What Comes Under 80ccd 1b What are covered under 80CCD Under Section 80CCD contributions towards National Pension Scheme NPS and Atal Pension Yojana APY are covered It also covers the employer s contribution to the NPS

Section 80CCD 1B provides an additional deduction of up to Rs 50 000 for contributions made to NPS over and above the deductions Overall Limit Combined with Sections 80C and 80CCC the maximum deduction under Section 80CCE is 1 5 lakh per financial year 2 Section 80CCD 1B Introduced to provide additional

What Comes Under 80ccd 1b

What Comes Under 80ccd 1b

https://www.financialexpress.com/wp-content/uploads/2022/12/tax-saving.jpg

2jfSrzhjG S7T noGbbemA72WScaSMsPepiIjqTH3tgxPZskzPHw QU7JJZ CaicePopj

https://yt3.ggpht.com/2jfSrzhjG-S7T_noGbbemA72WScaSMsPepiIjqTH3tgxPZskzPHw-QU7JJZ_CaicePopj_7G=s900-c-k-c0x00ffffff-no-rj

IT 80CCD 1B CPS

https://2.bp.blogspot.com/-T01obM7mFng/WJ-8zalbmaI/AAAAAAAAB6A/rV7GGIiPsoclni_phRUdkgpKpAKA7wLAgCLcB/s1600/IMG-20170212-WA0010.jpg

Learn about tax benefits under the National Pension System NPS and deductions available under Section 80CCD 1B Discover how to Section 80 CCD 1B The 80CCD1B limit is Rs 50 000 This is an additional benefit The total tax benefit that you can claim from your contributions to pension fund schemes is Rs 2 lakh Rs

1 Deduction for employee s own contribution to NPS is allowed as deduction u s 80CCD 1 to the maximum of 10 of salary Further a deduction u s 80CCD 1B is allowed to What is Section 80CCD 1B Section 80CCD 1B was introduced in the 2015 Budget to supplement the deductions available under Section 80CCD 1 It allows taxpayers to claim an

Download What Comes Under 80ccd 1b

More picture related to What Comes Under 80ccd 1b

Section 80CCD 1B Deduction NPS Scheme Tax Benefits Alankit

https://www.alankit.com/blog/blogimage/NPS-80CCD.jpg

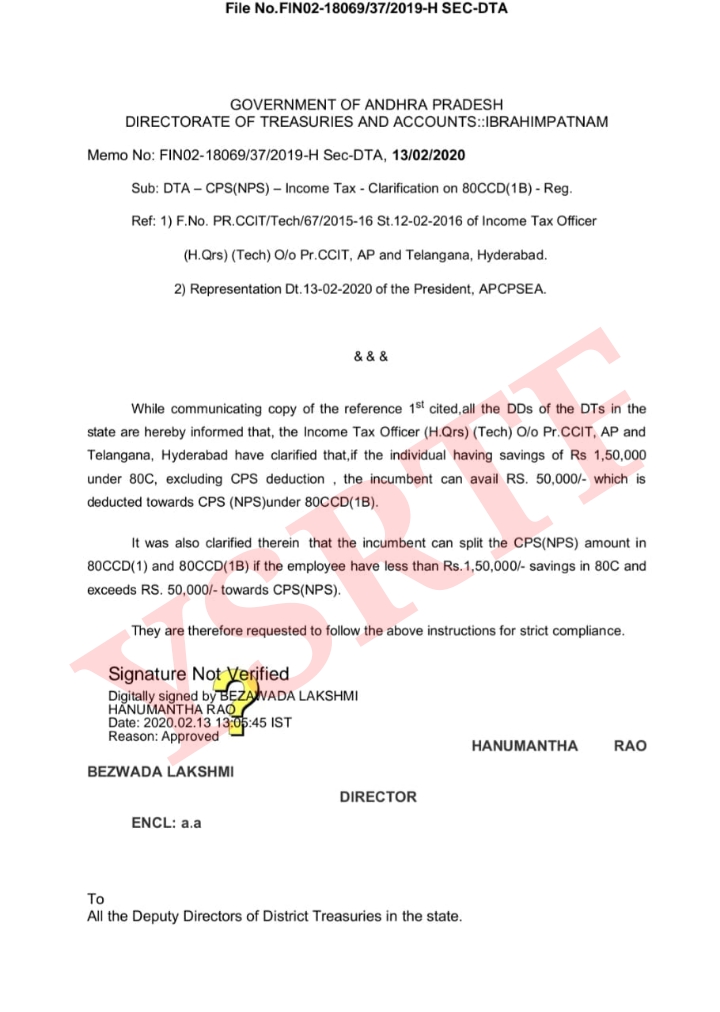

CPS NPS Income Tax Clarification On 80CCD 1B Memo No

https://lh3.googleusercontent.com/-lyueqhu4Khg/XkUdmkaNELI/AAAAAAAAPmw/KdzAx0TylbwB9-Yf7t8wC2sLKOE-MsFFQCLcBGAsYHQ/s1600/IMG-20200213-WA0037.jpg

What Is The National Pension System Section 80CCD 1B In Hindi

https://i0.wp.com/www.howtrending.com/wp-content/uploads/2022/01/et44t4.jpg?fit=720%2C432&ssl=1

Under Section 80 of the Income Tax Act 1961 an individual can avail exemptions and deductions that lowers their tax liability Under Section 80CCD personal and employer An employee can claim deduction under 80CCD 1 at a maximum of 10 of basic salary plus dearness allowance For self employed the limit for deduction is 20 of their income subject to Rs 1 5 lakh maximum limit of section 80C

SECTION 80CCD 1 Employee Employee s contribution up to 10 of basic salary and dearness allowance DA up to 1 5 lakh is eligible for a tax deduction SECTION 80CCD 1b Self Employer s contribution up to Under Section 80CCD 1B salaried and self employed individuals and NRIs can claim tax deductions for the investments made into the government pension schemes The tax benefit is

NPS Deduction Under Income Tax Act NPS Tax Benefit U s 80ccd 1 80ccd

https://i.ytimg.com/vi/rYJYpL_AjkM/maxresdefault.jpg

NPS 80CCD 1B Proof NPS Tax Benefits Sec 80C And Additional Tax

https://i.ytimg.com/vi/PbIdrmlETqQ/maxresdefault.jpg

https://www.etmoney.com › learn › income-tax

What are covered under 80CCD Under Section 80CCD contributions towards National Pension Scheme NPS and Atal Pension Yojana APY are covered It also covers the employer s contribution to the NPS

https://cleartax.in

Section 80CCD 1B provides an additional deduction of up to Rs 50 000 for contributions made to NPS over and above the deductions

Section 80GGC Of Income Tax Act Tax Deduction IndiaFilings

NPS Deduction Under Income Tax Act NPS Tax Benefit U s 80ccd 1 80ccd

How To Claim Section 80CCD 1B TaxHelpdesk

Income Tax Deduction Under 80C 80D And 80CCD Overview Types And

Deductions Under Section 80C Its Allied Sections

FAQs On Deductions Under Section 80C 80CCC 80CCD And 80D

FAQs On Deductions Under Section 80C 80CCC 80CCD And 80D

SNP Comes Under Attack For Centralising Power

How To Claim Section 80CCD 1B TaxHelpdesk

What Is Dcps In Salary Deduction Login Pages Info

What Comes Under 80ccd 1b - Section 80 CCD 1B The 80CCD1B limit is Rs 50 000 This is an additional benefit The total tax benefit that you can claim from your contributions to pension fund schemes is Rs 2 lakh Rs