What Expenses Are Not Covered By Hsa Generally you can t use your HSA to pay for expenses that don t meaningfully promote the proper function of the body or prevent or treat illness or disease Nutritional supplements and weight loss programs not prescribed by a physician are examples of expenses that would not be covered by your HSA

For HSA purposes expenses incurred before you establish your HSA aren t qualified medical expenses State law determines when an HSA is established An HSA that is funded by amounts rolled over from an Archer MSA or another HSA is established on the date the prior account was established Cigna provides a complete list of covered and not covered items If you re 64 or younger and withdraw funds for a non qualified expense you ll owe income taxes on the money plus a 20

What Expenses Are Not Covered By Hsa

What Expenses Are Not Covered By Hsa

http://thinkhealth.priorityhealth.com/wp-content/uploads/2015/11/Priority-Health-education-HSA-vs-FSA-difference-between-HSA-and-FSA.jpg

Collective Bargaining Why Only Half Of The Employees Work According To

https://www1.wdr.de/nachrichten/lieferando-streik-100~_v-gseagaleriexl.jpg

:max_bytes(150000):strip_icc()/dotdash-hsa-vs-fsa-v3-66871b956baa4be786d2138777e70067.jpg)

Health Savings Vs Flexible Spending Account What s The Difference

https://www.investopedia.com/thmb/PE1dbX0Tuo1ohlHmjw_RcTUcvNw=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/dotdash-hsa-vs-fsa-v3-66871b956baa4be786d2138777e70067.jpg

What expenses are not HSA eligible Rules have become stricter over the years about what expenses are eligible for HSA funds General purchases that may benefit your overall health don t According to the IRS generally any expense that doesn t meaningfully promote the body s proper function or prevent or treat illness or disease is not HSA or FSA eligible Some common expenses that typically aren t eligible include the following

You can use your HSA to purchase a wide range of qualified medical expenses that are not covered by your health insurance Expenses that qualify for the medical and dental expense deduction meet the criteria The main purpose of the expense must be to ease or prevent a physical or mental illness What Expenses Are Not HSA Eligible The IRS does specify certain health related costs that aren t considered to be qualified medical expenses Some of the things you can t use your HSA money to pay for without a tax penalty include

