What Is A Health Reimbursement Account Vs Hsa Health reimbursement arrangements HRAs and health savings accounts HSAs are two ways to pay for healthcare expenses not covered by high deductible health insurance

Health savings accounts HSAs and health reimbursement arrangements HRAs help you pay for qualified medical expenses Anyone enrolled in an HSA eligible health plan can contribute to an HSA Only those whose employers offer HRAs have access to them But what types of health reimbursement accounts are available Flexible Spending Accounts FSAs Health Reimbursement Arrangements HRAs and Health Savings Accounts HSAs are all types of reimbursement accounts to help pay for your health care expenses

What Is A Health Reimbursement Account Vs Hsa

What Is A Health Reimbursement Account Vs Hsa

https://www.wexinc.com/wp-content/uploads/2020/11/WEXB-All-864509-HRA-vs-HSA-Graphic-1.jpg.optimal.jpg

HRA Vs HSA Accounts Compare Differences And Pros And Cons The

https://m.foolcdn.com/media/dubs/images/HRA-vs-HSA-plans-infographic.width-880.png

What Is A Health Savings Account HSA Jefferson Bank

https://www.jefferson-bank.com/uploadedfiles/images/articles/anatomy-of-hsa-infographic-jb.jpg?v=1D57A10EA85CB80

