What Is Capital Allowance Capital allowances are a type of tax relief for businesses They let you deduct some or all of the value of an item from your profits before you pay tax You can claim capital allowances on

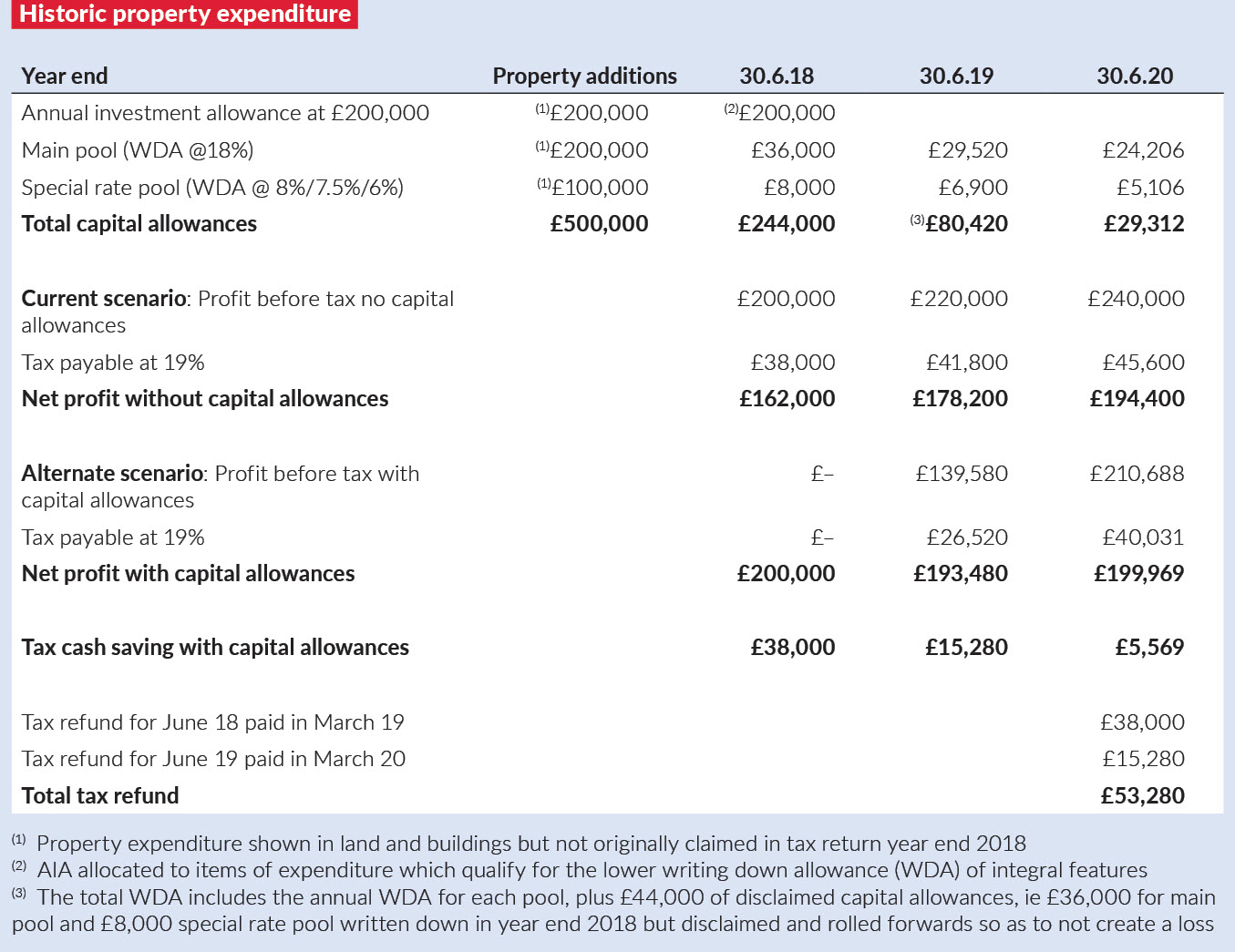

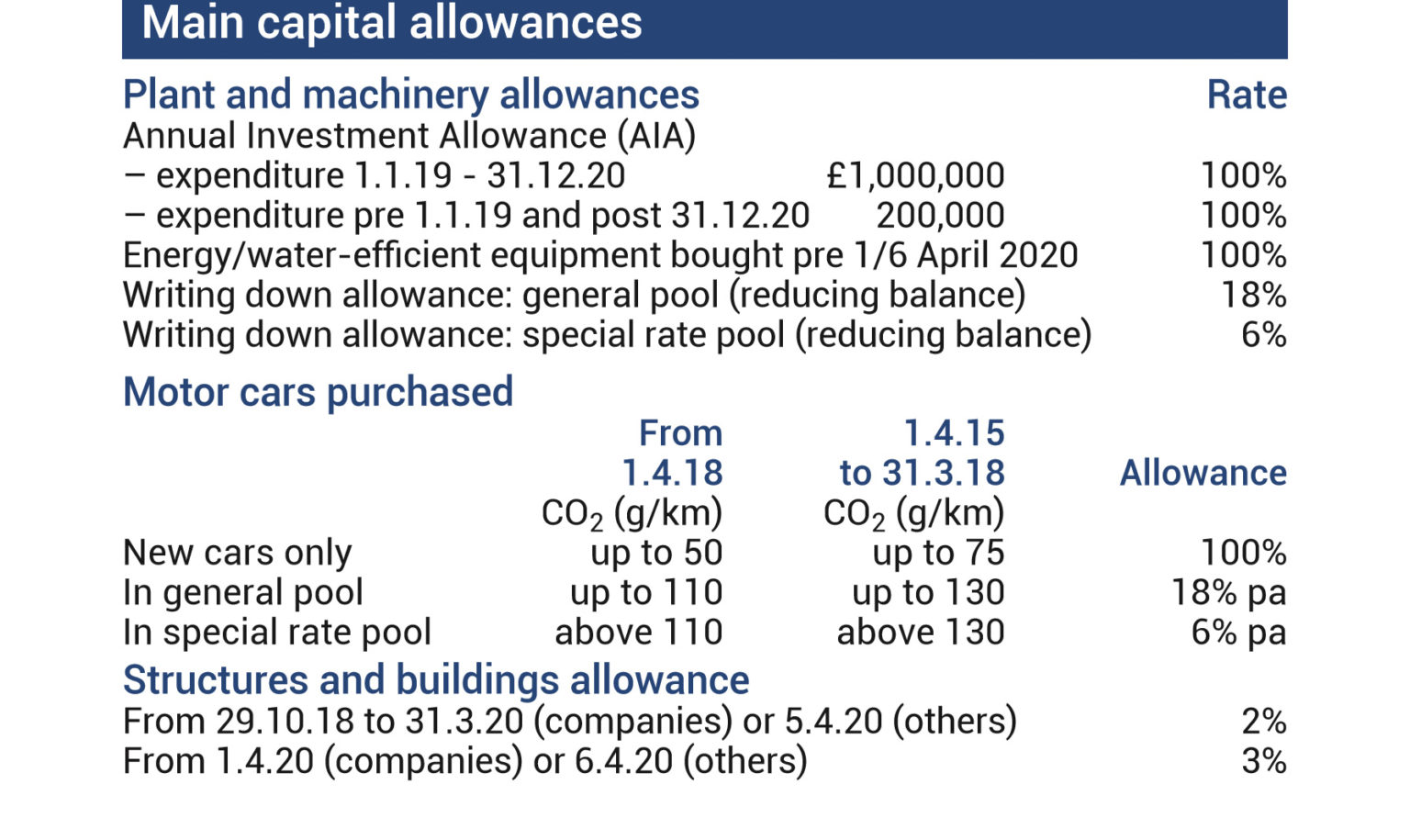

Capital allowances reduce a business s taxable profits and enable it to retain more of its profits With depreciation not allowable for tax purposes a thorough understanding of capital allowances is critical in managing the tax liability for Capital allowances are a type of tax relief which businesses can claim when they invest in long term assets Sometimes known as fixed assets or capital assets these are assets which you can reasonably expect to stay in use by the business for longer than 12 months

What Is Capital Allowance

What Is Capital Allowance

https://media.licdn.com/dms/image/D5612AQGxIS8bLBl8tw/article-cover_image-shrink_720_1280/0/1684151975428?e=2147483647&v=beta&t=EfOuem3iSEhXYJZIBaVxszzWmAYh9P_LN3ty4MX8Zw4

Chapter 7 Capital Allowances Students

https://image.slidesharecdn.com/chapter7capitalallowancesstudents-141101025109-conversion-gate02/95/chapter-7-capital-allowances-students-24-638.jpg?cb=1414815446

What Is Capital Allowance YouTube

https://i.ytimg.com/vi/hWzFyQItOdY/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4Ab4HgAKAD4oCDAgAEAEYciBGKDkwDw==&rs=AOn4CLDP2YFDV_IrPwVelEjwcfhRMOUJwQ

