What Day Does Your State Taxes Get Deposited Generally you can expect to receive your state tax refund within 30 days if you filed your tax return electronically If you filed a paper tax return it may take as many as 12 weeks for your refund to arrive

The deadline to file returns in 2024 is April 15 this sometimes varies based on weekends or state holidays This article includes a handy reference chart taxpayers When you mail your tax return it takes approximately six weeks from the date the IRS receives it to process your refund regardless of whether you choose direct deposit or a paper check And if you e file your return the processing time is cut in half

What Day Does Your State Taxes Get Deposited

What Day Does Your State Taxes Get Deposited

https://www.picnictax.com/wp-content/uploads/2020/10/x8266555568_76a0221632_k.jpg.pagespeed.ic_.7UZk5tRppC.jpg

Gov Ducey Signs Budget What s In Arizona s Tax Reform Package

https://files.taxfoundation.org/20210630163928/Arizona-income-tax-plan-e1625085595517.jpeg

R D Tax Subsidies In OECD Countries Tax Foundation

https://files.taxfoundation.org/20210316164723/RD-tax-subsidies-for-RD-spending-RD-tax-subsidies.-Tax-incentives-for-innovation-and-research-and-development-in-OECD-countries.jpg

If you file your tax return electronically and request direct deposit you can expect to receive your tax refund within 21 days You can find the status of your tax refund by visiting the IRS The IRS says it sends most federal tax refunds in 21 days but every state processes returns at its own pace For example refunds generally take up to two weeks to process in California if you e file while

How to set up a direct deposit for your tax refund The IRS uses direct deposit to electronically issue tax refund payments directly into taxpayers financial accounts In The IRS expects most EITC Additional CTC related refunds to be available in taxpayer bank accounts or on debit cards by February 27 if they chose direct deposit

Download What Day Does Your State Taxes Get Deposited

More picture related to What Day Does Your State Taxes Get Deposited

Corporate Income Tax Rates Around The World 2014

https://taxfoundation.org/wp-content/uploads/2015/10/international1.jpg

Which States Pay The Most Federal Taxes A Look At The Numbers

https://dyernews.com/wp-content/uploads/taxmap-1.png

The Harms Of Retaliatory Tax And Trade Policies Tax Foundation

https://taxfoundation.org/wp-content/uploads/2024/01/AdobeStock_253977390-scaled.jpeg

The IRS encourages taxpayers to file by the April 15 federal tax deadline and choose direct deposit to receive any refund they may be owed Where s My Refund is available almost all of the time However our system is not available every Monday early from 12 a m Midnight to 3 a m Eastern Time

The ANCHOR payments which are for the 2021 tax year will pay up to 1 500 to homeowners and 450 for renters with senior homeowners and renters Welcome to the Money blog a hub of personal finance and consumer news tips Today s posts include a look at the discounts available to students and local

Corporate Tax Rates Around The World 2016

https://taxfoundation.org/wp-content/uploads/2015/10/international2.jpg

Mortgage Interest Deduction Reviewing How TCJA Impacted Deductions

https://files.taxfoundation.org/20211014115145/Tax-Cuts-and-Jobs-Act-impact-mortgage-interest-deduction-state-and-local-tax-deduction-2017-tax-law.png

https://smartasset.com/taxes/irs-tax-ref…

Generally you can expect to receive your state tax refund within 30 days if you filed your tax return electronically If you filed a paper tax return it may take as many as 12 weeks for your refund to arrive

https://www.cpapracticeadvisor.com/2024/02/07/2024...

