What Happens If Your Property Taxes Are Sold In Illinois Even if your property taxes are sold you remain the property owner subject to the discussion below You must redeem or pay the delinquent taxes and penalties plus costs to the county clerk within 30 months of the tax sale If you do not the tax buyer can ask the court for a tax deed

If you fail to pay the full amount within the time period the law allows then you will lose your property and the tax buyer may petition for the deed Another Option If you cannot pay your taxes in full during the redemption period you can file a Chapter 13 bankruptcy When a property owner fails to pay property taxes the county in which the property is located creates a lien on it for the amount owed Tax liens are sold in order to recoup losses from unpaid taxes and the buyers of those liens get the benefit of investing in a piece of real estate January 8 2021

What Happens If Your Property Taxes Are Sold In Illinois

What Happens If Your Property Taxes Are Sold In Illinois

https://activerain-store.s3.amazonaws.com/blog_entries/935/5744935/original/RelayThat_save_on_property_tax_dollars.jpg?1660084904

Your Guide To Property Taxes Hippo

https://www.hippo.com/sites/default/files/content/paragraphs/inline/you-can-pay-property-taxes_0.png

5 Tips To Lower Your Property Tax Bill The Radishing Review

https://theradishingreview.com/wp-content/uploads/2020/03/PropertyTax_RR.jpg

What is the Illinois Property Tax Credit The Illinois Property Tax Credit is a credit on your individual income tax return equal to 5 percent of Illinois Property Tax real estate tax you paid on your principal residence You must own and reside in your residence in order to take this credit Options if your taxes are sold I Redemption of Taxes II Seeking a Sale in Error Declaration III Filing a Statutory Redemption Under Protest Redemption of Taxes Redemption of sold taxes through the Office of the Cook County Clerk is the only way to protect your property if and only if

If property taxes for the immediately preceding tax year are delinquent on a parcel the full delinquent tax amount due plus interest and penalties are offered for sale at the Annual Tax Sale To participate in the Annual Tax Sale potential bidders must review the rules and regulations complete registration and provide collateral or a bond Under Illinois law you have roughly two years to pay the taxes due which allows you to keep your home If you don t pay the taxes then the person or company that bought the tax lien gets a tax deed from the court and now owns your home How to

Download What Happens If Your Property Taxes Are Sold In Illinois

More picture related to What Happens If Your Property Taxes Are Sold In Illinois

Will Your Property Taxes Soar If N J Lawmakers Allow This Law To Die

https://www.nj.com/resizer/wXvU2f01k3iujGh1ast2SOdxG28=/1280x0/smart/advancelocal-adapter-image-uploads.s3.amazonaws.com/image.nj.com/home/njo-media/width2048/img/ledgerupdates_impact/photo/2017/11/01/taxesjpg-c317e379def907d7.jpg

Property Taxes By State County Median Property Tax Bills Tax

https://files.taxfoundation.org/20220912162330/Median-property-taxes-by-county-paid-property-tax-rankings.png

