What Income Is Taxable In Massachusetts Other Types of Massachusetts Taxable Income Massachusetts income includes a wide variety of income from different sources Find out what else you should

Introduction 5 0 personal income tax rate for tax year 2023 For tax year 2023 Massachusetts has a 5 0 tax on both earned salaries wages tips Massachusetts State Tax Quick Facts 24 cents per gallon of regular gasoline and diesel Find out how much you ll pay in Massachusetts state income taxes given your annual income

What Income Is Taxable In Massachusetts

What Income Is Taxable In Massachusetts

https://www.taxslayer.com/blog/wp-content/uploads/2023/02/Taxable-vs-Nontaxable-Income-min-2.jpg

Solved Please Note That This Is Based On Philippine Tax System Please

https://www.coursehero.com/qa/attachment/19096880/

What Income Is Subject To The 3 8 Medicare Tax

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

Massachusetts has a flat personal income tax rate of 5 of federal adjusted gross income Beginning in 2023 an additional 4 tax is imposed on income over 1 million Property taxes in For tax year 2023 taxes filed in 2024 Massachusetts s state income tax rate is 5 on annual gross income over 8 000 Gross income in Massachusetts includes

Massachusetts currently has a flat income tax of 5 percent However in November 2022 Bay State voters approved an additional 4 percent tax on annual The Massachusetts state tax rate is 5 on earned income like salaries commissions tips and wages and unearned interest dividends and certain capital gains income

Download What Income Is Taxable In Massachusetts

More picture related to What Income Is Taxable In Massachusetts

Taxable Vs Nontaxable Income Dalby Wendland Co P C

https://dalbycpa.com/wp-content/uploads/2016/03/taxable_nontaxable_income.jpg

What Is Taxable Income Explanation Importance Calculation Bizness

https://i1.wp.com/biznessprofessionals.com/wp-content/uploads/2020/02/Capture34.png?fit=2630%2C1497&ssl=1

T ml Rejtett tutal s Tax Payable Calculator Megfejt Tengerpart Kinyit

https://www.hrblock.com/tax-center/wp-content/uploads/2013/01/how-to-calculate-taxable-income.jpg

Income of up to 1 million from an IRA 401 k 403 b or any other type of retirement savings account is taxed at the state income tax rate of 5 while income that exceeds 1 million is subject to an extra 4 tax Massachusetts provides a standard Personal Exemption tax credit of 4 400 00 in 2023 per qualifying filer and 1 000 00 per qualifying dependent s this is used to reduced

Beginning in tax year 2020 the state exempted 35 percent of benefits for qualifying taxpayers As of 2021 that amount increased to 65 percent and in 2022 the Income Tax on Taxable Income Low of 2 on up to 500 for single filers and 1 000 for joint filers and a high of 5 on more than 3 000 for single filers and

Solved What Would Be Your Federal Income Tax If Your Taxable Chegg

https://media.cheggcdn.com/media/306/3064aa3f-45d1-4e88-91fc-d613aac9f0ab/phpjplfSo

What is taxable income Financial Wellness Starts Here

https://blog.navitmoney.com/wp-content/uploads/2020/07/what-is-taxable-income.png

https://www.mass.gov/info-details/other-types-of...

Other Types of Massachusetts Taxable Income Massachusetts income includes a wide variety of income from different sources Find out what else you should

https://www.mass.gov/guides/personal-income-tax-for-residents

Introduction 5 0 personal income tax rate for tax year 2023 For tax year 2023 Massachusetts has a 5 0 tax on both earned salaries wages tips

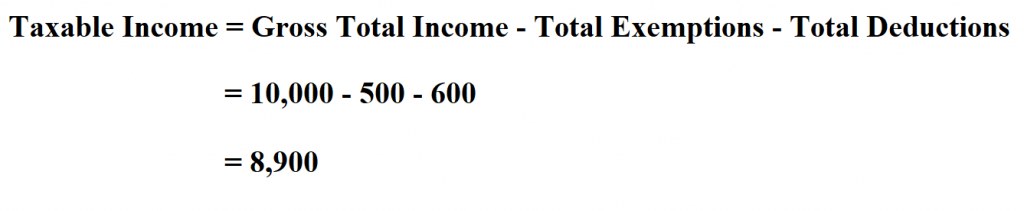

How To Calculate Taxable Income

Solved What Would Be Your Federal Income Tax If Your Taxable Chegg

:max_bytes(150000):strip_icc()/TaxableIncome_Final_4188122-0fb0b743d67242d4a20931ef525b1bb1.jpg)