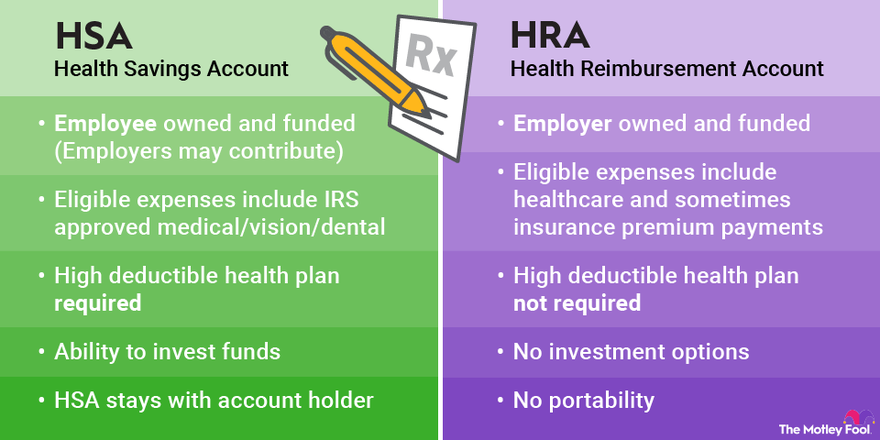

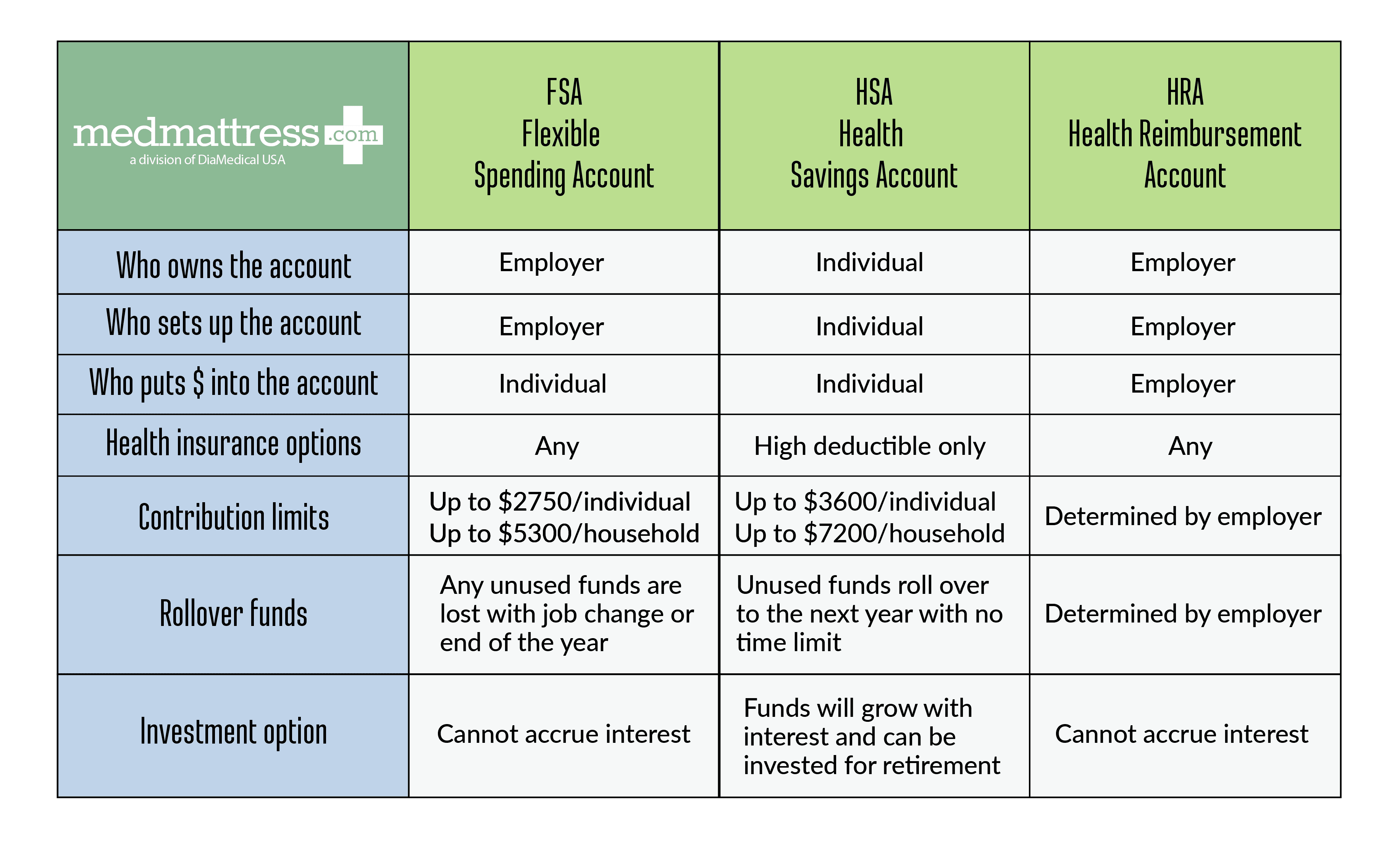

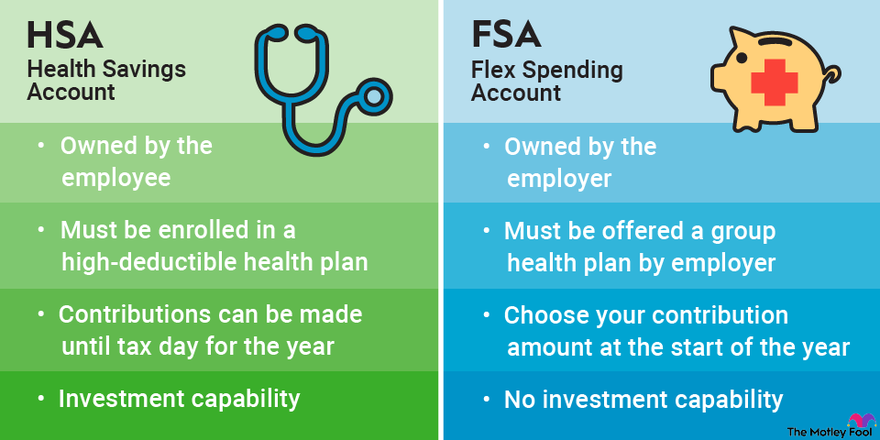

There are many differences between Health Savings Accounts HSAs Health Reimbursement Accounts HRAs and Flexible Spending Accounts FSAs and knowing these differences may help you know how to use these accounts to your advantage Compare the details about each type of account to learn which one may be right for you How do I get it HRAs health reimbursement arrangements and HSAs Health Savings Accounts are both ways to pay for qualified medical expenses The money in HRAs is deposited and owned by employers while HSA contributions are made and owned by individual account holders

