Declarations Property Tax Credit Claims and Renter Credit Claims may be filed electronically using tax software a tax preparer or on the Department s taxpayer

The Vermont Property Tax Credit assists many Vermont homeowners with paying their property taxes You may be eligible for a property tax credit based on your 2023 2024 property taxes if File online Visit the Vermont Department of Taxes website to file your homestead declaration and property tax credit form online Get help You can find free help to

Vt Property Tax Relief

Vt Property Tax Relief

https://s.hdnux.com/photos/01/31/15/45/23386439/3/rawImage.jpg

Tax Relief Free Of Charge Creative Commons Financial 3 Image

https://pix4free.org/assets/library/2021-04-28/originals/tax_relief.jpg

Property Tax Relief Applications Are Due March 1 Nashua NH Patch

https://patch.com/img/cdn/users/546351/2015/02/raw/20150254d3952cf1964.jpg

The property tax credit assists Vermont residents to pay property tax and is based on a percentage of household income Homeowners eligible for a credit are those who Do you own your home If you meet certain income and residency requirements the State of Vermont can help pay your property taxes You could be eligible for up to 8 000

The Vermont Property Tax Credit assists homeowners with paying their property taxes The maximum credit is 8 000 with a maximum of 5 600 for the education property tax portion MONTPELIER Vt WCAX As communities across the state continue to shoot down school budgets as part of a property tax revolt Vermont lawmakers are scrambling to

Download Vt Property Tax Relief

More picture related to Vt Property Tax Relief

R D Tax Relief In 2022 What You Need To Know

https://forrestbrown.co.uk/wp-content/uploads/2021/09/Stocksy_txp24f5e82ftaB300_Medium_3370983-1536x1024.jpg

Should You Protest Your Property Taxes In Austin

https://activerain-store.s3.amazonaws.com/blog_entries/935/5744935/original/RelayThat_save_on_property_tax_dollars.jpg?1660084904

4 Property Tax Relief Options Keep Asking

https://cdn.keepasking.com/keepasking/wp-content/uploads/2021/02/4-property-tax-relief-options-scaled.jpg

Homestead Declaration Individuals Property Tax Credit Contact Us Commissioner Craig Bolio Deputy Commissioner Rebecca Sameroff 802 828 2505 Property tax relief programs sometimes called exemptions release eligible homeowners from paying some or all their property tax obligation How long the exemption lasts can vary depending on where you live and the

Does Vermont have a Property Tax Reduction for Veterans Yes for some disabled veterans and families The following are eligible for the exemption Veterans receiving Disability But in much of Demrow s district property taxes are actually falling thanks to the latest changes to Vermont s school funding formula which give relative tax relief to

What Are Deferred Tax Assets Optima Tax Relief

https://optimataxrelief.com/wp-content/uploads/2023/07/23-optima-deferred-tax-assets.jpg

Here s The Real Story On Tax Relief RateMuse

https://i0.wp.com/blog.ratemuse.com/wp-content/uploads/2019/10/tax_relief.png?fit=1200%2C978&ssl=1

https://tax.vermont.gov/press-release/october-2024...

Homestead Declarations Property Tax Credit Claims and Renter Credit Claims may be filed electronically using tax software a tax preparer or on the Department s taxpayer

https://tax.vermont.gov/sites/tax/files/documents/...

The Vermont Property Tax Credit assists many Vermont homeowners with paying their property taxes You may be eligible for a property tax credit based on your 2023 2024 property taxes if

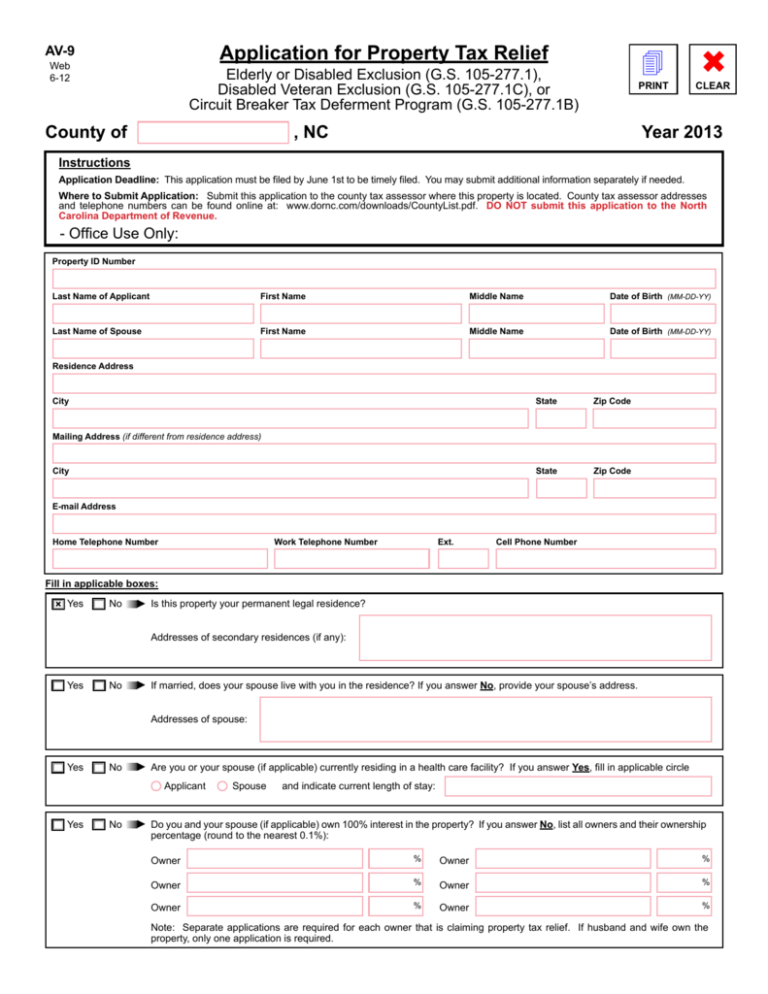

Application For Property Tax Relief

What Are Deferred Tax Assets Optima Tax Relief

Ten Ways To Protect Property Tax Relief In 2023

Property Tax Relief LinkedIn

Property Tax Relief How It Works Credit Karma

Minnesota Property Tax Refunds MNbump

Minnesota Property Tax Refunds MNbump

California Mortgage Relief Program Property Tax Relief Yolo County

VT Property Tax Credit Information Town Of Cavendish Vermont

Commercial Property Tax Relief Growth Business

Vt Property Tax Relief - Veterans with 50 or greater service connected disability or who are receiving Improved Pension are eligible for a property tax reduction some surviving spouse of these disabled veterans