What Does Irs Standard Deduction Mean The standard deduction is the portion of income not subject to tax that can be used to reduce your tax bill For 2023 the standard deduction was 13 850 for

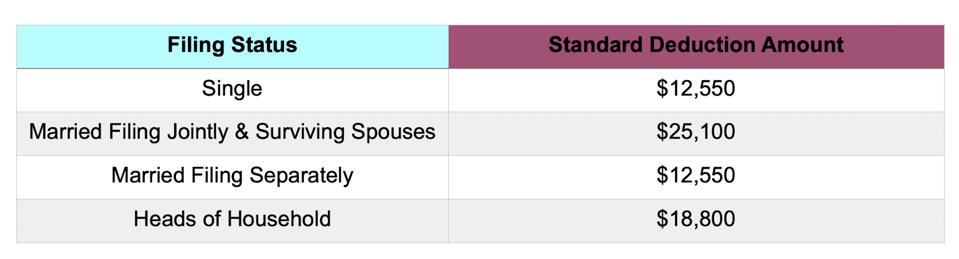

The standard deduction is a flat dollar amount set by the IRS based on your filing status It s the simplest way to reduce your taxable income on your tax return In fact Congress created The 2024 standard deduction for tax returns filed in 2025 is 14 600 for single filers 29 200 for joint filers or 21 900 for heads of household

What Does Irs Standard Deduction Mean

What Does Irs Standard Deduction Mean

https://wiggamlaw.com/wp-content/uploads/2022/01/AdobeStock_105842891-scaled-1.jpeg

IRS Releases 2021 Tax Rates Standard Deduction Amounts And More The

https://specials-images.forbesimg.com/imageserve/5f972c9ae5ab15d96e156167/960x0.jpg?fit=scale

IRS Standard Deduction 2023 Standard Deduction Calculator

https://urbanaffairskerala.org/wp-content/uploads/2023/02/IMG-20230221-WA0029_copy_1024x575.webp

The standard deduction in taxes is an amount the IRS enables you to write off on your taxes with no questions asked For some people it s enough to push them into a The standard deduction is a flat amount that reduces your taxable income and potentially your tax bill The amount set by the IRS could vary by tax year and filing status generally single married filing jointly married

The tax system gives you a choice of adding up all of your deductible expenses and providing evidence of those expenses to the IRS upon request or simply deducting a flat amount no questions asked That A tax deduction is an amount that you can deduct from your taxable income to lower the amount of taxes that you owe You can choose the standard deduction a single deduction of a fixed amount or

Download What Does Irs Standard Deduction Mean

More picture related to What Does Irs Standard Deduction Mean

IRS Announces Inflation Adjustments To 2022 Tax Brackets The Economic

https://www.ntu.org/Library/imglib/2021/11/ntuf-table1.png

What Does Tax Deductible Mean And How Do Deductions Work

https://s.yimg.com/uu/api/res/1.2/sHCVj52w77uMNRZtTsaifw--~B/aD0xMDgwO3c9MTkyMDtzbT0xO2FwcGlkPXl0YWNoeW9u/http://media.zenfs.com/en-US/homerun/gobankingrates_644/1782921ec4434716597a5408c994ca28

What Is A Tax Deduction

http://taxreceipts.com/wp-content/uploads/2012/03/what-is-a-deduction.jpg

The standard deduction is adjusted annually for inflation and the limits are based on your filing status For tax year 2022 the standard deduction ranges from 12 950 for single filers to 29 9o0 for married filing jointly For 2023 the federal standard deduction for single filers was 13 850 for married filing jointly it was 27 700 and for the head of household filers it increased to 20 800 Individuals who are at least partially blind or at least 65 years old get a larger standard deduction

The standard deduction is a fixed dollar amount you may subtract from your taxable income meaning more of your money isn t subject to taxes resulting in either a lower tax bill or a The standard deduction is a specific dollar amount that reduces the amount of income on which you re taxed Your standard deduction consists of the sum of the basic standard deduction and any additional standard deduction amounts for age and or blindness

How To Calculate Taxes With Standard Deduction Dollar Keg

https://dollarkeg.com/wp-content/uploads/2023/01/how-to-calculate-taxes-with-standard-deduction.png

Itemized Vs Standard Tax Deductions Pros And Cons 2023

https://cdn.ramseysolutions.net/media/blog/taxes/personal-taxes/itemizing-vs-standard-deduction.png

https://www.investopedia.com/terms/s/standarddeduction.asp

The standard deduction is the portion of income not subject to tax that can be used to reduce your tax bill For 2023 the standard deduction was 13 850 for

https://www.forbes.com/advisor/taxes/standard-deduction

The standard deduction is a flat dollar amount set by the IRS based on your filing status It s the simplest way to reduce your taxable income on your tax return In fact Congress created

2022 Tax Updates And A Refresh On How Tax Brackets Work Human Investing

How To Calculate Taxes With Standard Deduction Dollar Keg

The IRS Just Boosted Standard Deduction By 7 What It Means For You

What Does The Increased Standard Deduction Mean For Giving Giving

The Standard Deduction What You Need To Know Thesharpener

2023 IRS Standard Deduction

2023 IRS Standard Deduction

Small Business Expenses Tax Deductions 2023 QuickBooks

IRS Announces 2017 Tax Rates Standard Deductions Exemption Amounts

2023 IRS Inflation Adjustments Tax Brackets Standard Deduction EITC

What Does Irs Standard Deduction Mean - The standard deduction reduces a taxpayer s taxable income It ensures that only households with income above certain thresholds will owe any income tax Taxpayers can claim a standard deduction when filing their tax returns thereby reducing their taxable income and the taxes they owe