What Is A Vat Summary What is VAT VAT is a consumption tax imposed whenever a value is added on applicable goods and services at each stage of the supply chain from production to consumption It is levied on the use of taxable products and services supplied or imported into Kenya

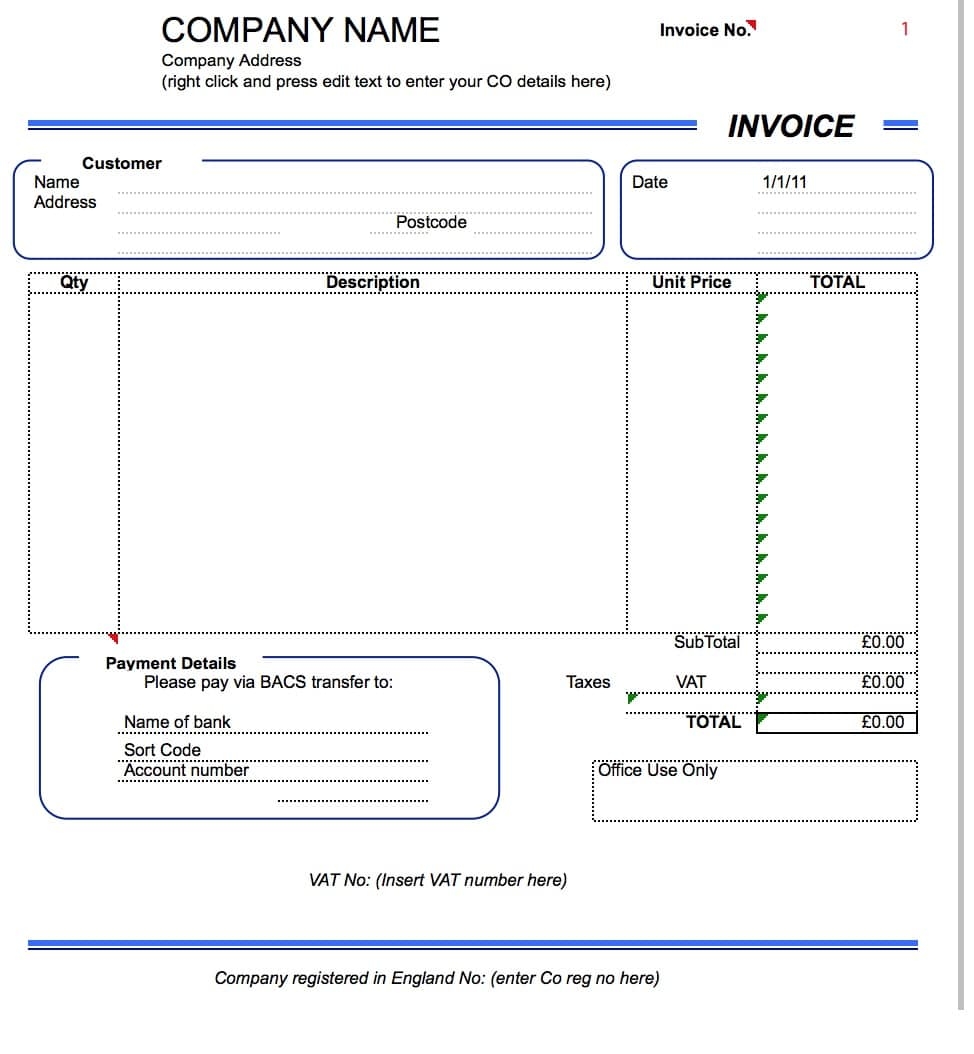

Input tax refers to VAT charged on purchases of taxable purchases and expenses for business purposes Output tax refers to the VAT charged on the sales of taxable goods or services VAT or Value Added Tax is a widely used form of indirect taxation applied to the consumption of goods and services For individuals and businesses alike understanding what VAT is and how it operates is essential for navigating financial and regulatory landscapes