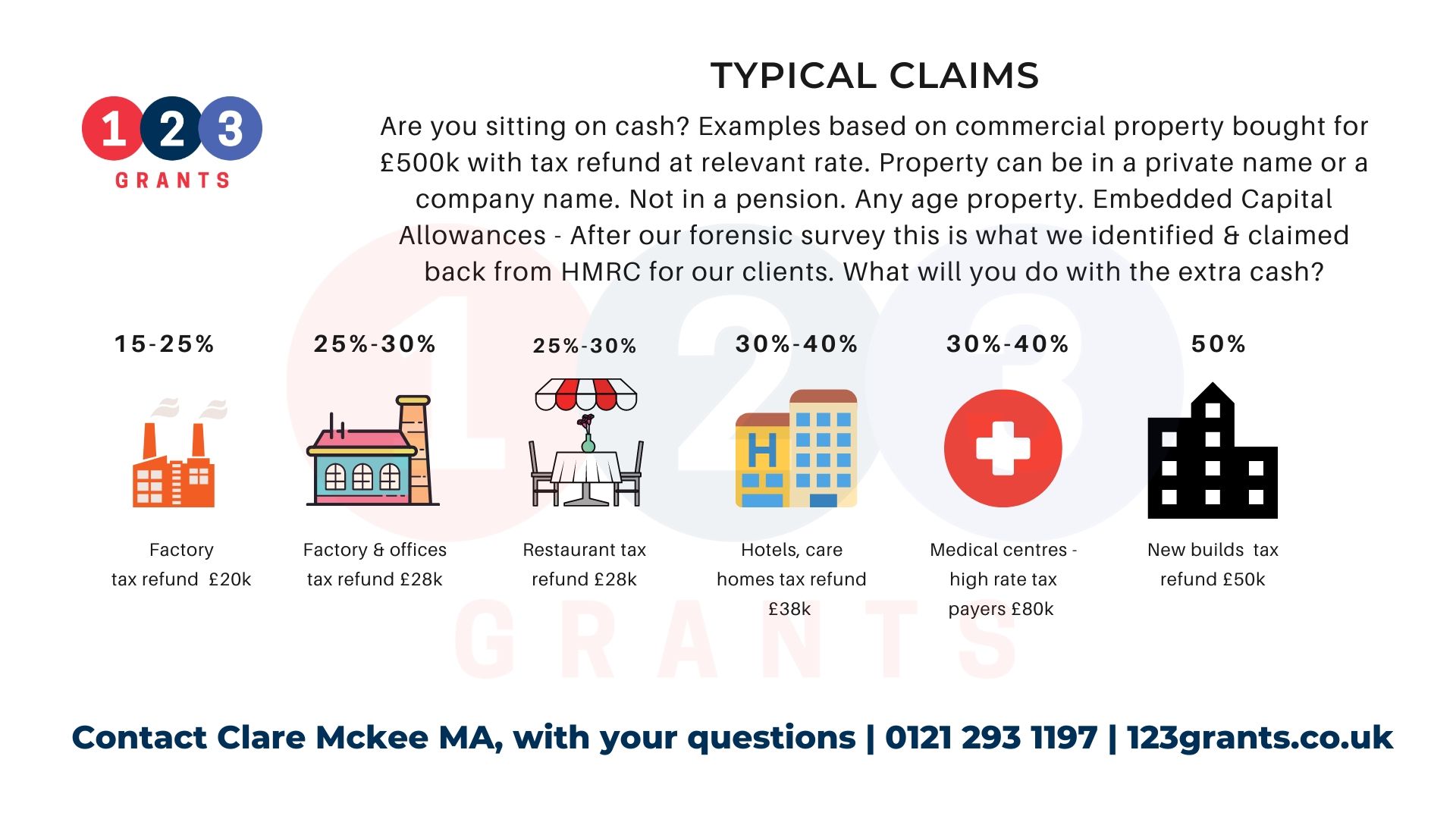

Capital allowances explained What is tax depreciation capital allowances Capital allowances are akin to a tax deductible expense and are available in respect of qualifying capital expenditure incurred on the provision of certain assets in use for the purposes of a trade or rental business What are capital allowances In a nutshell capital allowances enable you to reduce your taxable income by accounting for the capital assets you use for your business Capital allowances can typically be claimed on capital expenditure for tangible and intangible assets including equipment vehicles property research and patents

What Is Capital Allowance Capital allowances are a way of reducing your end of year tax bill by making a claim against your taxable profit This is when you spend money on something that will benefit your business in its long term future Claim capital allowances so your business pays less tax when you buy assets equipment fixtures business cars plant and machinery annual investment allowance first year allowances

Download What Is Capital Allowance

More picture related to What Is Capital Allowance

Capital Allowances

https://irp-cdn.multiscreensite.com/d3078a70/dms3rep/multi/capital-allowances-table.jpg

What Is Capital Allowance YouTube

https://i.ytimg.com/vi/15FAy96N614/maxresdefault.jpg

Guide About What Is Capital Allowance AccountingFirms

https://www.accountingfirms.co.uk/wp-content/uploads/2022/07/What-is-Capital-Allowance-1.png