The deadline to file returns in 2024 is April 15 this sometimes varies based on weekends or state holidays This article includes a handy reference chart taxpayers

Canada Digital Services Tax Details Analysis Tax Foundation

Corporate Tax Rates Around The World 2016

Texas Constitutional Amendment To Prohibit Individual Income Taxation

Corporate Alternative Minimum Tax Details Analysis Tax Foundation

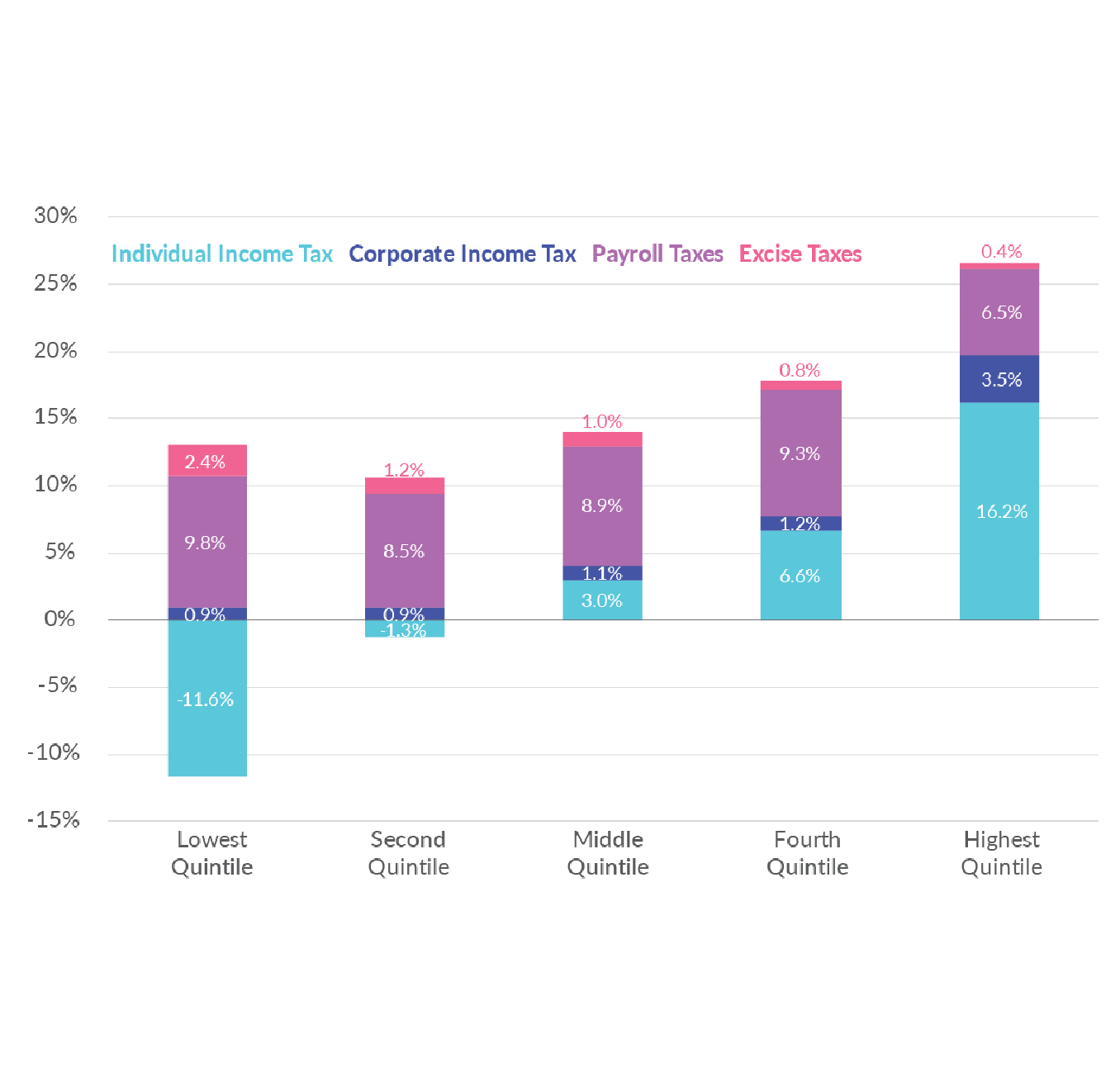

Does America Have A Progressive Tax Code Income Tax Liability

