What Is California Tax Rate On Capital Gains This means your capital gains taxes will run between 1 up to 13 3 depending on your overall income and corresponding California tax bracket Determining Your 2020 California Income Tax

In this article we ll explain what capital gains are how they are taxed in California We ll also show you different tax planning strategies that can significantly reduce your state capital gains tax Sell appreciated assets in a tax exempt trust through Charitable Remainder Trusts California s capital gains tax rates align with its progressive income tax system ranging from 1 to 13 3 The tax rate is determined by an individual s taxable income and filing status For instance single filers with taxable income exceeding 1 million face the highest rate of 13 3

What Is California Tax Rate On Capital Gains

What Is California Tax Rate On Capital Gains

https://i.insider.com/5e4317b83ac0c9352d748930?width=700&format=jpeg&auto=webp

Capital Gains Are The Profits You Make From Selling Your Investments

https://www.businessinsider.in/photo/79520838/Master.jpg

California State Taxes What You Need To Know Russell Investments

https://russellinvestments.com/-/media/images/us/blogs/images/kuhariccajuly20_1.jpg?la=en&hash=717E899384790A3236829815D21264B377FC4FB8

All taxpayers must report gains and losses from the sale or exchange of capital assets California does not have a lower rate for capital gains All capital gains are taxed as ordinary income Understanding California capital gains tax rate obligations can help you make proactive money moves to minimize your taxes owed to the Franchise Tax Board How Does California Tax Capital Gains Simply put California taxes all capital gains as regular income

The capital gains tax rate is in line with normal California income tax laws 1 13 3 These California capital gains tax rates can be lower than the federal capital gains tax rates which Discover the essential information on California s capital gains tax for 2024 with our comprehensive guide Learn about rates exemptions filing requirements and strategies to minimise your tax burden

Download What Is California Tax Rate On Capital Gains

More picture related to What Is California Tax Rate On Capital Gains

Short Term And Long Term Capital Gains Tax Rates By Income Free

https://i2.wp.com/financialsamurai.com/wp-content/uploads/2021/11/2022-singles-ST-LT-capital-gains-tax-rates.png

Capital Gains Tax Long Term Short Term Rates Calculation

https://www.wallstreetmojo.com/wp-content/uploads/2022/06/Capital-Gains-tax-rates-1.jpg.webp

Here s The Truth Raising Cap Gains Tax Won t Hurt Economy

https://assets.realclear.com/images/54/543513_6_.jpg

Apply the Appropriate Tax Rate In California long term capital gains are taxed at different rates than short term capital gains As of the latest information available long term capital gains tax rates in California range from 0 to 13 3 depending on the taxpayer s income level California Capital Gains Tax A tax on profits from the sale of assets including real estate and investments Short term vs Long term Gains Different tax rates based on the holding period of the asset Tax Brackets and Rates Understanding how California s tax brackets affect your capital gains

[desc-10] [desc-11]

:max_bytes(150000):strip_icc()/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

Capital Gains Tax 101

https://www.investopedia.com/thmb/lF5n0-4I2IMi0ew-IrYCmTmINzk=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png

A Guide To Short term Vs Long term Capital Gains Tax Rates TheStreet

https://www.thestreet.com/.image/t_share/MTk3MDQyNTMwNDMxMjgwNDQ3/screenshot-2023-04-05-at-11017-pm.png

https://www.forbes.com/sites/davidrae/2021/02/23/what-are-capital...

This means your capital gains taxes will run between 1 up to 13 3 depending on your overall income and corresponding California tax bracket Determining Your 2020 California Income Tax

https://learn.valur.com/california-capital-gains-tax

In this article we ll explain what capital gains are how they are taxed in California We ll also show you different tax planning strategies that can significantly reduce your state capital gains tax Sell appreciated assets in a tax exempt trust through Charitable Remainder Trusts

