What Is Additional Homestead Exemption Web An exemption equal to the assessed value of the property to an owner who has title to real estate in Florida with a just value less than 250 000 as determined in the first tax year that the owner applies and is eligible for the exemption and who has maintained permanent residence on the property for at least 25 years is 65 or older and whos

Web The additional exemption will be applied automatically to any property that currently is receiving a homestead exemption This additional exemption does not apply to the school board portion of your taxes which can be up to 40 of the tax bill How the additional exemption is calculated Web 19 Dez 2023 nbsp 0183 32 Homestead tax exemptions shelter a certain dollar amount or percentage of home value from property taxes They re called homestead exemptions because they apply to primary residences not rental properties or investment properties You must live in the home to qualify for the tax break

What Is Additional Homestead Exemption

What Is Additional Homestead Exemption

https://www.bankrate.com/2020/11/17092341/homestead-exemption.jpg

Reduce Florida Property Taxes With The Homestead Exemption South

https://sflsg.com/wp-content/uploads/2022/01/Homestead-Exemption-Document.png

Must Know Facts About Florida Homestead Exemptions Lakeland Real Estate

https://lakelandfloridaliving.com/wp-content/uploads/2021/09/Things-To-Know-About-Florida-Homestead-Exemption-663x1024.png

Web 6 Dez 2021 nbsp 0183 32 In Florida the homestead exemption lets you claim up to 50 000 the first 25 000 of the property s value is exempt from property taxes and if the property is worth over 50 000 there is an additional exemption of Web What is the additional 25 000 Homestead Exemption for and who can receive this All persons receiving the standard Homestead Exemption and who continue to qualify for that exemption automatically qualify to receive the additional Homestead Exemption No further application is necessary

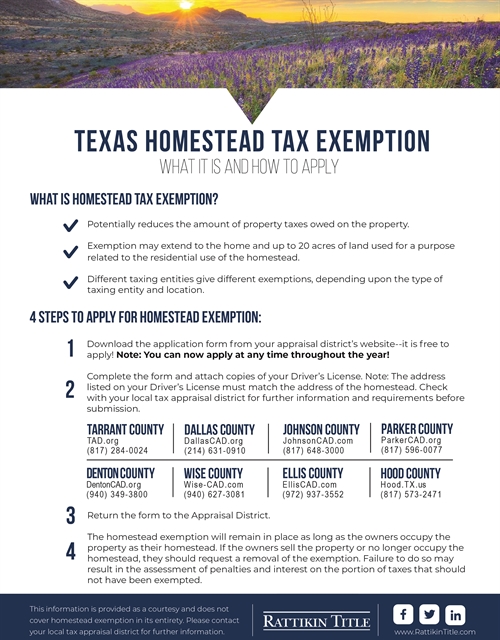

Web 21 Aug 2019 nbsp 0183 32 Texans can also claim an additional 3 000 exemption for certain county taxes In California however the exemption is much lower The first 7 000 of the value of the home is not taxed Web 30 Sept 2022 nbsp 0183 32 A homestead exemption is when a state reduces the property taxes you have to pay on your home It can also help prevent you from losing your home during economic hardship by protecting you from creditors The exact rules and amounts vary wildly but you could save a decent amount of money on your annual tax bill

