What Goods Are Taxable In Texas Taxable items purchased in a grocery or convenience store are exempt when legally purchased with Supplemental Nutrition Assistance Program SNAP benefits For more

Texas imposes a 6 25 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services Local taxing jurisdictions cities counties When is a purchase subject to use tax What is the tax rate for use tax Do I owe tax on goods purchased via mail order catalogs or online How do I report a use tax liability

What Goods Are Taxable In Texas

What Goods Are Taxable In Texas

https://www.taxslayer.com/blog/wp-content/uploads/2023/02/Taxable-vs-Nontaxable-Income-min-2.jpg

What Income Is Taxable Blog hubcfo

http://blog.hubcfo.com/wp-content/uploads/2015/04/What-Income-is-Taxable.png

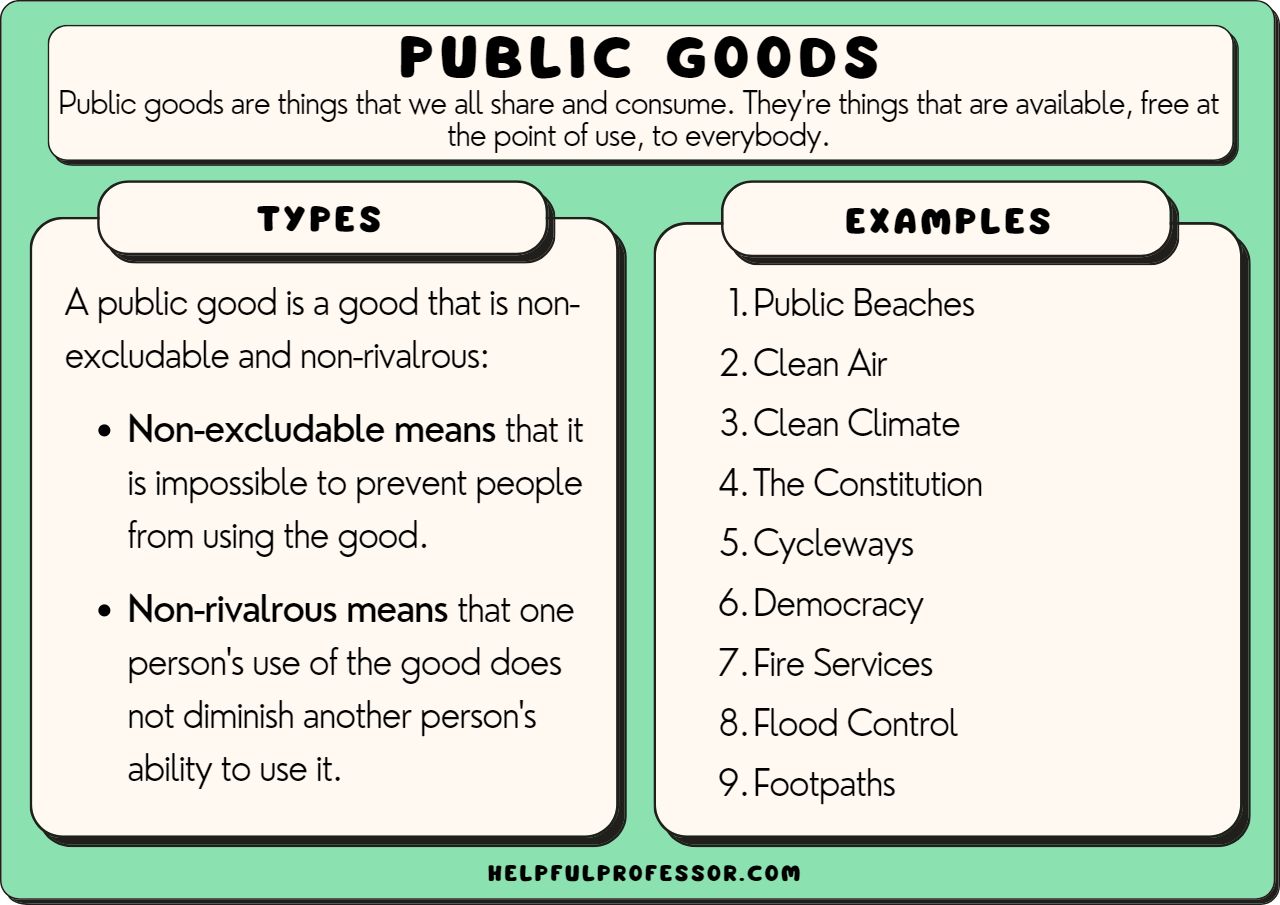

Eco What Is The Difference Between Public Goods And Private Goods

https://d77da31580fbc8944c00-52b01ccbcfe56047120eec75d9cb2cbd.ssl.cf6.rackcdn.com/71910210-481d-4fc5-9507-3500b7fe2d77/what-are-public-goods-and-private-goods---teachoo.jpg

Which Goods and Services are Taxable Determining whether or not the products or services your company sells are taxable Goods refers to the sale of tangible personal property which are generally taxable Services refers to the sale of labor or a non tangible benefit In Texas specified

Use tax laws in Texas apply to goods purchased out of the country but consumed in Texas To summarize use tax is due when goods are purchased tax free by a merchant and Taxable items in Texas include certain food items such as soft drinks and candy beer and wine and prepared foods 1 Almost all retail sales leases rentals

Download What Goods Are Taxable In Texas

More picture related to What Goods Are Taxable In Texas

