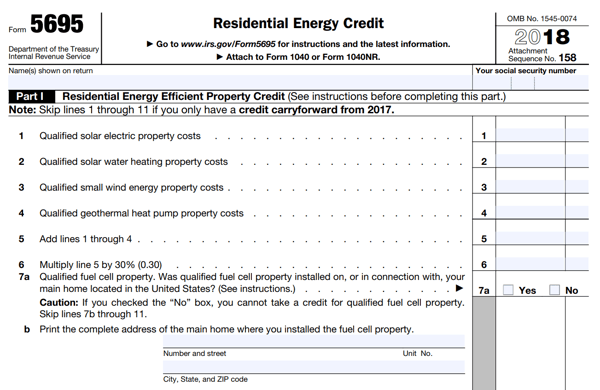

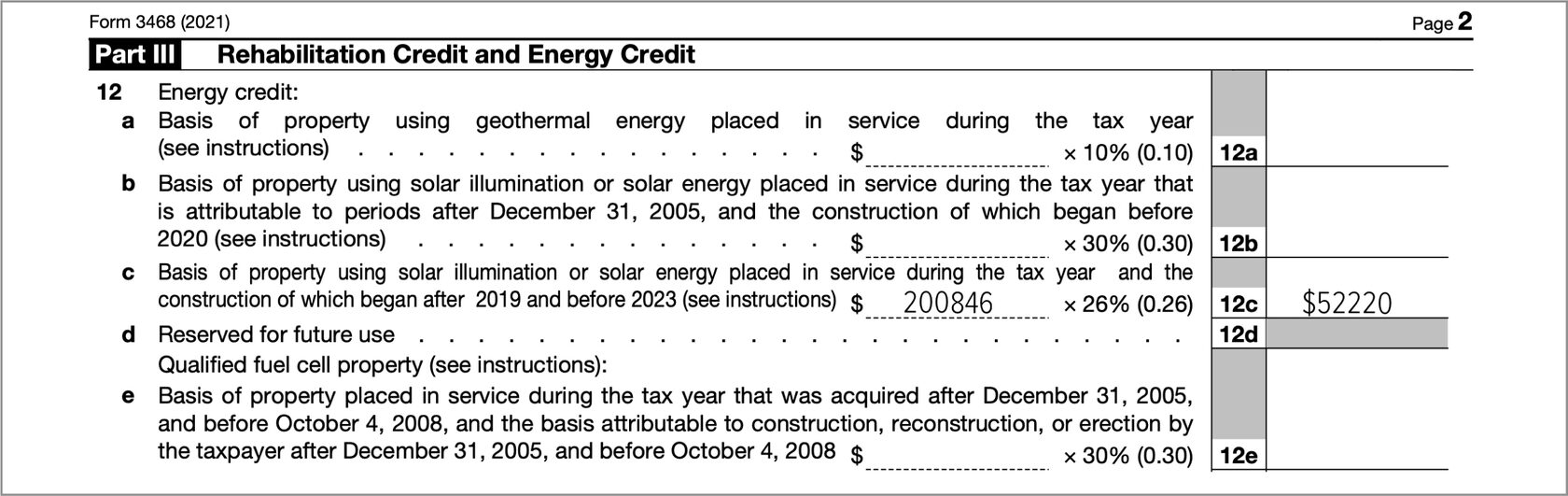

What Forms Do I Need For Solar Tax Credit You may be able to take a credit of 30 of your costs of qualified solar electric property solar water heating property small wind energy property geothermal heat pump property battery storage technology and fuel cell property

