What Education Tax Credit Do I Qualify For Education credits like the American Opportunity Tax Credit AOTC and the Lifetime Learning Credit LLC can help with the cost of higher education See if you qualify

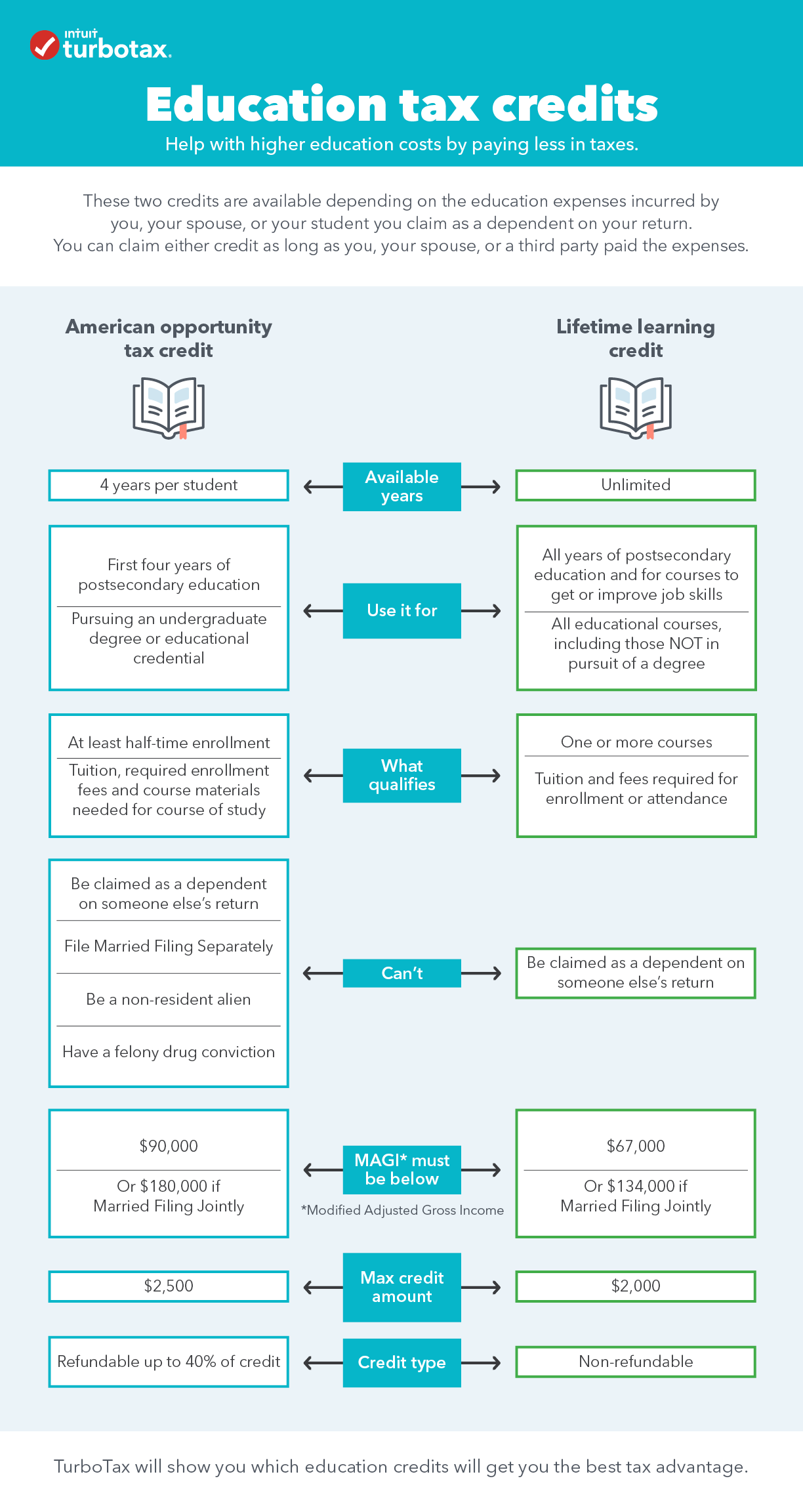

Eligible students and parents can trim college or trade school costs by thousands of dollars with the education tax credits Still need to file An expert can help or do taxes for you with 100 accuracy The Lifetime Learning Credit is a non refundable tax credit of up to 2 000 per tax return where you can claim qualifying expenses for any level of college or education courses

What Education Tax Credit Do I Qualify For

What Education Tax Credit Do I Qualify For

https://taxshop.tax/wp-content/uploads/2020/12/educationtaxcredit.jpg

Do I Qualify For Bankruptcy Husker Law

https://www.huskerlaw.com/wp-content/uploads/2020/12/how-to-qualify-for-bankruptcy-1536x1024.jpeg

