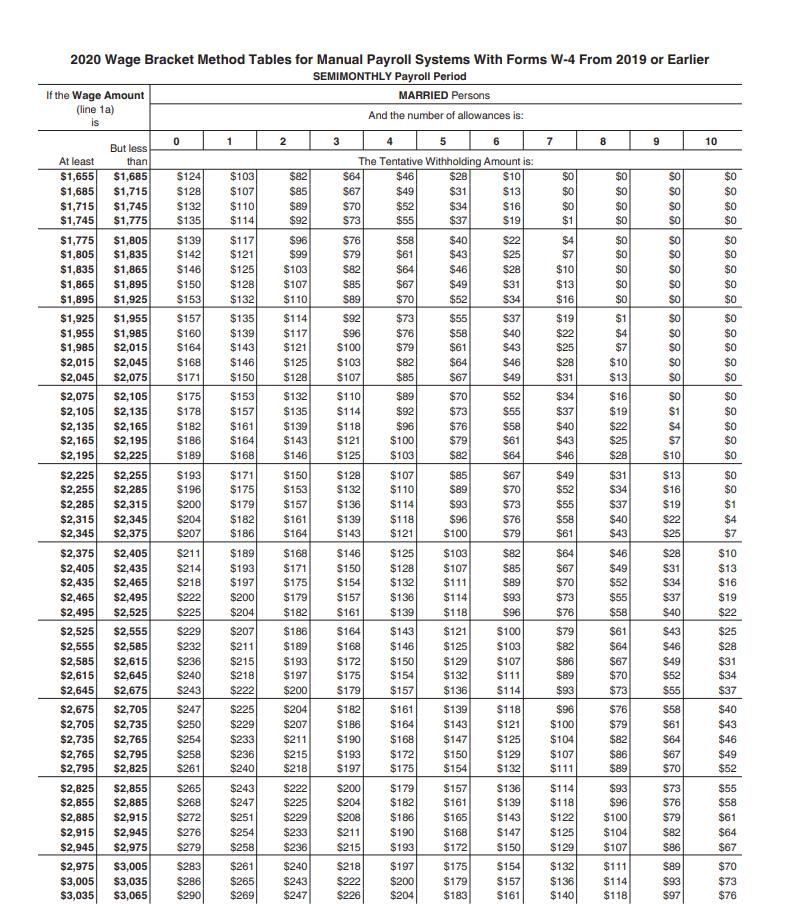

Wage Withholding Tax Netherlands The precise payroll taxes you must either withhold or pay for your account depends on a number of factors You withhold wage tax when your employee must pay income tax in

Employers must withhold salaries tax and national insurance contributions from all income components paid to employees and remit them to the Tax and Customs Administration Wage Tax Wage tax in the Netherlands is a progressive income tax that is withheld from employees wages The tax rate ranges from 2 3 to 52 depending on

Wage Withholding Tax Netherlands

Wage Withholding Tax Netherlands

https://solusiaccounting.id/wp-content/uploads/2020/03/Neraca-3.jpg

Property Tax For Expats In The Netherlands Expatra

https://expatra.com/wp-content/uploads/2009/07/property-tax-netherlands.jpg

Taxes In The Netherlands The Complete Guide College Life

https://collegelife.co/wp-content/uploads/2022/12/51-1.png

If you are employed by a company then your income tax will be withheld from your salary by your employer this is known as wage tax which is contained within payroll tax If you are self employed in the 31 rowsThe wage withholding tax is a deduction of wages social security benefits and pensions as an advance payment for the income tax paid through the employer etc

