What Is 7500 Tax Credit Mean Those who buy new electric vehicles may be eligible for a tax credit of up to 7 500 and used electric car buyers may qualify for up to 4 000 New in 2024 consumers can also opt to transfer

You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Beginning Jan 1 2023 eligible vehicles may qualify for a tax credit of up to 7 500 The amount of the credit depends on when the eligible new clean vehicle is placed in service

What Is 7500 Tax Credit Mean

What Is 7500 Tax Credit Mean

https://cdn.motor1.com/images/custom/toyota-us-federal-tax-credit-q2-2022-b.png

The Complete List Of Cars Eligible For The 7 500 EV And PHEV Federal

https://www.carscoops.com/wp-content/uploads/2023/01/EV-PHEV-Tax-Credit-7500-Carscoops-1024x576.jpg

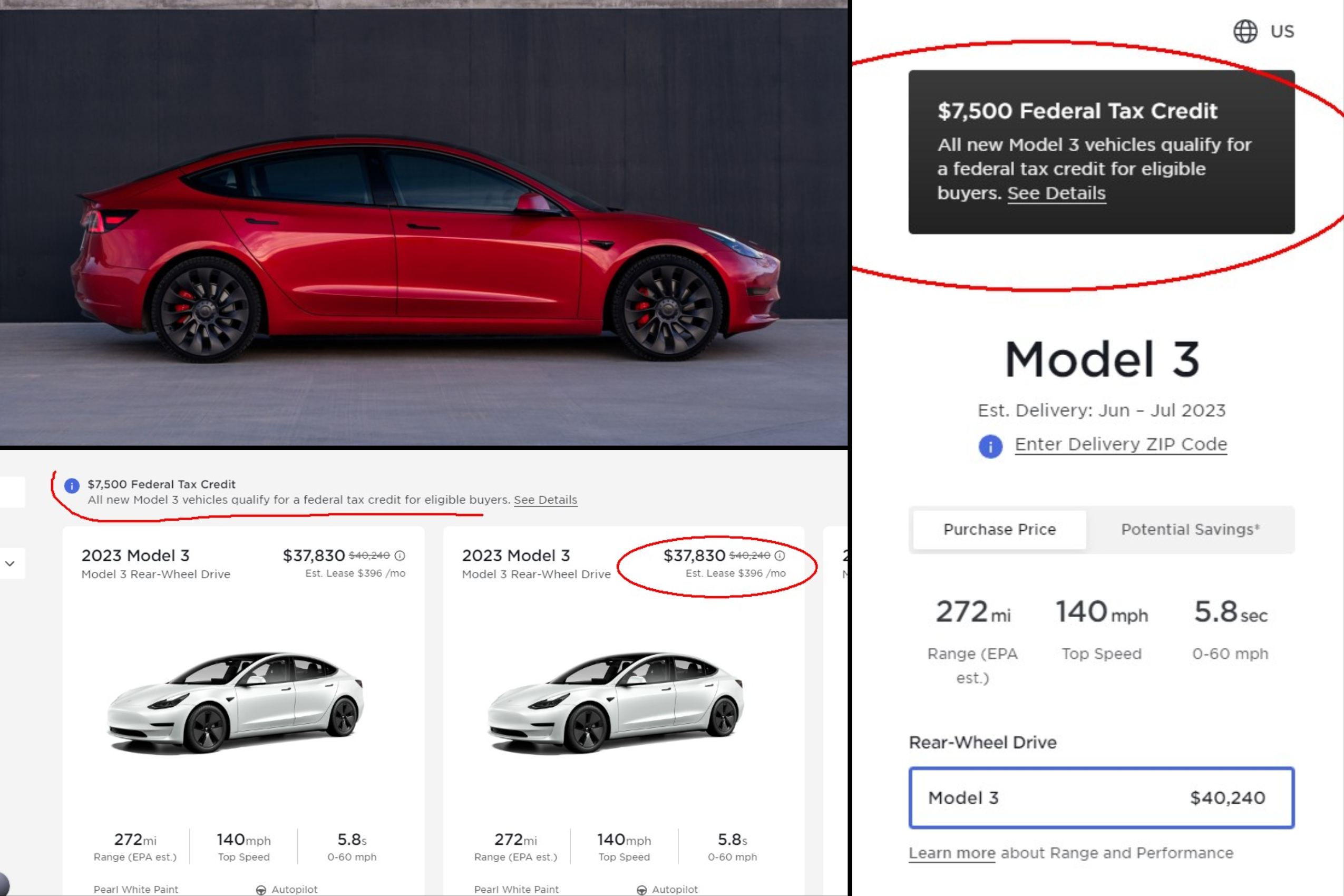

How Tesla Bent IRA Rules To Get Full 7 500 Tax Credit For Model 3 RWD

https://s1.cdn.autoevolution.com/images/news/how-tesla-massaged-the-ira-to-qualify-the-model-3-rwd-for-the-full-7500-tax-credit-216038_1.jpg

