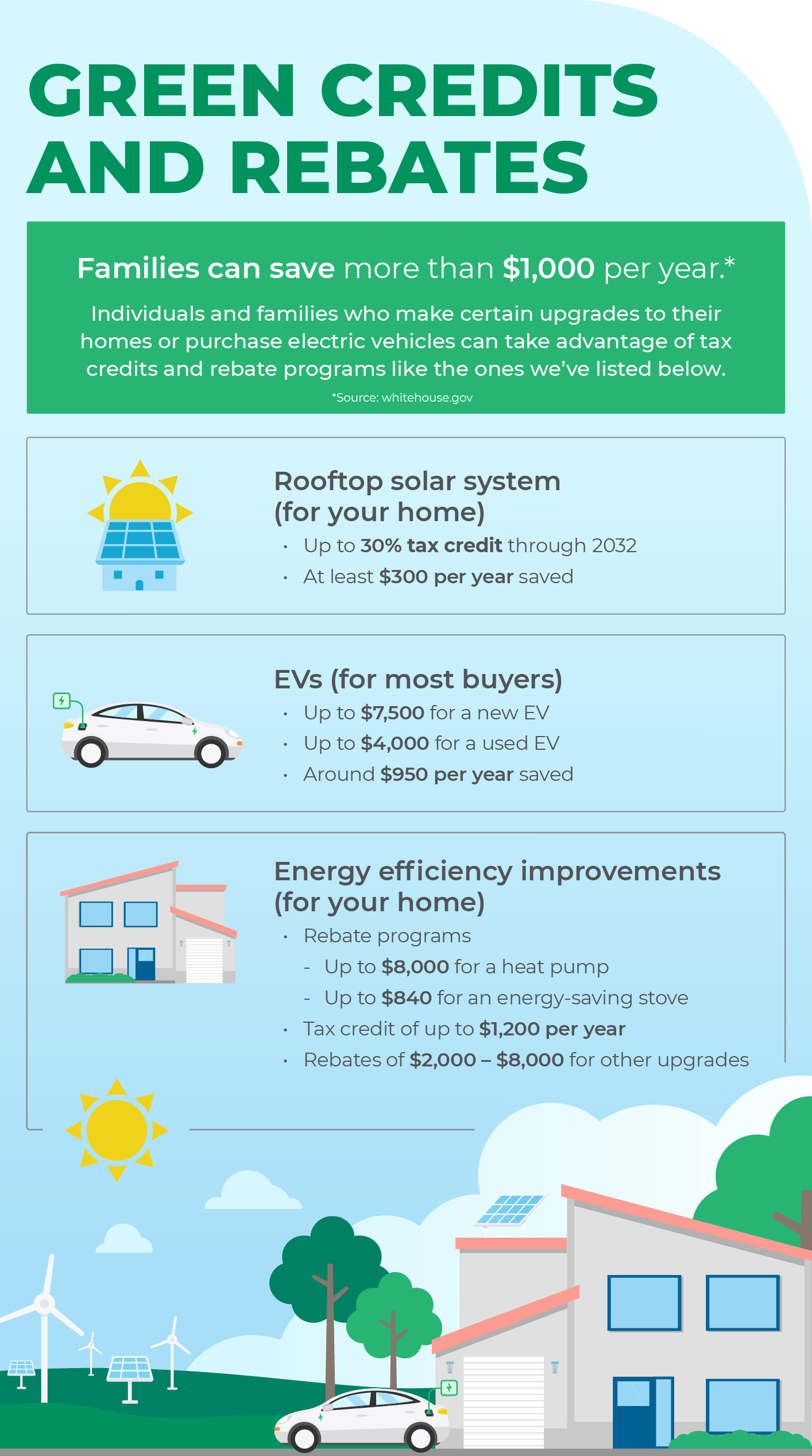

What Appliances Qualify For Energy Tax Credit 2023 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through

Energy improvements to your home such as solar or wind generation biomass stoves fuel cells and new windows may qualify you for credits expanded in 2022 If you make energy The Renewable Energy tax credits have also been extended and now will be available through the end of 2023 These include incentives for Geothermal Heat Pumps Residential Wind Turbines Solar Energy

What Appliances Qualify For Energy Tax Credit 2023

What Appliances Qualify For Energy Tax Credit 2023

https://i.pinimg.com/originals/d9/ad/96/d9ad96393cb13907229e3e2b1609bcc1.jpg

4 Home Improvement Projects That Qualify For Energy Tax Credits RWC

https://www.rwcnj.com/wp-content/uploads/2018/01/Depositphotos_14725837_m-2015.jpg

Kitchen Appliance In Bahrain Buy Online Bahrain

https://yyfakhro.com/wp-content/uploads/2020/04/appliances-e1576685982524-scaled.jpg

Federal Tax Credits for Energy Efficiency The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help reduce energy costs There are lots of ways to save on energy bills around the home by upgrading your appliances Water heaters air conditioners and certain stoves qualify for a 30 percent tax credit when you upgrade to newer more efficient

Q Who is eligible for tax credits A Homeowners including renters for certain expenditures who purchase energy and other efficient appliances and products Q What do consumers do to get The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide details on

