What Expenses Can I Claim As A Sole Trader Nz In this video we explain the difference between revenue and capital expenses as well as the difference between business and private expenses and what you can claim in your

Usually a self employed person can start in business without following any formal or legal set up tasks Tax summary If you re self employed you use your individual IRD number To help sole traders and small businesses keep more of their money the IRD allows some business expenses to be claimed as tax deductions What this essentially means is that you re rewarded for investing in your

What Expenses Can I Claim As A Sole Trader Nz

What Expenses Can I Claim As A Sole Trader Nz

https://www.creative.onl/payrollindex/wp-content/uploads/2022/04/sole-trader-pay.jpg

What Expenses Can I Claim As A Sole Trader Allowable Expenses

https://ascott-blake.com/wp-content/uploads/2023/02/sole-trader-expenses.jpg

11 STEPS TO SETTING UP AS A SOLE TRADER SELF EMPLOYED Post 7 Of 10

https://i.pinimg.com/originals/9c/f8/4c/9cf84c237adfa1389e95d8971b978fa9.jpg

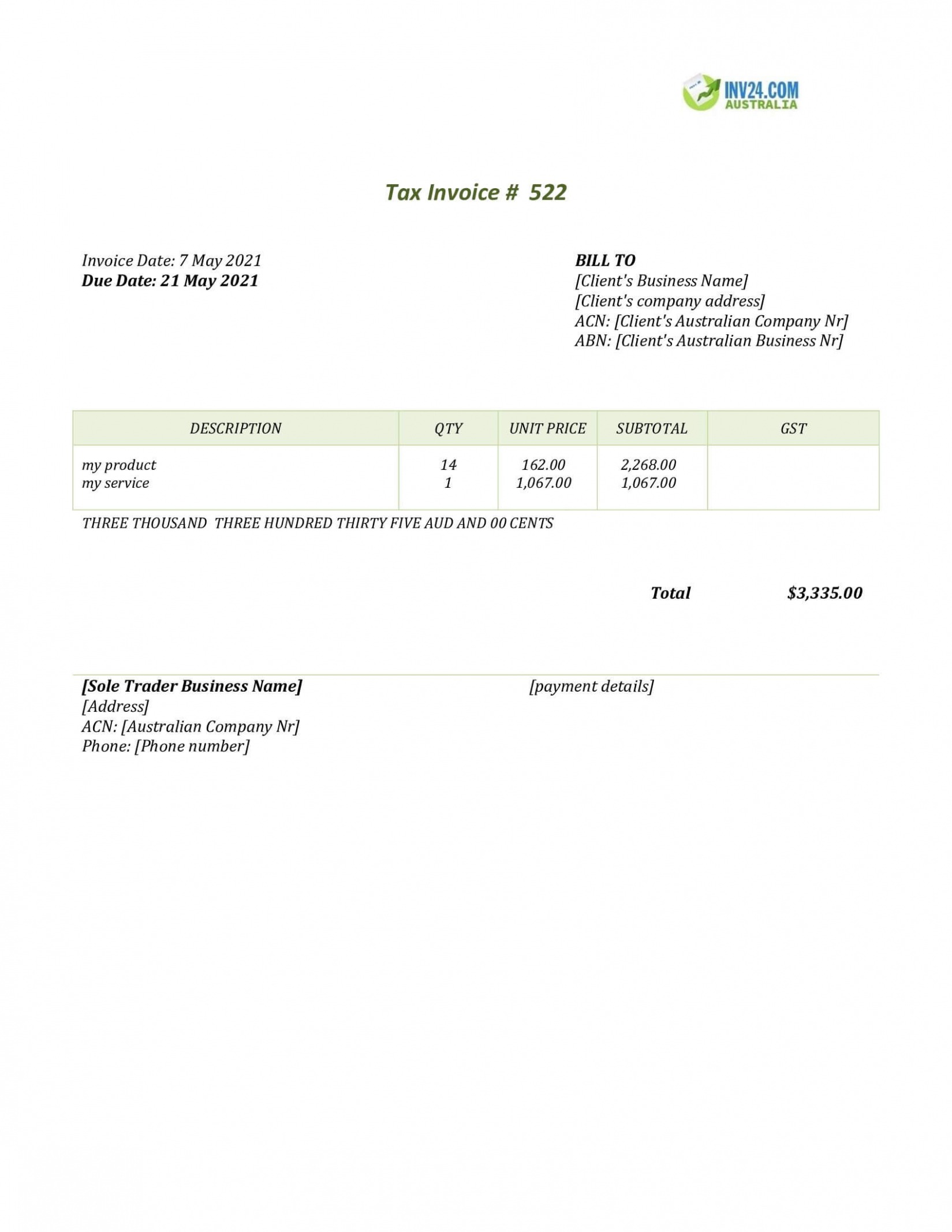

As a New Zealand sole trader you can claim business expenses and reduce your tax bill Claiming sole trader deductible expenses doesn t have to be difficult But knowing which expenses you can claim can There are three kinds of taxes and levies sole traders contractors and solo operators need to be aware of income tax ACC levies GST When planning your cash flow you might

Can I claim an expense on my individual income tax return The answer will depend on your own personal circumstances Work through the questions below to find out what We have information and guidance on claiming expenses Claiming expenses For a video and explanation about claiming expenses to help you prepare head to Inland Revenue

Download What Expenses Can I Claim As A Sole Trader Nz

More picture related to What Expenses Can I Claim As A Sole Trader Nz

Sole Trader Tax Deductions How To Optimise Your Taxes In 2022

https://uploads-ssl.webflow.com/5efd455be224bd10a27ddf8c/628f57631956b41f6612c16a_tax deductions table.png

What Expenses Can I Claim As A Contractor NZ Find Out Now

https://engineereddaily.com/wp-content/uploads/2023/07/what-expenses-can-i-claim-as-a-contractor-nz.jpg

What Expenses Can I Claim As A Sole Trader self employed UK Tax