Types Of Goods Economic Goods Consumer Goods Capital Goods

https://i.ytimg.com/vi/BGU2LyXRK9E/maxresdefault.jpg

Texas Tax Free Weekend List Of Items That Are Taxable And What s Not

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA1f13zf.img?w=1280&h=960&m=4&q=79

How To Calculate Taxable Income A Comprehensive Guide The Tech Edvocate

https://www.thetechedvocate.org/wp-content/uploads/2023/09/TaxableIncome_Final_4188122-0fb0b743d67242d4a20931ef525b1bb1.jpg

What is taxable in Texas Tangible personal property goods that can be grasped by your senses are taxable These include gadgets toys furniture etc Texas businesses must collect and pay sales taxes on most items they sell The sales tax varies from county to county the state has a base sales tax plus the

What s taxable and exempt Texas imposes a 6 25 sales tax on most retail sales leases and rentals of most goods and taxable services Local jurisdictions Automate sales tax calculations reporting and filing today to save time and reduce errors Up to date Texas sales tax rates and business information for 2024

Calam o Sales Goods And Services

https://p.calameoassets.com/151105053427-c21b1e828d2ef9245e6abeedc89fa7e5/p1.jpg

37 Public Goods Examples A To Z List 2024

https://helpfulprofessor.com/wp-content/uploads/2022/04/public-goods-examples-definition-and-types.jpg

https://comptroller.texas.gov/taxes/publications/96-280.php

Taxable items purchased in a grocery or convenience store are exempt when legally purchased with Supplemental Nutrition Assistance Program SNAP benefits For more

https://comptroller.texas.gov/taxes/sales

Texas imposes a 6 25 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services Local taxing jurisdictions cities counties