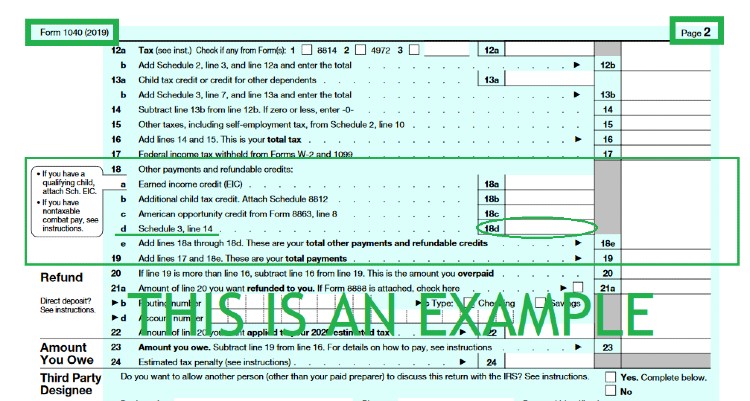

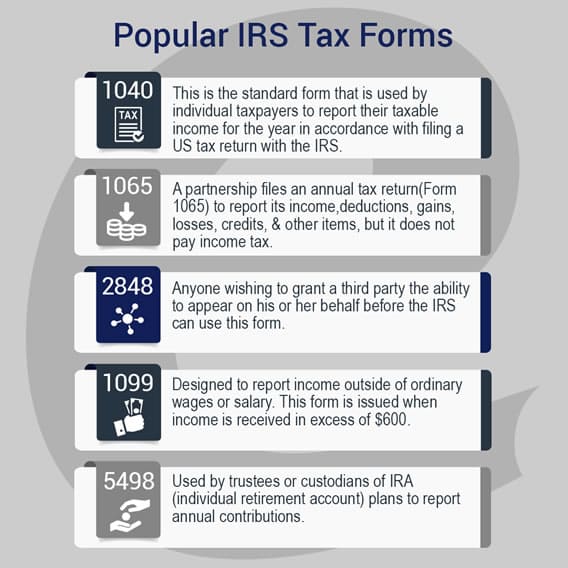

To claim the solar tax credit you ll need first to determine if you re eligible then complete IRS Form 5695 and finally add your renewable energy tax credit information to Schedule 3 and Form 1040 What you need to claim the tax credit Fill out your Form 1040 as you normally would Stop when you reach line 20 and move to Schedule 3 where you can fill in other payments and additional credits like the solar tax credit To figure out your tax credit value you ll use Form 5695

What Forms Do I Need For Solar Tax Credit

What Forms Do I Need For Solar Tax Credit

https://blog.pickmysolar.com/hs-fs/hubfs/solar-form-5695.png?width=600&name=solar-form-5695.png

How To Claim The Federal Solar Investment Tax Credit Solar Sam

https://www.solarsam.com/wp-content/uploads/2021/01/File-the-Federal-Tax-Credit-Form-5695-to-Claim-the-Solar-ITC-on-Taxes-and-have-Solar-Panels-Professionally-Installed-by-Solar-Sam-1536x974.png

How To File The Federal Solar Tax Credit A Step By Step Guide

https://blog.pickmysolar.com/hs-fs/hubfs/pkms-blog-federal-tax-credit.jpg?width=1305&name=pkms-blog-federal-tax-credit.jpg

If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit Information about Form 5695 Residential Energy Credits including recent updates related forms and instructions on how to file Use Form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit

How do I claim the federal solar tax credit After seeking professional tax advice and ensuring you are eligible for the credit you can complete and attach IRS Form 5695 to your federal tax return Form 1040 or Form 1040NR Instructions on filling out the form are available here Where can I find more information Ask Questions You will need four IRS tax forms plus their instructions to file for your solar panel tax credit Form 1040 standard federal income tax form Schedule 3 Form 1040

Download What Forms Do I Need For Solar Tax Credit

More picture related to What Forms Do I Need For Solar Tax Credit

Filing For The Solar Tax Credit Wells Solar

https://wellssolar.com/wp-content/uploads/2020/01/IRS-solar-tax-credit-form-1040-SM.jpg

Here s How To Claim The Solar Tax Credits On Your Tax Return Southern

https://i1.wp.com/southerncurrentllc.com/wp-content/uploads/IRS-Form-1040-Solar-Tax-Credit-Claim.png?resize=760%2C581

How Do I Claim The Solar Tax Credit A1 Solar Store

https://static.tildacdn.com/tild6231-3633-4430-a365-356165636165/10_How_to_Claim_the_.jpg

The following expenses are included Solar PV panels or PV cells used to power an attic fan but not the fan itself Contractor labor costs for onsite preparation assembly or original installation including permitting fees inspection costs and developer fees The solar panel tax credit allows filers to take a tax credit equal to up to 30 of eligible costs There is no income limit to qualify and you can claim the credit each year you re

Generally you can claim a tax credit on the expenses related to the new solar PV system that already came installed on the house for the year in which you moved into the house assuming the builder did not claim the tax credit in other words you may claim the credit in 2021 To claim your tax credit for solar panels you must file Form 5695 Residential Energy Credits along with Form 1040 for the year the panels were installed You ll need the following

