What Are The Tax Benefits Of Owning A Home Verkko 8 jouluk 2023 nbsp 0183 32 A tax deduction reduces your adjusted gross income AGI which reduces the amount of taxes you owe For example if you re in the 24 tax bracket your tax liability will be reduced by 24

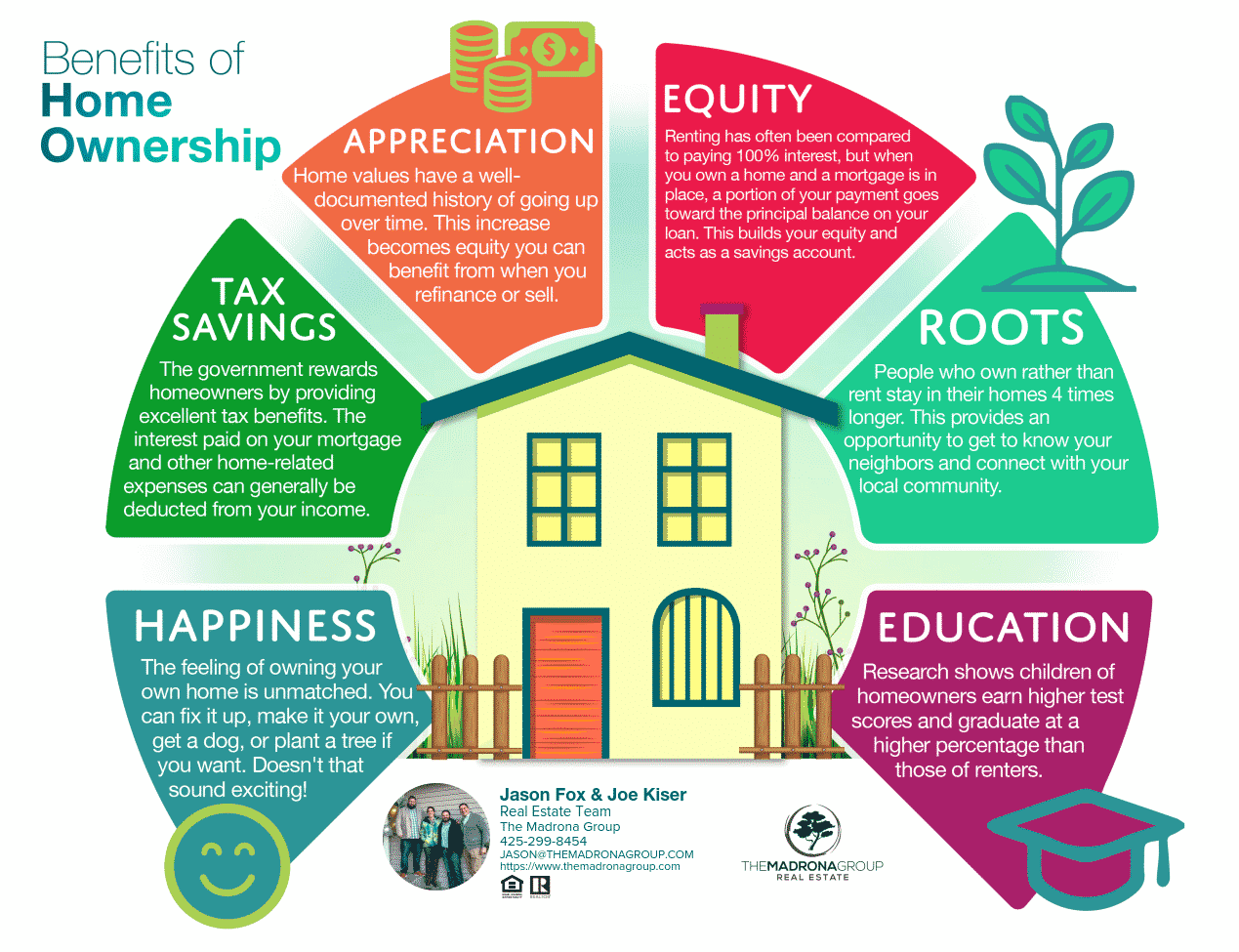

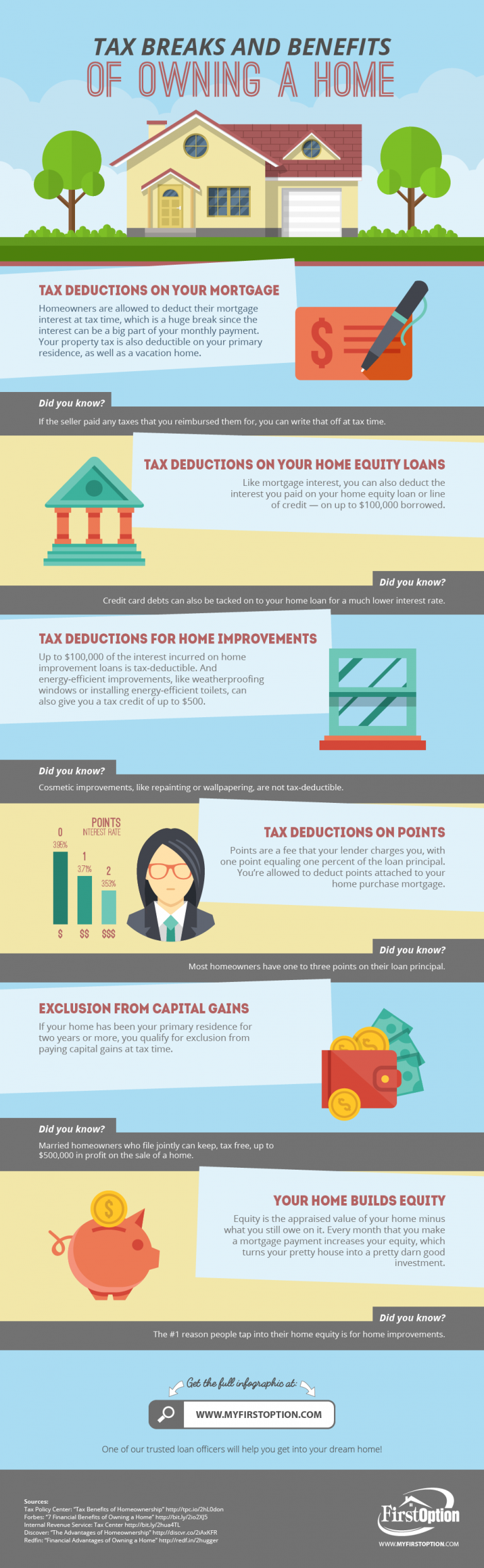

Verkko 3 marrask 2023 nbsp 0183 32 In the U S owning a home can lead to significant tax benefits which might include deductions for mortgage interest property taxes and home sale exclusion among others A financial advisor can help you determine how to take advantage for your own tax situation Verkko 23 tammik 2020 nbsp 0183 32 The tax code grants tax benefits that reduce your costs of buying owning fixing up and selling a home Here are brief descriptions of tax benefits of owning a home the

What Are The Tax Benefits Of Owning A Home

What Are The Tax Benefits Of Owning A Home

https://sell-4free.net/wp-content/uploads/2022/08/What_Are_the_Tax_Benefits_of_Owning_a_Home.jpeg

PacRes Mortgage What Are The Tax Benefits Of Owning A Home

https://cdn2.assets-servd.host/pacres-mortgage/production/images/22_1226_Blog_What-Are-the-Tax-Benefits-of-Owning-a-Home4-1.png

What Are The Tax Benefits Of Owning A Home Leia Aqui Does Owning A

https://upwardhomes.net/wp-content/uploads/2023/03/Maximize-Your-Savings-5-Tax-Benefits-og-Owning-a-Home.png

