What Is A Student Loan Interest Deduction Student loan interest is interest you paid during the year on a qualified student loan It includes both required and voluntarily prepaid interest payments You

How Much Student Loan Interest Is Tax Deductible You can deduct either 2 500 in student loan interest or the actual amount of loan interest you paid during The student loan interest deduction is a tax break for college students or parents who took on debt to pay for their school It allows you to deduct up to 2 500 in

What Is A Student Loan Interest Deduction

What Is A Student Loan Interest Deduction

https://www.payfored.com/wp-content/uploads/2020/01/2019-Student-Loan-Interest-Deduction-Chart.png

Guide To Student Loan Interest Rates And How Much You Will Pay

https://www.gannett-cdn.com/-mm-/3095bbe1c7b29d9ac3460534e28a55c79c2eb0ef/c=0-226-1942-1318/local/-/media/2019/02/28/USATODAY/usatsports/MotleyFool-TMOT-d92ea364-student-loans.jpg?width=3200&height=1680&fit=crop

Student Loan Interest Deduction A Tax Move You Must Make

https://www.dollarsprout.com/wp-content/uploads/2017/04/Student-Loan-Interest-Deduction-Calculator-e1538187085887.jpg

The student loan interest tax deduction is for students and their parents who are repaying federal student financial aid It s the above the line adjustment to your adjusted gross income AGI if you If you made federal student loan payments in 2023 you may be eligible to deduct a portion of the interest paid on your 2023 federal tax return This is known as a

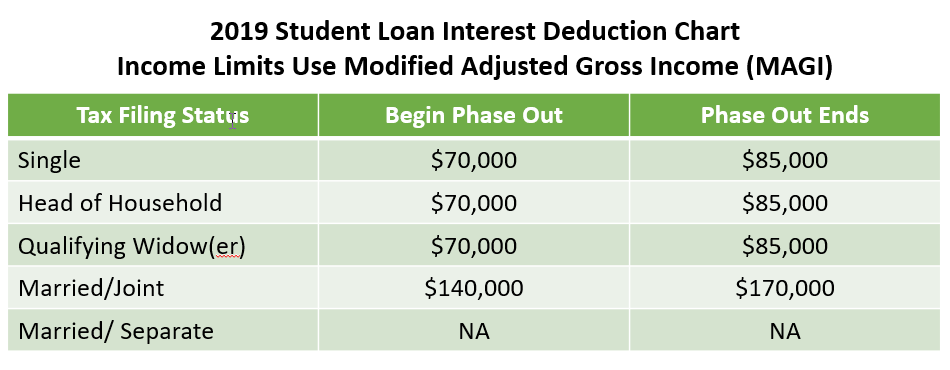

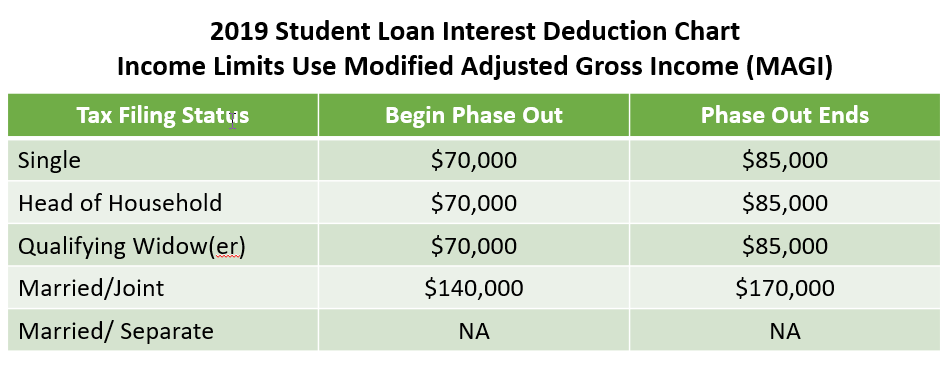

The Student Loan Interest Deduction is a tax deduction that may allow you to reduce your taxable income by the amount you paid in student loan interest Like the student loan interest deduction how much you can claim is phased out based on your MAGI Once your MAGI hits 58 000 or 116 000 if you file jointly the maximum possible credit will

Download What Is A Student Loan Interest Deduction

More picture related to What Is A Student Loan Interest Deduction

Student Loan Interest Deduction Are You Eligible LendEDU

https://lendedu.com/wp-content/uploads/2017/11/Student-Loan-Interest-Deduction.jpg

Student Loan Interest Deduction Who s Eligible And How To Apply For A

https://phantom-marca.unidadeditorial.es/b9d9e750c88f4c28889d6c6e55172bb0/resize/1320/f/jpg/assets/multimedia/imagenes/2022/03/23/16480644606624.jpg

How Do Student Loans Appear On Your Credit Report CreditRepair

https://www.creditrepair.com/blog/wp-content/uploads/2016/06/shutterstock_406924213-2000x1333.jpg

The student loan interest deduction is a tax benefit that can offset the costs of borrowing to pay for your education If you qualify you can deduct up to 2 500 of student loan interest per year How Much Is the Deduction The maximum student loan interest deduction you can claim is 2 500 and it might be less It can be limited by your

In fact federal student loan borrowers could qualify to deduct up to 2 500 of student loan interest per tax return per tax year You can claim the student loan interest tax The student loan interest deduction can take some of the sting out of the interest you pay on your student loans each year If you re carrying the average

Student Loan Interest Deduction A 2020 Guide Templateroller

https://www.templateroller.com/img/blog_post_img/medium/75d87721c582676fd40a0256c4e4bff7.jpg

How To Claim The Student Loan Interest Deduction Tomcaligist

https://d32ijn7u0aqfv4.cloudfront.net/wp/wp-content/uploads/raw/Deducting-Student-Loan-Interest-1.png

https://www.irs.gov/taxtopics/tc456

Student loan interest is interest you paid during the year on a qualified student loan It includes both required and voluntarily prepaid interest payments You

https://www.forbes.com/advisor/taxes/student-loan...

How Much Student Loan Interest Is Tax Deductible You can deduct either 2 500 in student loan interest or the actual amount of loan interest you paid during

Student Loan Interest Deduction What You Need To Know

Student Loan Interest Deduction A 2020 Guide Templateroller

Student Loan Interest Deduction How Much Can You Really Save

Student Loan Interest Deduction How Can I Claim It

Student Loan Interest Deduction 2013 PriorTax Blog

How To Claim Your Student Loan Interest Deduction

How To Claim Your Student Loan Interest Deduction

Student Loan Interest Deduction H R Block

Student Loan Interest Deduction And Tuition Fees Deduction Offer Tax

Learn How The Student Loan Interest Deduction Works

What Is A Student Loan Interest Deduction - The Student Loan Interest Deduction is a tax break that allows taxpayers to subtract up to 2 500 of interest paid on qualified student loans from their total income