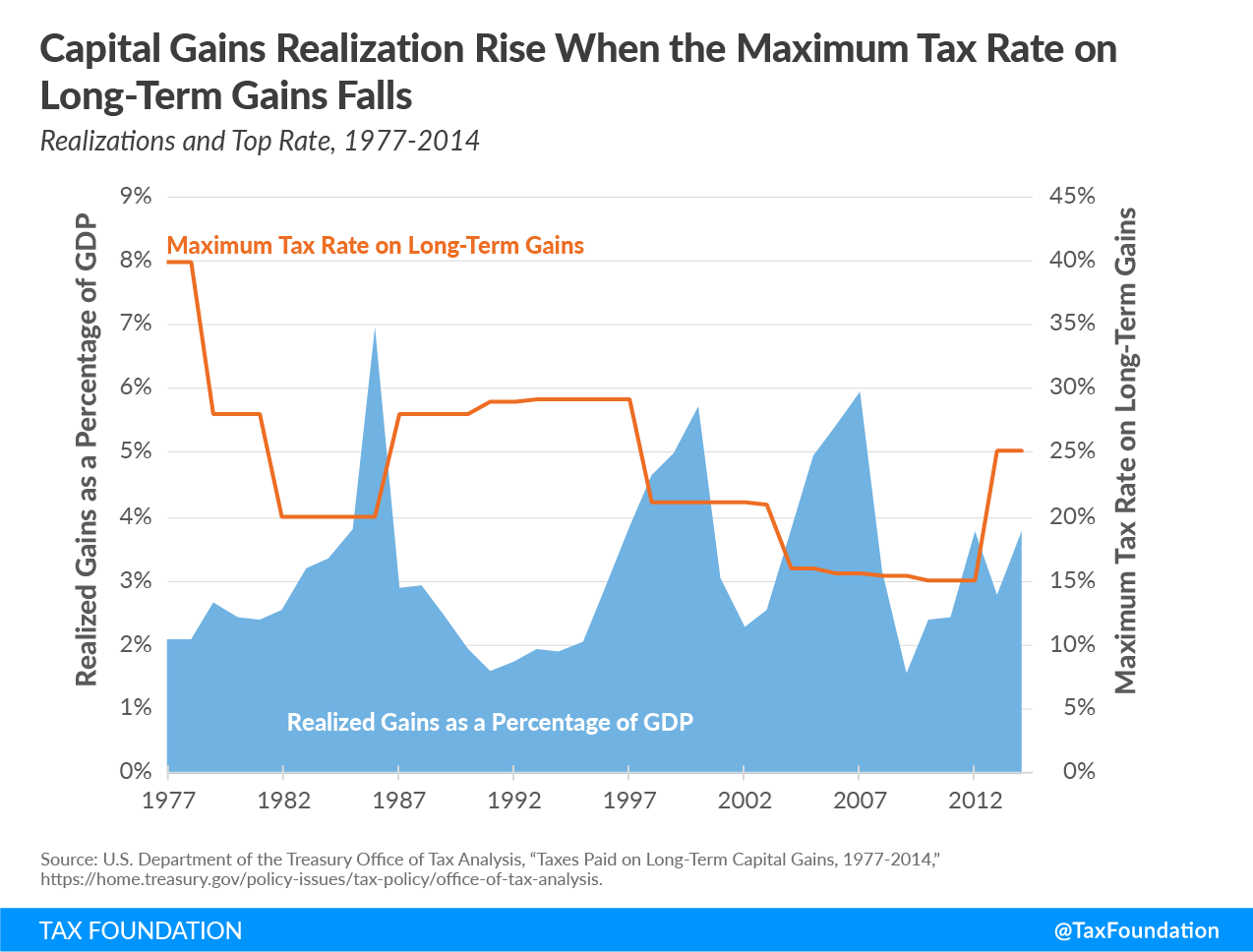

How High Are Capital Gains Taxes In Your State Tax Foundation

:max_bytes(150000):strip_icc()/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

Capital Gains Tax 101

Capital Gains Taxes Are Going Up Tax Policy Center

Capital Gains Tax Notes GAINS DERIVED FROM DEALINGS IN PROPERTY

Understanding The Capital Gains Tax A Case Study

2021 Capital Gains Tax Rates In Europe Tax Foundation

2021 Capital Gains Tax Rates In Europe Tax Foundation

Short Term And Long Term Capital Gains Tax Rates By Income

An Overview Of Capital Gains Taxes Tax Foundation

Capital Gains Tax Brackets For Home Sellers What s Your Rate Tax

What Is California Tax Rate On Capital Gains - All taxpayers must report gains and losses from the sale or exchange of capital assets California does not have a lower rate for capital gains All capital gains are taxed as ordinary income