Beginning January 1 2023 eligible vehicles may qualify for a tax credit of up to 7 500 The amount of the credit depends on when the eligible new clean vehicle is Through a 7500 credit administered by the Internal Revenue Service many buyers of battery electric and plug in hybrid vehicles have reduced their tax bills or taken the credit at the point of

If you buy a new all electric plug in hybrid or fuel cell electric vehicle in 2023 or after you can claim a clean vehicle tax credit of up to 7 500 The tax credit is The federal EV tax credit worth up to 7 500 is a nonrefundable tax credit that has been an effective way to lower the cost of EV ownership for taxpayers The Inflation Reduction Act of 2022

Download What Is 7500 Tax Credit Mean

More picture related to What Is 7500 Tax Credit Mean

What EV Buyers Need To Know About The 7 500 EV Tax Credit Clean

https://cleanfleetreport.com/wp-content/uploads/2022/09/dcbel-uBKg9f0aUrY-unsplash-1-scaled.jpg

NJ Child Tax Credit Expansion What It Means For Your Family

https://www.gannett-cdn.com/presto/2021/07/13/PNJM/ef6a0c76-a8e8-499a-99d6-86979f6eda7a-1.jpg?crop=4031,2268,x0,y373&width=3200&height=1801&format=pjpg&auto=webp

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

https://www.autopromag.com/usa/wp-content/uploads/2022/08/EV-Federal-Tax-Credits-5MgJUp.jpeg?is-pending-load=1

The credit of up to 7 500 will be offered to people who buy certain new electric vehicles as well as some plug in gas electric hybrids and hydrogen fuel cell vehicles For people who buy a IRS guidance limits the number of EVs that qualify for the full 7 500 EV tax credit Those EV tax credit rules address requirements for critical mineral and battery component requirements for

In this guide we ll help you determine whether you and the car you buy are eligible to receive the Federal Electric Car Tax Credit of up to 7 500 It s always wise to The IRS released new guidance on the EV tax credit today and the changes mean that starting next year low and middle income buyers will be able to get the full

U S Car Brands Will Benefit Most From Electric Vehicle Tax Breaks

https://static01.nyt.com/images/2023/04/17/multimedia/17ev-credits-1-vbpt/17ev-credits-1-vbpt-videoSixteenByNine3000.jpg

These Electric Vehicles Qualify For A 7 500 Tax Credit Best Of Motoring

https://www.komando.com/wp-content/uploads/2023/04/kk-article-20230419-only-6-evs-qualify-fed-tax-credit-1200x675-1.jpg

https://www.nerdwallet.com/article/tax…

Those who buy new electric vehicles may be eligible for a tax credit of up to 7 500 and used electric car buyers may qualify for up to 4 000 New in 2024 consumers can also opt to transfer

https://www.irs.gov/credits-deductions/credits-for...

You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction

How To Qualify For 7 500 EV Tax Credit Smart Money Cookie

U S Car Brands Will Benefit Most From Electric Vehicle Tax Breaks

3 6 Hours Left To Get A Tesla With 7 500 US Tax Credit

How To Calculate Electric Car Tax Credit OsVehicle

:format(webp)/cdn.vox-cdn.com/uploads/chorus_asset/file/23593118/ahawkins_220512_5248_0008.jpg)

The Inflation Reduction Act s Tax Credit For EVs Explained The Verge

Buying An EV Here Are The Ones That Will Get You The Full 7 500 Tax

Buying An EV Here Are The Ones That Will Get You The Full 7 500 Tax

What Is Federal Tax Credit For Electric Cars ElectricCarTalk

Will Midwestern Republicans Addiction To Ethanol Subsidies Trip Up

Debbie Downer GM CEO Mary Barra Says That GM EVs Will Qualify For Full

What Is 7500 Tax Credit Mean - If you buy a new all electric plug in hybrid or fuel cell electric vehicle in 2023 or after you can claim a clean vehicle tax credit of up to 7 500 The tax credit is