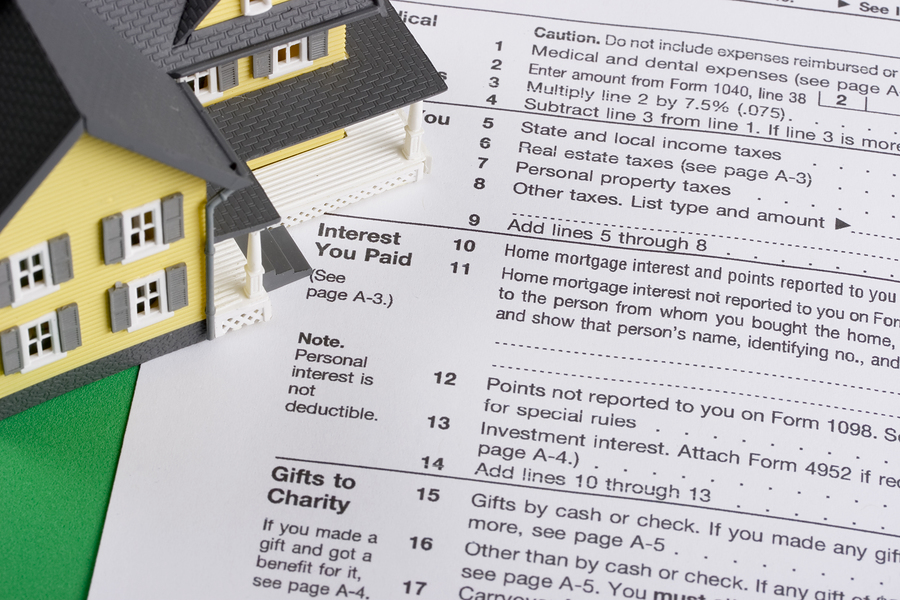

Verkko 29 kes 228 k 2022 nbsp 0183 32 Key Takeaways Buying a house comes with the tax benefit of deducting eligible discount points or eligible prepaid property taxes assessed at closing Owning a house includes ongoing possible deductions of mortgage insurance premiums qualifying mortgage interest and local and state property taxes Verkko 10 helmik 2023 nbsp 0183 32 The Tax Benefits of Owning a Home Must Know Deductions and Credits As a homeowner there are a number of tax breaks you might be eligible for such as a property tax deduction and a mortgage credit certificate here s how they work Miranda Marquit Edited by Chris Jennings Updated February 10 2023