What Is A Vat Summary

What Is A Vat Summary

https://img.hechtgroup.com/can_i_claim_vat_back_on_a_commercial_property.png

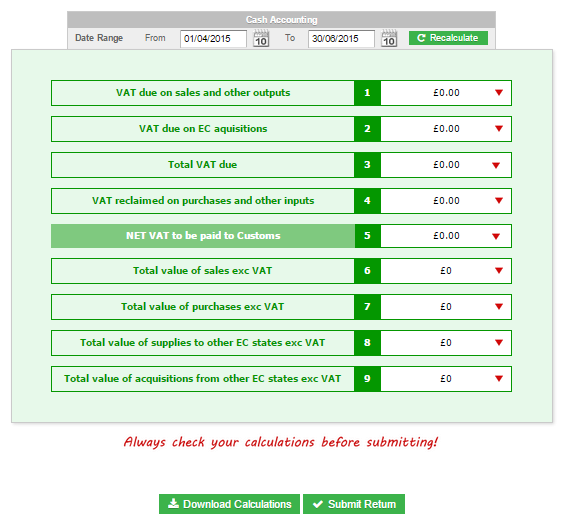

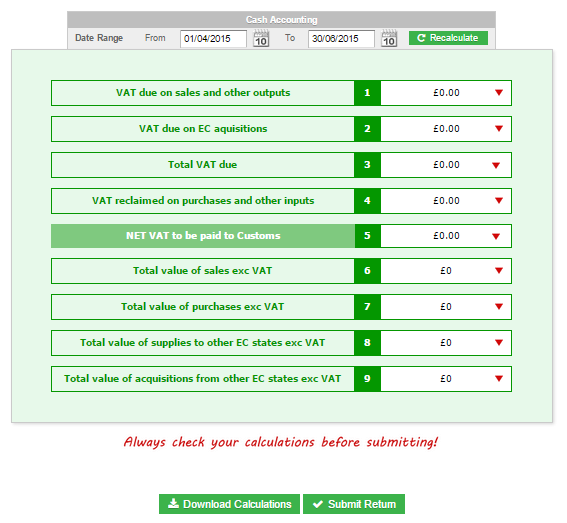

VAT Returns Guide VAT QuickFile

https://community.quickfile.co.uk/uploads/default/original/2X/4/48203105a42f2921150e849f046123b9dfa9f5ce.png

