What Is A Business Expense Write Off A tax write off is a business expense that can be claimed as a tax deduction on a federal income tax return lowering the amount the business will be assessed for taxes Tax write offs are deducted from total revenue to determine total

SOLVED by TurboTax 13980 Updated March 14 2024 If you re self employed or own a small business you can deduct eligible business expenses to pay fewer taxes These expenses must be common for your type of business and also necessary for your operations Business expenses are costs incurred in the ordinary course of business Business expenses are tax deductible and are always netted against business income

What Is A Business Expense Write Off

What Is A Business Expense Write Off

https://i.ytimg.com/vi/Tl98Y8RyB8o/maxresdefault.jpg

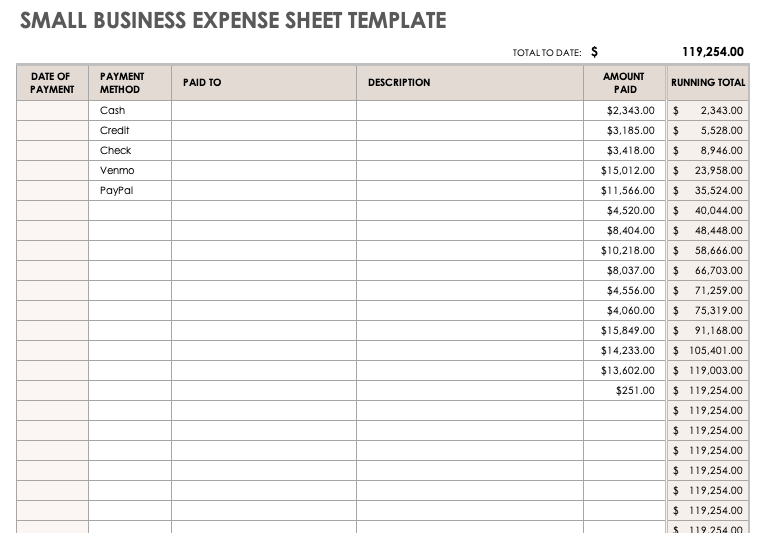

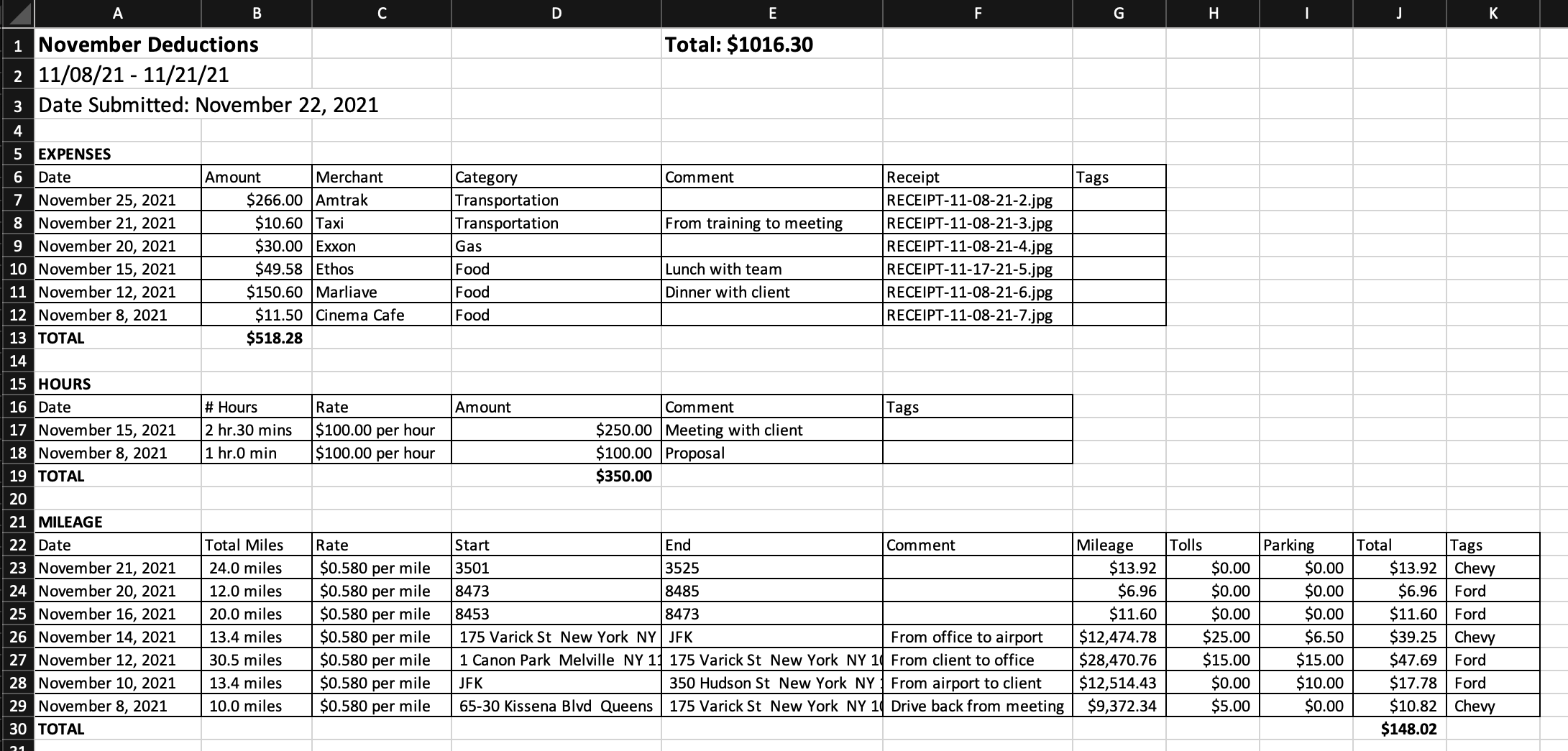

30 Best Business Expense Spreadsheets 100 Free TemplateArchive

https://i.pinimg.com/736x/b8/99/ea/b899ea320ccd9491fee51828e842ce10.jpg

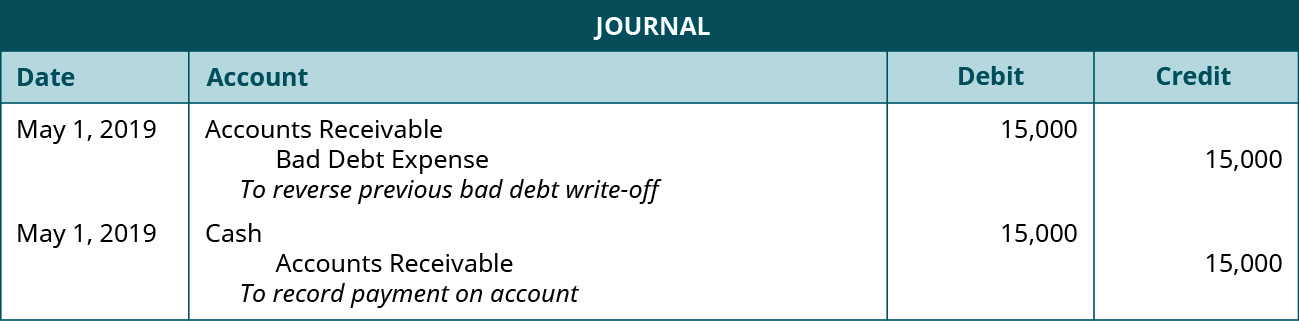

Bad Debts Written Off Journal Entry ZoearesLin

https://psu.pb.unizin.org/app/uploads/sites/236/2020/07/figure-3.24.jpeg

Each of these expenses are tax deductible Consider this a checklist of small business tax write offs And remember some of the deductions in this list may not be available to your small business Consult with your tax advisor or CPA before claiming a deduction on your tax return Writing off small business expenses can help you lower your tax liability Here s a look at what you can write off and how the process works

