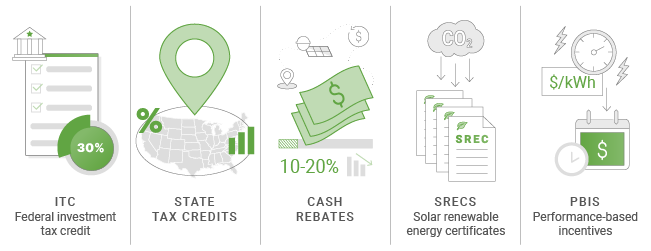

What Are The Tax Incentives For Solar Panels The solar panel tax credit allows filers to take a tax credit equal to up to 30 of eligible costs There is no income limit to qualify and you can claim the credit

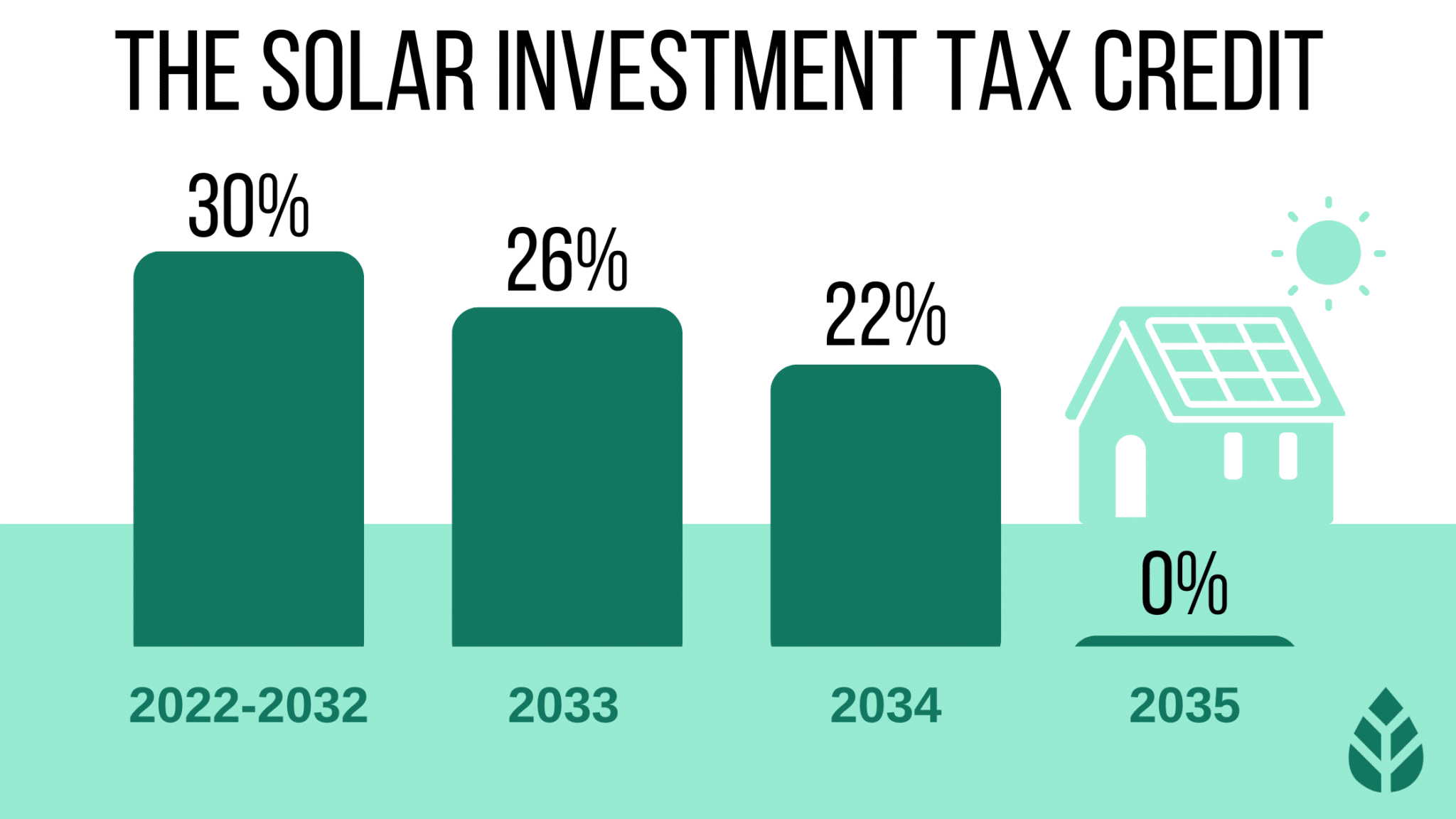

The federal solar Investment Tax Credit ITC offers a direct reduction in taxes owed as an incentive for installing a new solar energy system Per the Inflation Reduction Act the ITC is Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 4 It will decrease to 26 for systems installed in 2033 and to 22 for systems installed in 2034

