What Is A Tax Credit Scholarship Verkko Scholarship tax credit In the United States scholarship tax credits also called tax credit scholarships education tax credits or tuition tax credits are a form of school choice that allows individuals or corporations to receive a tax credit from state taxes against donations made to non profit organizations that grant private

Verkko Tax credit scholarships sometimes called scholarship tax credits are different from other school choice programs such as school vouchers What sets them apart The way they are Verkko 2 p 228 iv 228 228 sitten nbsp 0183 32 A scholarship is generally an amount paid or allowed to a student at an educational institution for the purpose of study A fellowship grant is generally an amount paid or allowed to an individual for the purpose of study or research Other types of grants include need based grants such as Pell Grants and Fulbright grants

What Is A Tax Credit Scholarship

What Is A Tax Credit Scholarship

https://i.ytimg.com/vi/6NS5twv5-ig/maxresdefault.jpg

All You Need To Know About Earned Income Tax Credit

https://www.unitedtaxgroup.com/images/37/opengraph.jpg

What Is A Tax Credit Scholarship YouTube

https://i.ytimg.com/vi/KC3lrdAqBs0/maxresdefault.jpg

Verkko An STC grants a full or partial tax credit to individual and or corporate taxpayers in return for contributions to non profit scholarship organizations These organizations then help low Verkko 9 maalisk 2019 nbsp 0183 32 Currently tax credit scholarships are used primarily to allow students often from low income families to attend tuition charging private schools The new Education Freedom Scholarships proposal would allow state selected SGOs to provide the scholarships for any program designed to increase students opportunities

Verkko It is a tax credit of up to 2 500 of the cost of tuition certain required fees and course materials needed for attendance and paid during the tax year Also 40 percent of the credit for which you qualify that is more than the tax you owe up to 1 000 can be refunded to you Verkko Tax Rules for Scholarships Pell grants and many other scholarships can be treated in one of two ways for tax purposes Excluded from student s income if used for tuition and related expenses In this case the scholarship must be subtracted from expenses that would qualify for the AOTC or LLC Or

Download What Is A Tax Credit Scholarship

More picture related to What Is A Tax Credit Scholarship

Tax Credit Scholarship YouTube

https://i.ytimg.com/vi/PAE27Ph4URE/maxresdefault.jpg

How To Apply For A Tax Credit Scholarship With Empower IL YouTube

https://i.ytimg.com/vi/-RUpRausDYc/maxresdefault.jpg

Everything You Need To Know About The Opportunity Scholarship Tax

https://childrenstuitionfund.org/wp-content/uploads/2021/05/Opportunity-Scholarship-Tax-Credit-Program-1024x769.jpg

Verkko 3 tammik 2024 nbsp 0183 32 Scholarships are one of the most common sources of financial aid A 2023 report from Sallie Mae revealed that 61 of families use scholarships to pay for a portion of college expenses On average Verkko 23 kes 228 k 2021 nbsp 0183 32 A scholarship or grant is tax free as long as it doesn t exceed the amount you need to cover your qualified education expenses According to the IRS qualified education expenses include

Verkko 13 tammik 2023 nbsp 0183 32 Scholarships fellowships and Pell grants received by registered students who are working toward a degree at a college university or other accredited educational institution are generally nontaxable as long as the money is used entirely for qualified education expenses Verkko For 2022 you may be able to claim a credit of up to 2 500 for adjusted qualified education expenses paid for each student who qualifies for the American opportunity credit A tax credit reduces the amount of income tax you may have to pay

Tax Credit Scholarship Smore Newsletters For Education

https://s.smore.com/ss/e293/61e02981278f2e3499629a60-screenshot-fb_wide.jpg?_v=1642080849

How To Apply For 19 20 Tax Credit Scholarship Empower Illinois On Vimeo

https://i.vimeocdn.com/video/750765572-f6fa582f59f01c6a11410714f11da8b2d845b464243fce37fe69493fc17ed70b-d?mw=1920&mh=1080&q=70

https://en.wikipedia.org/wiki/Scholarship_Tax_Credit

Verkko Scholarship tax credit In the United States scholarship tax credits also called tax credit scholarships education tax credits or tuition tax credits are a form of school choice that allows individuals or corporations to receive a tax credit from state taxes against donations made to non profit organizations that grant private

https://www.youtube.com/watch?v=KC3lrdAqBs0

Verkko Tax credit scholarships sometimes called scholarship tax credits are different from other school choice programs such as school vouchers What sets them apart The way they are