Guide to Business Expense Resources Note We have discontinued Publication 535 Business Expenses the last revision was for 2022 Below is a mapping to the major resources for each topic For a full list go to the Publication 535 for 2022 PDF June 23 2023 Business write offs are deductions from a business s earnings For income tax purposes write offs are business expenses that get subtracted from revenue to find your total taxable revenue For example a freelance interior designer can claim car mileage as a tax deduction since they travel to meet with clients

Download What Is A Business Expense Write Off

More picture related to What Is A Business Expense Write Off

Free Small Business Expense Report Templates Smartsheet

https://www.smartsheet.com/sites/default/files/IC-Small-Business-Expense-Sheet-Template.png

Small Business Printable Expense Report Template

https://i.pinimg.com/originals/d0/e9/5e/d0e95eac3b3732ea691f3c344d4a2c2d.jpg

What Is A Stock SIP Is Stock SIP A Good Idea Dhan Blog

https://blog.dhan.co/blog/wp-content/uploads/2023/01/What-is-a-Stock-SIP-Is-Stock-SIP-a-Good-Idea.jpg

To be written off an expense needs to be incurred by a business intending to make a profit Some expenses may be fully deductible whereas others are partially deductible or won t be fully deducted the year they re incurred Writing off business expenses can lower your tax bill and make paying for the items your business needs a little less painful But what does that mean and how do you write off business expenses Most small businesses are