State Unemployment Trust Funds American Rescue Plan Treasury Rule

State Unemployment Trust Funds American Rescue Plan Treasury Rule

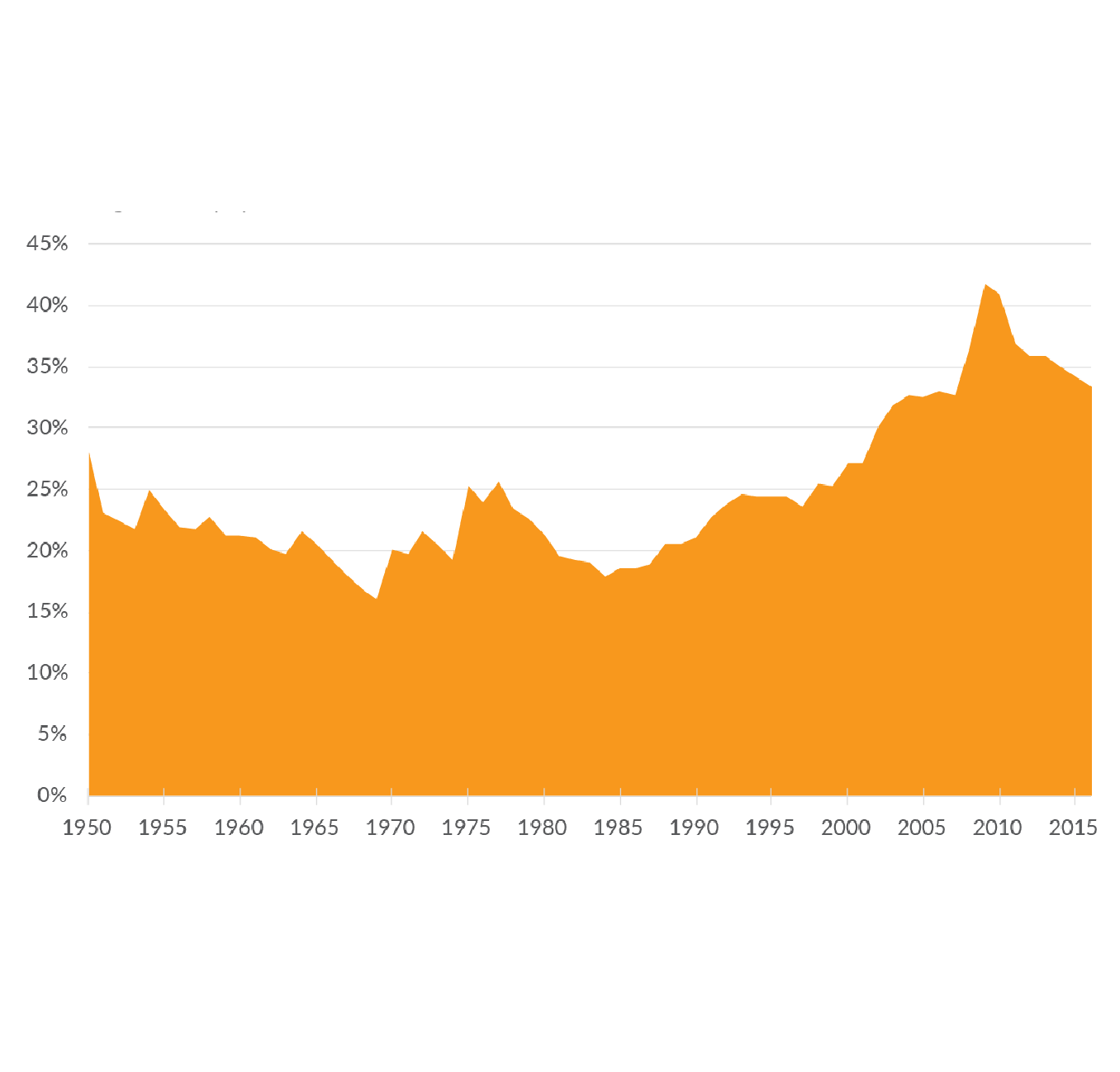

Federal Tax Rates By Income Group And Tax Source

Capital Gains Tax Rate Increase Revenue Details Analysis

2011 Facts Figures How Does Your State Compare PDF Income Tax In

What Day Does Your State Taxes Get Deposited - The IRS must hold those refunds until mid February by law meaning they won t hit taxpayers bank accounts until around Feb 27 according to the IRS Here s