The Federal Tax Credit For Electric Cars Is Set To Expire OsVehicle

https://cdn.osvehicle.com/can_i_claim_the_ev_tax_credit_every_year.png

Taxpayers can take education credits for themselves their spouse and or dependents claimed on the tax return who were enrolled at or attended an eligible postsecondary Average higher education costs for tuition fees and room and board have climbed over the last few decades from 11 411 in 1964 to 26 903 in 2022 according to the U S Department of Education

An education tax credit is a type of tax benefit provided by the U S government to help offset the costs of higher education expenses Education tax credits can help reduce the amount of tax owed or American Opportunity Tax Credit eligibility 80 000 or less 160 000 or less Full credit More than 80 000 but less than 90 000 Here are the key differences between these two education

Download What Education Tax Credit Do I Qualify For

More picture related to What Education Tax Credit Do I Qualify For

When Am I Eligible For Medicare Insurance

https://hp-prod-wp-data.s3.us-west-1.amazonaws.com/content/uploads/medicare-eligibility.png

2022 Education Tax Credits Are You Eligible

https://www.taxdefensenetwork.com/wp-content/uploads/2022/11/2022-Education-Credits-Comparison-scaled.jpg

Cool Tax Credits Usa 2022 Finance News

https://i2.wp.com/i.ytimg.com/vi/tiTLw0XHeBE/maxresdefault.jpg

Neither credit is available if your tax filing status is married filing separately American Opportunity Tax Credit How it works The American Opportunity Tax Credit is an education tax credit Claiming credits could wipe out your tax bill and even result in a refund The lifetime learning credit is equal to 20 of qualified education expenses up to a 2 000 credit

The good news is that if you re paying for school for yourself or others there are a number of education tax credits and deductions still available to you in 2023 and 2024 The American opportunity tax credit AOTC is a credit for qualified education expenses paid for an eligible student for the first four years of higher

Tax Credits Save You More Than Deductions Here Are The Best Ones

https://www.gannett-cdn.com/-mm-/14ee05d59f10019b9af859e1b8044dff44c16b5c/c=0-64-2118-1261&r=x1683&c=3200x1680/local/-/media/2017/03/28/USATODAY/USATODAY/636262972570306279-tax-credits.jpg