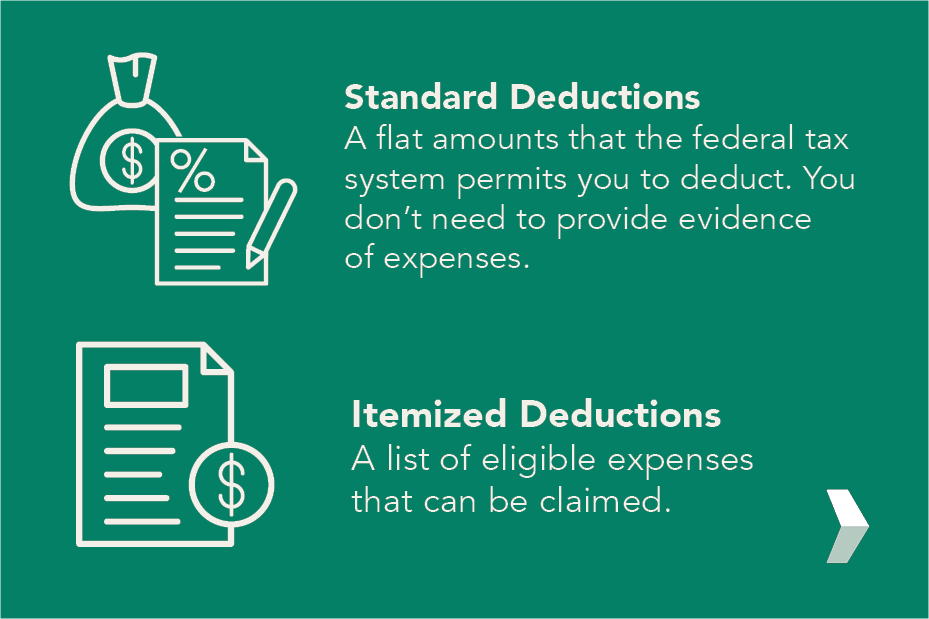

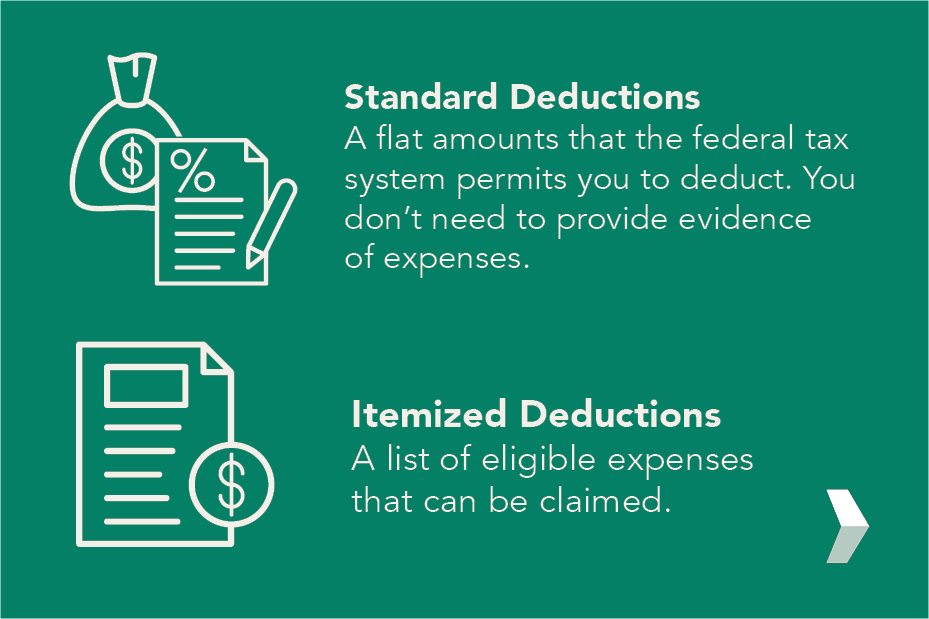

Verkko What are the tax benefits of owning a home Plenty of homeowners are asking themselves this right around now as they prepare to file their taxes You may recall the Tax Cuts and Jobs Verkko 28 jouluk 2023 nbsp 0183 32 When it comes to tax breaks for buying a house your CPA might explain the tax benefits of homeownership can come in one of two formats either a tax deduction or a tax credit Tax deductions Deductions are expenses that the IRS has agreed you can subtract from your taxable income so that when you pay your tax bill

Download What Are The Tax Benefits Of Owning A Home

More picture related to What Are The Tax Benefits Of Owning A Home

What Are The Tax Benefits Of Owning A Home Discover Spring Texas

https://discoverspringtexas.com/wp-content/uploads/2009/01/spring-texas-homeownership-tax-deductions.jpg

What Are The Tax Benefits Of Owning A Home Property Ownership Tax

https://localrecordsoffices.com/wp-content/uploads/2021/07/local-records-office-tax-benefits-owning-home-infographic-418x501.png

6 Benefits Of Home Ownership

https://www.themadronagroup.com/wp-content/uploads/2019/02/6-Benefits-of-Home-Ownership.png

Verkko 10 marrask 2021 nbsp 0183 32 Pride of Ownership Appreciation Mortgage Interest Deductions Property Tax Deductions Capital Gains Exclusion Photo Gary Burchell Getty Images You ve probably listened to the advice of friends family and co workers many of whom are likely encouraging you to buy a home However you may still wonder whether Verkko 3 huhtik 2023 nbsp 0183 32 Deciding whether to buy or rent is a big decision so let s look at some of the pros and cons of renting too Pros Cons You can move without penalty when your lease is up You can t make any changes or renovations to your apartment without landlord approval Monthly rent payments are likely lower than house payments

Verkko 2 toukok 2023 nbsp 0183 32 If you re financially ready to have a place of your own it s time to think about these 10 often overlooked benefits of owning a home 1 You can control your monthly housing payment 2 You ll build home equity with each monthly payment 3 Your home value will rise over time 4 Verkko 17 elok 2023 nbsp 0183 32 Once you have an MCC you could qualify for a credit on a portion of your mortgage interest which directly reduces your tax liability For example let s say your mortgage interest for the year is 8 000 and your MCC rate is 20 You can get a credit of 1 600 8 000 20 taken directly off your tax bill

Tax Benefits Of Buying Owning A Home In 2012 2013

http://www.letsdotaxes.com/wp-content/uploads/2012/10/Tax-benefits-of-owning-a-house.png

What Are The Tax Benefits Of Owning A Home Digs By OJO

https://digs.co/wp-content/uploads/2019/04/header-1.jpg

https://www.investopedia.com/articles/personal-finance/051915/what-are...

Verkko 8 jouluk 2023 nbsp 0183 32 A tax deduction reduces your adjusted gross income AGI which reduces the amount of taxes you owe For example if you re in the 24 tax bracket your tax liability will be reduced by 24

https://smartasset.com/taxes/tax-benefits-of-owning-a-home

Verkko 3 marrask 2023 nbsp 0183 32 In the U S owning a home can lead to significant tax benefits which might include deductions for mortgage interest property taxes and home sale exclusion among others A financial advisor can help you determine how to take advantage for your own tax situation

