What Counts As Income For Pension Tax Relief Individuals who are members of an overseas pension scheme may claim tax relief on contributions to that scheme if they meet all of the criteria for migrant member relief These are the

At a glance Tax relief on pension contributions made by an individual into a qualifying pension scheme is limited to the higher of 100 of their relevant UK earnings or 3 600 per annum Contributions are also limited by the Annual Allowance The following earnings are relevant UK earnings Tax relief is paid on your pension contributions at the highest rate of income tax you pay So Basic rate taxpayers get 20 pension tax relief Higher rate taxpayers can claim 40 pension tax relief Additional rate

What Counts As Income For Pension Tax Relief

What Counts As Income For Pension Tax Relief

https://www.moneyboxapp.com/wp-content/uploads/2020/01/Copy-of-How-do-_pensions-work_-02-1024x516.png

What Counts As Income For A Mortgage Loan 2023 Guide

https://assets.themortgagereports.com/wp-content/uploads/2022/09/What-Counts-As-Income-For-Mortgage-Qualifying.jpg

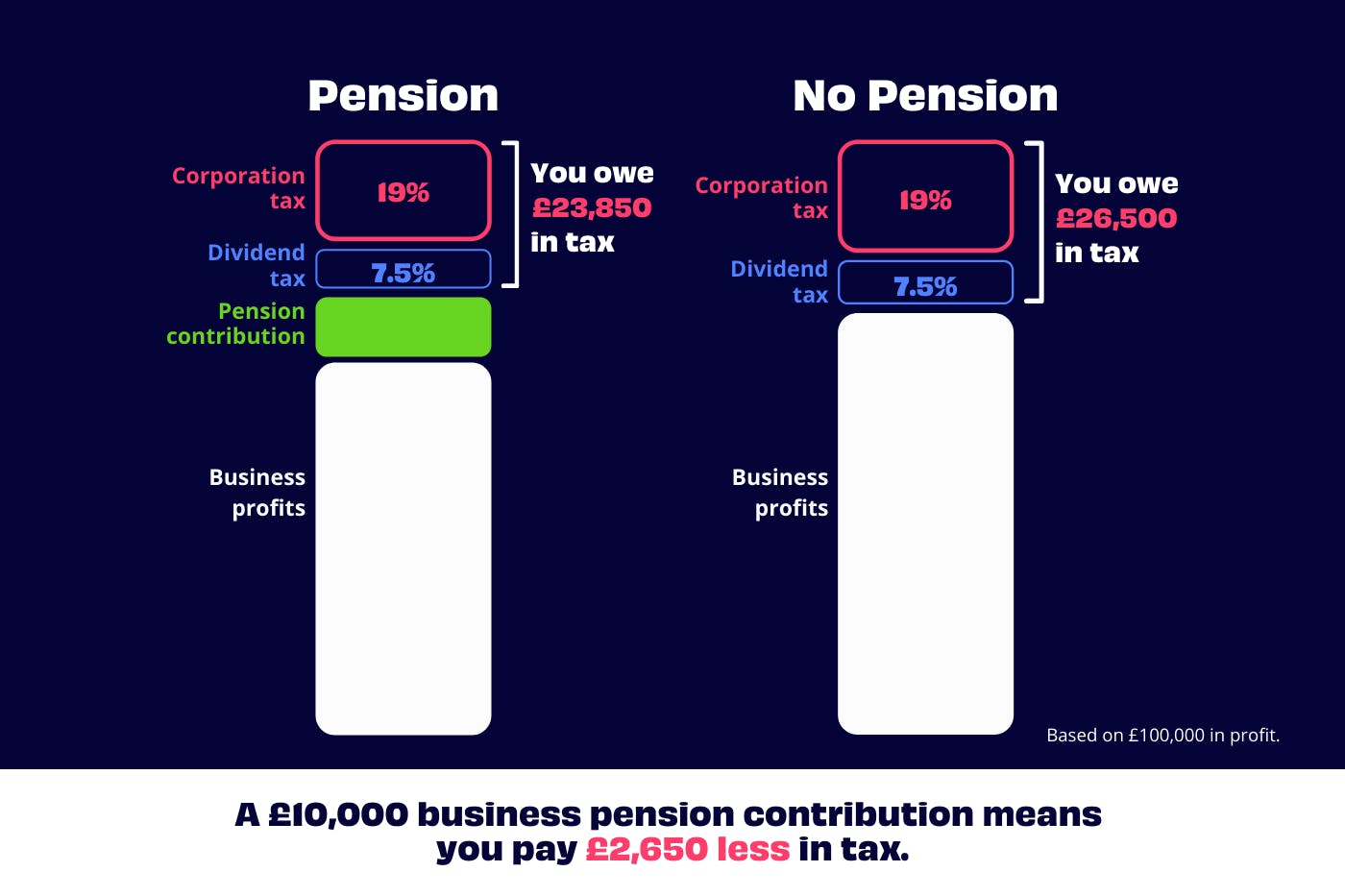

Self Employed Pension Tax Relief Explained Penfold Pension

https://images.prismic.io/penfold/ba0b1433-4a37-46a6-b157-69f454c7d2af_director-pension-contribution-tax.png?auto=compress

Income from pension products don t count as relevant UK earnings opens in a new window There are three main methods for giving tax relief relief at source net pay arrangement and relief on making a claim On the one hand suppose you earn 30 000 in the 2022 23 tax year and your pension scheme uses the relief at source method for pension tax relief You will be able to make a total pension contribution of 30 000 24 000 through your payments 6 000 with the basic rate tax relief for that year

Income from a pension is not relevant UK earnings Investment income property rental income and dividends don t count as relevant UK earnings Three main methods in giving tax relief relief at source net pay arrangement and relief on making a What counts towards the pensions annual allowance Your annual allowance is made up of all contributions to your pension made by you your employer and any third party including pension tax relief For example say you earn 40 000 a year You contribute 3 to your company pension and your employer contributes 5

Download What Counts As Income For Pension Tax Relief

More picture related to What Counts As Income For Pension Tax Relief

Tax Relief On Pension Contributions Gooding Accounts

https://www.goodingaccounts.co.uk/app/uploads/2022/07/bench-g836200001_1920.jpg

Pension Tax Relief Calculator TaxScouts

https://taxscouts.com/wp-content/uploads/pension_tax_og.png

How To Calculate Income Tax Malaysia Sean White

