What Income Is Taxed In Idaho Find out how much you ll pay in Idaho state income taxes given your annual income Customize using your filing status deductions exemptions and more

SmartAsset s Idaho paycheck calculator shows your hourly and salary income after federal state and local taxes Enter your info to see your take home pay The income tax rate for 2023 is 5 8 on Idaho taxable income See tax rate schedules for past years Whether you need to file depends on your residency status and your gross income You must file individual income tax returns with Idaho if you re any of the following

What Income Is Taxed In Idaho

What Income Is Taxed In Idaho

https://i.ytimg.com/vi/B05OtAHXuJI/maxresdefault.jpg

How Is Rental Income Taxed

https://www.sandiegopropertymanagement.com/images/blog/how-is-rental-income-taxed.jpg

How Rental Income Is Taxed A Guide Private Capital Investors

https://privatecapitalinvestors.com/wp-content/uploads/2022/08/How-Rental-Income-Is-Taxed-A-Guide.png

If you make 70 000 a year living in Idaho you will be taxed 10 851 Your average tax rate is 10 94 and your marginal tax rate is 22 This marginal tax rate means that your immediate Idaho resident Taxed on income from all sources Part year Idaho resident Taxed on income received while an Idaho resident Idaho nonresident Taxed on Idaho source income

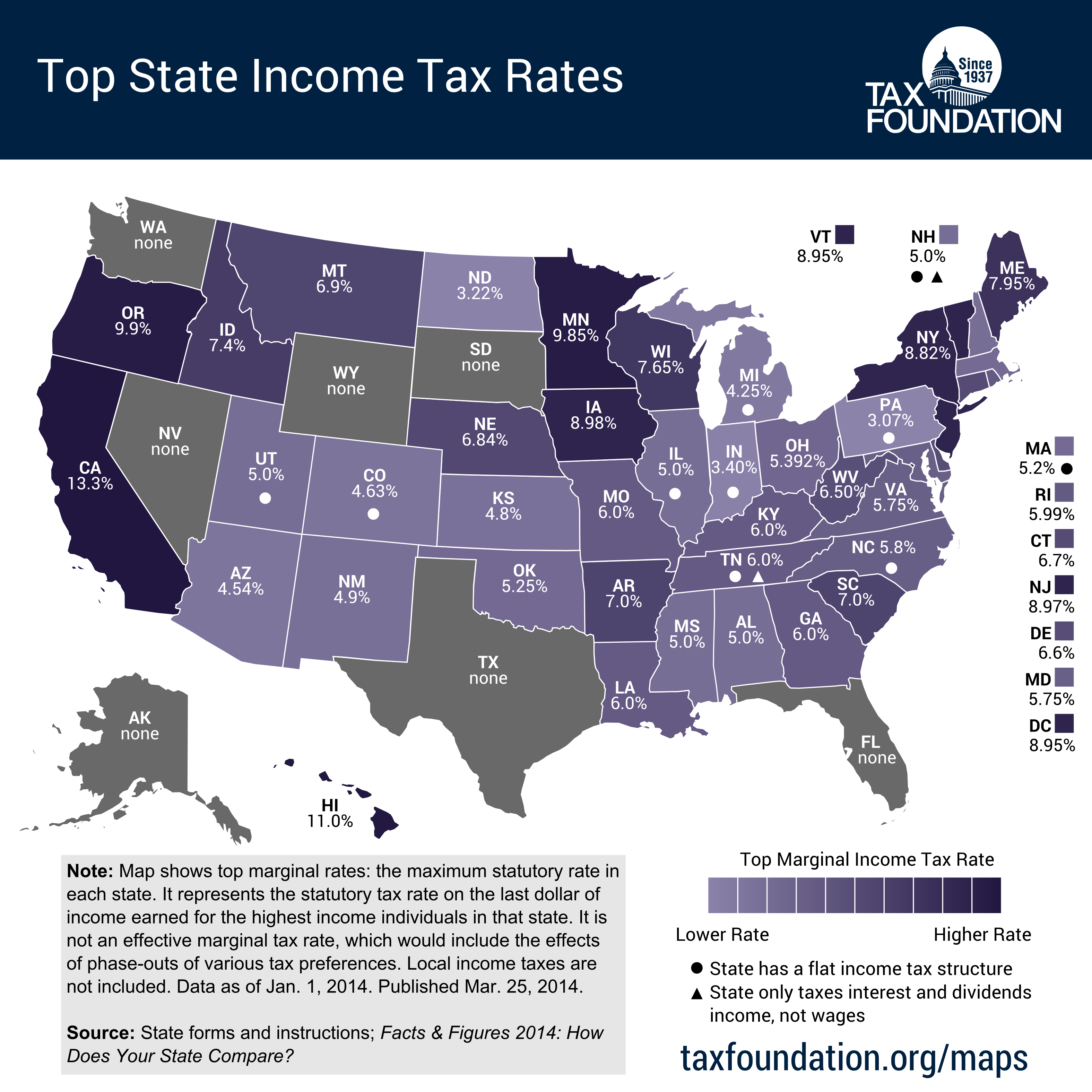

The Idaho income tax has one tax bracket with a maximum marginal income tax of 5 800 as of 2024 Detailed Idaho state income tax rates and brackets are available on this page Idaho has a flat income tax rate of 5 8 according to the Tax Foundation Idaho tax on retirement benefits Social Security benefits and Railroad Retirement benefits are not taxed by the

