What Are The Tax Exemptions For 2022 199A deduction 2022 AVE Federal Estate Tax Exemption The federal estate tax exemption for decedents dying in 2022 will increase to 12 06 million per

In 2022 the standard deductions are as follows 12 950 for Single or Married Filing Separately 25 900 for Married Filing Jointly or Qualifying Widow er 19 400 for Head Your Guide to Tax Year 2022 Deductions Learn how tax deductions work and which ones you might be able to take for tax year 2022 By Jessica Walrack Edited

What Are The Tax Exemptions For 2022

What Are The Tax Exemptions For 2022

https://tax.net.pk/wp-content/uploads/2021/07/Updated-tax-exemptions-and-tax-credits.jpeg

2022 Tax Tables Married Filing Jointly Printable Form Templates And

https://www.ntu.org/Library/imglib/2021/11/ntuf-table1.png

Mismanaged Idle SSS Assets Justifies Tax Exemption Says BMP The

http://1.bp.blogspot.com/-NX8698xLmNQ/Vge5ULTlAeI/AAAAAAAAWSs/Yi11-3oPwKw/s1600/TAX-EXEMPTION.jpg

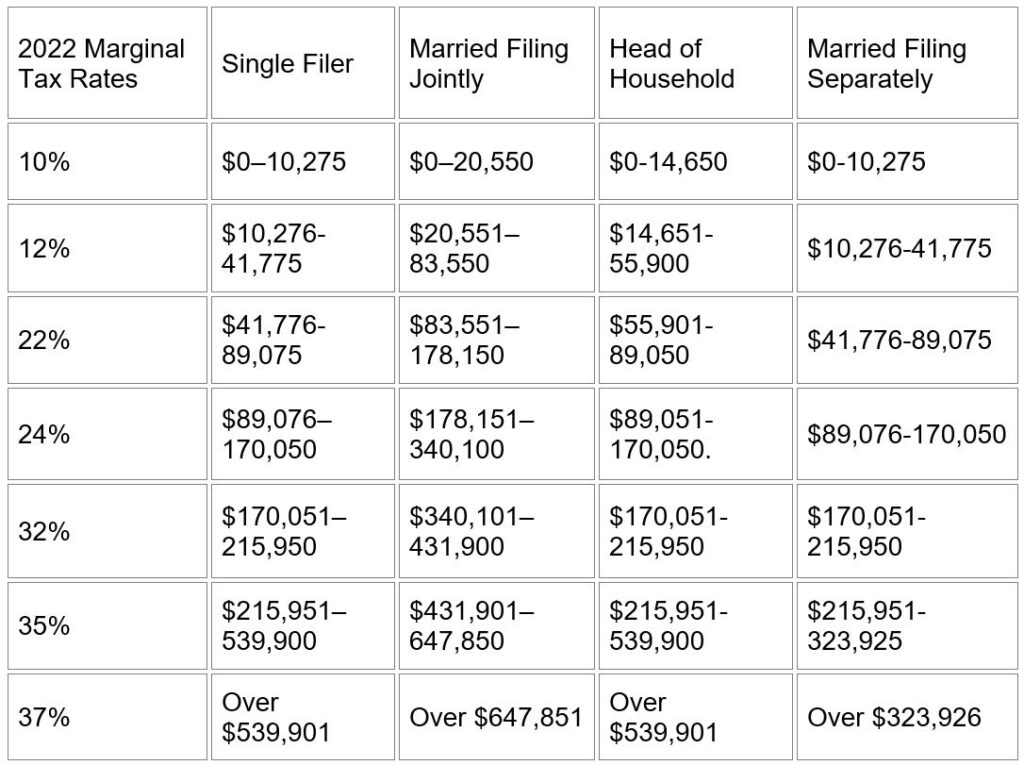

Different tax brackets or ranges of income are taxed at different rates These are broken down into seven 7 taxable income groups based on your federal 2022 Personal Exemption The personal exemption for 2022 remains at 0 The Tax Cuts and Jobs Act of 2017 eliminated the personal exemption until tax year

The IRS is working on implementing the Inflation Reduction Act of 2022 This major legislation will affect individuals businesses tax exempt and government entities Many The AMT exemption amount for 2022 is 75 900 for singles and 118 100 for married couples filing jointly Table 3 In 2022 the 28 percent AMT rate applies to