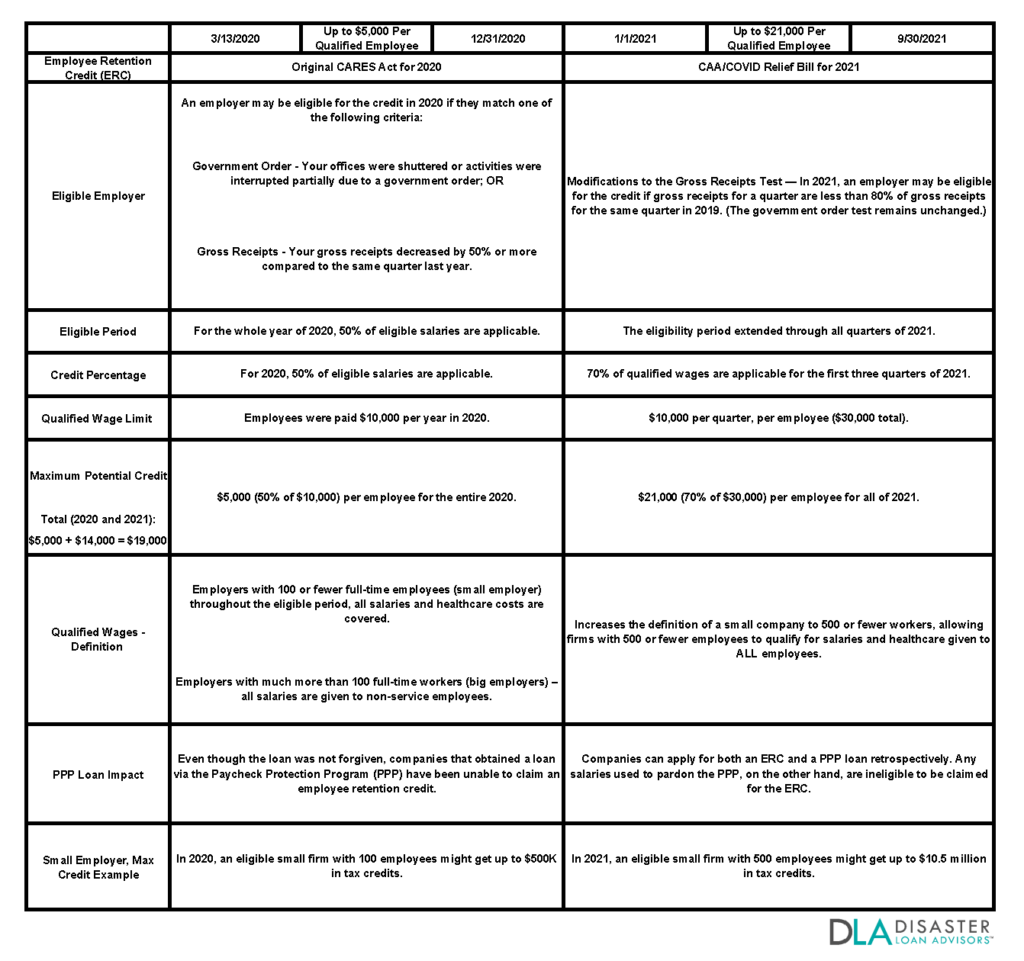

Can You Still Claim Employee Retention Credit For 2020 Leia Aqui What

https://www.disasterloanadvisors.com/wp-content/uploads/2022/05/How-to-Determine-Eligibility-for-the-Employee-Retention-Tax-Credit-ERC-ERTC-1024x961.png

https://www.irs.gov/.../education-credits-aotc-llc

Education credits like the American Opportunity Tax Credit AOTC and the Lifetime Learning Credit LLC can help with the cost of higher education See if you qualify

https://turbotax.intuit.com/tax-tips/colle…

Eligible students and parents can trim college or trade school costs by thousands of dollars with the education tax credits Still need to file An expert can help or do taxes for you with 100 accuracy

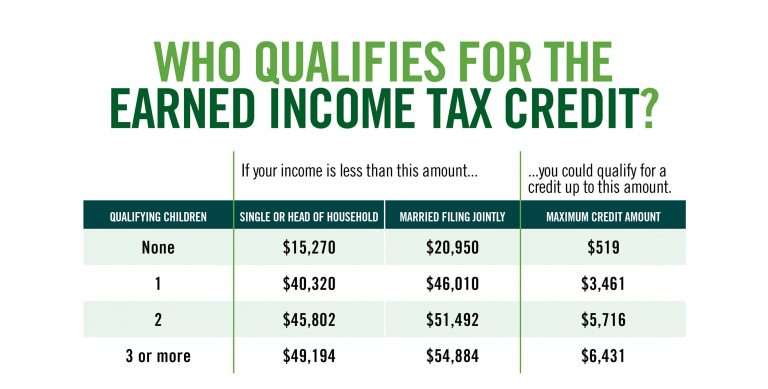

Earning Income Tax Credit Table

Tax Credits Save You More Than Deductions Here Are The Best Ones

The 2 Education Tax Credits For Your Taxes Credible

:max_bytes(150000):strip_icc()/what-are-basic-requirements-qualify-payday-loan.aspFinal-1b6684790a684488bc21480e6dced3b2.jpg)

How Do I Qualify For Fast Cash Leia Aqui What Is The Easiest Loan To

Who Gets Tax Credits Leia Aqui Who Gets Federal Tax Credits

Low income Mainers Filing Taxes Right Now Can Claim Piece Of 200

Low income Mainers Filing Taxes Right Now Can Claim Piece Of 200

FAQ WA Tax Credit

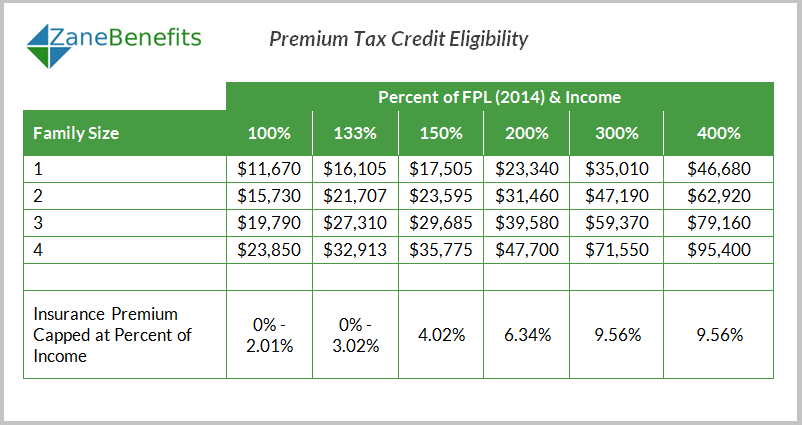

Premium Tax Credit Charts 2015

What Education Tax Credits Are Available

What Education Tax Credit Do I Qualify For - You as a Dependent or Qualifying Child In most cases you cannot be a dependent or qualifying child of another taxpayer and claim the EITC In most cases if you re under