What Is Capital Allowance Assets What are capital allowances In a nutshell capital allowances enable you to reduce your taxable income by accounting for the capital assets you use for your

Capital allowances are a type of tax relief which businesses can claim when they invest in long term assets Sometimes known as fixed assets or capital assets these are assets which you The main difference between capital allowances and depreciation is that capital allowances allow businesses to deduct the cost of capital assets from their taxable profits reducing the tax they owe

What Is Capital Allowance Assets

What Is Capital Allowance Assets

https://media.licdn.com/dms/image/D5612AQGxIS8bLBl8tw/article-cover_image-shrink_720_1280/0/1684151975428?e=2147483647&v=beta&t=EfOuem3iSEhXYJZIBaVxszzWmAYh9P_LN3ty4MX8Zw4

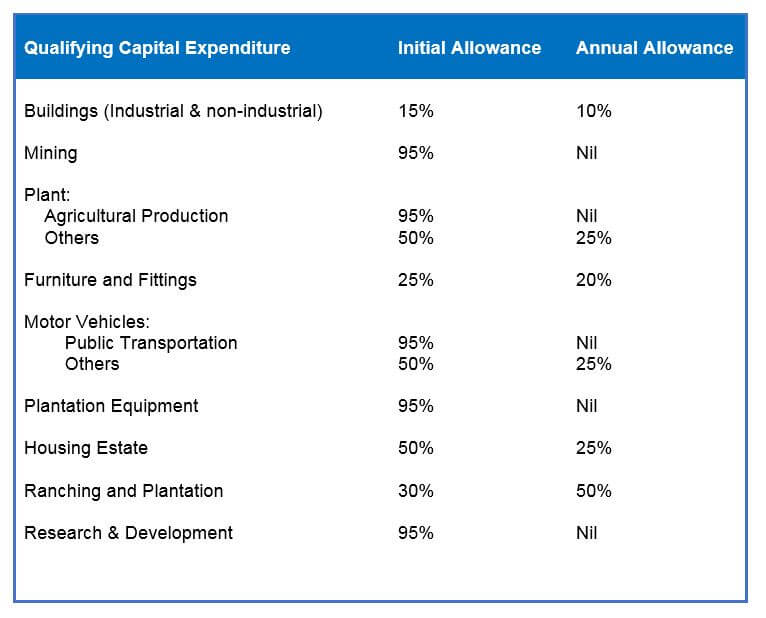

Capital Allowance In Nigeria Bomes Resources Consulting BRC

https://www.bomesresourcesconsulting.com/wp-content/uploads/2018/10/capital-alowance-rates.jpg

Capital Allowance Assets Disposal Of Capital Assets

https://www.bellhowleyperrotton.co.uk/images/2022/07/19/capital-allowance-assets.jpeg