Download What Are The Tax Exemptions For 2022

More picture related to What Are The Tax Exemptions For 2022

IRS 2021 Tax Tables Deductions Exemptions Purposeful finance

https://images.squarespace-cdn.com/content/v1/572ff08b044262a7f8c2405e/1611843812978-ODAF19Y1BP5NUAKIHJDB/2021+Income+Tax+Bracket+Table+MFJ+SF.png

Exemption In New Tax Regime List Of All The New Tax Regime

https://www.godigit.com/content/dam/godigit/directportal/en/contenthm/tax-exemption.jpg

Tax Exemptions Know Your Taxes

https://knowyourtaxes.org/wp-content/uploads/2021/04/exemptions-768x858.jpg

OVERVIEW Tax exemptions come in many forms but one thing they all have in common is they either reduce or entirely eliminate your obligation to pay tax Like the American Opportunity tax credit the right to claim the Lifetime Learning tax credit on your 2022 federal tax return phases out for income between 80 000 to 90 000 for

Tax software can walk you through your expenses and losses to show the option that gives you the lowest tax Some people including nonresidents and partial The federal estate tax exemption is the amount excluded from estate tax when a person dies It s increased to 13 61 million in 2024 up from 12 92 million in 2023

Standard Deduction U s 16 ia For Ay 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-3-768x432.jpg

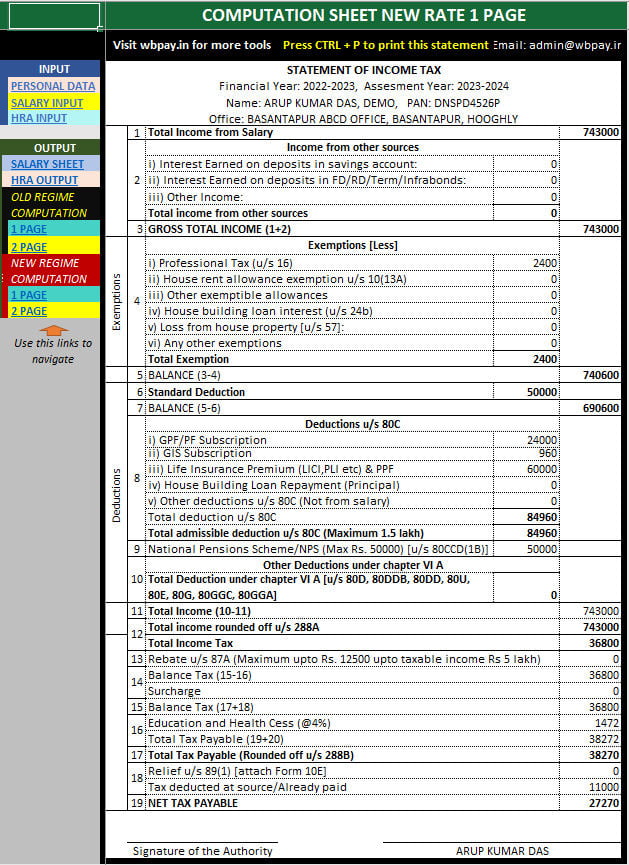

All In One Income Tax Calculator For The FY 2022 23

https://wbpay.in/wp-content/uploads/2023/01/All-in-one-income-tax-calculator-2022-23.jpg

https://www.forbes.com/sites/ashleaebeling/2021/11/...

199A deduction 2022 AVE Federal Estate Tax Exemption The federal estate tax exemption for decedents dying in 2022 will increase to 12 06 million per

https://irsadviser.com/2022-standard-deductions-exemptions

In 2022 the standard deductions are as follows 12 950 for Single or Married Filing Separately 25 900 for Married Filing Jointly or Qualifying Widow er 19 400 for Head

How To Choose Between The New And Old Income Tax Regimes Chandan

Standard Deduction U s 16 ia For Ay 2021 22 Standard Deduction 2021

How To Correctly Fill Out Your W4 Form Youtube Gambaran

State Withholding Tax Form 2023 Printable Forms Free Online

22 Questions Answered For 2022 Tax Filing Emerald Advisors

2018 Tax Law Changes Proper Wealth Management

2018 Tax Law Changes Proper Wealth Management

What Are Tax Exemptions TurboTax Tax Tips Videos

Get More Tax Exemptions For Income Tax In Malaysia IMoney

Tax File Number Declaration Form Pdf Withholding Tax Payments Vrogue

What Are The Tax Exemptions For 2022 - 2022 Personal Exemption The personal exemption for 2022 remains at 0 The Tax Cuts and Jobs Act of 2017 eliminated the personal exemption until tax year