Download What Income Is Taxed In Idaho

More picture related to What Income Is Taxed In Idaho

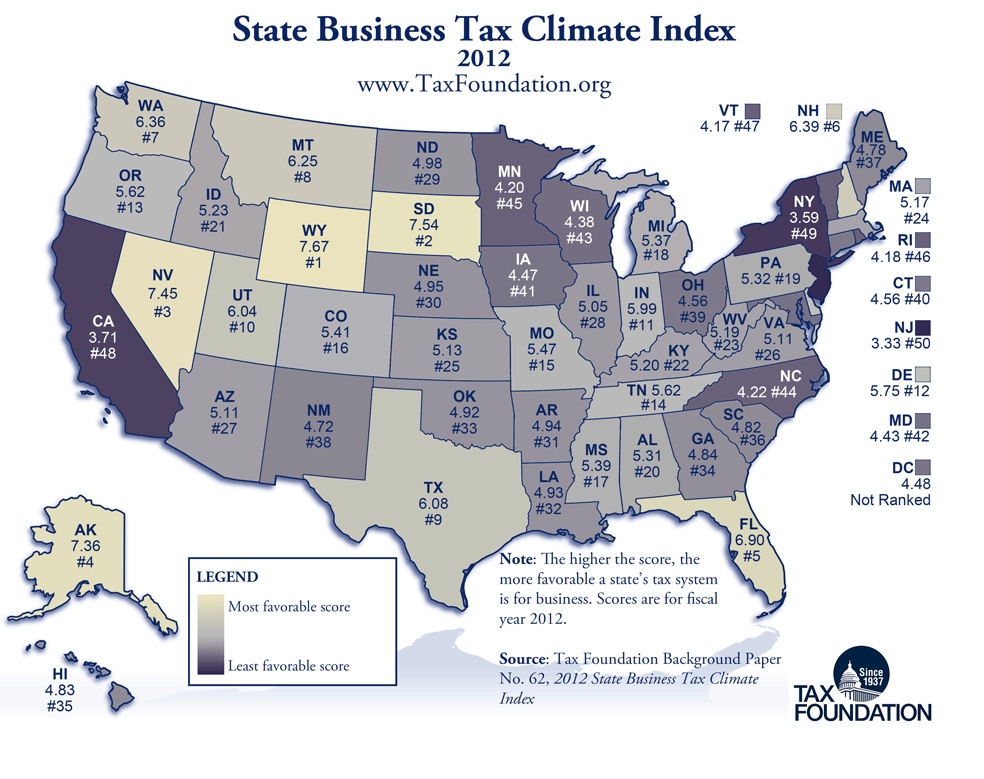

Idaho Ranks 21st In The Annual State Business Tax Climate Index

http://stateimpact.npr.org/idaho/files/2012/01/TaxFoundation_2012BizClimate.jpg

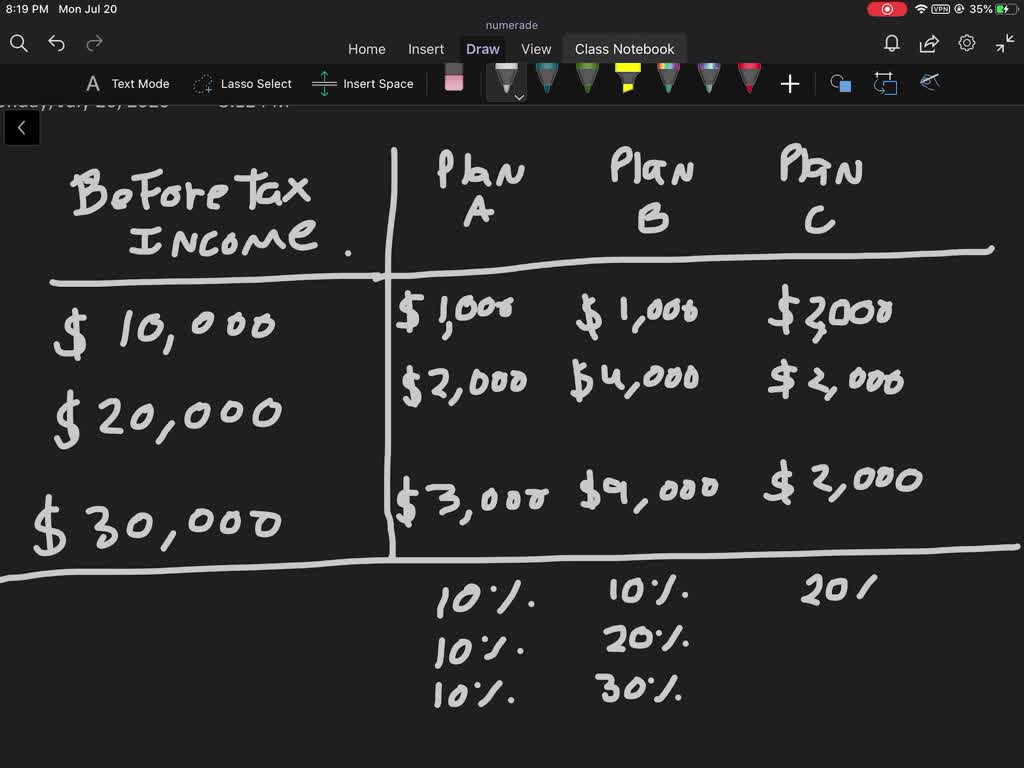

SOLVED In A System Designed To Work Out The Tax To Be Paid An

https://cdn.numerade.com/previews/a7d5d033-62da-4ac9-b0a1-81c40e9029a3_large.jpg

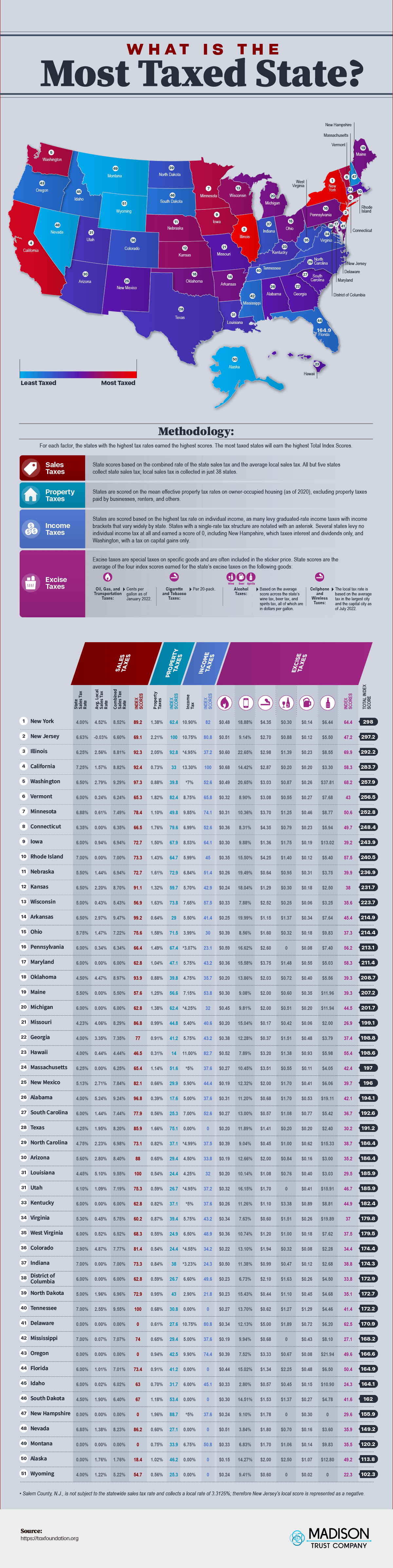

What Is The Most Taxed State

https://www.madisontrust.com/wp-content/uploads/2023/02/most-taxed-state-5.png

Idaho has a 5 8 percent corporate income tax rate Idaho also has a 6 00 percent state sales tax rate and an average combined state and local sales tax rate of 6 03 percent Idaho has a 0 47 percent effective property tax rate on owner occupied housing value In Idaho income tax rates range from 1 to 6 5 percent Personal income tax rates in Idaho are based on your income and filing status One important thing to know about Idaho income taxes