Download What Appliances Qualify For Energy Tax Credit 2023

More picture related to What Appliances Qualify For Energy Tax Credit 2023

Inflation Reduction Act Of 2022 Clean Vehicle Energy Credit Bregante

https://bcocpa.com/wp-content/uploads/2022/10/AdobeStock_525155507-1-scaled.jpeg

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

https://www.eesi.org/images/content/Summary_of_Clean_Energy_Credits.png

The Complete List Of Cars Eligible For The 7 500 EV And PHEV Federal

https://www.carscoops.com/wp-content/uploads/2023/01/EV-PHEV-Tax-Credit-7500-Carscoops-1024x576.jpg

Q Who is eligible for tax credits A Homeowners including renters for certain expenditures who purchase energy and other efficient appliances and products Q What do The overall total limit for an efficiency tax credit in one year is 3 200 This breaks down to a total limit of 1 200 for any combination of home envelope improvements windows doors skylights

Beginning with the 2023 tax year tax returns filed now in early 2024 the credit is equal to 30 of the costs for all eligible home improvements made during the year Consumer Reports explains you how you might qualify for the electric appliance rebates included in the Inflation Reduction Act

Federal Solar Tax Credit What It Is How To Claim It For 2024

https://www.ecowatch.com/wp-content/uploads/2022/10/Solar-Investment-Tax-Credit-5-1-2.png

The Federal Tax Credit For Electric Cars Is Set To Expire OsVehicle

https://cdn.osvehicle.com/can_i_claim_the_ev_tax_credit_every_year.png

https://www.irs.gov › credits-deductions › energy...

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through

https://www.irs.gov › credits-deductions › home-energy-tax-credits

Energy improvements to your home such as solar or wind generation biomass stoves fuel cells and new windows may qualify you for credits expanded in 2022 If you make energy

Energy Efficient Appliances That Qualify For Tax Deductions TheStreet

Federal Solar Tax Credit What It Is How To Claim It For 2024

Free Appliances Available For Those Who Qualify Free Appliances

Does A New Roof Qualify For Energy Tax Credit In Florida Bay To Bay

How Does The Tax Credit System Work Leia Aqui How Do Tax Credits

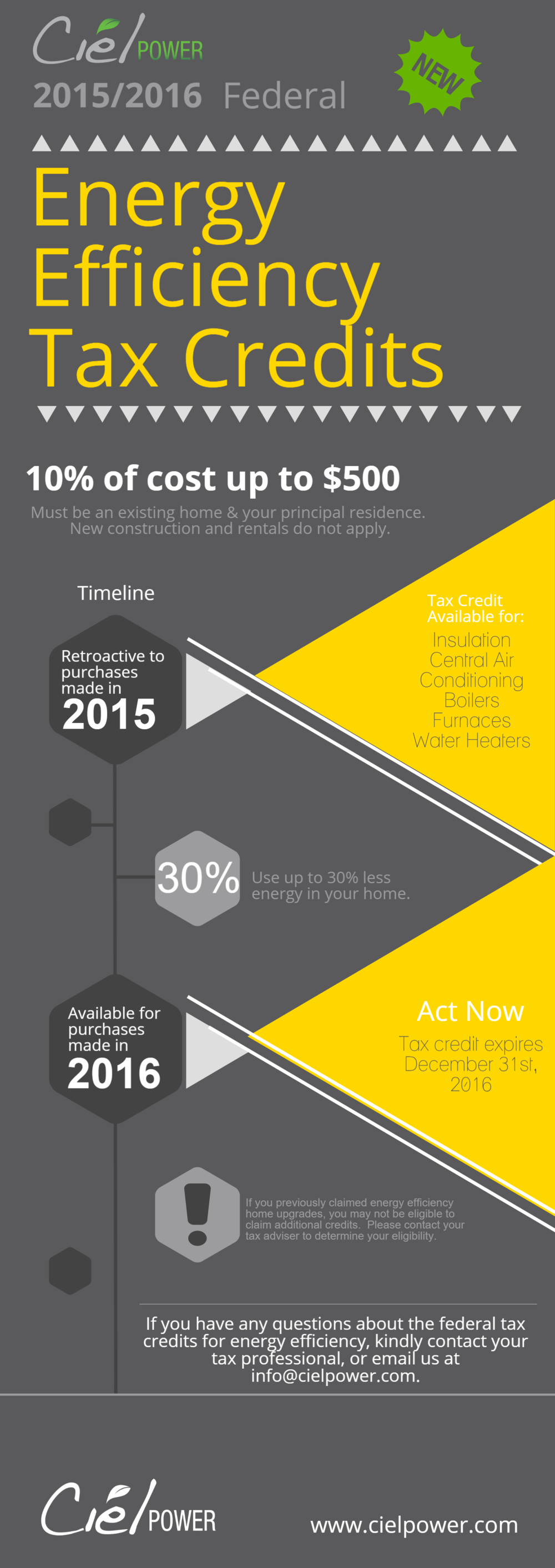

2015 2016 Federal Energy Efficiency Tax Credit Ciel Power LLC

2015 2016 Federal Energy Efficiency Tax Credit Ciel Power LLC

What Roof Shingles Qualify For Energy Tax Credit A Guide To Saving And

White Goods Removal Disposal Sydney Paul s Rubbish

2023 Residential Clean Energy Credit Guide ReVision Energy

What Appliances Qualify For Energy Tax Credit 2023 - The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide details on