What Are The Income Tax Benefit On Home Loan Since the Tax Cuts and Jobs Act doubled the standard deduction far fewer taxpayers benefit from itemizing deductions like mortgage interest and property taxes and those who do tend to need

On purchase of property with home loans borrowers enjoy a variety of deductions on their income tax liability These deductions against the tax could be claimed under four sections of the income tax The tax code grants tax benefits that reduce your costs of buying owning fixing up and selling a home Here are brief

What Are The Income Tax Benefit On Home Loan

What Are The Income Tax Benefit On Home Loan

https://blog.saginfotech.com/wp-content/uploads/2016/09/income-tax-benefit.jpg

Home Loan Tax Benefits Interest On Home Loan Section 24 And

https://i.ytimg.com/vi/M-wUkSDKAfk/maxresdefault.jpg

Income Tax Benefits On Home Loan Loanfasttrack

https://www.loanfasttrack.com/blog/wp-content/uploads/2020/12/IncomeTaxBenfits-800x534.png

The Tax Benefits of Owning a Home Must Know Deductions and Credits As a homeowner there are a number of tax breaks you might be eligible for such as a property tax deduction and a In the past homeowners could deduct up to 1 million in mortgage interest However the Tax Cuts and Jobs Act has reduced this limit to 750 000 as a single filer or married couple filing jointly If you are

The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750 000 of mortgage debt Homeowners who bought houses before Every homeowner s financial circumstances are unique so the impact of tax benefits may vary depending on factors such as income mortgage size and the

Download What Are The Income Tax Benefit On Home Loan

More picture related to What Are The Income Tax Benefit On Home Loan

Income Tax Saving Calculator On Home Loan ONCOMIE

https://i.pinimg.com/originals/4b/d3/3f/4bd33f387fa34990f35512eb3562fc18.png

What Is The Maximum Tax Benefit On Housing Loan Leia Aqui Is There A

https://www.idfcfirstbank.com/content/dam/idfcfirstbank/images/blog/finance/income-tax-benefit-on-home-loan-repayment.jpg

TAX BENEFITS WHILE AVAILING HOME LOANS PO Tools

https://4.bp.blogspot.com/-ZLgMMJK-3J4/WhIrMf_3PiI/AAAAAAAAOLQ/zk_YIBwDoUw7lotIaBwpqte8pSljxzJPgCLcBGAs/s1600/Home%2BLoan.png

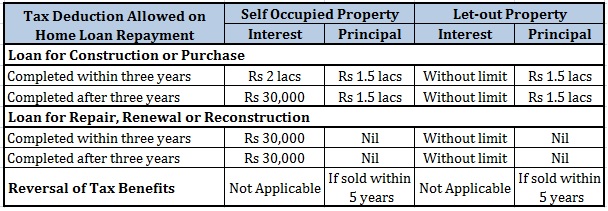

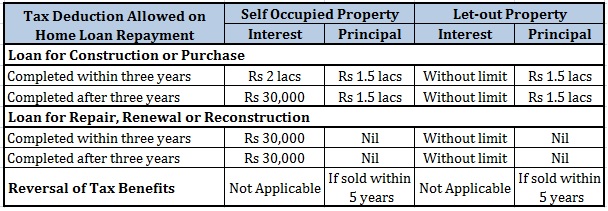

Home loan borrowers should note all income tax breaks offered on home loans because doing so can help you significantly lower your tax liabilities 2016 17 Governed by Section 24 b of the Income Tax Act of 1961 it allows you to claim a tax rebate of up to 30 000 annually on the interest paid on your home improvement loan

Sections of Income Tax Act Tax Deduction Section 80C Up to Rs 1 5 lakh on principal repayment including stamp duty and registration fee Section 24 b Up to If an individual is planning to opt for the old tax regime in the current financial year 2021 22 and has ongoing home loan planning to avail home loan then here are

20151209 Tax Benefits On A Home Loan Personal Finance Plan

https://www.personalfinanceplan.in/wp-content/uploads/2015/12/20151209_Tax-Benefits-on-a-Home-Loan.jpg?x85738

Income Tax Benefit On Home Loan Your Quick Guide On Tax Exemption

https://static.tnn.in/photo/msid-99078262,imgsize-56716,updatedat-1680063914632,width-1280,height-720,resizemode-75/99078262.jpg

https://www.forbes.com/advisor/mortgages/t…

Since the Tax Cuts and Jobs Act doubled the standard deduction far fewer taxpayers benefit from itemizing deductions like mortgage interest and property taxes and those who do tend to need

https://housing.com/news/home-loans-guide …

On purchase of property with home loans borrowers enjoy a variety of deductions on their income tax liability These deductions against the tax could be claimed under four sections of the income tax

Income Tax Benefits On Home Loan Mothish Kumar Property Coach YouTube

20151209 Tax Benefits On A Home Loan Personal Finance Plan

How To Claim Tax Benefit On Home Loan For Under Construction Property

Tax Benefits Of Home Loan

What Are The Tax Benefit On Home Loan FY 2020 2021

Statement Of Activities Reading A Nonprofit Income Statement The

Statement Of Activities Reading A Nonprofit Income Statement The

Home Loan Tax Benefit Smart Guide To Tax Benefit On Home Loan 2015

Have You Claimed These Home Loan Tax Benefits Yet

:max_bytes(150000):strip_icc()/TermDefinitions_Incomestatementcopy-9fe294644e634d1d8c6c703dc7642018.png)

Income Statement How To Read And Use It 2023

What Are The Income Tax Benefit On Home Loan - Employees and employers typically pay half of the 12 4 Social Security 1 45 Medicare benefit each for a total of 15 3 Self employed people pay self employment taxes