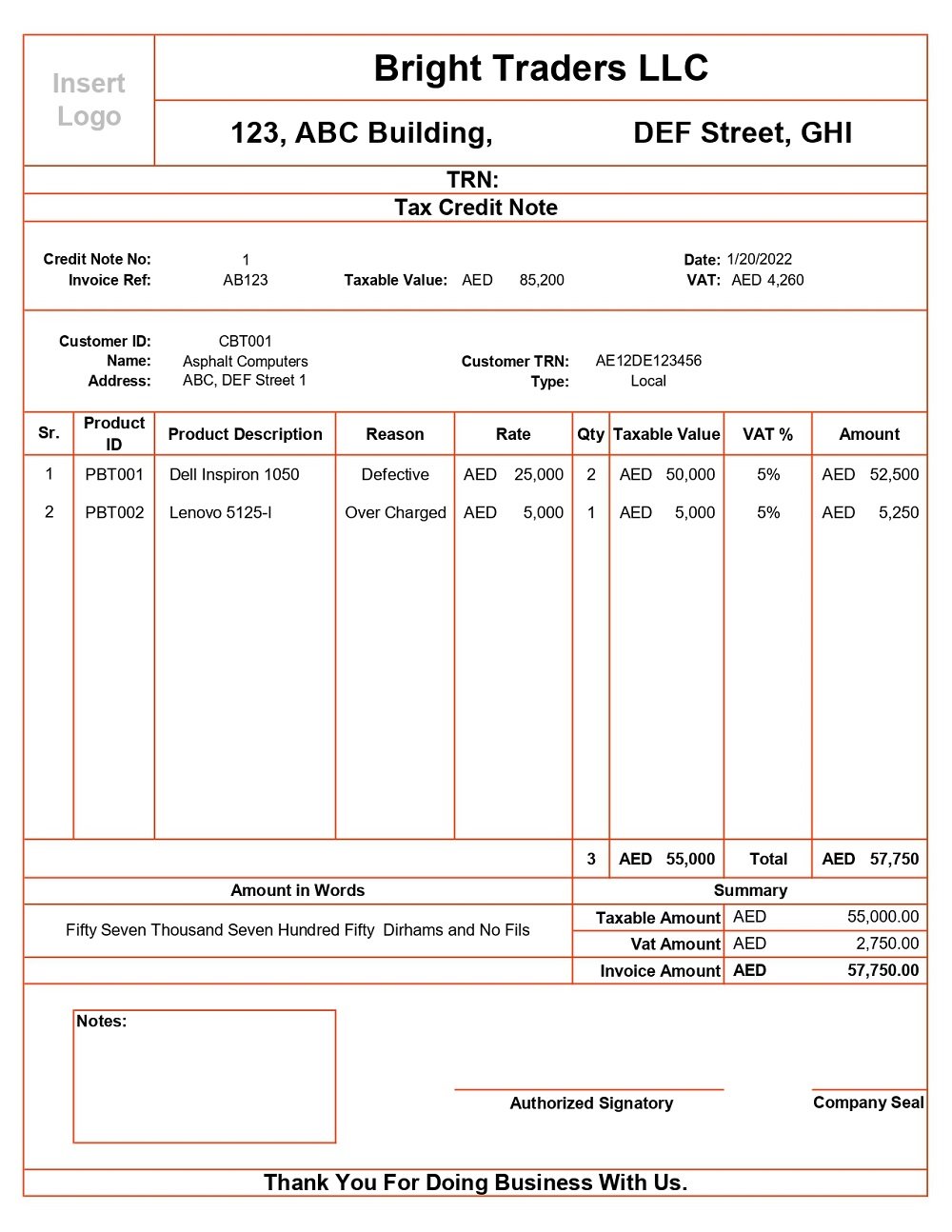

Ready To Use UAE VAT Credit Note Format MSOfficeGeek

https://msofficegeek.com/wp-content/uploads/2022/01/UAE-VAT-Credit-Note-Template.jpg

