What Insulation Qualifies For Energy Tax Credit These expenses may qualify if they meet requirements detailed on energy gov Exterior doors windows skylights and insulation materials Central air

What Insulation Qualifies for Energy Tax Credit Most insulation materials qualify under the Energy Efficient Home Improvement tax credit Common types of eligible insulation include foam board loose fill rolls Credits are typically applied to a taxpayer s income tax liability and thereby can offset the cost of energy saving improvements such as insulation windows and doors solar panel systems or other qualifying

What Insulation Qualifies For Energy Tax Credit

What Insulation Qualifies For Energy Tax Credit

https://i.kinja-img.com/gawker-media/image/upload/c_fill,f_auto,fl_progressive,g_center,h_675,pg_1,q_80,w_1200/db8de6eb71e5308c72a13a0e3314c74e.jpg

Accounting For Energy Tax Credits

https://golf.kpmg.us/content/dam/info/en/news-perspectives/images/2022/5.31.22 - Accounting for Energy Thumbnail.jpg

What Home Improvements Qualify For Tax Credit Energy Texas

https://www.energytexas.com/blog/wp-content/uploads/2022/11/AdobeStock_82265451.jpeg

Taxpayers that make qualified energy efficient improvements to their home after Jan 1 2023 may qualify for a tax credit up to 3 200 As part of the Inflation The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help reduce energy costs and demand as we

The Inflation Reduction Act provides federal income tax credits that are specially targeted to home owners that make energy efficient home improvements involving insulation and air Q How do I know if my Home Energy Audit is eligible for a credit A Consumers can visit this IRS page on the Energy Efficient Home Improvement Credit

Download What Insulation Qualifies For Energy Tax Credit

More picture related to What Insulation Qualifies For Energy Tax Credit

MRCOOL GeoCool 48K BTU 4 Ton Vertical Two Stage CuNi Coil Right

https://i.pinimg.com/originals/6a/d5/a8/6ad5a87c3f0d6fb1b59be98e29296b6f.jpg

New Studies Highlight The Potential Of Self heating Plasmas For Fusion

https://scx1.b-cdn.net/csz/news/800a/2022/new-studies-highlight-1.jpg

2023 TAX CREDIT INFORMATION Welcome To Mincin Insulation

https://mincin-insulation.com/wp-content/uploads/2023/02/Blog-Post-Header-1.jpg

Q Who is eligible for tax credits A Homeowners including renters for certain expenditures who purchase energy and other efficient appliances and products What is the energy efficient home improvement credit The energy efficient home improvement credit can help homeowners cover costs related to qualifying improvements made from 2023 to 2032 The

The previous expired credit was worth 10 of the costs of installing certain energy efficient insulation windows doors roofing and similar energy saving Through December 31 2022 the energy efficient home improvement credit is a 500 lifetime credit As amended by the IRA the energy efficient home