How To Calculate Your ERC Tax Credit The News God

Tax Credit Scholarship Smore Newsletters For Education

Business Contributions To Fund Scholarships Through State Tax Credit

How Tax Credit Scholarships Empower Those Most In Need

Donate To A Tax Credit Scholarship Catholic Schools

What Is The Difference Between A Tax Credit And Tax Deduction

What Is The Difference Between A Tax Credit And Tax Deduction

TAX TIPS WITH TIMALYN Bowens Tax Solutions

What Is A Secured Credit Card

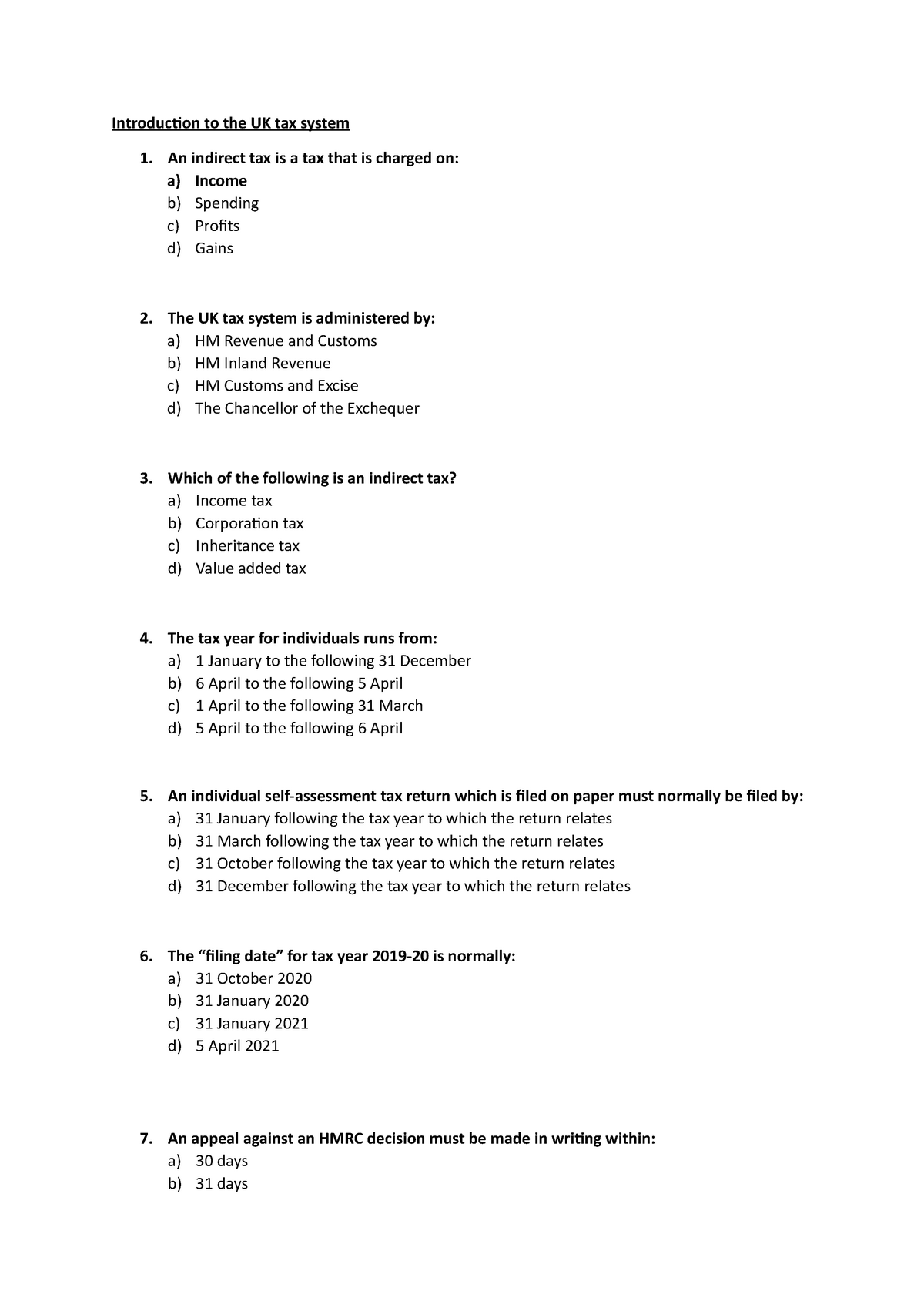

MCQ Questions Taxation Introduction To The UK Tax System An Indirect

What Is A Tax Credit Scholarship - Verkko 24 jouluk 2012 nbsp 0183 32 A tax credit scholarship program incentivizes corporations to donate to non profit organizations that offer scholarships for K 12 education Corporations who make these donations receive a break in their yearly franchise or insurance taxes The nonprofit is then in charge of dispersing the corporate donations in the form of