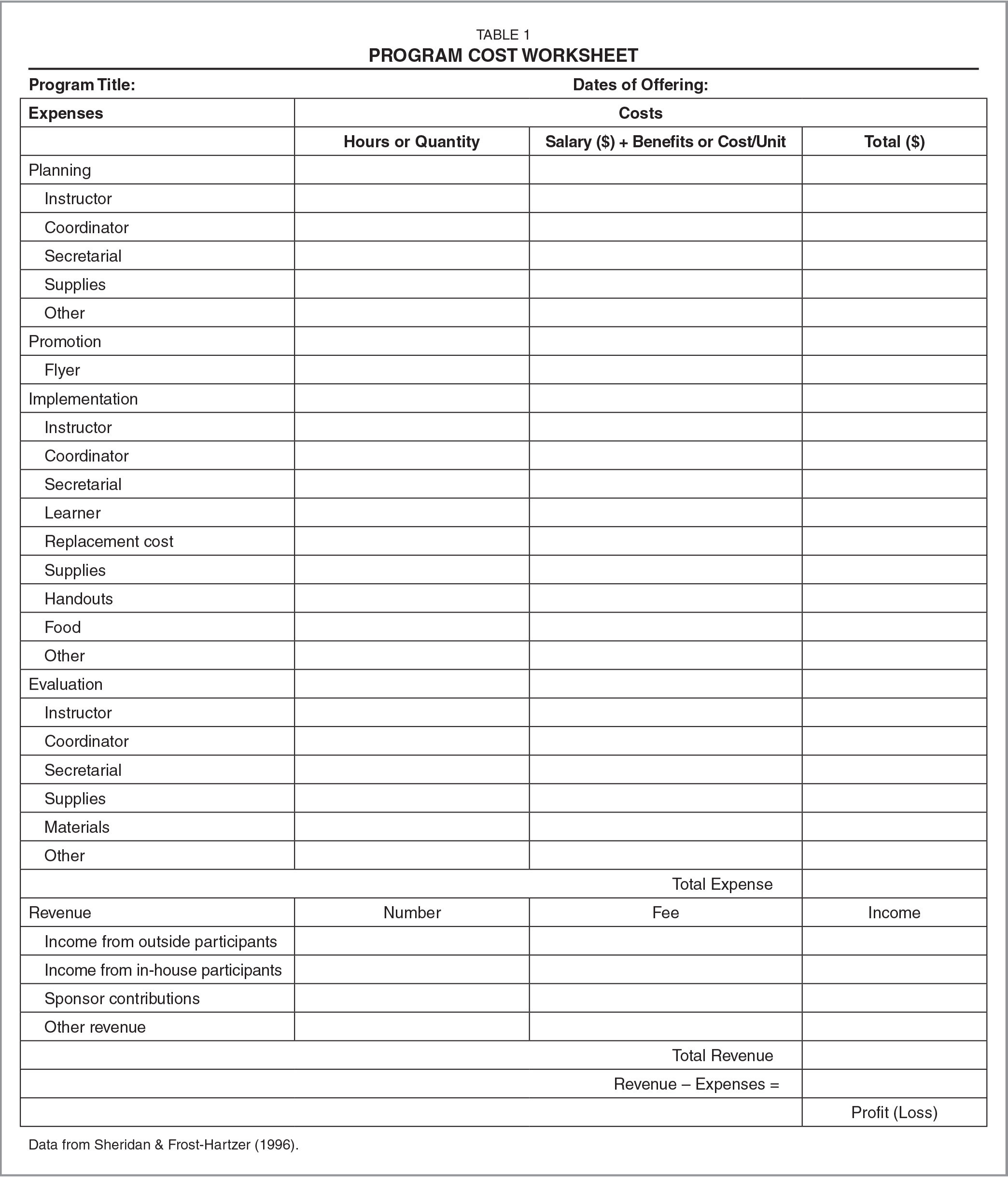

What Counts As Medical Expenses For Taxes Medical care expenses include payments for the diagnosis cure mitigation treatment or prevention of disease or payments for treatments affecting any structure or function of the body Deductible medical expenses may include but aren t limited to the following