F rmula De Los Ingresos Gravables Aprenda M s FinancePal

Calam o Sales Goods And Services

GST Taxable And Non taxable Goods Infographic Data Visualization

Cost Of Goods Sold COGS Formula Examples What Is Included

Taxable Digital Marketing Services In Texas What You Need To Know

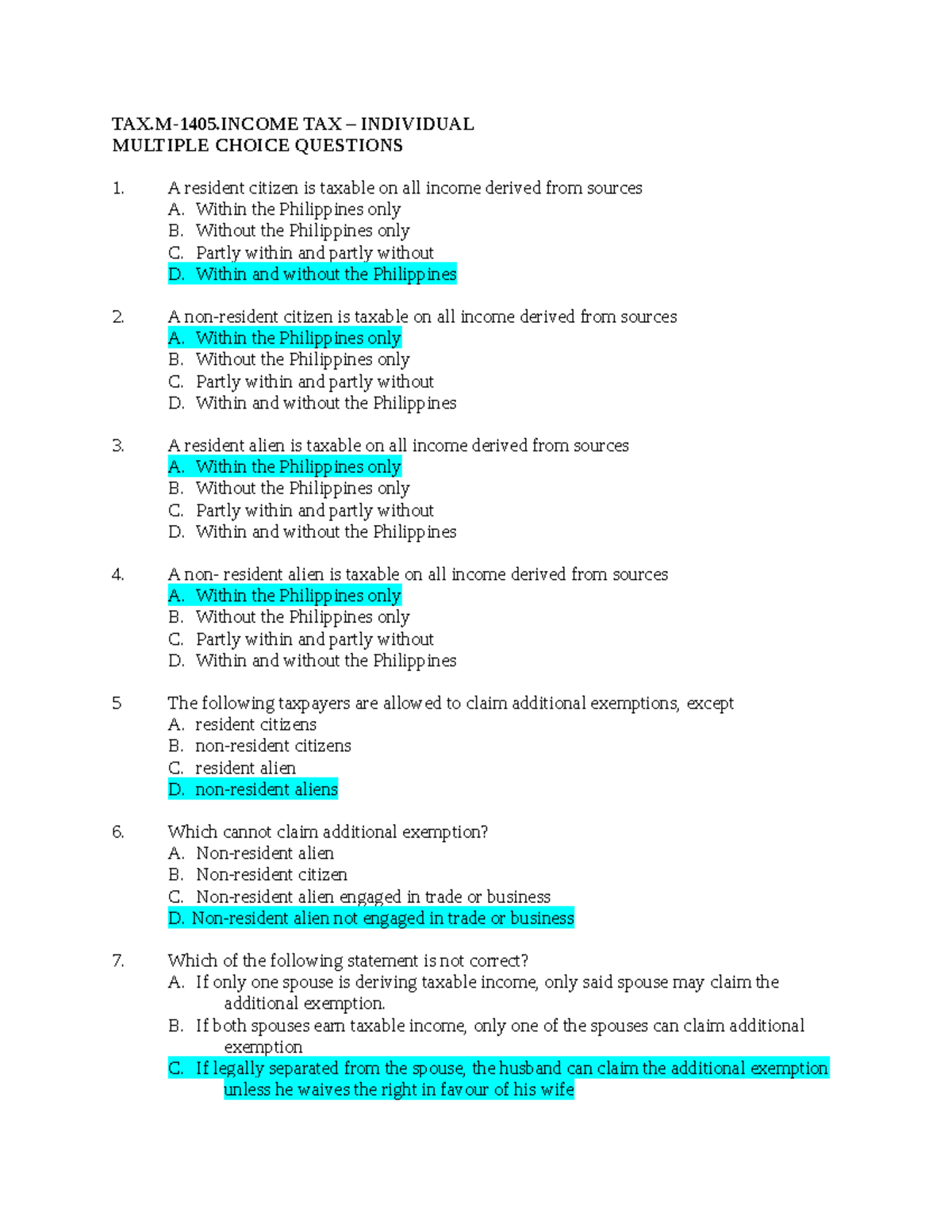

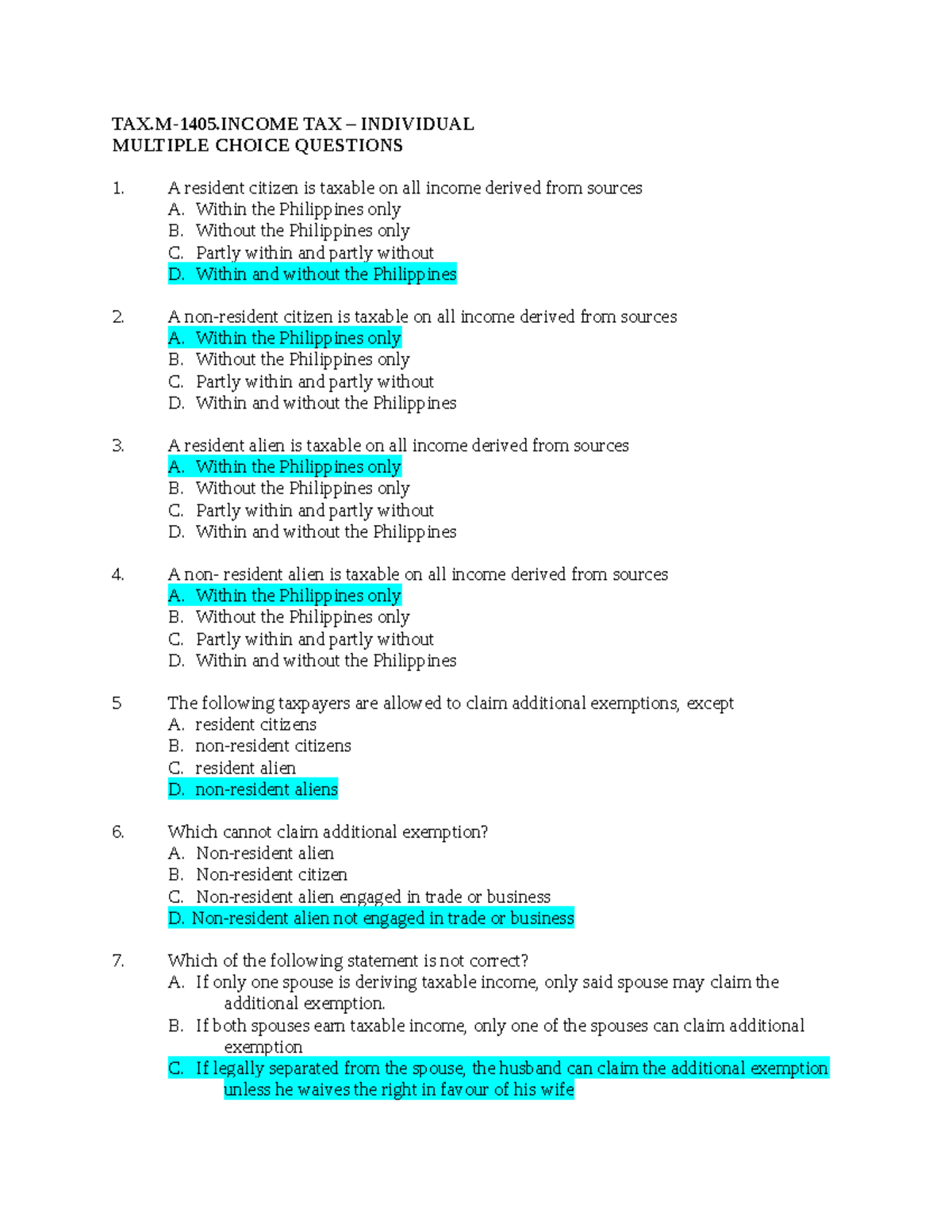

14965412 Note TAX M 1405 TAX INDIVIDUAL MULTIPLE CHOICE QUESTIONS

14965412 Note TAX M 1405 TAX INDIVIDUAL MULTIPLE CHOICE QUESTIONS

How Do You Get From Net Income For Tax Purposes To Taxable Income To

Car Accident Settlements Taxable In Texas The Hadi Law Firm

Is SaaS Taxable In Texas TaxValet

What Goods Are Taxable In Texas - Use tax laws in Texas apply to goods purchased out of the country but consumed in Texas To summarize use tax is due when goods are purchased tax free by a merchant and