https://soyacincau.com/wp-content/uploads/2022/03/220324-efiling-tax-relief-scaled.jpeg

Tax relief is available on your pension contributions at the highest rate of income tax that you pay So for non Scottish taxpayers this means Non taxpayers that is people who earn under the personal allowance get no pension tax relief unless they are in a relief at source scheme as explained above Annual allowance Your annual allowance is the most you can save in your pension pots in a tax year 6 April to 5 April before you have to pay tax You ll only pay tax if you go above the annual

There are two ways you can get tax relief on your pension contributions These are known as relief at source and net pay If you re in a workplace pension your employer chooses which method is used If you re in a personal pension the relief at source method is The annual allowance is the limit on how much you can save into your pensions each tax year while still benefiting from tax relief on your contributions any employer contributions and any contributions made on your behalf by someone else

Income Tax Guide On Pension How To File Pension Income In ITR Mint

https://www.livemint.com/lm-img/img/2023/03/26/1600x900/pension_1572444986212_1679839213971_1679839213971.JPG

Are You Due A Huge Pension Tax Refund Which News

https://s3.eu-west-1.amazonaws.com/prod.news.product.which.co.uk/news/wp-content/uploads/2017/03/Pensions.jpg

https://www.gov.uk › hmrc-internal-manuals › pensions-tax-manual

Individuals who are members of an overseas pension scheme may claim tax relief on contributions to that scheme if they meet all of the criteria for migrant member relief These are the

https://www.rossmartin.co.uk › income-claims-reliefs

At a glance Tax relief on pension contributions made by an individual into a qualifying pension scheme is limited to the higher of 100 of their relevant UK earnings or 3 600 per annum Contributions are also limited by the Annual Allowance The following earnings are relevant UK earnings

ABI Revives Call For Flat Rate Pension Tax Relief Philip James

Income Tax Guide On Pension How To File Pension Income In ITR Mint

Save It For Another Day Pension Tax Relief And Options For Reform

How To Claim Higher Rate Tax Relief On Pension Contributions

A Consultation On Pensions Tax Relief Provisio Wealth

How To Claim Pension Tax Relief 2023 Updated

How To Claim Pension Tax Relief 2023 Updated

Flat Rate Pension Tax Relief Proposals Divide Experts Money Marketing

.jpg)

How Does Tax Relief Work On Pensions Tax Walls

What Is Pension Tax Relief Retire Gen Z

What Counts As Income For Pension Tax Relief - Income from pension products don t count as relevant UK earnings opens in a new window There are three main methods for giving tax relief relief at source net pay arrangement and relief on making a claim