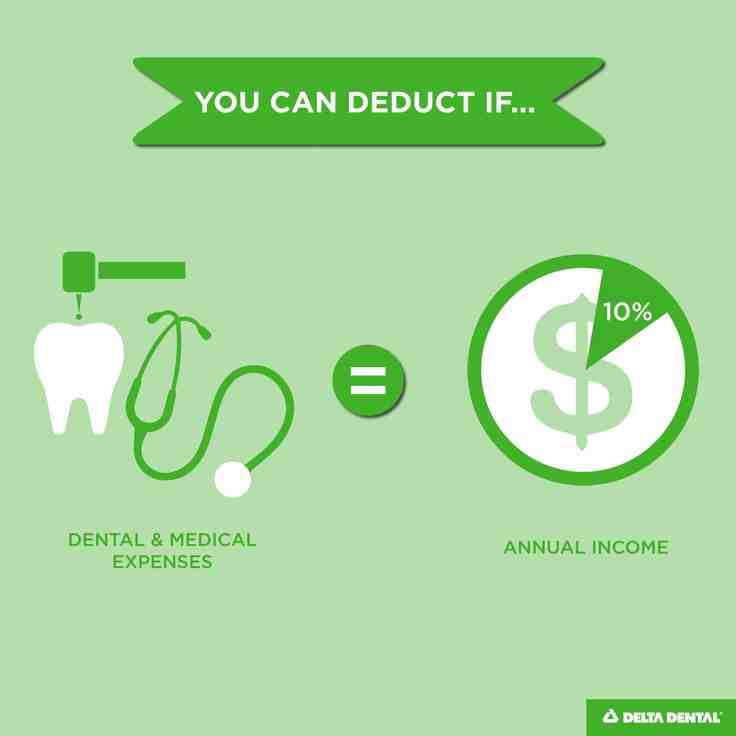

Medical expenses include health and dental insurance premiums doctor and hospital visits co pays prescription and over the counter drugs glasses and contacts crutches and wheelchairs to You ll need to multiply 60 000 by 7 5 60 000 x 0 075 4 500 If your total tax deductible medical expenses exceed 7 5 of your AGI you can claim these medical expenses on your tax return and reduce your taxable income Using the example above you can only deduct the portion of your expenses that exceeds 4 500

What Counts As Medical Expenses For Taxes

What Counts As Medical Expenses For Taxes

https://www.reluctantlandlord.net/wp-content/uploads/2015/05/Medical-Expenses1.jpg

Common Health Medical Tax Deductions For Seniors In 2024

https://www.seniorliving.org/app/uploads/2017/05/Senior-Taxes-Medical-Expenses.png

Free Printable Medical Expense Log Printable Templates

https://templates.udlvirtual.edu.pe/images/free-printable-medical-expense-log-gid-2.jpg

Tax law defines medical expenses as costs for the diagnosis cure mitigation treatment or prevention of disease and for treatments affecting any part or function of the body The IRS defines medical expenses as the costs of diagnosis cure mitigations treatment or prevention of an injury or disease These expenses include payments to doctors and other medical practitioners prescriptions and insulin X rays and laboratory tests eyeglasses and contact lenses and nursing help and hospital care

According to IRS Publication 502 you can only classify services or items as medical expenses if they alleviate or prevent a physical or mental disability or illness Below are 99 medication expenses you may be able to deduct on your tax return in 2024 organized by category Medical expenses include dental expenses and in this publication the term medical expenses is often used to refer to medical and dental expenses You can deduct on Schedule A Form 1040 only the part of your medical and dental expenses that is more than 7 5 of your adjusted gross income AGI

Download What Counts As Medical Expenses For Taxes

More picture related to What Counts As Medical Expenses For Taxes

Deductible Business Expenses For Independent Contractors Financial

https://www.financialdesignsinc.com/wp-content/uploads/2020/11/Expenses-1.jpg

Accounts Expense Report Template Sample Images And Photos Finder

https://i.pinimg.com/originals/d0/e9/5e/d0e95eac3b3732ea691f3c344d4a2c2d.jpg

Medical Expenses Islamicmyte

https://db-excel.com/wp-content/uploads/2019/09/schedule-c-expenses-worksheet-home-design-ideas-home.jpg

