What Can I Claim On My Hst Return If you are filing an electronic return file the following rebate applications electronically with your return using GST HST NETFILE or the File a return service in My Business Account or Represent a Client

When you calculate your ITCs you can include the GST HST for purchases and expenses for which you have been invoiced but not yet paid This means that you can claim an ITC on your return for the GST HST you owe to your suppliers before you pay the invoice The simplified method uses a single formula to help businesses file a GST HST return and claim the ITC All you need to do is add up all your eligible business expenses multiply it by a fixed amount which is based on the rate at which you paid tax and then add any additional amounts that apply to your situation

What Can I Claim On My Hst Return

What Can I Claim On My Hst Return

https://images.squarespace-cdn.com/content/v1/5510bad9e4b0ce924f0445c5/1591045269227-VP84B76ENM22TGRFB25R/Can+I+claim+my+travel+expenses+as+business+expenses+when+I+travel+full+time+as+a+digital+nomad+or+full-time+RVer.+NuventureCPA.com

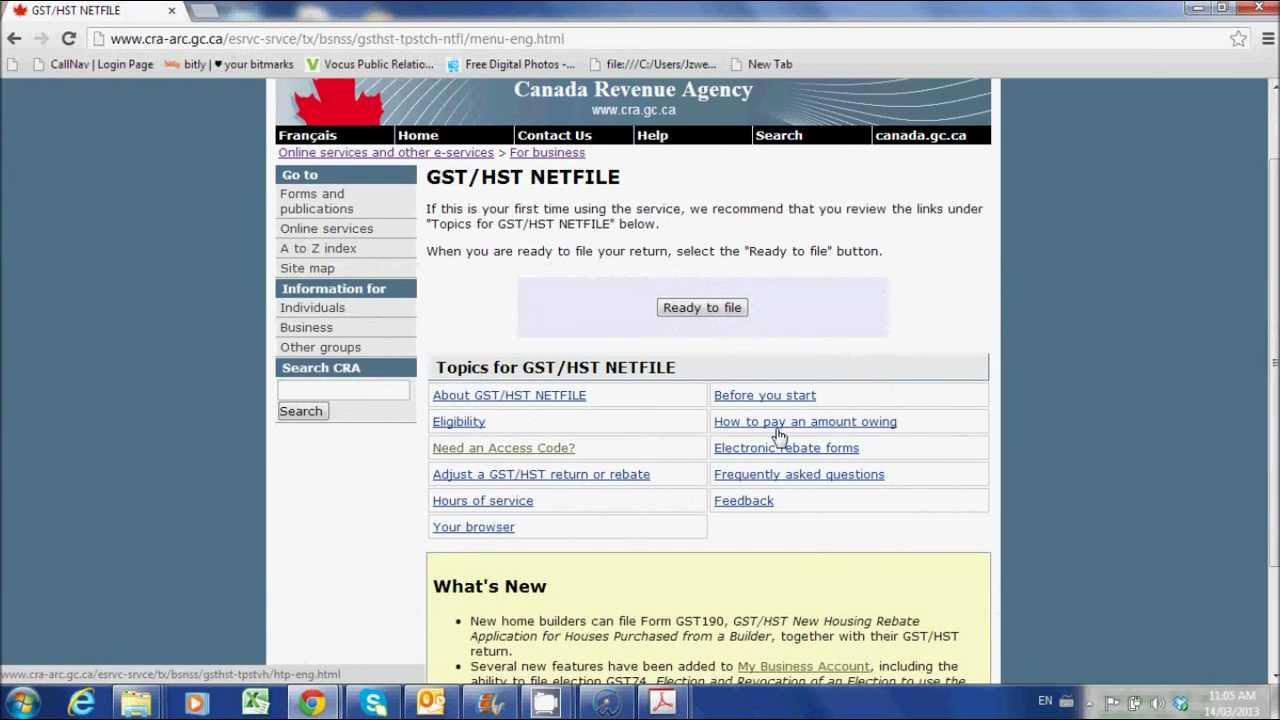

Obtaining New Access Code To NETFILE GST HST Return Filing Taxes

https://lh6.googleusercontent.com/PQUA9hs91F59ZS9YlwpguB7uOj6qWs2DcsTsFimw-debiHP1Zq1YILIST03h84tPhzklel2ZJw5CV-pD7yWdwRzp0VWV5GuHUywHjzDea-ADGqqhc6gUze63pmSDLM1yUNuCVFhc

