What Can You Claim On Tax Engineer Verkko 22 marrask 2023 nbsp 0183 32 The interest you pay for your mortgage can be deducted from your taxes The write off is limited to interest on up to 750 000 375 000 for married filing separately taxpayers of mortgage debt

Verkko 12 huhtik 2021 nbsp 0183 32 Tax Deductions for Engineers Engineers can receive tax deductions for different aspects of their jobs The best tax deductions for engineers follow 1 Advertising You can claim a tax deduction Verkko You can claim tax relief on 163 6 a week from April 2020 where you will not need to keep evidence of your extra costs Or 163 4 a week for previous tax years For claims over 163 6 a week you ll need to provide evidence

What Can You Claim On Tax Engineer

What Can You Claim On Tax Engineer

https://ieusa.org.au/wp-content/uploads/2022/05/220527-ATO-Teacher-Claim2.jpg

EOFY 2021 What Can I Claim On Tax When It Comes To Marketing Expenses

https://www.clixpert.com.au/blog/wp-content/uploads/2021/06/eofy-what-claim-tax-marketing-expenses-2.jpg

What Can You Claim On Tax As A Student College Aftermath

https://collegeaftermath.com/wp-content/uploads/2023/01/kelly-sikkema-xoU52jUVUXA-unsplash-1024x588.jpg

Verkko Self employed expenses you can claim If you re self employed there are certain business expenses you are allowed to deduct from your tax bill This guide explains the expenses you can and can t claim with Verkko 6 p 228 iv 228 228 sitten nbsp 0183 32 You can claim tax back on some of the costs of running your business what HMRC calls allowable expenses These appear as costs in your business accounts deducted from the profit you pay tax

Verkko 4 jouluk 2023 nbsp 0183 32 You re likely to encounter additional business costs you can claim on your taxes such as Banking credit card processing and financial service fees Tax return and financial software A portion of your housing costs rent utility bills via home office deductions Professional services including lawyer s fees Verkko 2 tammik 2024 nbsp 0183 32 How to claim tax deductions Simple tax filing with a 50 flat fee for every scenario Powered by With this user friendly tax software registered NerdWallet members pay one fee regardless

Download What Can You Claim On Tax Engineer

More picture related to What Can You Claim On Tax Engineer

A Beginner s Guide To Investment Property Tax Deduction Liviti Blogs

https://blogs.liviti.com.au/wp-content/uploads/2022/03/news-thumbnail-62-1000x670.png