Download What Expenses Are Not Covered By Hsa

More picture related to What Expenses Are Not Covered By Hsa

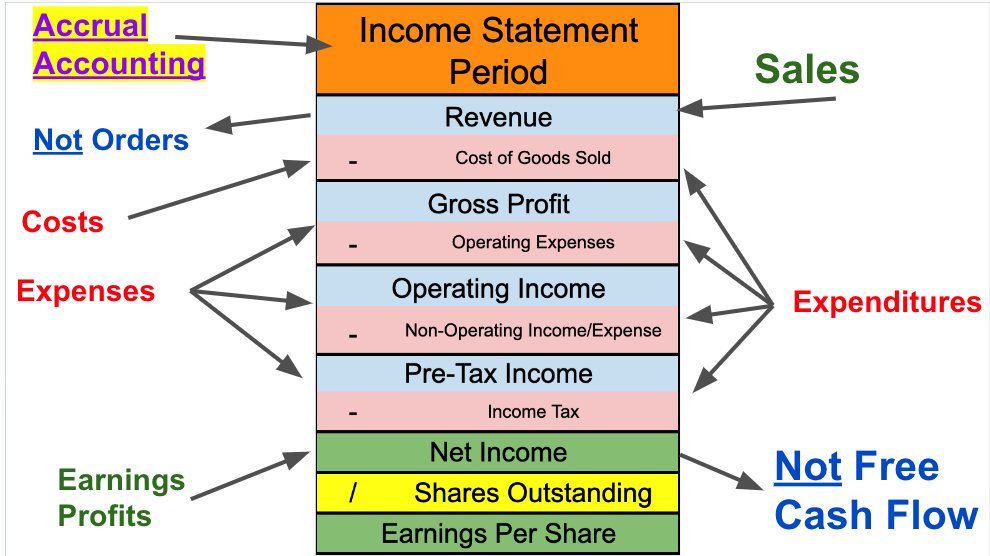

Blinded By The Light On Twitter RT BrianFeroldi Revenue And Income

https://pbs.twimg.com/media/FvSKbAzXsAcl3yd.jpg

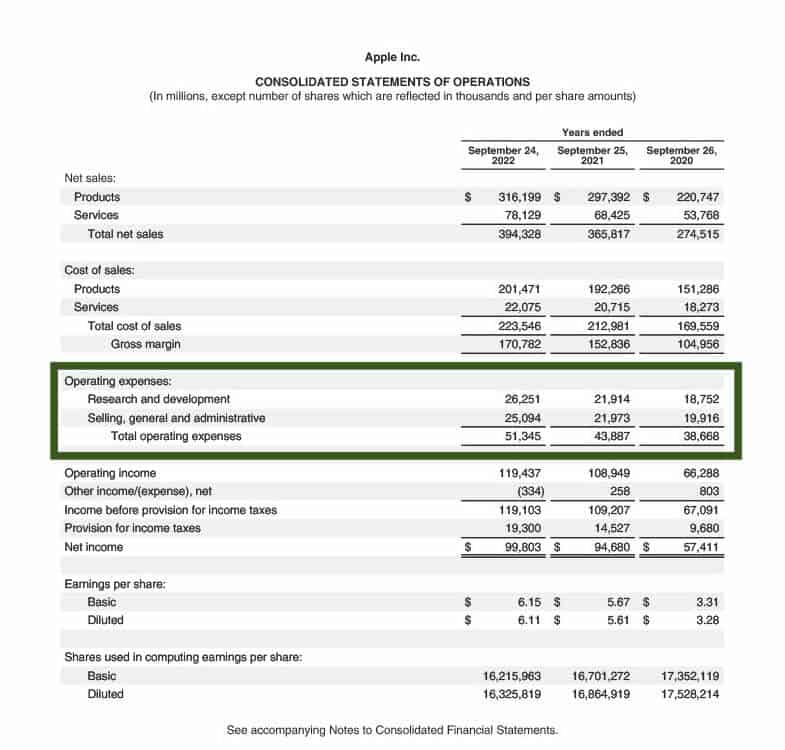

What Are Expenses Definition Types And Examples Forage

https://www.theforage.com/blog/wp-content/uploads/2023/02/apple-statement-of-ops-expenses1024_1.jpg

Fundraiser By Angelina Tafoya Help Tara With Medical Expenses

https://d2g8igdw686xgo.cloudfront.net/67964473_1662621389190245_r.jpg

If you are currently participating in a High Deductible Health Plan HDHP and are contributing to an HSA you may also participate in a Limited Purpose HRA or Health FSA Expenses are limited to dental and vision expenses identified with an in the list below What s Covered That means as outlined in the FAQs that the costs associated with the following expenses are covered Dental exam Eye exam Physical exam

A Health Savings Account HSA is a tax advantaged account to help you save for medical expenses that are not reimbursed by high deductible health plans HDHPs Whose qualified medical expenses can be covered by my HSA A common misconception is that individuals must be covered by a high deductible health plan HDHP in order for their QMEs to be covered by an HSA