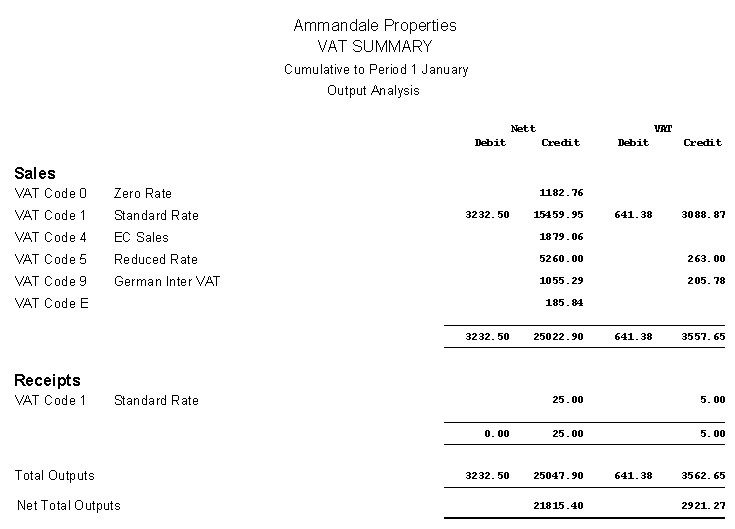

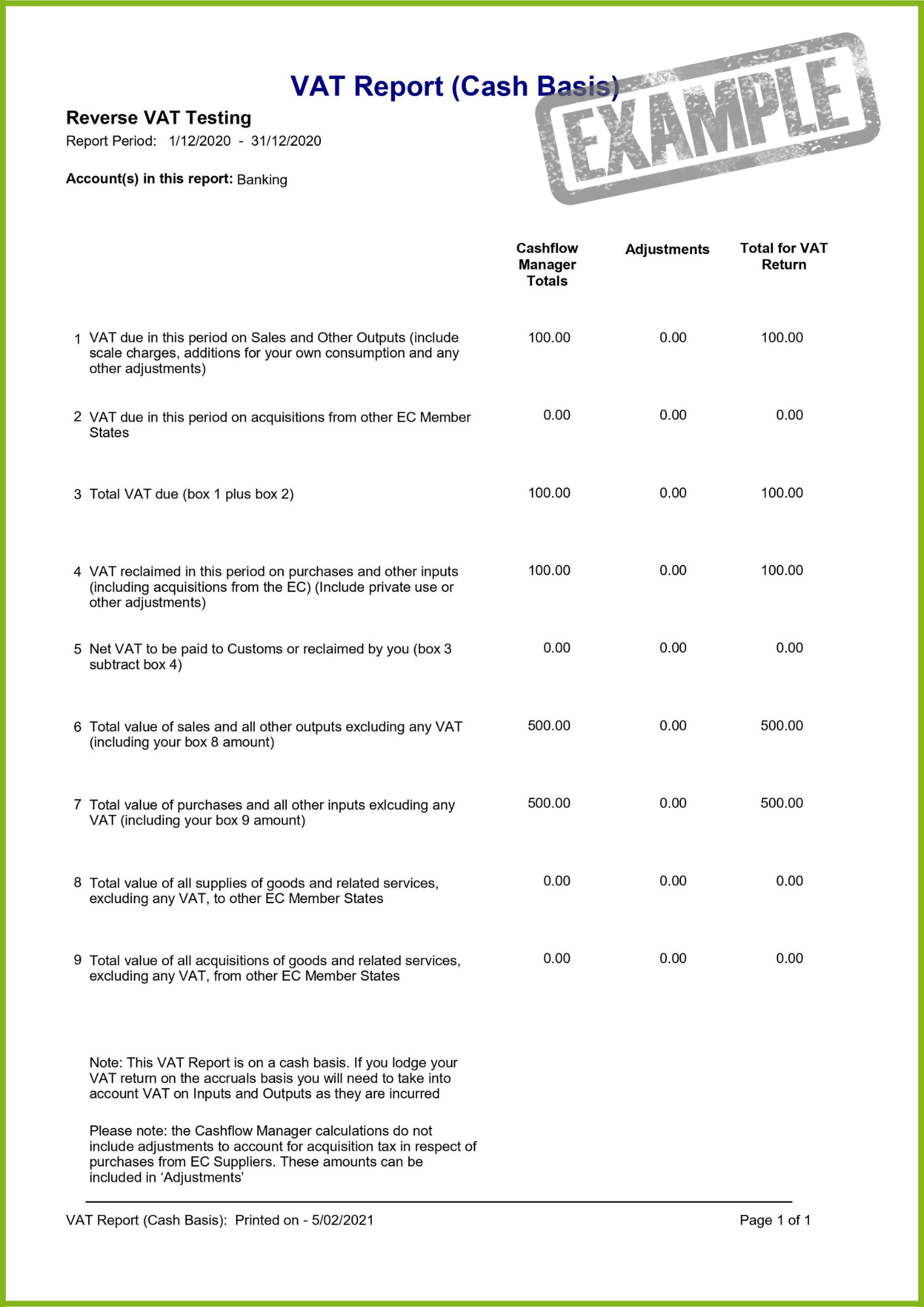

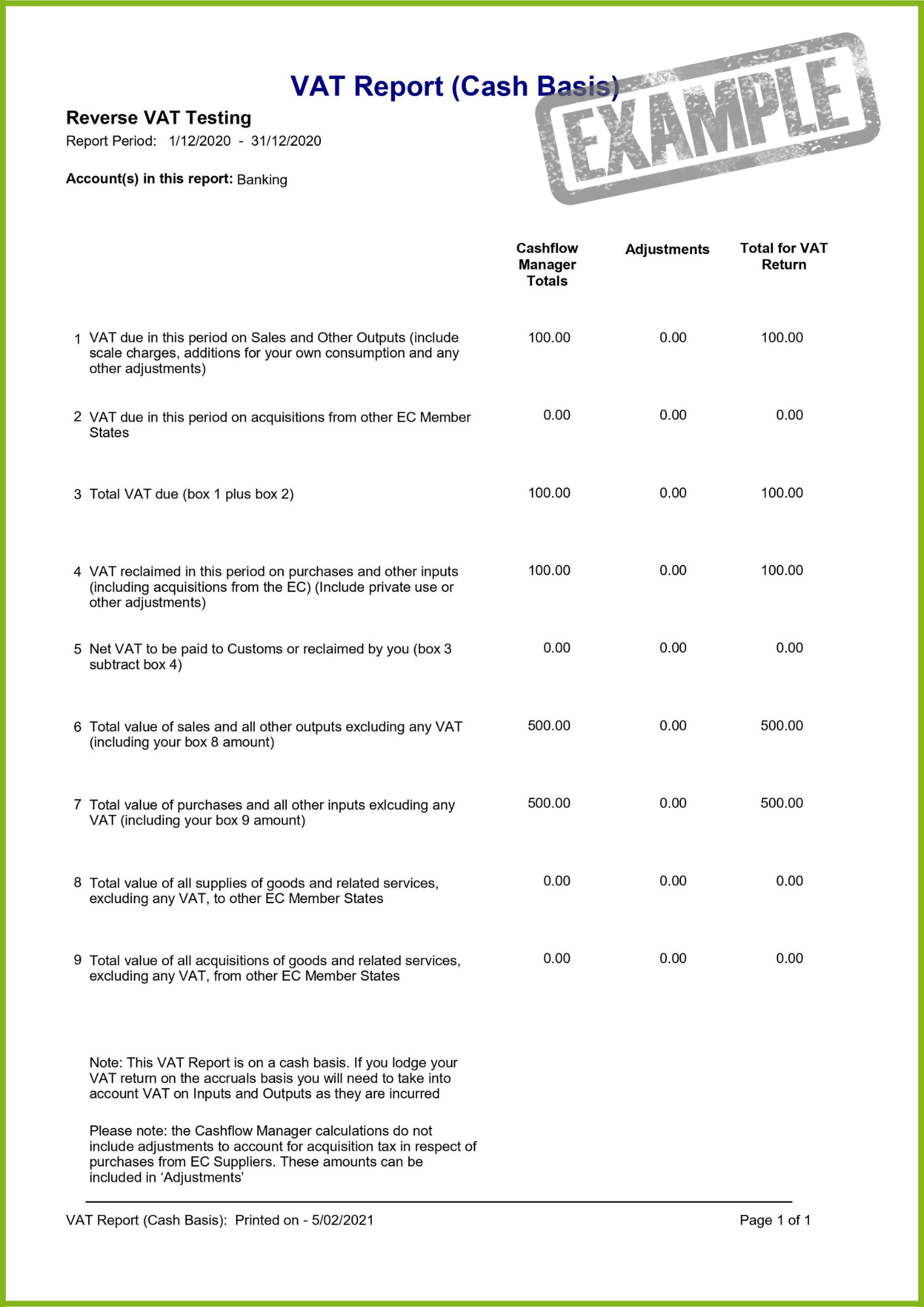

Input VAT Summary report details all the VAT acquired from bills and purchase returns done within the period The report computes the Total Input VAT the Total Input VAT Returns and the Total Input VAT after VAT Returns A VAT report is a financial document that summarises a company s VAT eligible transactions over a specified accounting period helping the company complete their VAT Return If a company is registered for VAT they must charge VAT on eligible sales output VAT and can reclaim the VAT on any purchases made by the business input VAT

The VAT Summary report is a comprehensive summary of your VAT returns This report contains a list of tax return files which are generated for a specific time period The tax returns report generated in Zoho Invoice follows the standards and specifications mentioned by the Kenya Revenue Authority It is important that a VAT registered business maintains complete and up to date records This includes details of all supplies purchases and expenses In addition a VAT account should be maintained This is a summary of output tax payable and input tax recoverable by the business All business records should be kept for six years

Download What Is A Vat Summary

More picture related to What Is A Vat Summary

VAT Summary Report Prelude Software Help

http://help.prelude.software/wp-content/uploads/2019/12/VATSummary1.jpg