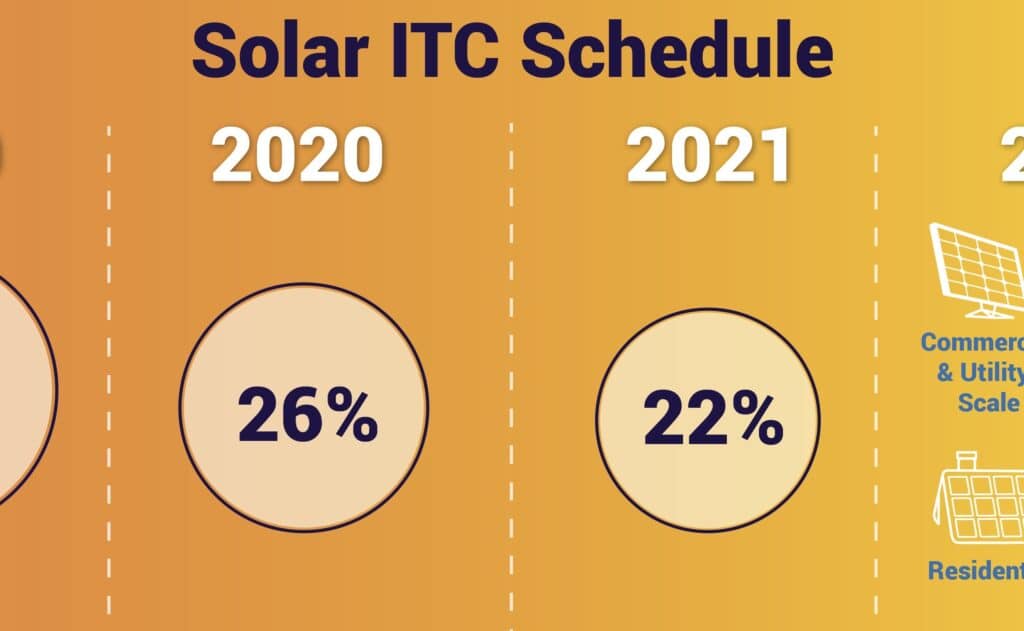

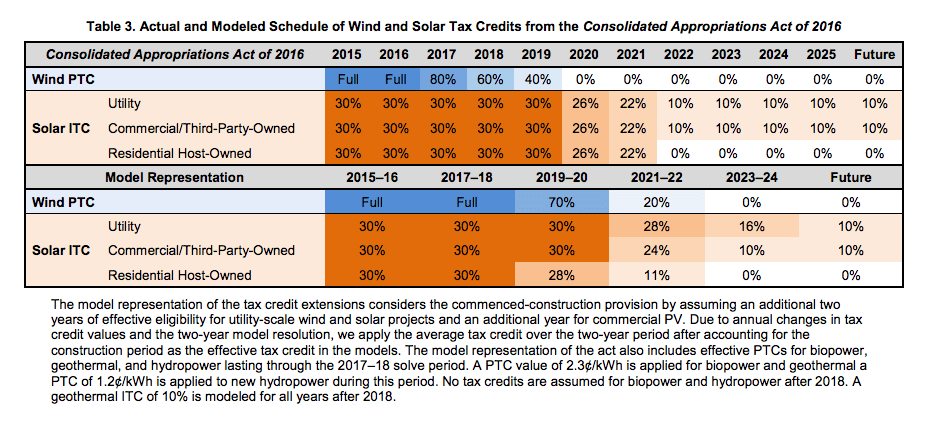

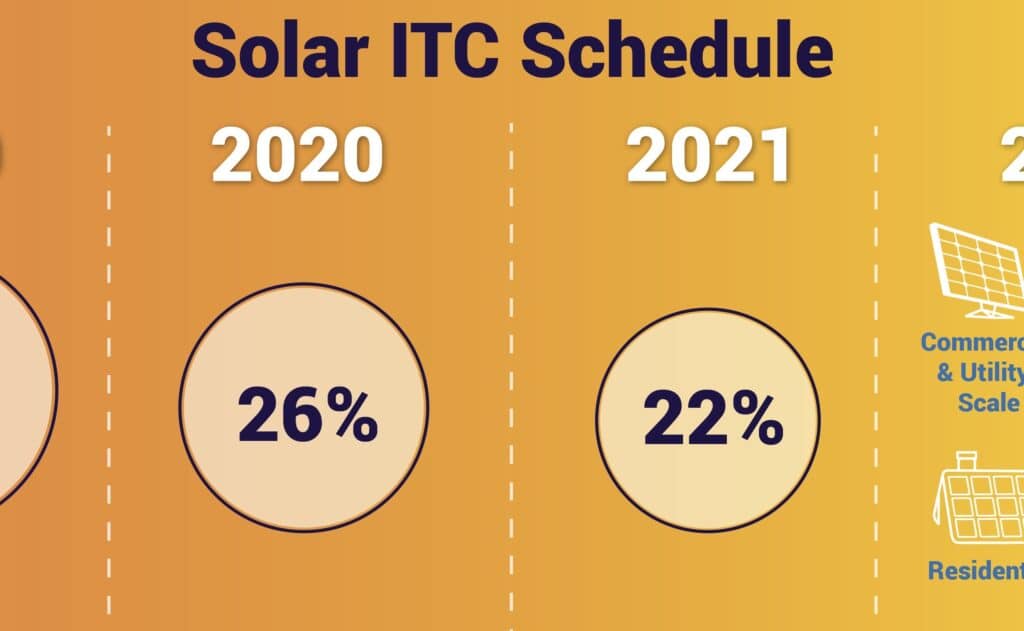

Solar Tax Credit Act Now My Generation Energy MA

https://www.mygenerationenergy.com/wp-content/uploads/2019/11/SOLAR-ITC-RAMPDOWN-GRAPHIC-1024x631.jpeg

Solar Tax Credit Extended 2 More Years SunWork

https://sunwork.org/wp-content/uploads/2021/01/Solar-Tax-Credit-Timeline-2.jpg

https://www.irs.gov › instructions

You may be able to take a credit of 30 of your costs of qualified solar electric property solar water heating property small wind energy property geothermal heat pump property battery storage technology and fuel cell property

https://www.energysage.com › solar › how-do-i-claim...

To claim the solar tax credit you ll need first to determine if you re eligible then complete IRS Form 5695 and finally add your renewable energy tax credit information to Schedule 3 and Form 1040