Updated on January 12 2023 Reviewed by Eric Estevez In This Article View All Photo sturti Getty Images Individuals can claim some of the cost of medical dental and other health care related expenses on tax returns if they For 2023 tax returns filed in 2024 taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their 2023 adjusted gross income The 7 5 threshold used to be 10

What medical expenses are tax deductible The IRS provides a list of approved medical and dental expenses that you can claim on your tax return You re probably aware that you can deduct unreimbursed payments to doctors dentists and other medical practitioners However here are a few deductible items that may surprise you What Counts as a Deductible Medical Expense To the IRS medical care expenses are costs related primarily to alleviating or preventing a physical or mental disability

What Is An FSA Definition Eligible Expenses More Finansdirekt24 se

https://www.patriotsoftware.com/wp-content/uploads/2017/06/FSA-eligible-expenses-compressed.png

Understanding How GDPR Fits Into The New Normal TinsleyNET

https://tinsleynet.co.uk/wp-content/uploads/Home-Office-GDPR.png

https://www.irs.gov/taxtopics/tc502

Medical care expenses include payments for the diagnosis cure mitigation treatment or prevention of disease or payments for treatments affecting any structure or function of the body Deductible medical expenses may include but aren t limited to the following

https://www.investopedia.com/terms/m/medical-expenses.asp

Medical expenses include health and dental insurance premiums doctor and hospital visits co pays prescription and over the counter drugs glasses and contacts crutches and wheelchairs to