Understanding What Is Taxable Income Definition Track And Receive

Maximize Your Paycheck Understanding FICA Tax In 2023

Income Tax Excel Spreadsheet Spreadsheet Downloa Income Tax Excel Sheet

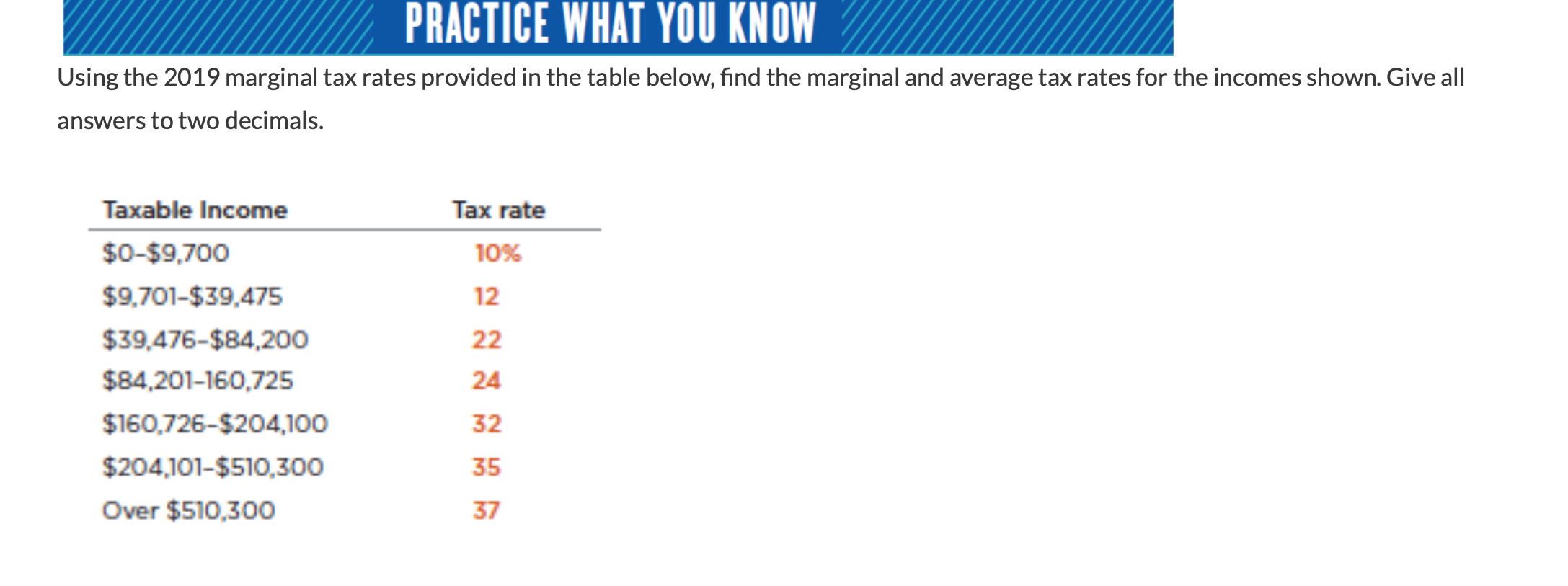

How To Find Average Income Tax Rate Parks Anderem66

How To Find Average Income Tax Rate Parks Anderem66

Tax And Taxation Corporate Income Tax

Oct 19 IRS Here Are The New Income Tax Brackets For 2023

2022 Tax Refund Calculator Hr Block Very Hot Log Book Photographs

What Income Is Taxable In Massachusetts - Massachusetts has a flat personal income tax rate of 5 of federal adjusted gross income Beginning in 2023 an additional 4 tax is imposed on income over 1 million Property taxes in