What Is A Refundable Tax Credit Refundable credits are paid out in full providing a refund for any remaining tax credit amount beyond zero tax due Federal and state governments may grant tax

A refundable credit is a tax credit that is refunded to the taxpayer no matter how much the taxpayer s liability is Typically a tax credit is A refundable tax credit is a state or federal credit that can put cash in your pocket regardless of your tax liability First a refundable credit reduces your tax

What Is A Refundable Tax Credit

What Is A Refundable Tax Credit

https://www.universalcpareview.com/wp-content/uploads/2021/01/Personal-tax-credits.png

What Is A Refundable Tax Credit The TurboTax Blog

https://blog.turbotax.intuit.com/wp-content/uploads/2021/11/What-is-a-Refundable-Tax-Credit_1.png?resize=44

What Is A Refundable Tax Credit

https://a57.foxnews.com/static.foxbusiness.com/foxbusiness.com/content/uploads/2018/02/0/0/8523d5ad-tax-credit_gettyimages-504572064_la-869f3de6e31c8510VgnVCM100000d7c1a8c0____.jpg?ve=1&tl=1

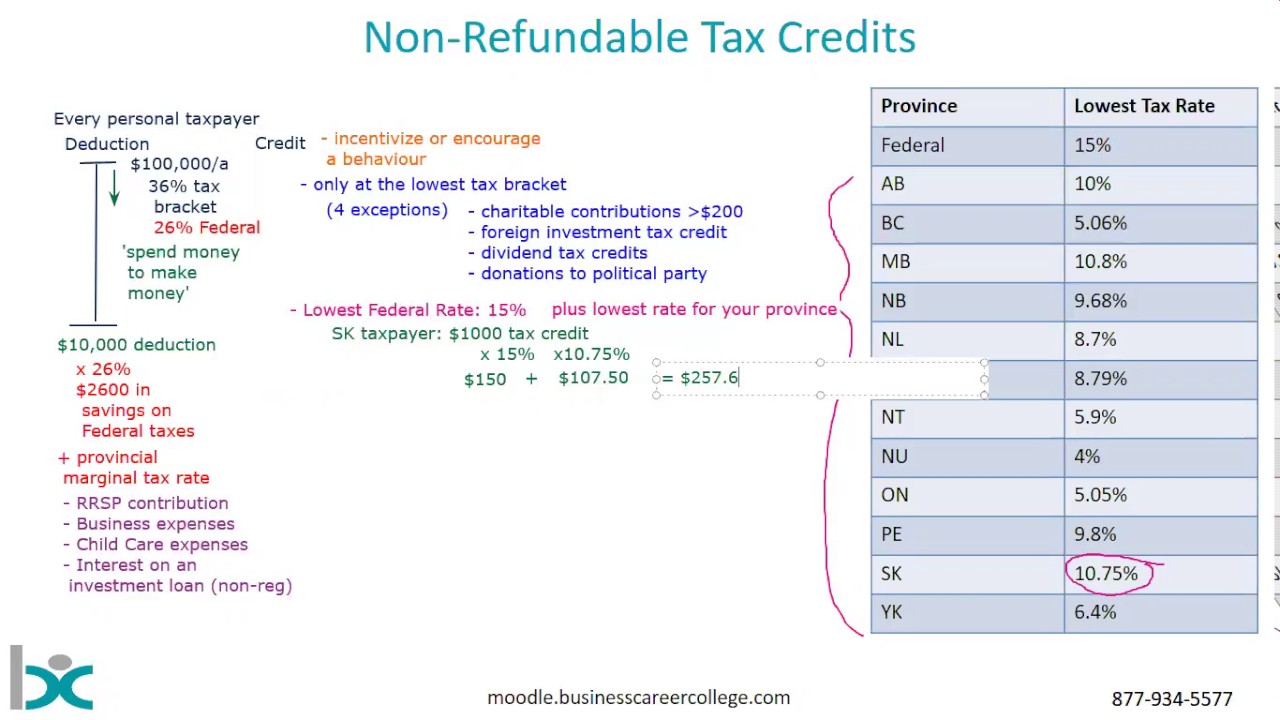

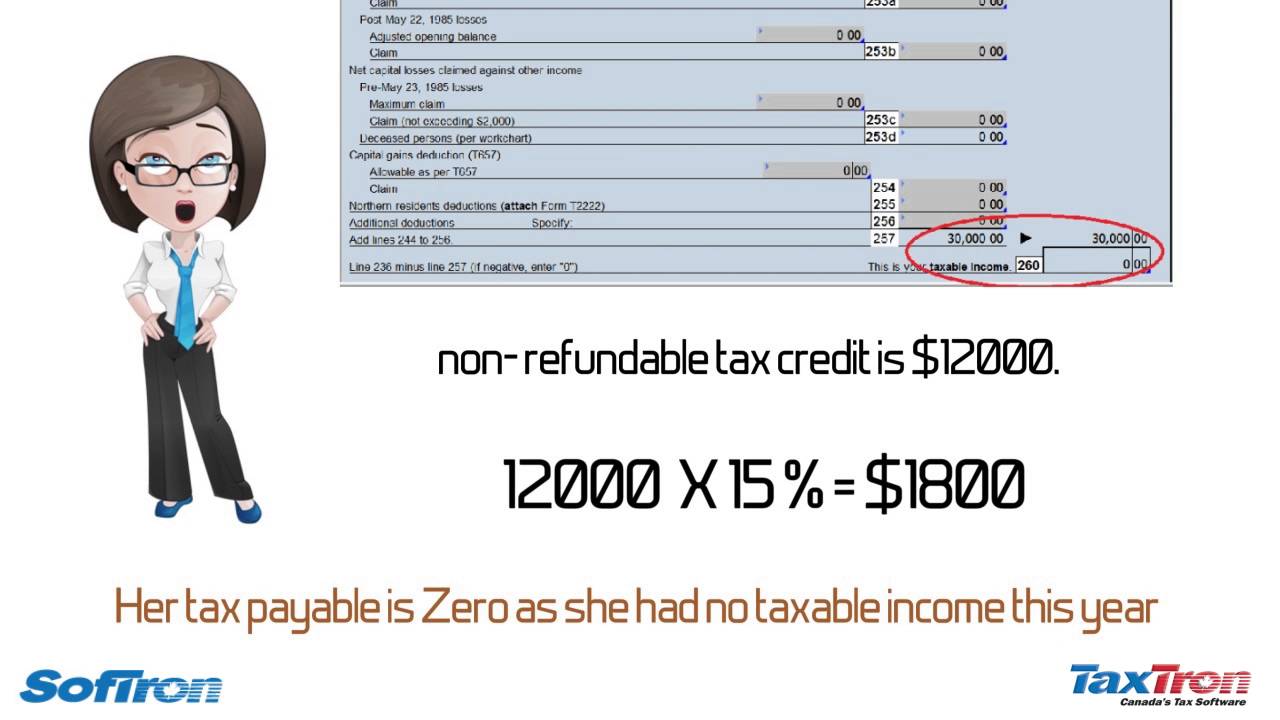

A tax credit is a dollar for dollar amount taxpayers claim on their tax return to reduce the income tax they owe Eligible taxpayers can use them to reduce their tax bill and potentially increase their refund Refundable tax credits have the potential to reduce your tax liability to less than 0 resulting in a refund When it comes to reducing your tax bill don t overlook refundable tax

Refundable tax credits allow you to receive a refund if the amount is larger than the amount you owe in taxes Nonrefundable tax credits only allow you to reduce your taxes owed to 0 Tax credits can be nonrefundable refundable or partially refundable If a refundable credit exceeds the amount of income taxes owed the difference is paid as a refund If a nonrefundable credit exceeds the amount of income taxes owed the excess is lost The maximum value of a nonrefundable tax credit is capped at a taxpayer s income tax liability