Idaho State Income Tax Tables in 2023 The Income tax rates and personal allowances in Idaho are updated annually with new tax tables published for Resident and Non resident taxpayers The Tax tables below include the tax rates thresholds and allowances included in the Idaho Tax Calculator 2023 In 2024 the state income tax in Idaho ranges from 0 to 5 8 Individuals are taxed at 0 on the first 4 489 taxable income and 5 8 on any income above it Married couples have a higher threshold of 8 978

Billionaires Income Tax Proposal Seeks To Ensure That U S Ultra

https://equitablegrowth.org/wp-content/uploads/2021/12/policies-in-house-passed-build-back-better-act-reduce-burden-on-all-but-highest-income-americans-1080x691.png

What Income Do I Pay Tax On If I m A Nonresident In The US

https://blog.sprintax.com/wp-content/uploads/2021/11/Taxable-income-NRAs.jpg

https://smartasset.com/taxes/idaho-tax-calculator

Find out how much you ll pay in Idaho state income taxes given your annual income Customize using your filing status deductions exemptions and more

https://smartasset.com/taxes/idaho-paycheck-calculator

SmartAsset s Idaho paycheck calculator shows your hourly and salary income after federal state and local taxes Enter your info to see your take home pay

States That Tax Social Security Benefits Tax Foundation

Billionaires Income Tax Proposal Seeks To Ensure That U S Ultra

LLC Vs S Corporation Which One Can Save You More On Your Taxes RBA

How To Calculate Your Marginal Tax Rate Haiper

How Is Rental Income Taxed WealthFit

2022 Kansas Income Tax Brackets Post Spotwalls

2022 Kansas Income Tax Brackets Post Spotwalls

Marxist Oder Auch Dilemma Overall Tax Burden Kosten Western Rostfrei

California Tops List Of 10 States With Highest Taxes

How Is Rental Income Taxed American Home Team Realty

What Income Is Taxed In Idaho - If you make 70 000 a year living in Idaho you will be taxed 10 851 Your average tax rate is 10 94 and your marginal tax rate is 22 This marginal tax rate means that your immediate