VAT Certificate B R Rail

https://www.brrail.com/wp-content/uploads/2017/04/VAT-Certificate-740x1024.png

Example Of Vat Invoice Invoice Template Ideas

https://simpleinvoice17.net/wp-content/uploads/2017/08/free-value-added-tax-vat-invoice-template-excel-pdf-word-example-of-vat-invoice.jpg

VAT is intricate in its workings but at its core it s a multi stage tax Businesses collect the tax on behalf of the government when they buy goods or services they are charged VAT and when they sell goods or services they charge VAT A value added tax VAT or goods and services tax GST general consumption tax GCT is a consumption tax that is levied on the value added at each stage of a product s production and distribution VAT is similar to and is often compared with a sales tax

[desc-10] [desc-11]

Co To Jest Deklaracja VAT FreeAgent I m Running

https://freeagent-res.cloudinary.com/image/upload/c_limit,w_1000/dpr_auto,f_auto/website-images/screenshots/screenshot_vat-return.png

VAT Registration Certificate Koon Trading

https://www.koonco.com/wp-content/uploads/2021/08/vat-page1.jpg

https://kra.go.ke › news-center › blog

What is VAT VAT is a consumption tax imposed whenever a value is added on applicable goods and services at each stage of the supply chain from production to consumption It is levied on the use of taxable products and services supplied or imported into Kenya

https://www.kra.go.ke › images › publications › ...