Federal Tax Credit ITC For Solar Energy Gets Extended

Solar Tax Credit Act Now My Generation Energy MA

The Federal Solar Tax Credit Can Save You Thousands Green Ridge Solar

Solar Investment Tax Credit In 2023 Rebates Incentives

Is There A Residential Solar Tax Credit Planned For 2022 Wanwas

Pin On Per Lo Spazio

Pin On Per Lo Spazio

IRS Tax Forms 1040EZ 1040A More E file

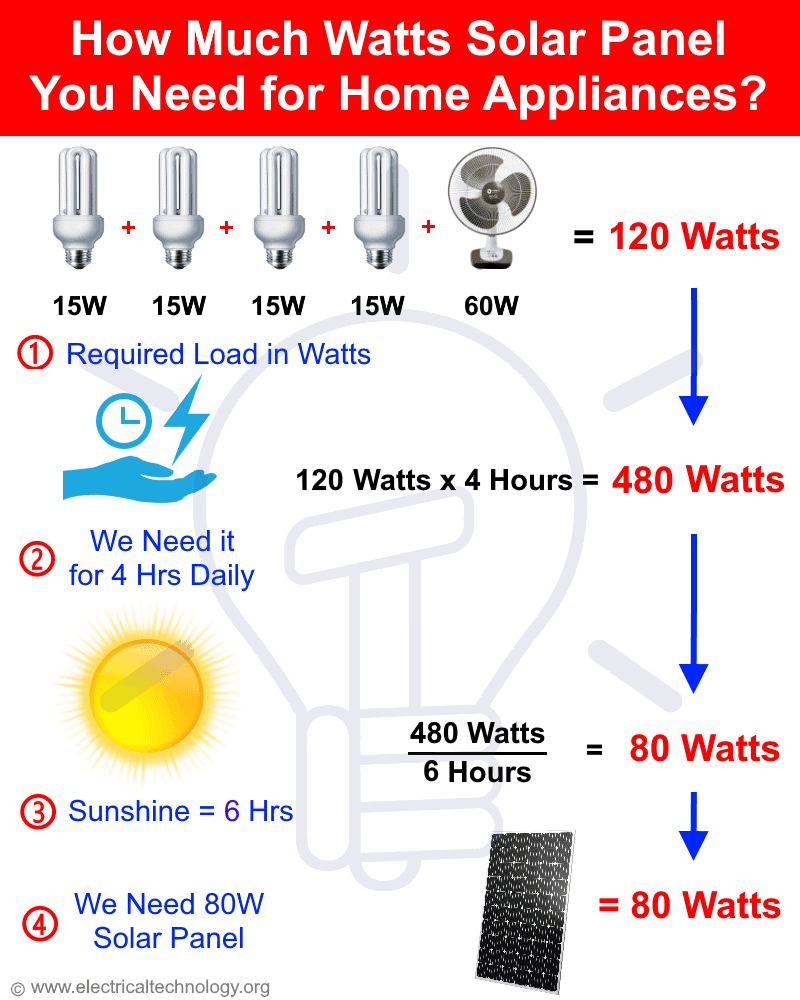