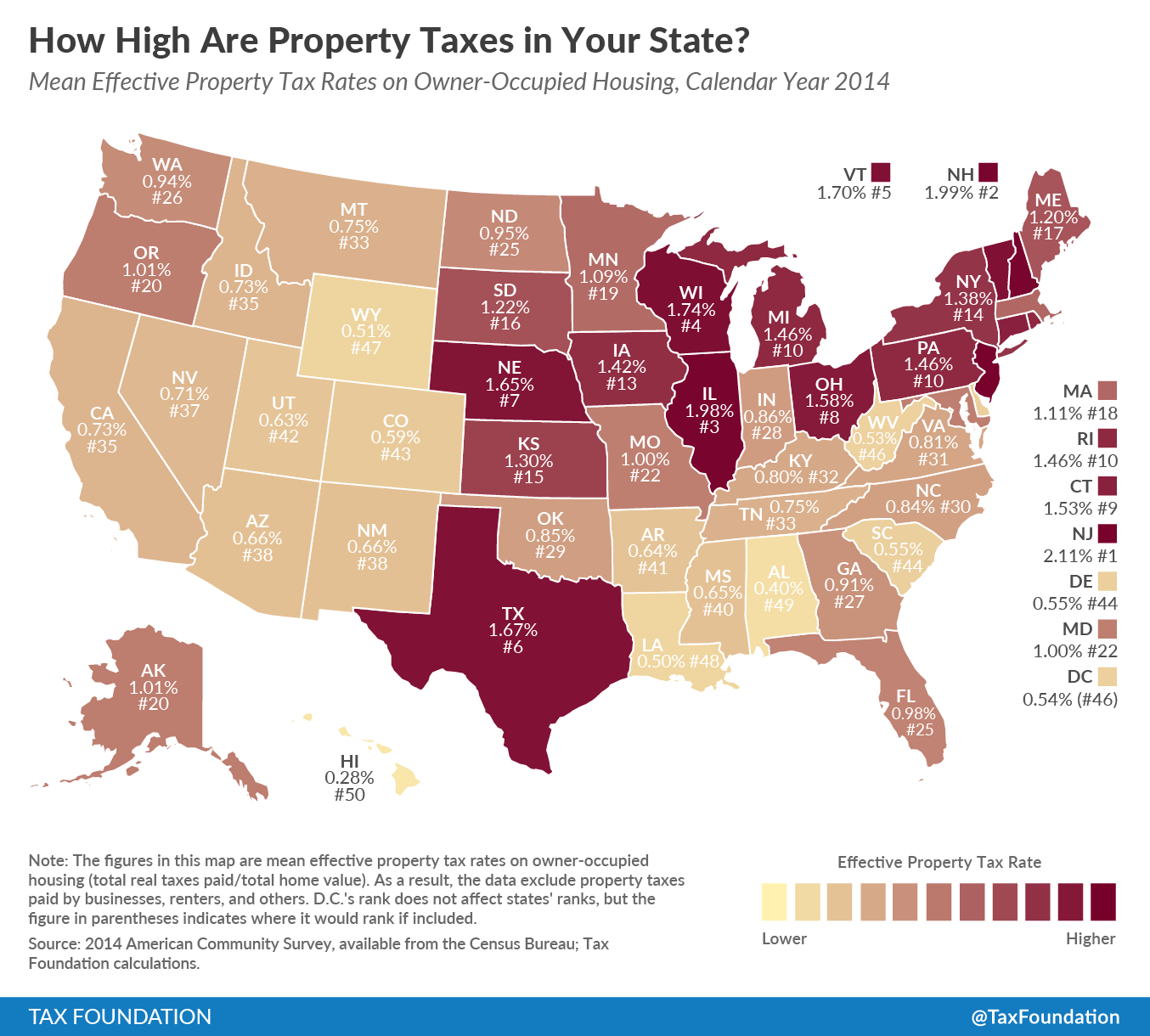

How High Are Property Taxes In Your State American Property Owners

https://propertyownersalliance.org/wp-content/uploads/2020/10/property-taxes-by-state-2020-FV-01-1024x868-1.png

All states have laws allowing the local government to then sell your home through a tax lien process to collect the delinquent taxes In this article you ll learn about how property tax sales work and how you might be able to save your home even after a Method 1 Compare the fair market value of your property with recent sales of similar properties in your neighborhood The fair market value of your property is defined as the price you would accept if a willing and able buyer

A Tax Redemption Process After delinquent taxes are sold at a tax sale those sold taxes must be repaid redeemed in order for the current owner not to lose ownership of the property The County Clerk s Office administers the redemption process Timeline of Redemption Process June November Taxes go delinquent Generally one to three years must expire before a home can be sold to recover unpaid taxes Again the specific process and the length of time you can go without paying property taxes before losing your home varies by location so talk to your local taxing authority or an attorney to get specifics about where you live

What Happens If You Don t Pay Your Taxes A Complete Guide All

https://www.allthingsfinance.net/wp-content/uploads/2020/04/image1-56-1536x1086.jpg

These States Have The Highest Property Tax Rates TheStreet

https://www.thestreet.com/.image/t_share/MTkzMTM5Mzg2MDIyNDM4MjQ0/table-property-taxes-101922.png

https://www.illinoislegalaid.org/legal-information/...

Even if your property taxes are sold you remain the property owner subject to the discussion below You must redeem or pay the delinquent taxes and penalties plus costs to the county clerk within 30 months of the tax sale If you do not the tax buyer can ask the court for a tax deed

https://chicagomoneylawyer.com/portfolio/how-to...

If you fail to pay the full amount within the time period the law allows then you will lose your property and the tax buyer may petition for the deed Another Option If you cannot pay your taxes in full during the redemption period you can file a Chapter 13 bankruptcy

The Union Role In Our Growing Taxocracy California Policy Center

What Happens If You Don t Pay Your Taxes A Complete Guide All

In Illinois How Are My Property Taxes Determined

How High Are Property Taxes In Your State 2016 Tax Foundation

What Happens If You Don t Pay Your Personal Property Tax

What Happens If Someone Pays Your Property Taxes In Texas Johnson

What Happens If Someone Pays Your Property Taxes In Texas Johnson

Hecht Group Personal Property Taxes By State

Hecht Group How To Pay Commercial Property Tax Online

States Without Property Tax On Cars Draw vip

What Happens If Your Property Taxes Are Sold In Illinois - Options if your taxes are sold I Redemption of Taxes II Seeking a Sale in Error Declaration III Filing a Statutory Redemption Under Protest Redemption of Taxes Redemption of sold taxes through the Office of the Cook County Clerk is the only way to protect your property if and only if