How To Claim Medical Expenses On Your Tax Return

What Is An FSA Definition Eligible Expenses More Finansdirekt24 se

Solved Linda Who Files As A Single Taxpayer Had AGI Of Chegg

Medical Expense Tracker Money Money Money Pinterest Medical

Are Implants An Irs Deduction Under Dental Expenses Dental News Network

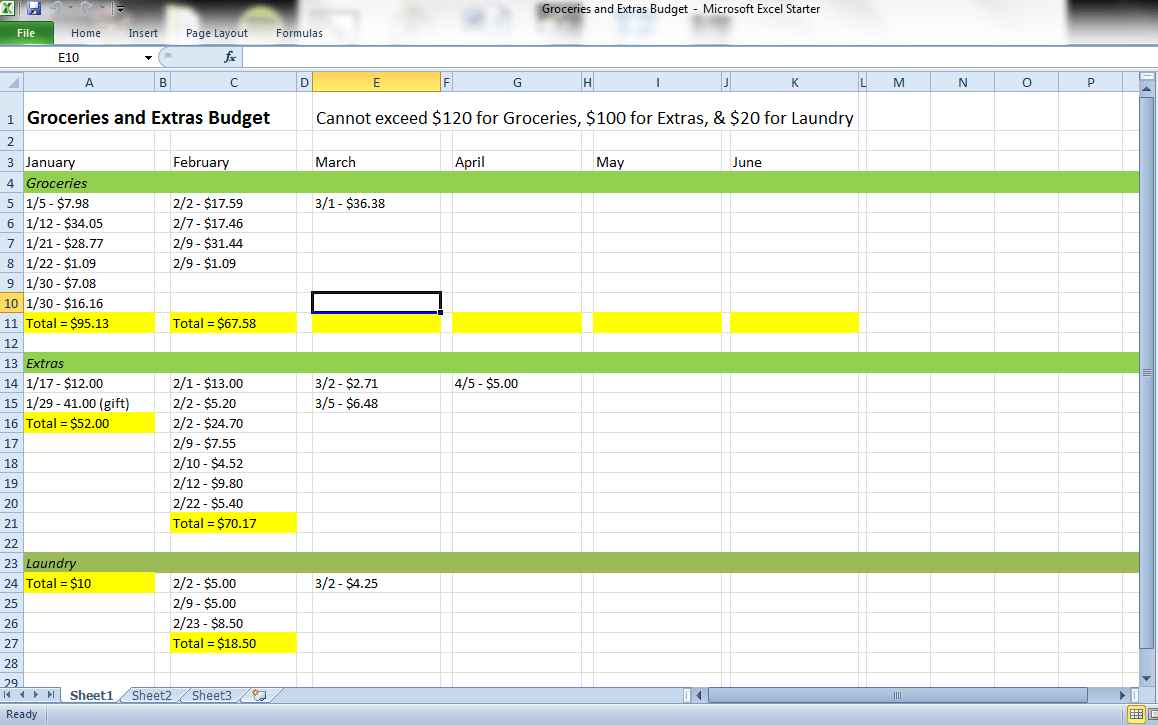

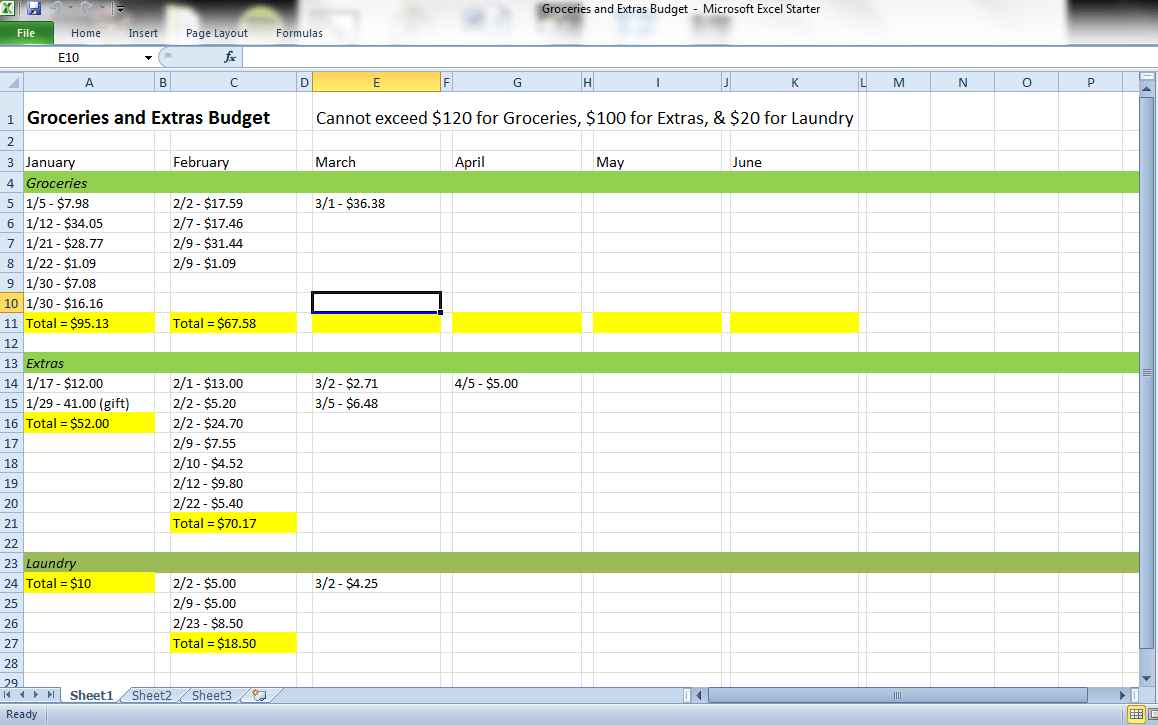

How To Keep A Spreadsheet Of Expenses With Regard To Track Expenses And

How To Keep A Spreadsheet Of Expenses With Regard To Track Expenses And

Quick Guide Who Should Claim Medical Expenses On Taxes Canada

The Master List Of All Types Of Tax Deductions INFOGRAPHIC Small

12 Medical Expense Deductions You Can Claim On Tax Day

What Counts As Medical Expenses For Taxes - Most forms of medical spending from insurance premiums to treatment are tax deductible if you meet the IRS requirements To claim this deduction you must take itemized deductions rather than the standard deduction and must have spent more than 7 5 of your income on qualified medical bills