What Are The Tax Incentives For Solar Panels

What Are The Tax Incentives For Solar Panels

https://thenewutility.com/wp-content/uploads/2020/03/solar-panel-incentives.jpg

10 Available Incentives For Using Solar Energy SolarNRG

https://solarnrg.ph/wp-content/uploads/2022/09/Blog20-Incentives-for-Solar-Energy.jpg

All Solar Panel Incentives Tax Credits In 2023 By State

https://www.solarreviews.com/images/og/SolarIncentives.jpg

The first and most important solar incentive to know about is the federal solar tax credit which can earn solar owners 30 of the cost to install solar panels back on their income taxes in the year after installation If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit

IR 2024 202 Aug 7 2024 The Department of the Treasury and the Internal Revenue Service today issued statistics on the Inflation Reduction Act clean energy tax credits for tax year 2023 The bulk of the money more than 6 billion helped households install rooftop solar panels small wind turbines and other renewable energy systems These credits were most popular in sunny states

Download What Are The Tax Incentives For Solar Panels

More picture related to What Are The Tax Incentives For Solar Panels

Tax Incentives A Guide To Saving Money For U S Small Businesses

https://www.freshbooks.com/wp-content/uploads/2022/04/tax-incentives-examples.jpg

Solar Tax Credit 2022 Incentives For Solar Panel Installations

https://quickelectricity.com/wp-content/uploads/2020/12/Federal-Solar-Tax-Credit-Extension-2022.jpg

Solar Tax Credit Incentives For Your Project Verogy

https://www.verogy.com/wp-content/uploads/2020/11/20200514_120052715_iOS-1-scaled.jpg

The Investment Tax Credit ITC or solar federal tax credit is a nationwide incentive for homeowners and business owners who install solar panels The credit is worth 30 of your total The 2023 solar tax credit applicable for taxes filed in 2024 provides financial incentives to make solar installations more accessible and affordable for homeowners

The federal solar tax credit commonly referred to as the investment tax credit or ITC allows you to claim 30 of the cost of your solar energy system as a credit to your federal tax bill If it costs 10 000 to install your solar panel system you ll receive a 3 000 credit which directly reduces your tax bill The solar tax credit which is among several federal Residential Clean Energy Credits available through 2032 allows homeowners to subtract 30 percent of the cost of installing solar heating

The Power Of Government Support 5 Funding Schemes For Indian Startup

https://media.licdn.com/dms/image/D4D12AQGjj3G0hyZS3g/article-cover_image-shrink_720_1280/0/1683229633763?e=2147483647&v=beta&t=YeMgzMvV_8UIGHrWVhZXrpGTIpOhDaAnb9mO3qrBjdI

Property Tax Incentives For Solar By State

https://2.bp.blogspot.com/-hBJ0DHdznOo/U5d0UEN7NjI/AAAAAAAARss/oK7qUB2rkJw/s1600/Property+tax+incentives+by+state+for+solar.PNG

https://www.nerdwallet.com/article/taxes/solar-tax-credit

The solar panel tax credit allows filers to take a tax credit equal to up to 30 of eligible costs There is no income limit to qualify and you can claim the credit

https://www.forbes.com/home-improvement/solar/solar-tax-credit-by-state

The federal solar Investment Tax Credit ITC offers a direct reduction in taxes owed as an incentive for installing a new solar energy system Per the Inflation Reduction Act the ITC is

Solar Rebates And Incentives EnergySage

The Power Of Government Support 5 Funding Schemes For Indian Startup

Tennessee Solar Incentives Grants Solar Alliance

Federal Solar Tax Credits For Businesses Department Of Energy

Solar Tax Credit Calculator NikiZsombor

Who Qualifies For Federal Tax Credit Leia Aqui Do I Qualify For

Who Qualifies For Federal Tax Credit Leia Aqui Do I Qualify For

2023 Residential Clean Energy Credit Guide ReVision Energy

Solar Incentives Are Growing Foundation For Economic Education

Texas Solar Incentives Tax Credits Rebates More In 2023

What Are The Tax Incentives For Solar Panels - The first and most important solar incentive to know about is the federal solar tax credit which can earn solar owners 30 of the cost to install solar panels back on their income taxes in the year after installation