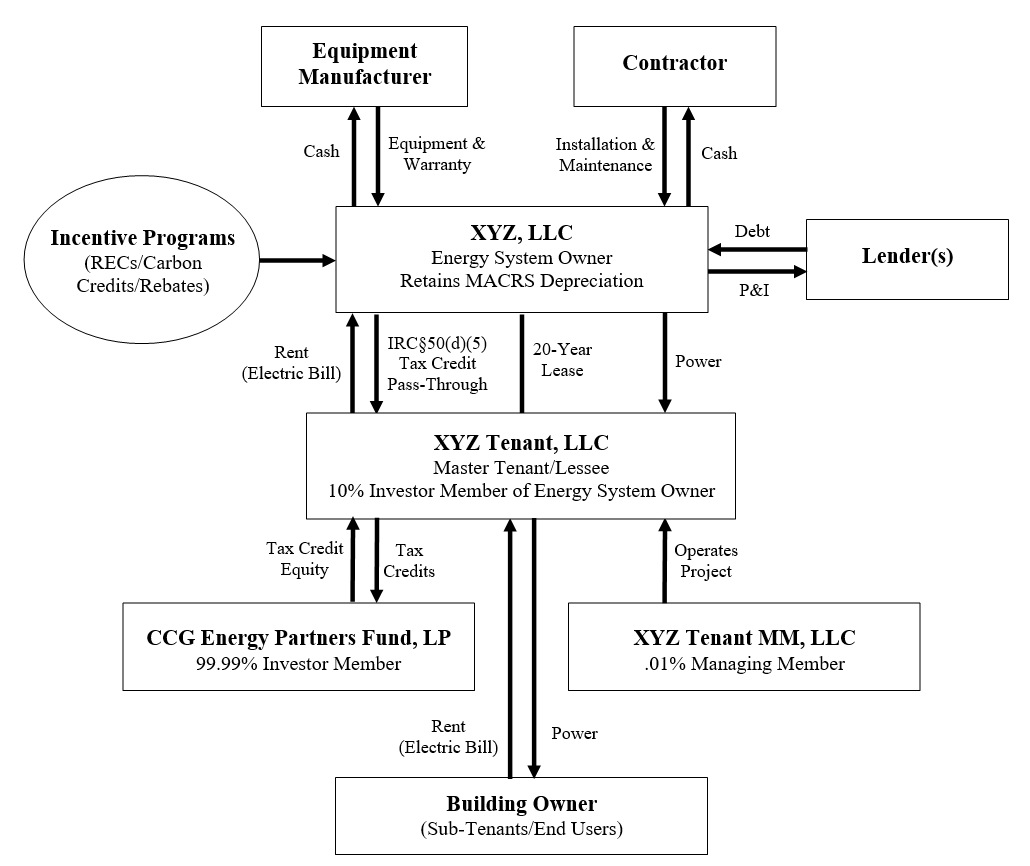

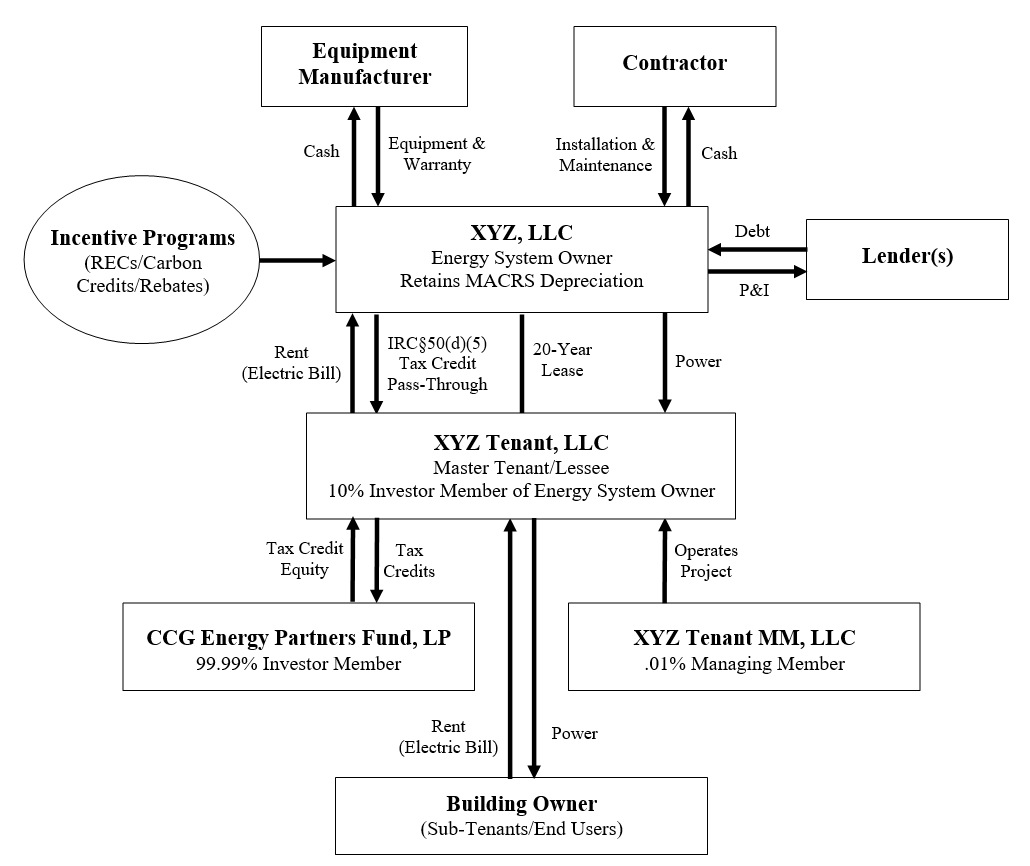

Solar Energy Transactional Structures CityScape Capital Group The

https://images.squarespace-cdn.com/content/v1/5b072f6789c172576d276207/1527364069036-7KEFSJLYUBE4USCMBKKY/setc_multitier_lease.png

2023 Wood Stove And Pellet Heater Tax Credit

https://images.salsify.com/image/upload/s--ne3uzAua--/aiezo4lwsncyi8injsyq

https://www.irs.gov/credits-deductions/home-energy-tax-credits

These expenses may qualify if they meet requirements detailed on energy gov Exterior doors windows skylights and insulation materials Central air

https://www.joinarbor.com/.../insulation …

What Insulation Qualifies for Energy Tax Credit Most insulation materials qualify under the Energy Efficient Home Improvement tax credit Common types of eligible insulation include foam board loose fill rolls

2015 2016 Federal Energy Efficiency Tax Credit Ciel Power LLC

Solar Energy Transactional Structures CityScape Capital Group The

Spray Foam Tax Credit Information And More

Who Qualifies For A Business Credit Card Flipboard

2022 Tax Credits For Residential Energy Efficiency Improvements Ciel

MRCOOL GeoCool 36K BTU 3 Ton Horizontal Two Stage CuNi Coil Right

MRCOOL GeoCool 36K BTU 3 Ton Horizontal Two Stage CuNi Coil Right

What Roof Shingles Qualify For Energy Tax Credit A Guide To Saving And

What Qualifies For The Residential Energy Tax Credit Boston Standard

What Roofing Qualifies For Tax Credit

What Insulation Qualifies For Energy Tax Credit - The Inflation Reduction Act of 2022 P L 117 169 expanded and renamed the nonbusiness energy property credit as the energy efficient home improvement credit