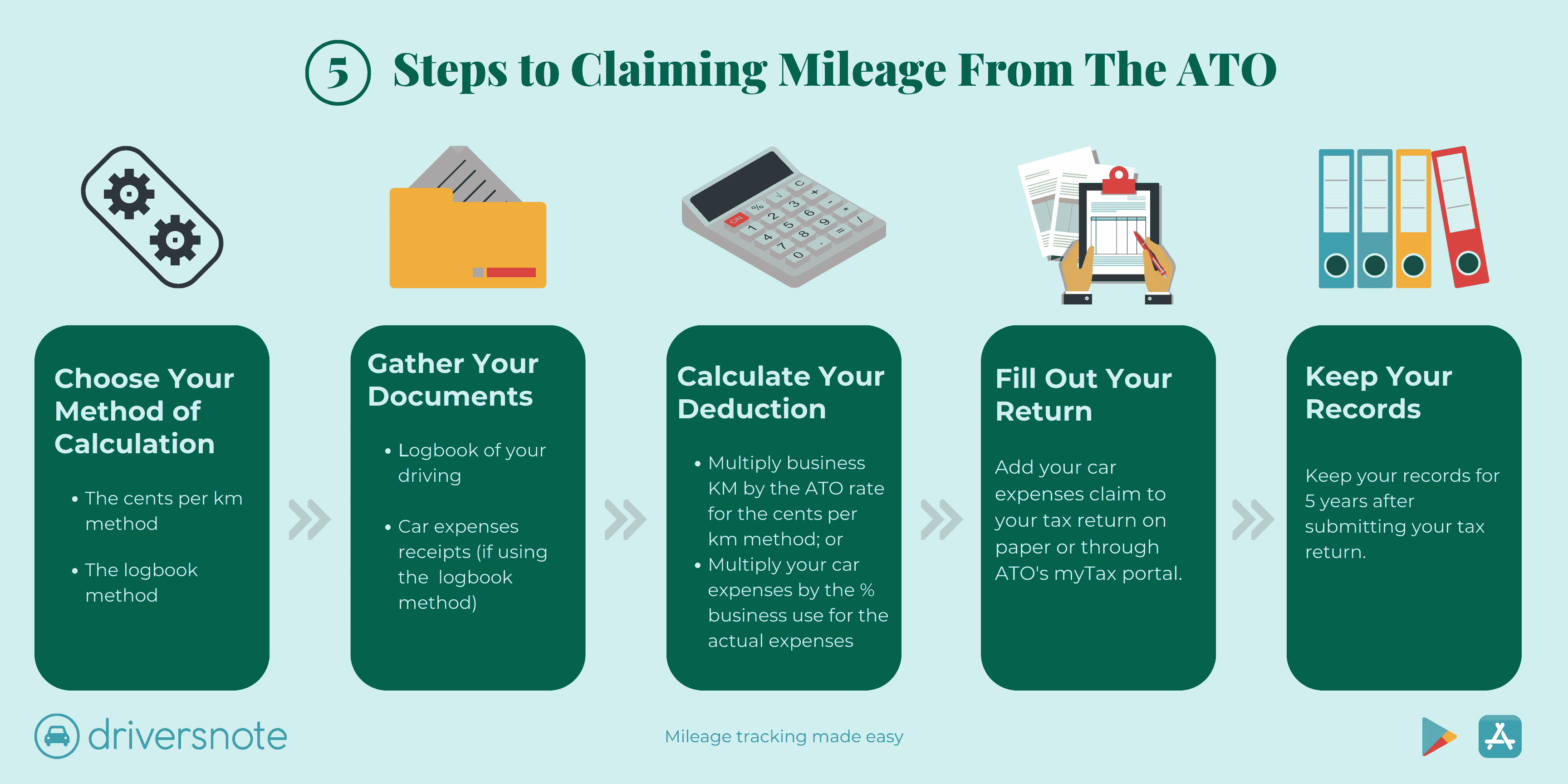

Claim Car Expenses From The ATO In 5 Simple Steps 2023 ATO Claims

https://storage.googleapis.com/driversnote-marketing-pages/AU infographic - how to deduct mileage-landscape.png

What Can You Claim On Tax What You re Missing Nib

https://images.ctfassets.net/hkmafl6harxv/4P8G5hrPCUAAm2kG6MAYS6/94c9d56795184dc573606e0d2670a1ee/960x540_TaxReturn_02.jpg?w=1200&h=630&fm=webp

Verkko 21 tuntia sitten nbsp 0183 32 You pay 40 tax so you can personally claim back 20 of 163 125 163 25 If you ever donate via sites such as JustGiving search your emails you should have receipts saying how much you gave Verkko 21 jouluk 2023 nbsp 0183 32 So the small and very specific group of W 2 employees who can claim work from home tax deductions are Armed Forces reservists certain performing artists state or local government officials who are paid on a fee basis people with physical or mental disabilities and teachers 1 If you fall into any of those groups

Verkko 1 tammik 2015 nbsp 0183 32 Flat rate expenses sometimes known as a flat rate deduction allow you to claim tax relief for an agreed fixed amount each tax year to cover what you spend on the clothing and tools Verkko Don t claim anything without receipts and make sure you keep a record of how you ve apportioned between personal and business use IIRC you can t deduct a laptop but the depreciation on the laptop may be deductible The ATO have specific guides for particular industries yours might be covered on their website

Sole Trader Tax Deductions How To Optimise Your Taxes In 2022

https://uploads-ssl.webflow.com/5efd455be224bd10a27ddf8c/628f57631956b41f6612c16a_tax deductions table.png

What Can You Claim On Tax As A Nurse Countingup

http://countingup.com/wp-content/uploads/2021/07/company-thumbsup-thumbsdown.png

https://www.forbes.com/advisor/taxes/tax-write-offs-you-can-claim-on...

Verkko 22 marrask 2023 nbsp 0183 32 The interest you pay for your mortgage can be deducted from your taxes The write off is limited to interest on up to 750 000 375 000 for married filing separately taxpayers of mortgage debt

https://1800accountant.com/blog/engineer-tax-d…

Verkko 12 huhtik 2021 nbsp 0183 32 Tax Deductions for Engineers Engineers can receive tax deductions for different aspects of their jobs The best tax deductions for engineers follow 1 Advertising You can claim a tax deduction

What Can You Claim On Tax Without Receipts In Australia

Sole Trader Tax Deductions How To Optimise Your Taxes In 2022

Can You Claim Home Insurance On Taxes

What Can You Claim Without Receipts One Click Life

17 Things You Can t Claim In Your Tax Return Platinum Accounting

What Tax Deductions Can You Claim When Working From Home Work

What Tax Deductions Can You Claim When Working From Home Work

How Much Tax Can You Claim Without Receipts

Can I Submit My Tax Return Early TI Accountancy Ltd

What Can You Claim On Tax Without Receipts In Australia

What Can You Claim On Tax Engineer - Verkko 2 tammik 2024 nbsp 0183 32 How to claim tax deductions Simple tax filing with a 50 flat fee for every scenario Powered by With this user friendly tax software registered NerdWallet members pay one fee regardless