What Can I Claim On My Tax Return

https://www.taxback.co.uk/wp-content/uploads/2022/04/shaun-wadham-DHBeQcFPyU0-unsplash-1200x800.jpg

The total GST HST rebate is claimed on line 45700 of your income tax return The calculation of the GST HST rebate consists of two parts rebate on expenses other than CCA and rebate on CCA expenses Once you calculate the amount you can claim you report it on line 108 or line 106 if you file on paper of your GST HST return New registrants may be able to claim ITC s for GST HST paid on property owned for commercial purposes at the time of registration

If you pay the goods and services tax GST or harmonized sales tax HST on goods or services for your business you may be eligible to claim some of these taxes as credits and reduce your total taxes due Learn more about When you file your GST HST return you can claim ITCs for expenses directly related to your business operations Understanding ITC eligibility is crucial for maximizing your tax savings What documentation do I need for ITC claims You need invoices or receipts showing the GST HST paid on purchases along with proof of payment

Download What Can I Claim On My Hst Return

More picture related to What Can I Claim On My Hst Return

Simple HST Return Part One YouTube

https://i.ytimg.com/vi/8NgnEltHkRA/maxresdefault.jpg

Processing GST HST Payments Telpay

https://support.telpay.ca/hc/en-us/article_attachments/202467350/GSTHST2.jpg

Gst Return Working Complete With Ease AirSlate SignNow

https://www.signnow.com/preview/100/105/100105630/large.png

Is your business able to claim the input tax credit on GST HST Discover who can make a claim how to meet the conditions and what expenses are eligible If you are operating a Canadian business and registered for the GST HST you can get back the GST HST you ve paid out during a particular reporting period by claiming it through input tax credits ITCs on your GST HST return

You can claim a refund if your net tax line 109 of your GST HST return for a reporting period is a negative amount Generally the CRA process a GST HST return in 2 weeks if you filed electronically 4 weeks if you filed a paper return When completing your GST HST return you must declare the amount of GST HST that you collected from your customers and deduct your ITCs in order to determine your GST HST net tax If the result is negative this signifies that you will receive a

Ready For Tax Time Security Solutions Media

https://www.securitysolutionsmedia.com/wp-content/uploads/2023/06/What-can-I-claim.png

How To Make Payment To CRA HST Return JKtax

http://jktax.ca/wp-content/uploads/2018/04/Screenshot-2018-04-15-22.19.48-1024x942.png

https://www.canada.ca › en › revenue-agency › services › ...

If you are filing an electronic return file the following rebate applications electronically with your return using GST HST NETFILE or the File a return service in My Business Account or Represent a Client

https://www.canada.ca › en › revenue-agency › services › ...

When you calculate your ITCs you can include the GST HST for purchases and expenses for which you have been invoiced but not yet paid This means that you can claim an ITC on your return for the GST HST you owe to your suppliers before you pay the invoice