Download What Is A Refundable Tax Credit

More picture related to What Is A Refundable Tax Credit

What Is The Difference Between Non refundable And Refundable Tax

https://cdn.taxory.com/wp-content/uploads/2020/12/refundable-and-non-refundable-tax-credits-1080x590.jpg

Is The Electric Vehicle Credit Refundable Electric Vehicle List

https://electricvehicleslist.com/wp-content/uploads/2023/08/1691784664is_the_electric_vehicle_credit_refundable.jpg

Refundable Vs Non Refundable Tax Credits Wessel Company

https://www.wesselcpa.com/wp-content/uploads/2019/04/543881659.jpg

A refundable tax credit can be used to generate a federal tax refund larger than the amount of tax paid throughout the year In other words a refundable tax credit creates the possibility of a negative federal tax liability An example of a refundable tax With refundable tax credits you can receive cash back if the credit is larger than the amount of tax you owe Even if you don t owe any tax you can get money from the IRS with certain refundable tax credits but you will have to file a tax return to get the credit

[desc-10] [desc-11]

Tax Credit Vs Tax Deduction What s The Difference Guide

https://www.expatustax.com/wp-content/uploads/2022/05/Tax-Credit-vs-Tax-Deduction.jpg

Understanding Refundable Tax Credits CKH Group

https://www.ckhgroup.com/wp-content/uploads/2022/02/Website-article-images-2-768x576-1-768x550.png

https://www.investopedia.com/terms/t/taxcredit.asp

Refundable credits are paid out in full providing a refund for any remaining tax credit amount beyond zero tax due Federal and state governments may grant tax

https://www.investopedia.com/terms/r/refundablecredit.asp

A refundable credit is a tax credit that is refunded to the taxpayer no matter how much the taxpayer s liability is Typically a tax credit is