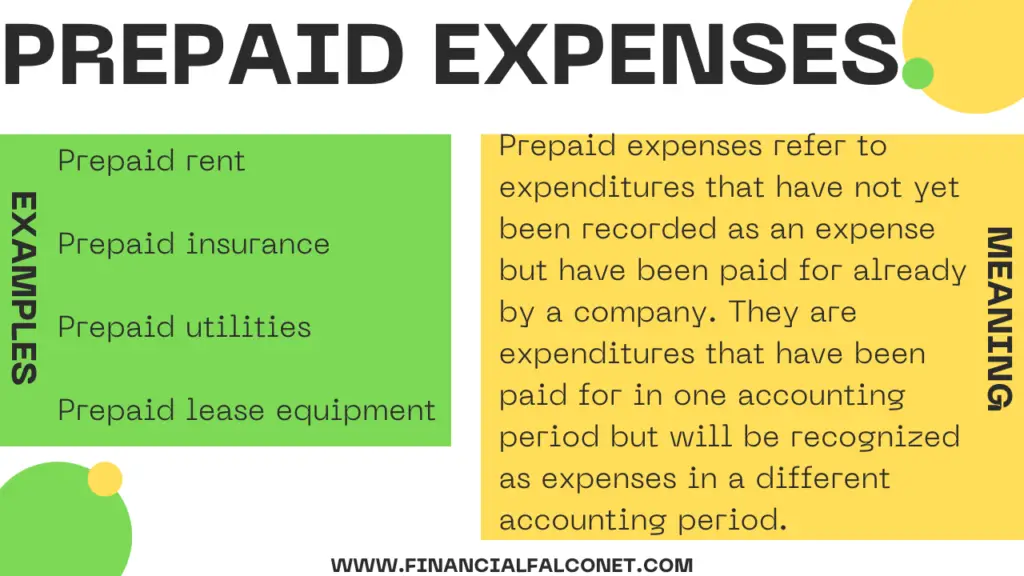

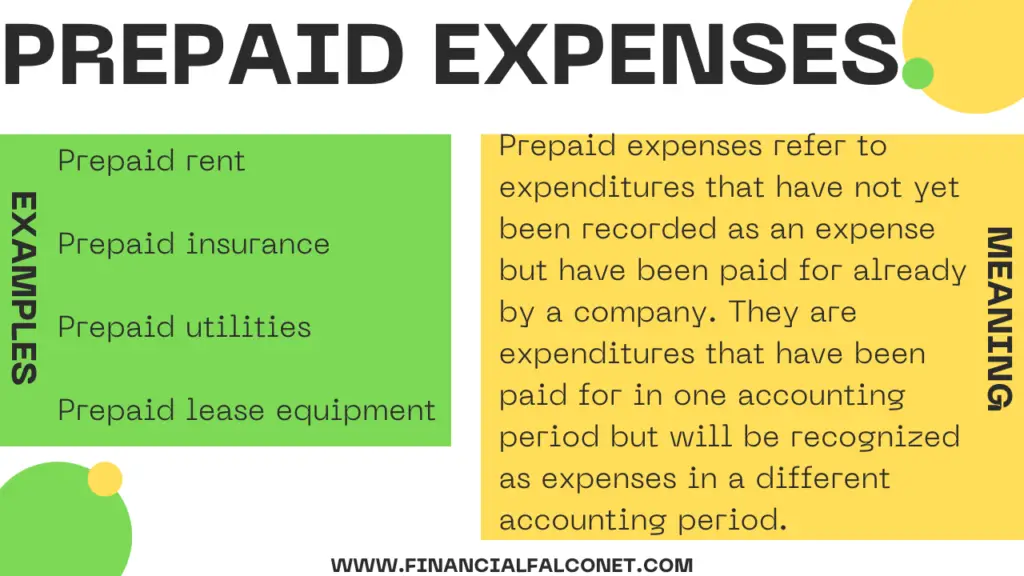

Why Prepaid Expenses Appear In The Current Asset Section Of The Balance

https://financialfalconet.com/wp-content/uploads/2023/01/Prepaid-expenses-Meaning-and-example-1024x576.png

:max_bytes(150000):strip_icc()/dotdash_Final_How_operating_expenses_and_cost_of_goods_sold_differ_Sep_2020-01-558a19250f604ecabba2901d5f312b31.jpg)

Cost Of Goods Sold Vs Operating Expenses What Is The Difference Hot

https://www.investopedia.com/thmb/CDgFK7iKgp5_uZoJPUSRJh1SenU=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/dotdash_Final_How_operating_expenses_and_cost_of_goods_sold_differ_Sep_2020-01-558a19250f604ecabba2901d5f312b31.jpg

https://communications.fidelity.com/pdf/wi/pay-with-hsa.pdf

Generally you can t use your HSA to pay for expenses that don t meaningfully promote the proper function of the body or prevent or treat illness or disease Nutritional supplements and weight loss programs not prescribed by a physician are examples of expenses that would not be covered by your HSA

https://www.irs.gov/publications/p969

For HSA purposes expenses incurred before you establish your HSA aren t qualified medical expenses State law determines when an HSA is established An HSA that is funded by amounts rolled over from an Archer MSA or another HSA is established on the date the prior account was established

Super Payments

Why Prepaid Expenses Appear In The Current Asset Section Of The Balance

Who Are Not Covered By The Labor Code Alburo Law Offices

Health Expenses Covered By HSA Or FSA Qualified Medical Expense

DO VIBRATION PLATES WORK Eilison Vibration Plate Review YouTube

Excel Templates For Expenses

Excel Templates For Expenses

Are Baby Monitors Covered By HSA Or FSA A Guide For Parents Useful

Privacy Policy Scyne Advisory

2 College Expenses Not Covered By 529 Plans YouTube

What Expenses Are Not Covered By Hsa - Health Reimbursement Accounts HRAs Health Savings Accounts HSAs and Flexible Spending Accounts FSAs can be great cost savings tools You can use them to reimburse yourself for eligible health care dental and dependent care expenses But it s important to know which expenses can be reimbursed