A tax write off refers to any business deduction allowed by the IRS for the purpose of lowering taxable income To qualify for a write off the IRS uses the terms ordinary and necessary that is an expense must be regarded as necessary and appropriate to the operation of your type of business All of these deductions can be claimed by sole proprietorships as well as C corps and S corps partnerships and LLCs although there might be different rules for each 1 Startup and

Write Off A Class Related To Your Business EclipseAviation

https://ecicdn.eclipseaviation.com/can_you_claim_a_class_as_a_business_expense.jpg

How To Calculate And Record The Bad Debt Expense QuickBooks

https://quickbooks.intuit.com/oidam/intuit/sbseg/en_us/Blog/Graphic/bad-debt-expense-direct-write-off-method-title.jpg

https://www.freshbooks.com/hub/accounting/write-offs

A tax write off is a business expense that can be claimed as a tax deduction on a federal income tax return lowering the amount the business will be assessed for taxes Tax write offs are deducted from total revenue to determine total

https://ttlc.intuit.com/turbotax-support/en-us/...

SOLVED by TurboTax 13980 Updated March 14 2024 If you re self employed or own a small business you can deduct eligible business expenses to pay fewer taxes These expenses must be common for your type of business and also necessary for your operations

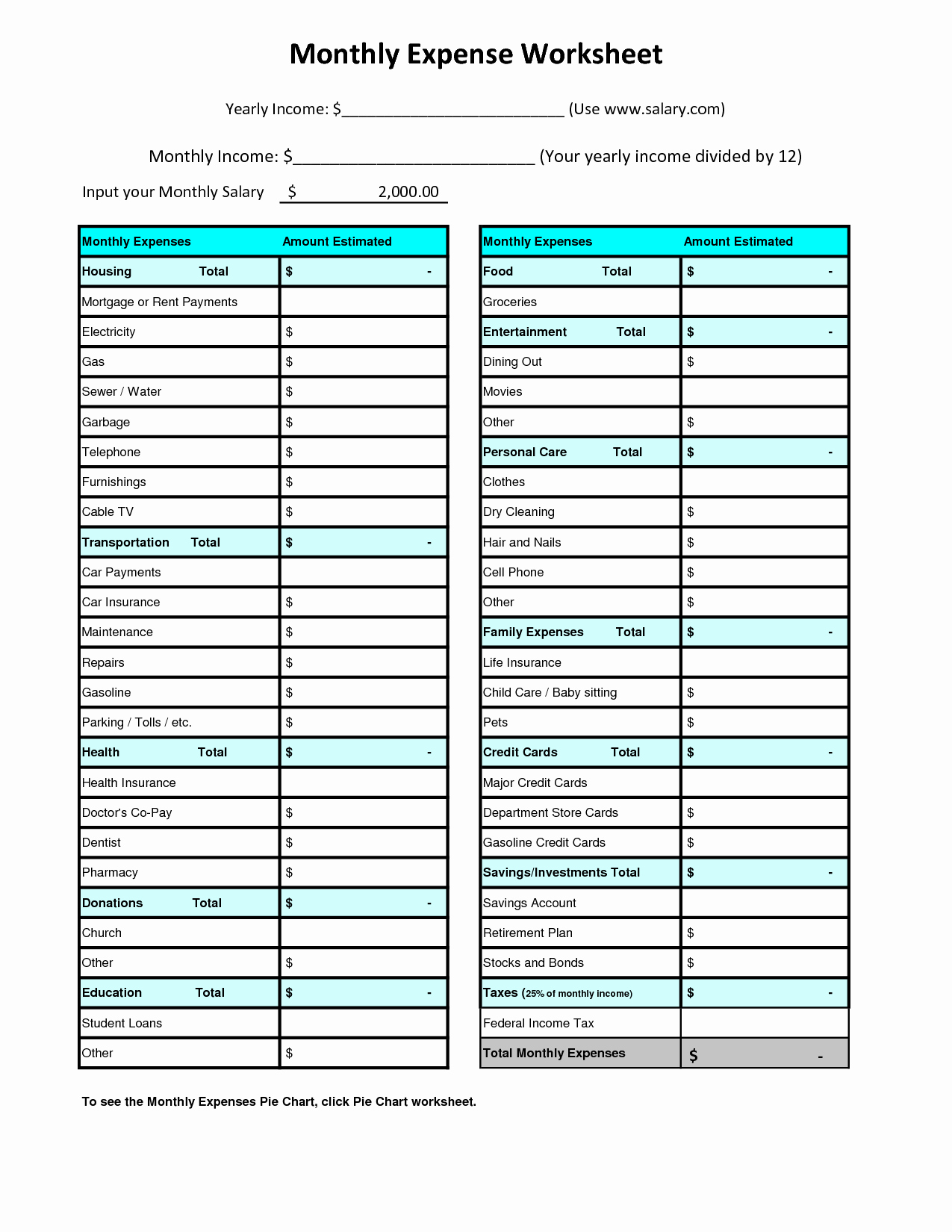

Free Monthly Income And Expense Worksheet Template Gasebin

Write Off A Class Related To Your Business EclipseAviation

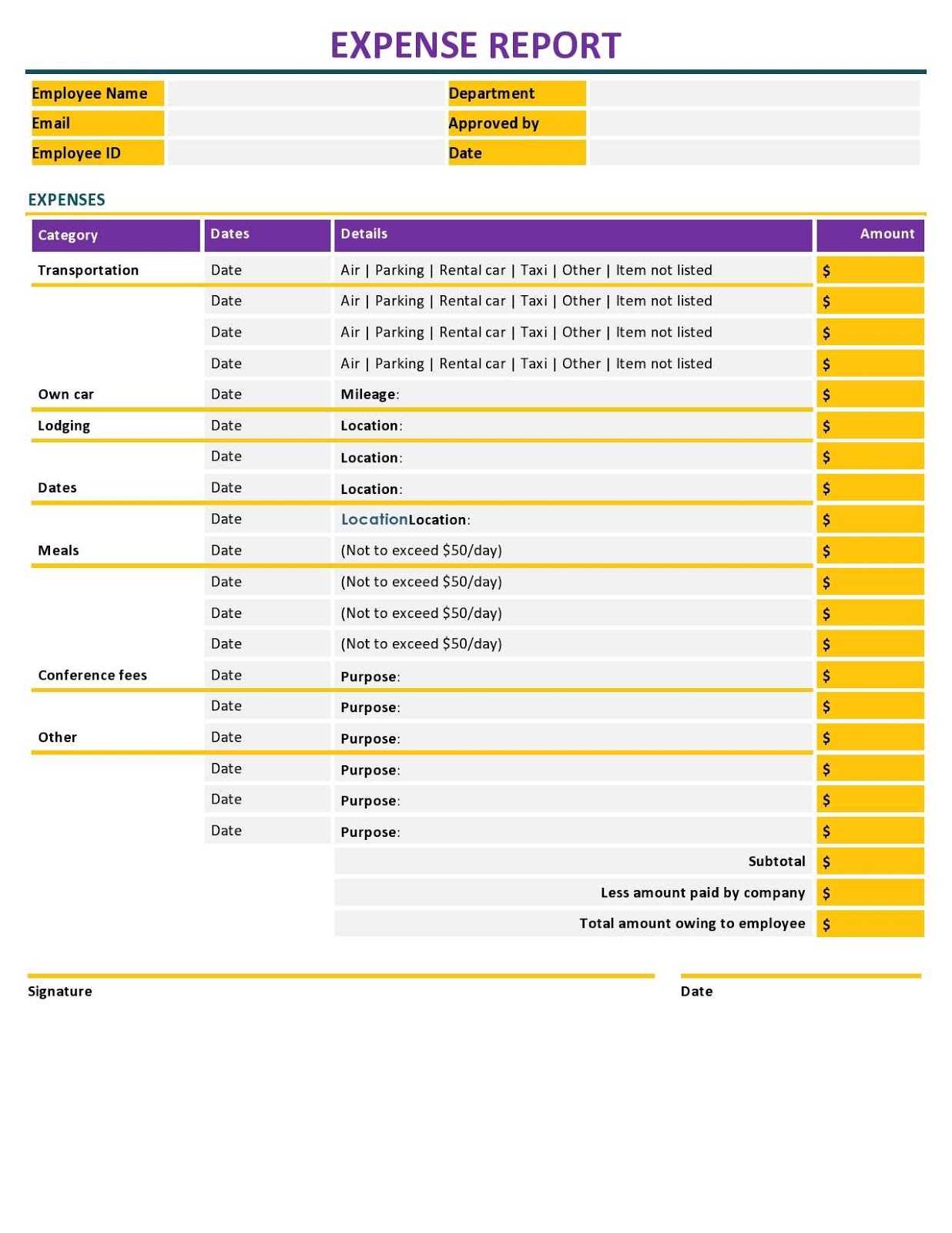

How To Do Expense Report To Lower Your Business Tax with Template

Food Expense Report Template Deporecipe co

What You Need To Prove A Business Expense Entrepreneur

Can Workwear Be Claimed As A Business Expense

Can Workwear Be Claimed As A Business Expense

Are Business Cards A Business Expense FIND SVP

How To Write Something Off As A Small Business Expense

What Can I Claim As A Business Expense

What Is A Business Expense Write Off - How to Write Off Business Expenses by Toby Mathis Article Update Jan 25th 2023 If you are self employed or run your own company you can reduce your annual tax burden by writing off certain business expenses