49 Free Claim Letter Przyk ady jak Napisa Claim Letter Tech Blog

Ready For Tax Time Security Solutions Media

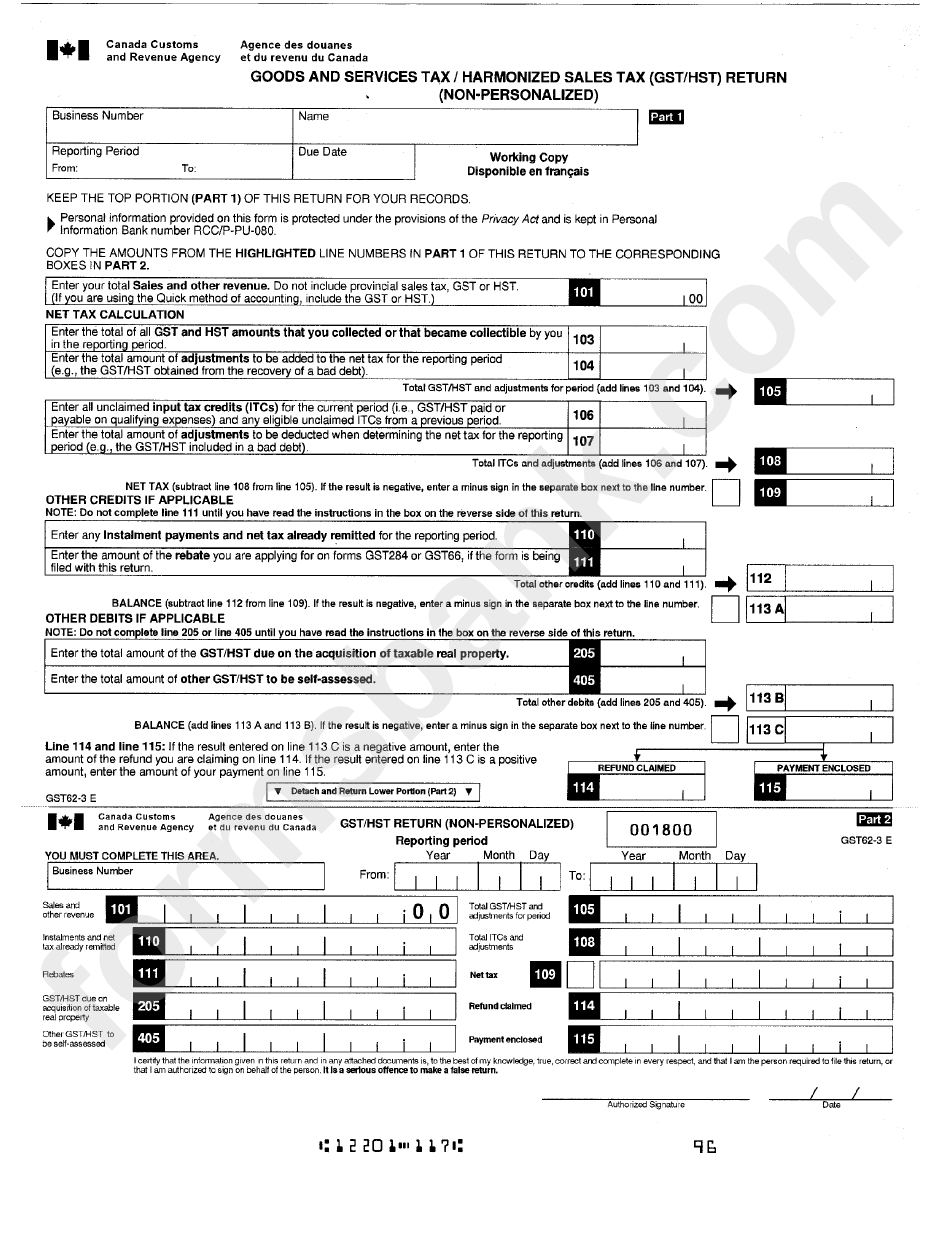

Form Gst62 3 E Goods And Services Tax harmonized Sales Tax Gst hst

Letter Of Demand For Damages Car Accident Demand Settlement Letter Riset

2011 2024 Form Canada GST62 E Fill Online Printable Fillable Blank

Image Result For Hair Salon Expenses Printable Business Tax

Image Result For Hair Salon Expenses Printable Business Tax