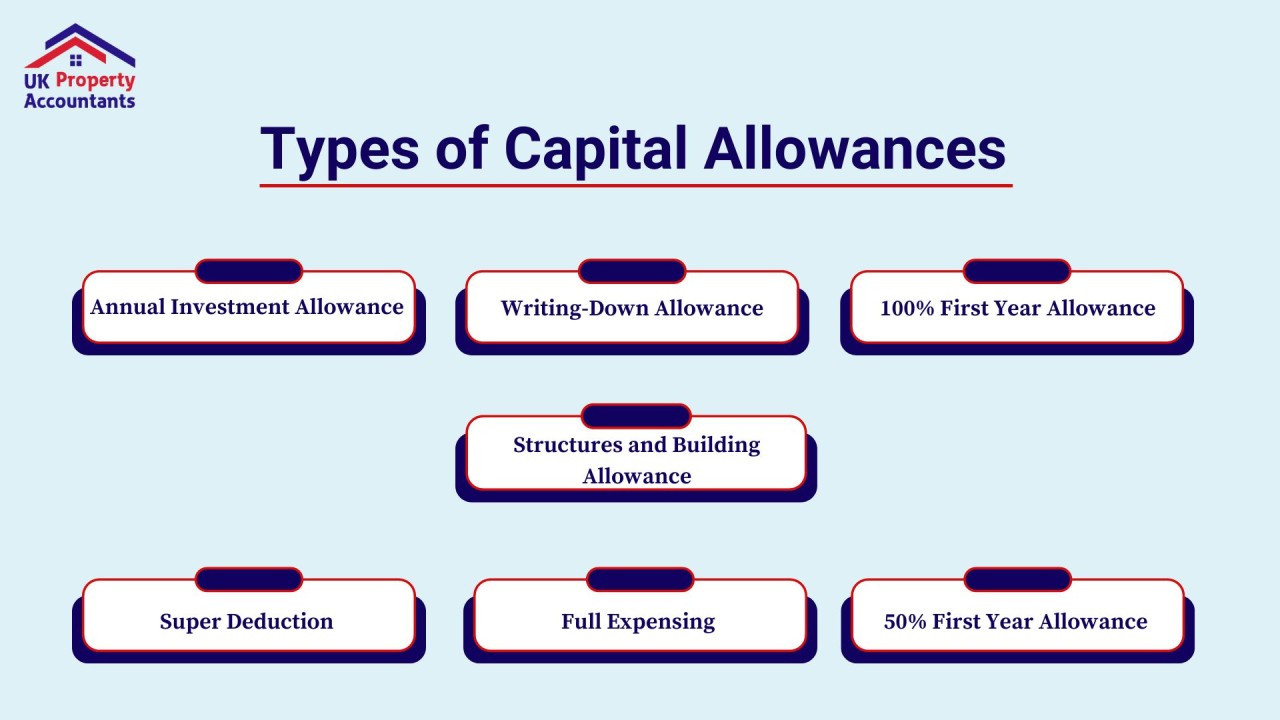

Claim capital allowances so your business pays less tax when you buy assets equipment fixtures business cars plant and machinery annual investment allowance first year allowances Capital allowances are the means by which tax relief is given for some but not all capital expenditure They are effectively a standardised tax deductible version of depreciation or amortisation broadly intended to give tax relief which reflects the economic lives of business assets

[desc-10] [desc-11]

What Are Capital Allowances UWM Accountants

https://uwm.co.uk/wp-content/uploads/2022/02/what-is-capital-allowance.jpg

Capital Allowances

https://parkerhartley.co.uk/wp-content/uploads/2019/03/Capital-Allowances.jpg

https://www.gov.uk/capital-allowances

Capital allowances are a type of tax relief for businesses They let you deduct some or all of the value of an item from your profits before you pay tax You can claim capital allowances on

https://www.accaglobal.com/gb/en/member/discover/...

Capital allowances reduce a business s taxable profits and enable it to retain more of its profits With depreciation not allowable for tax purposes a thorough understanding of capital allowances is critical in managing the tax liability for

What Is Capital Allowance Your Tax Questions Explained

What Are Capital Allowances UWM Accountants

What Is Capital Allowance And Industrial Building Allowance How To

What Is Capital Allowance

Capital Allowances Commercial Property Unlock 000 s 123 Grants

What Is Capital Allowance Claim What Is Capital Capitals Allowance

What Is Capital Allowance Claim What Is Capital Capitals Allowance

Capital Allowances

Self employed Capital Allowances What Can You Claim Which

Advisorsavvy What Is Capital Cost Allowance

What Is Capital Allowance - What are capital allowances In a nutshell capital allowances enable you to reduce your taxable income by accounting for the capital assets you use for your business Capital allowances can typically be claimed on capital expenditure for tangible and intangible assets including equipment vehicles property research and patents