Input tax refers to VAT charged on purchases of taxable purchases and expenses for business purposes Output tax refers to the VAT charged on the sales of taxable goods or services

A Complete Guide To VAT Codes The Full List Tide Business

Co To Jest Deklaracja VAT FreeAgent I m Running

VAT Return Get Hands On Help With Your VAT

How VAT Works And Is Collected value added Tax Perfmatters

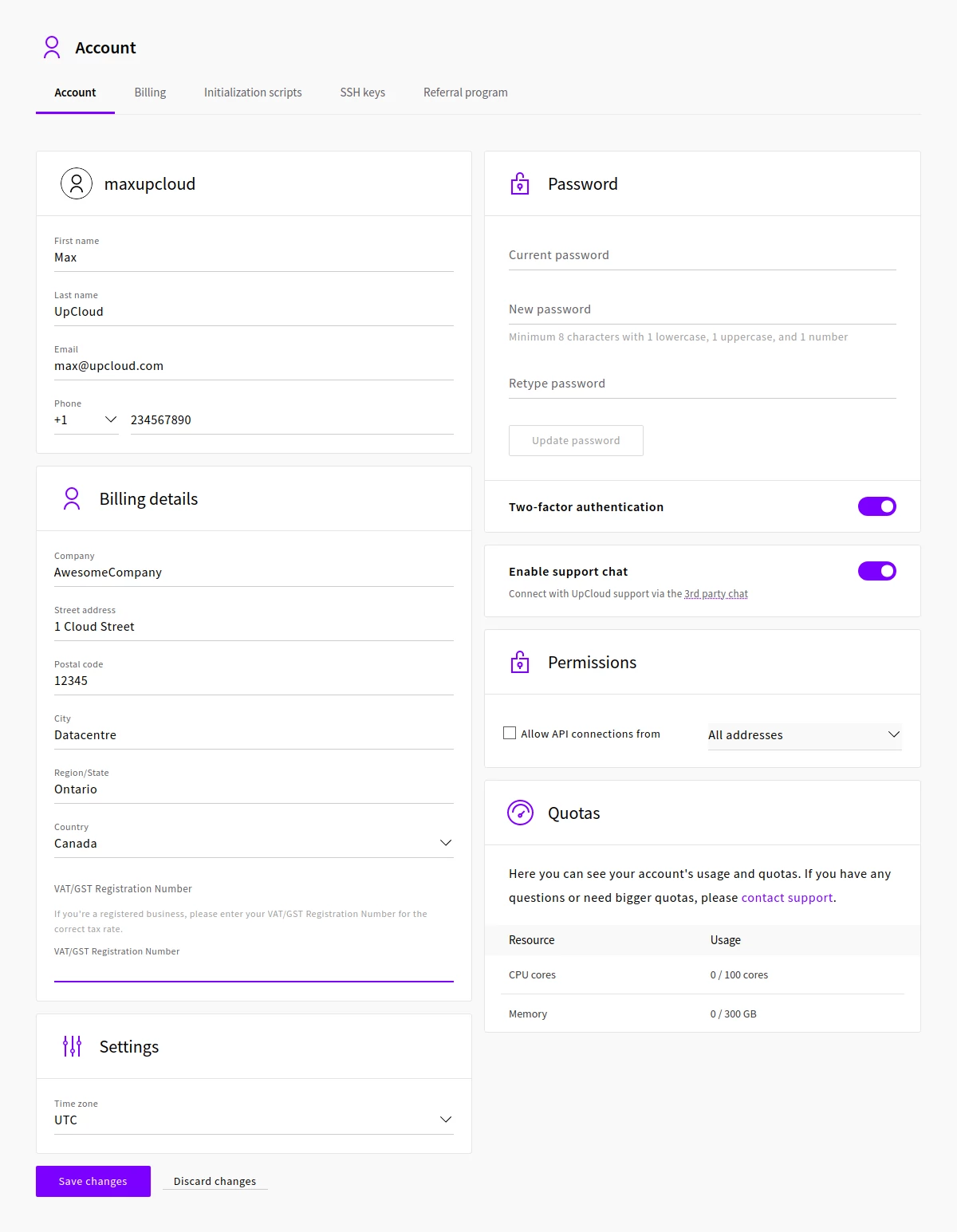

VAT And GST For International Businesses UpCloud

The Small Business Owners Guide To VAT Cashflow Manager UK

The Small Business Owners Guide To VAT Cashflow Manager UK

What Is A VAT Return FreeAgent

What Is A VAT WorldAtlas

VAT The Basics

What Is A Vat Summary - [desc-14]