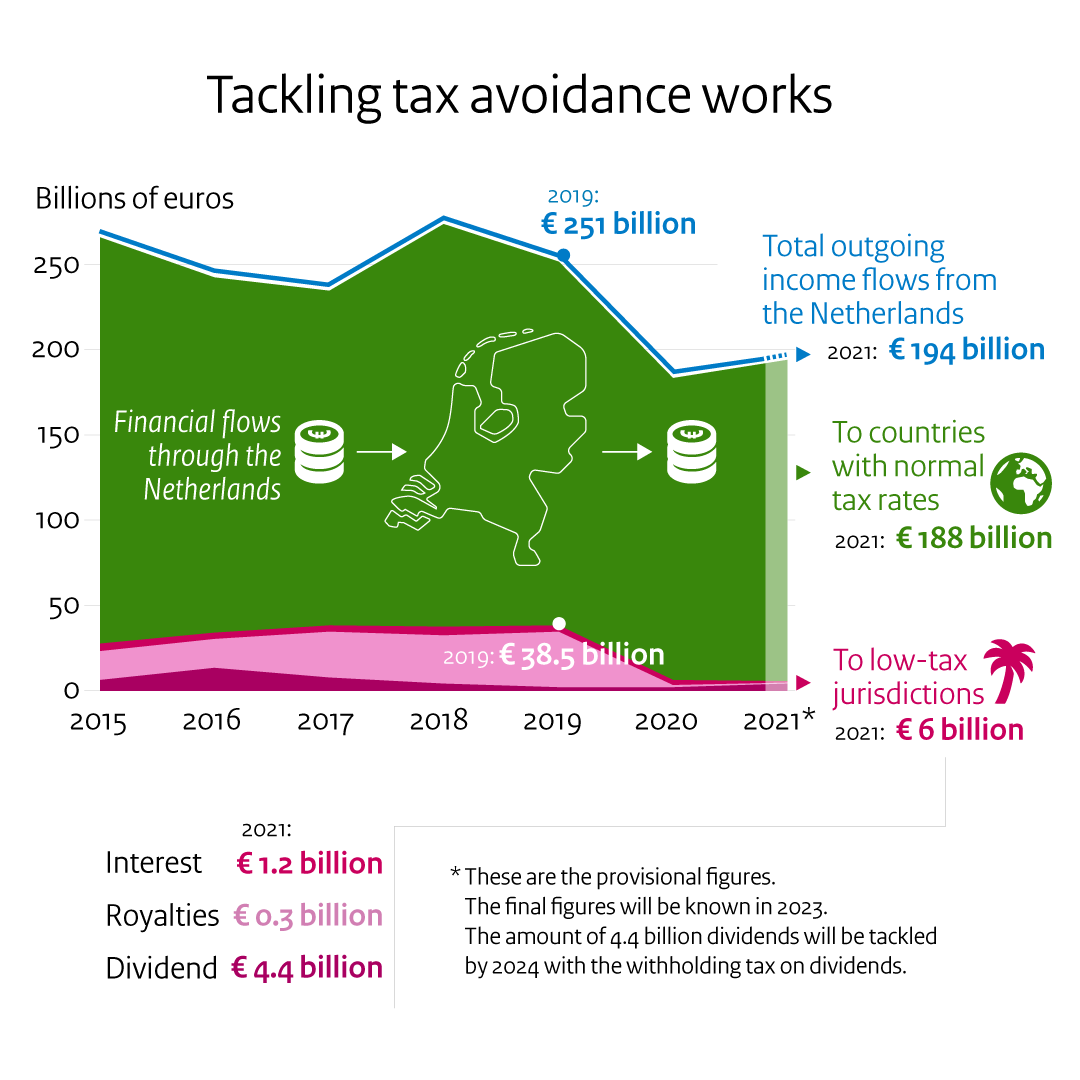

The WHT tax is levied at a rate equal to the highest rate of Dutch CIT in the current tax year For 2023 this rate is 25 8 The WHT rate may however be reduced by a tax The Netherlands has various forms of withholding tax where taxation is levied at the source The primary types include dividend and payroll tax while interest or royalties are

Download Wage Withholding Tax Netherlands

More picture related to Wage Withholding Tax Netherlands

Colorado Wage Withholding Tax Form Dr 1094 WithholdingForm

https://i0.wp.com/www.withholdingform.com/wp-content/uploads/2022/08/2015-form-co-dor-dr-1094-fill-online-printable-fillable-blank.png

Tax Free Havens Curacao Netherlands Antilles Tax Rates 49 4

https://www.taxfreehaven.info/wp-content/uploads/2013/06/Curacao-110.jpg

Gr mad De Trib ngrijorare Dutch Income Tax Calculator Curcan Taxa De

https://www.companyformationnetherlands.com/uploads/default/files/Income_Tax_in_the_Netherlands.png

Every year and sometimes even twice the Dutch tax office publishes new wage tax tables from which the exact amount of payroll tax to be withheld can be Wage tax or wage withholding tax Loonheffing is an advance payment for the individual income tax Wage tax and national social insurance contributions

You are a withholding agent in the Netherlands in the following situations You have a permanent establishment in the Netherlands Your employee works on the Dutch Payment of tax If an employee is on a Dutch payroll wage tax will be withheld from one s salary Generally speaking if taxpayers have sizable income that

The Netherlands To Introduce Withholding Tax On Dividends Taxlinked

https://taxlinked.net/sites/default/files/inline-images/netherlands_tax.png

The Tax System In The Netherlands A Guide For Taxpayers Expatica

https://www.expatica.com/app/uploads/sites/3/2014/05/netherlands-tax-1920x1080.jpg

https://www.belastingdienst.nl/wps/wcm/connect...

The precise payroll taxes you must either withhold or pay for your account depends on a number of factors You withhold wage tax when your employee must pay income tax in

https://www.government.nl/topics/taxation-and...

Employers must withhold salaries tax and national insurance contributions from all income components paid to employees and remit them to the Tax and Customs Administration

Tax Avoidance Via The Netherlands Significantly Reduced Thanks To

The Netherlands To Introduce Withholding Tax On Dividends Taxlinked

Withholding Taxes In The Philippines All You Need To Know Eezi

Printable Federal Withholding Tables 2022 Table Onenow

Ms Employee Withholding Form 2023 Printable Forms Free Online

ALL ABOUT WITHHOLDING TAXES

ALL ABOUT WITHHOLDING TAXES

A Guide To Taxes In The Netherlands All About Expats

Where Could Interest And Tax Rates Be Headed Mercer Advisors

Impact Of The Multilateral Instrument On Dutch Bilateral Tax Treaties

Wage Withholding Tax Netherlands - If you are employed by a company then your income tax will be withheld from your salary by your employer this is known as wage tax which is contained within payroll tax If you are self employed in the