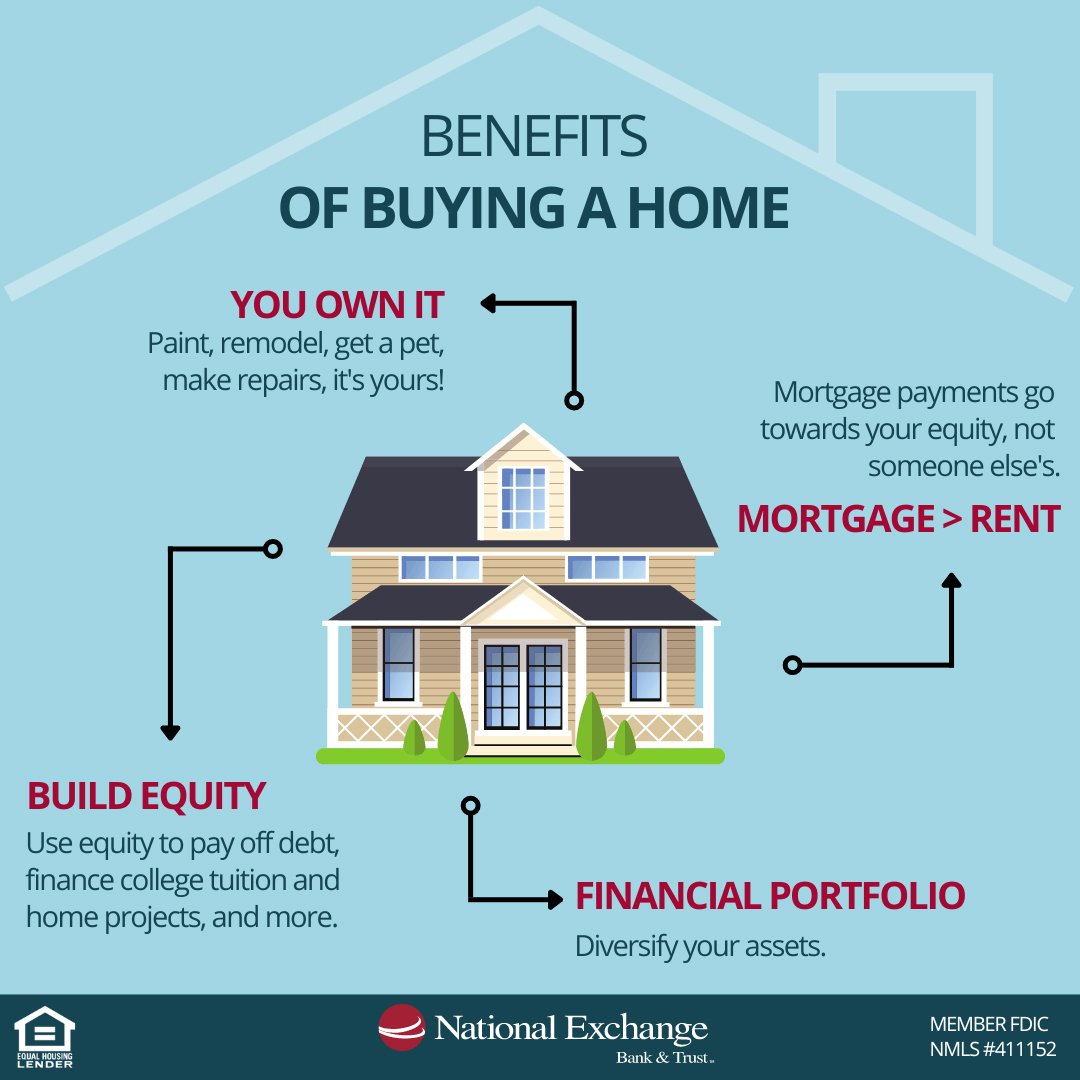

Benefits Of Owning A Home infographic

Tax Benefits Of Buying Owning A Home In 2012 2013

What Are The Tax Benefits Of Owning A House See Here Finances All

Benefits Of Owning A Home

Tax Breaks And Benefits Of Owning A Home

Tax Benefits Of Owning Rental Properties Real Property Management

Tax Benefits Of Owning Rental Properties Real Property Management

What Are The Tax Benefits Of Owning An Orlando Rental Property Homevest

Rent Vs Own BrookHampton Realty

Benefits Of Buying A Home NEBAT Blog

What Are The Tax Benefits Of Owning A Home - Verkko 1 helmik 2023 nbsp 0183 32 The next tax benefit of buying a home is the mortgage points deduction If you paid points to lower your interest rate when you got your mortgage you may be able to deduct those points from your taxes One point is equal to 1 of the loan amount So if you paid two points on a you would be able to deduct 2 000 from your