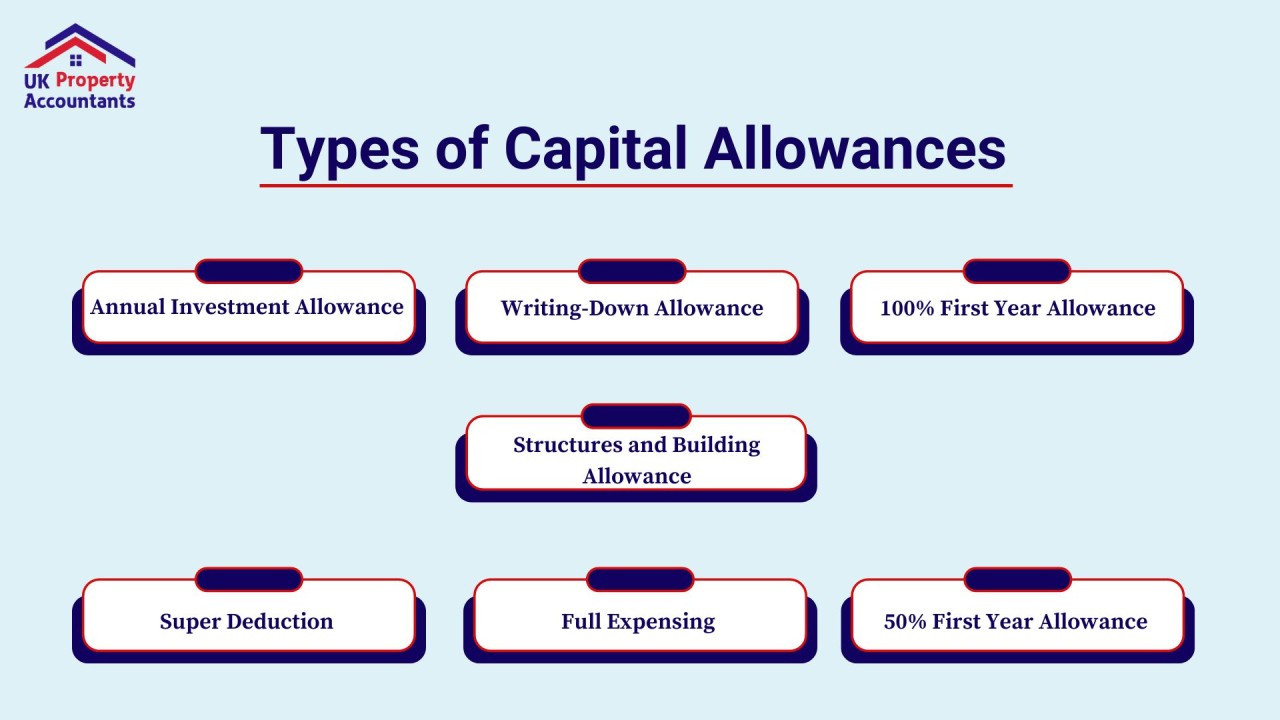

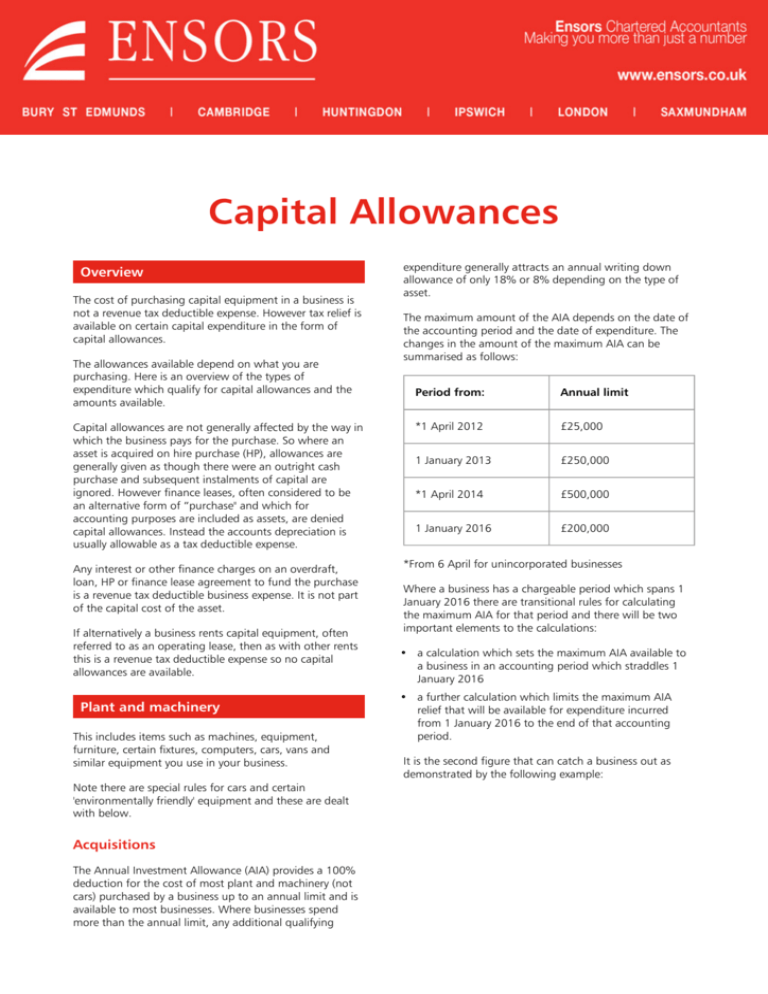

Capital allowances is the practice of allowing tax payers to get tax relief on capital expenditure by allowing it to be deducted against their annual taxable income Claim capital allowances so your business pays less tax when you buy assets equipment fixtures business cars plant and machinery annual investment allowance

A capital allowance is the amount of capital investment costs or money directed towards a company s long term growth a business can deduct each year from its revenue via depreciation These are also sometimes Understand the basics of capital allowances define what is and isn t capital expenditure recognise who can claim capital allowances and how they are claimed identify

Download What Is Capital Allowance Assets

More picture related to What Is Capital Allowance Assets

Capital Allowance Calculation Malaysia With Examples SQL Account

https://cdn.sql.com.my/wp-content/uploads/2021/07/building.jpg

Guide About What Is Capital Allowance AccountingFirms

https://www.accountingfirms.co.uk/wp-content/uploads/2022/07/What-is-Capital-Allowance-1.png

What Are Capital Allowances Understanding The Basics

https://www.moneytaskforce.com/wp-content/uploads/2020/09/22a1dc7c52ed67d420dd5d007a44fbe8.jpg

Claim capital allowances so your business pays less tax when you buy assets equipment fixtures business cars plant and machinery annual investment allowance Where an asset is temporarily disused for business purposes it is still entitled for capital allowances provided the asset was in use immediately prior to the disuse and

General depreciation rules set the amounts capital allowances that can be claimed based on the asset s effective life You may be able to claim an immediate deduction Capital allowances are a horrendously complex area of UK tax but claiming allowances wherever possible can help a business make a big dent in its tax

Advisorsavvy What Is Capital Cost Allowance

https://advisorsavvy.com/wp-content/uploads/2022/06/What-is-Capital-Cost-Allowance-600x338.jpg

What Is Capital Allowance Maven Solutions

https://mavensolutions.co.uk/wp-content/uploads/2022/06/Capital-Allowance.jpg

https://quickbooks.intuit.com/global/resources/...

What are capital allowances In a nutshell capital allowances enable you to reduce your taxable income by accounting for the capital assets you use for your

https://www.theaccountancy.co.uk/tax/ta…

Capital allowances are a type of tax relief which businesses can claim when they invest in long term assets Sometimes known as fixed assets or capital assets these are assets which you

What Is Capital Allowance And Industrial Building Allowance How To

Advisorsavvy What Is Capital Cost Allowance

Notes Capital Allowance CAPITAL ALLOWANCE Capital Allowance Is A

What Is Capital Allowance Capital Claims Tax Depreciation

Capital Allowances

Capital Allowances Performance Accountancy

Capital Allowances Performance Accountancy

Capital Works Allowance Kingsman Accountants

What Is Capital Allowance How Does It Work

What Is Capital Allowance YouTube

What Is Capital Allowance Assets - Capital allowances is the practice of allowing tax payers to get tax relief on capital expenditure by allowing it to be deducted against their annual taxable income