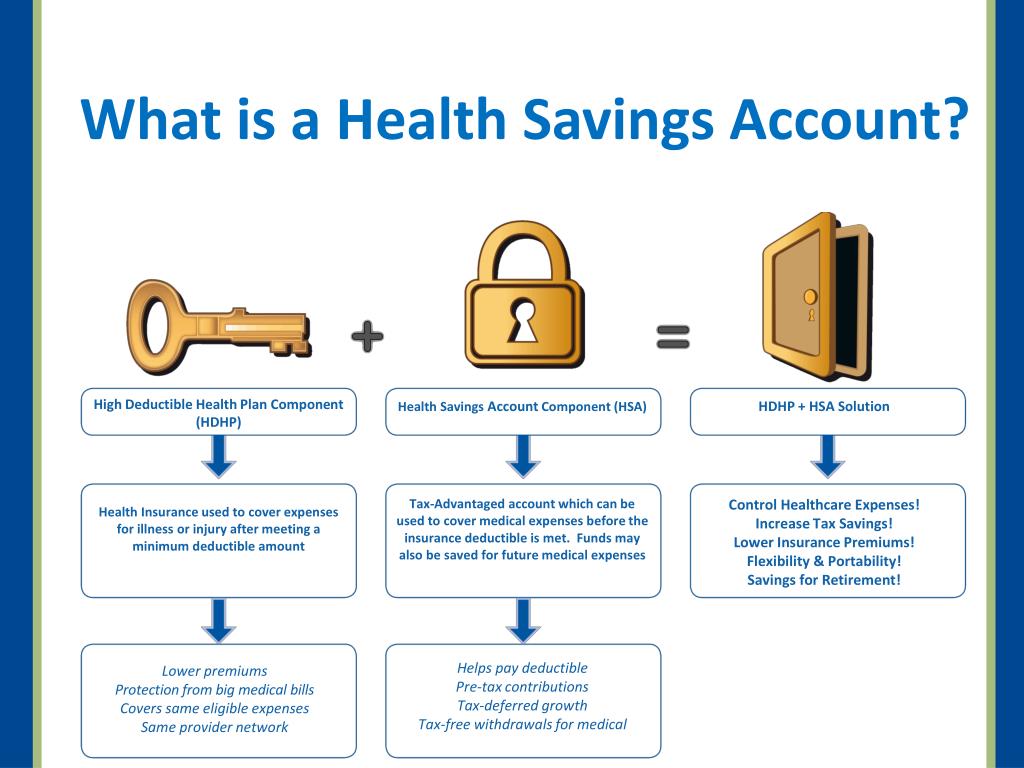

HSA Health Savings Account and HRA Health Reimbursement Arrangement differ primarily in ownership funding and portability HSAs are owned by individuals funded through pre tax contributions and are portable even if you change jobs Both health savings accounts HSAs and health reimbursement accounts HRAs offer tax advantaged ways to save for future medical expenses But they work in very different ways An HSA allows you to set aside money for healthcare costs that are not covered by your health insurance plan on a pre tax basis

Download What Is A Health Reimbursement Account Vs Hsa

More picture related to What Is A Health Reimbursement Account Vs Hsa

FSA HSA HRA Comparison And Differences HomeCare Hospital Beds

https://homecarehospitalbeds.com/wp-content/uploads/2021/08/Health-Accounts-Comparison.png

Health Savings Account HSA Vs Health Reimbursement Arrangement HRA

https://d32ijn7u0aqfv4.cloudfront.net/wp/wp-content/uploads/raw/SOBK0522002_1560x880_desktop.jpg

What Is A Health Reimbursement Arrangement HRA And How Does A

https://www.myfederalretirement.com/wp-content/uploads/2019/11/hsa-hra-2019.png

A health savings account HSA or health reimbursement arrangement HRA are two types of popular healthcare savings reimbursement accounts Both help offset healthcare expenses but when it comes to an HRA vs HSA there are differences HRA vs HSA What s the Difference Health reimbursement arrangements HRA and health savings accounts HSA are both ways to pay for qualified medical expenses tax free An HRA is solely funded by an employer whereas

Healthcare reimbursement arrangements and health savings accounts are both pre tax ways to help employees pay for qualified medical expanded and out of pocket costs But which is the right fit for your business This guide explores HRA vs HSA including the pros and cons of each their eligibility criteria and how employees can use them Health Reimbursement Arrangements HRAs and Health Savings Accounts HSAs are two popular options that offer unique benefits and are designed to support your healthcare spending HRAs and HSAs are both designed to offer tax advantages that can ease the financial burden of healthcare costs

What s The Difference Between An HSA And A Medicare MSA

https://uploads-ssl.webflow.com/5c4a7c673b460b7f41c6e7a1/5cb622cc4057720fa16cc1d9_HSA vs MSA.png

Understanding The Differences Of FSA HSA HRA Accounts MedMattress

https://medmattress.com/wp-content/uploads/2021/08/Blog-Tables_MedMattress-02.png

https://www.investopedia.com

Health reimbursement arrangements HRAs and health savings accounts HSAs are two ways to pay for healthcare expenses not covered by high deductible health insurance

https://www.fidelity.com › learning-center › smart-money › hra-vs-hsa

Health savings accounts HSAs and health reimbursement arrangements HRAs help you pay for qualified medical expenses Anyone enrolled in an HSA eligible health plan can contribute to an HSA Only those whose employers offer HRAs have access to them

Health Savings Accounts HSA Grant Smith Health Insurance Agency

What s The Difference Between An HSA And A Medicare MSA

HSA Vs FSA What s The Difference Quick Reference Chart

HSA Vs FSA Accounts Side by Side Healthcare Comparison The Motley Fool

PPT HSA 101 A Quick Review Of Health Savings Account Basics

What Is A Health Savings Account HSA UnitedHealthcare

What Is A Health Savings Account HSA UnitedHealthcare

HSA Vs FSA See How You ll Save With Each WEX Inc

HSA Vs FSA See How You ll Save With Each WEX Inc

Benefits A Z Reimbursement Plans

What Is A Health Reimbursement Account Vs Hsa - A health reimbursement account HRA and a health savings account HSA can both provide tax free dollars to spend on your healthcare But gaining a clear understanding of HRA vs HSA can go a long way in helping you better manage your healthcare costs