https://finanche.co.uk/wp-content/uploads/2022/12/e041a9a3-d66f-45fb-88ba-d9f635b737f8-768x512.jpg

You can claim business expenses such as home office expenses and deduct these from your income before calculating tax Claiming expenses business govt nz Get your As a sole trader your business income is considered personal income After deducting business expenses you pay tax on the remaining profit also known as taxable

As a self employed sole trader you pay tax on your net profit This is calculated by filing an annual individual income return IR3 using your individual IRD number You declare When do sole traders need to lodge a tax return Sole traders need to lodge a tax return by 7 July every year This tax return covers your income and expenses from the previous

Can I Claim My Laptop As An Education Expense Leia Aqui Is A Laptop

https://assets-global.website-files.com/601d611d601043ab3e22931b/63c0f1e767846cf05c7af85e_how-to-write-off-expenses-as-an-independent-contractor.webp

How Do I Claim Business Expenses As A Sole Trader Pandle

https://www.pandle.com/wp-content/uploads/2021/12/How-Do-I-Claim-Business-Expenses-as-a-Sole-Trader-08.png

https://www.ird.govt.nz/about-us/videos/campaigns/...

In this video we explain the difference between revenue and capital expenses as well as the difference between business and private expenses and what you can claim in your

https://www.ird.govt.nz/roles/self-employed

Usually a self employed person can start in business without following any formal or legal set up tasks Tax summary If you re self employed you use your individual IRD number

Sole Trader Allowable Expenses Sandra Silk Bookkeeping

Can I Claim My Laptop As An Education Expense Leia Aqui Is A Laptop

Invoicing In New Zealand 4 Most Popular Methods

Expense Claim Form Template Excel Printable Word Searches

What Expenses Can I Claim As A Sole Trader 2024 Updated RECHARGUE

Self Employed Allowable Expenses Accounting Basics Best Accounting

Self Employed Allowable Expenses Accounting Basics Best Accounting

What Expenses Can A Sole Trader Claim In The UK

Non Gst Invoice Template

Sole Trader Invoice Template Invoice Complete Riset

What Expenses Can I Claim As A Sole Trader Nz - There are three kinds of taxes and levies sole traders contractors and solo operators need to be aware of income tax ACC levies GST When planning your cash flow you might