How Much Watt Solar Panel Required For Home Solar Panels Watts

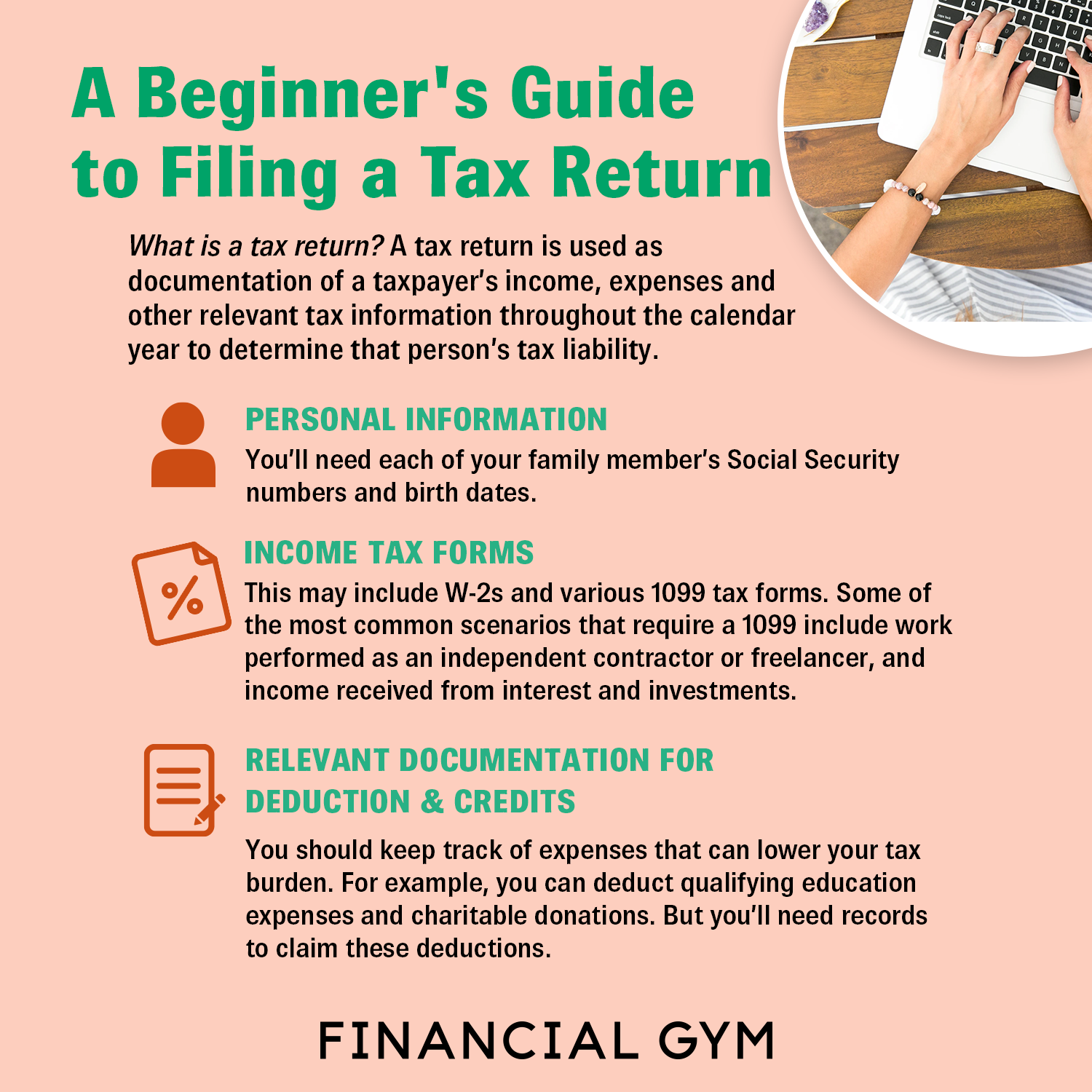

A Beginner s Guide To Filing A Tax Return

What Forms Do I Need For Solar Tax Credit - Form 5695 is the IRS document you submit to get a credit on your tax return for installing solar panels or adding to or upgrading a solar system on your home We commonly think of Tax Form 5695 as the Residential Clean Energy Credit Form