Download What Is Additional Homestead Exemption

More picture related to What Is Additional Homestead Exemption

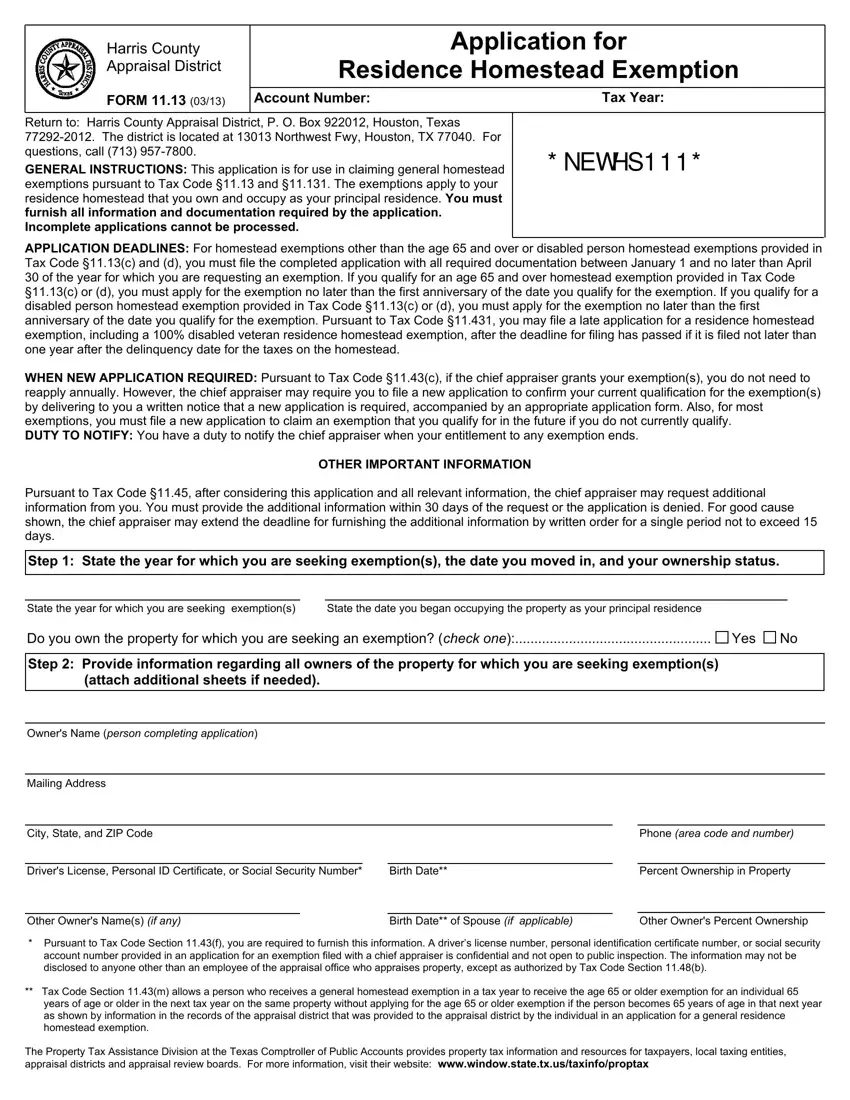

Harris County Homestead Exemption Form ExemptForm

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/harris-county-homestead-exemption-form-printable-pdf-download-3.png

Filing For Homestead Exemption In Georgia

https://www.heathermurphygroup.com/wp-content/uploads/2023/03/HMG-Filing-for-Homestead-Exemption-in-Georgia.png

What Is A Homestead Exemption For Property Ta Bios Pics

https://www.joecloud.com/wp-content/uploads/2022/01/1.png

Web 24 Apr 2022 nbsp 0183 32 The homestead exemption often can help you reduce your property tax bill In some states homestead exemptions help protect the equity you have in your homes during legal proceedings Rules for what the homestead exemption does who it applies to and how to file for it differ from state to state Web When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent the property owner may be eligible to receive a homestead exemption that would decrease the property s taxable value by as much as 50 000 This exemption qualifies the home for the Save Our Homes assessment

Web The homestead exemption is a legal regime to protect the value of the homes of residents from property taxes creditors and circumstances that arise from the death of the homeowner s spouse Such laws are found in the statutes or the constitution of many of the states in the United States Web Low Income Senior s Additional Homestead Exemption Many Florida senior citizens are now eligible to claim an additional 25 000 Exemption which applies only to the County s portion of the taxes and city taxes for residents of cities which also adopted the

Legislation To Increase Income Qualifier For Additional Homestead

https://1.bp.blogspot.com/-rIkPtIpXP9o/XmJd8LKgYzI/AAAAAAAAQEw/AjhyJBQ-y4Q1NobFfoulvUjOBkgyyDdsQCLcBGAsYHQ/s1600/homestead%2Bexemption.jpg

York County Sc Residential Tax Forms Homestead Exemption CountyForms

https://i0.wp.com/www.countyforms.com/wp-content/uploads/2022/10/sc-application-for-homestead-exemption-fill-and-sign-printable.png

https://floridarevenue.com/.../Documents/AdditionalHomeste…

Web An exemption equal to the assessed value of the property to an owner who has title to real estate in Florida with a just value less than 250 000 as determined in the first tax year that the owner applies and is eligible for the exemption and who has maintained permanent residence on the property for at least 25 years is 65 or older and whos

https://www.miamidade.gov/pa/exemptions_homestead_additional.asp

Web The additional exemption will be applied automatically to any property that currently is receiving a homestead exemption This additional exemption does not apply to the school board portion of your taxes which can be up to 40 of the tax bill How the additional exemption is calculated

What Is A Homestead Exemption And Do You Qualify WalletGenius

Legislation To Increase Income Qualifier For Additional Homestead

Homestead Exemptions What You Need To Know Rachael V Peterson

Homestead Exemption

Miami dade County Claim Of Exemption Form ExemptForm

THE HOMESTEAD EXEMPTION DEADLINE IS MARCH 1st The Sheehan Agency

THE HOMESTEAD EXEMPTION DEADLINE IS MARCH 1st The Sheehan Agency

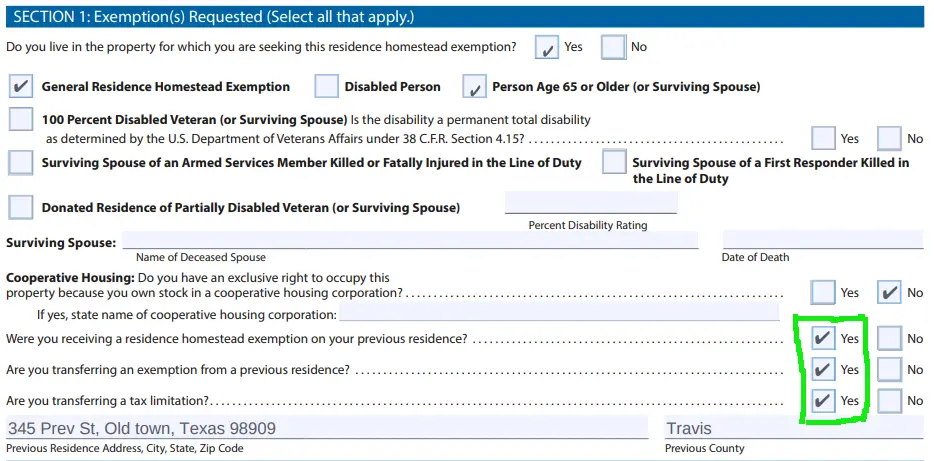

How To Fill Out Texas Homestead Exemption Form 50 114 The Complete

Dallas County Homestead Exemption Form 2023 Printable Forms Free Online

Texas Homestead Exemption Form Fill Out Printable PDF Forms Online

What Is Additional Homestead Exemption - Web What is the additional 25 000 Homestead Exemption for and who can receive this All persons receiving the standard Homestead Exemption and who continue to qualify for that exemption automatically qualify to receive the additional Homestead Exemption No further application is necessary