GST Return Filing Online Know GST Return Filing Procedure

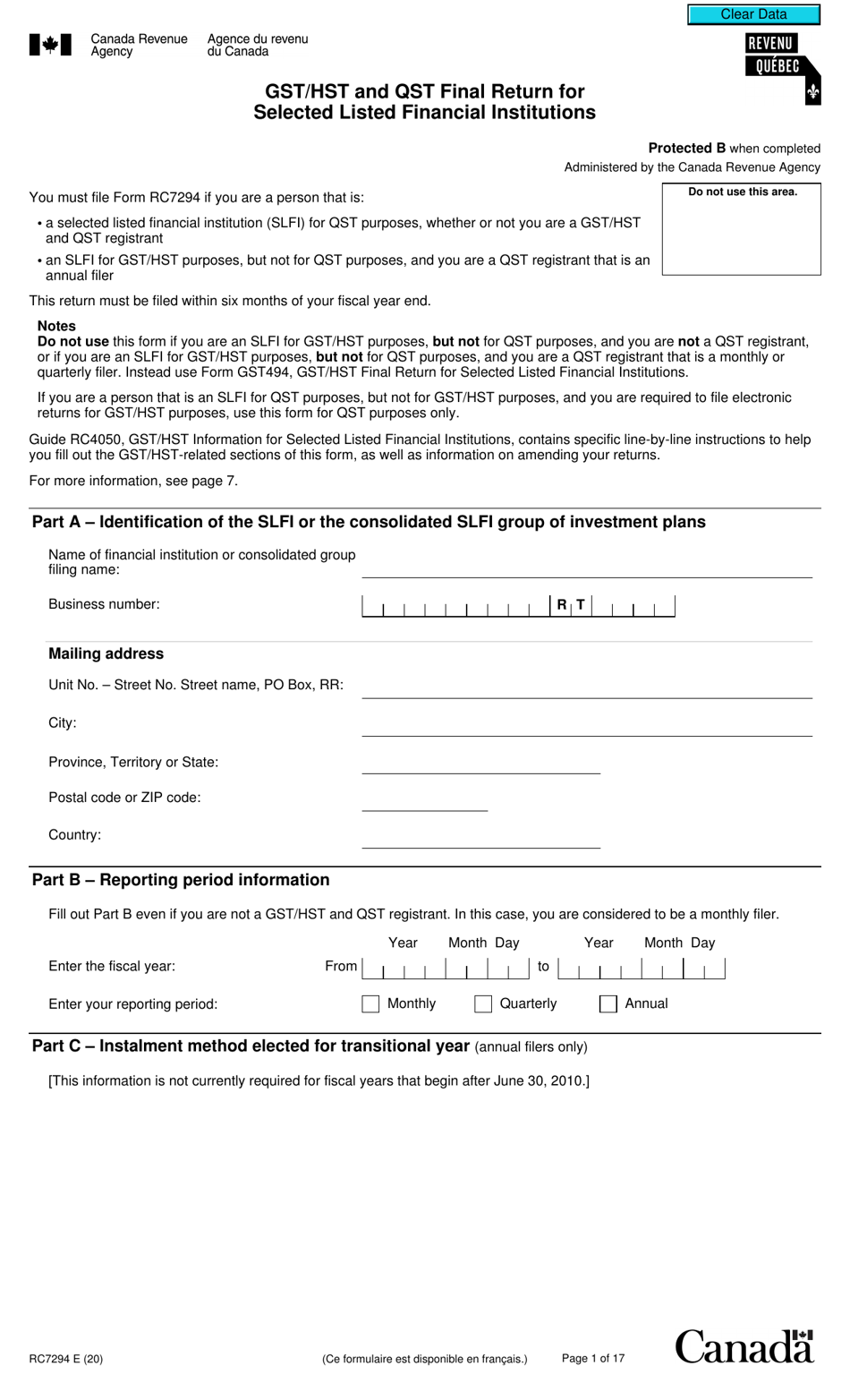

Form RC7294 Download Fillable PDF Or Fill Online Gst Hst And Qst Final

File Your GST HST Return Online YouTube

What Can I Claim On My Hst Return - The total GST HST rebate is claimed on line 45700 of your income tax return The calculation of the GST HST rebate consists of two parts rebate on expenses other than CCA and rebate on CCA expenses