What Is The Difference Between A Refundable And A Nonrefundable Credit

Tax Credit Vs Tax Deduction What s The Difference Guide

What Is A Non Refundable Tax Credit Where Is My US Tax Refund

Non Refundable Tax Credits YouTube

What You Need To Know About Qualifying For The Employee Retention Tax

2022 Education Tax Credits Are You Eligible

2022 Education Tax Credits Are You Eligible

Difference Between Refundable And Nonrefundable Tax Credits Canada

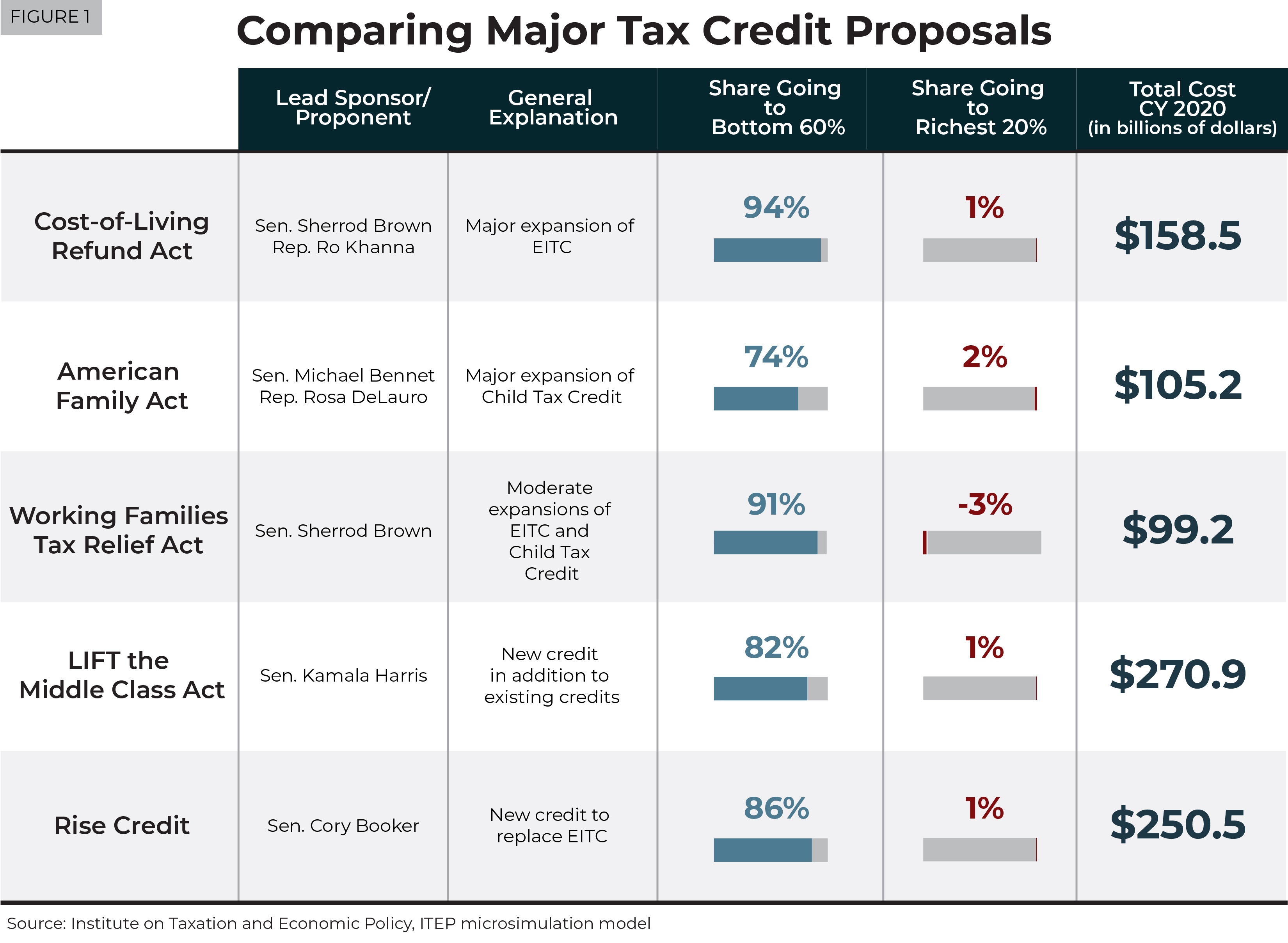

Understanding Five Major Federal Tax Credit Proposals Common Dreams

What Is The Difference Between Refundable And Nonrefundable Credits

What Is A Refundable Tax Credit - [desc-12]