What Is Deduction Under Section 80d Under Section 80DDB the maximum deduction is Rs 1 lakh per dependent Explore Section 80D of the Income Tax Act to understand deductions available for medical and health insurance premiums Learn about eligibility limits and how to maximize your tax benefits for yourself and your family

Section 80D of the Income tax Act 1961 allows an individual to claim deduction from gross taxable income The deduction can be claimed if an individual has paid medical insurance premium during the year for self spouse and dependent children A preventive health check up under Section 80D refers to a deduction allowed by The Income Tax Act 1961 for expenses incurred on health check ups It was introduced by the government in the financial year 2013 14 with the purpose of preventing the onset or worsening of illnesses

What Is Deduction Under Section 80d

What Is Deduction Under Section 80d

https://www.indianivesh.in/CmsApp/MediaGalary/images/Section 80D_1-202003061333183976953.jpg

Section 80D Deduction In Respect Of Health Or Medical Insurance

http://incometaxmanagement.com/Pages/Tax-Ready-Reckoner/GTI/Tax-Deductions/Maximum Deduction Amount under Section 80D.jpg

Deduction Under Section 80D Medical Insurance Tax Saving YouTube

https://i.ytimg.com/vi/rLNZXvzHDFs/maxresdefault.jpg

Yes under Section 80D taxpayers can avail of tax deduction up to INR 25 000 per year for medical premium paid for self family and dependent who are under 60 years of age Under Section 80D you can claim deductions for the following expenses incurred on healthcare Medical insurance premium paid for self spouse dependent children and parents Expenses incurred on preventive health checkups but within the overall limit

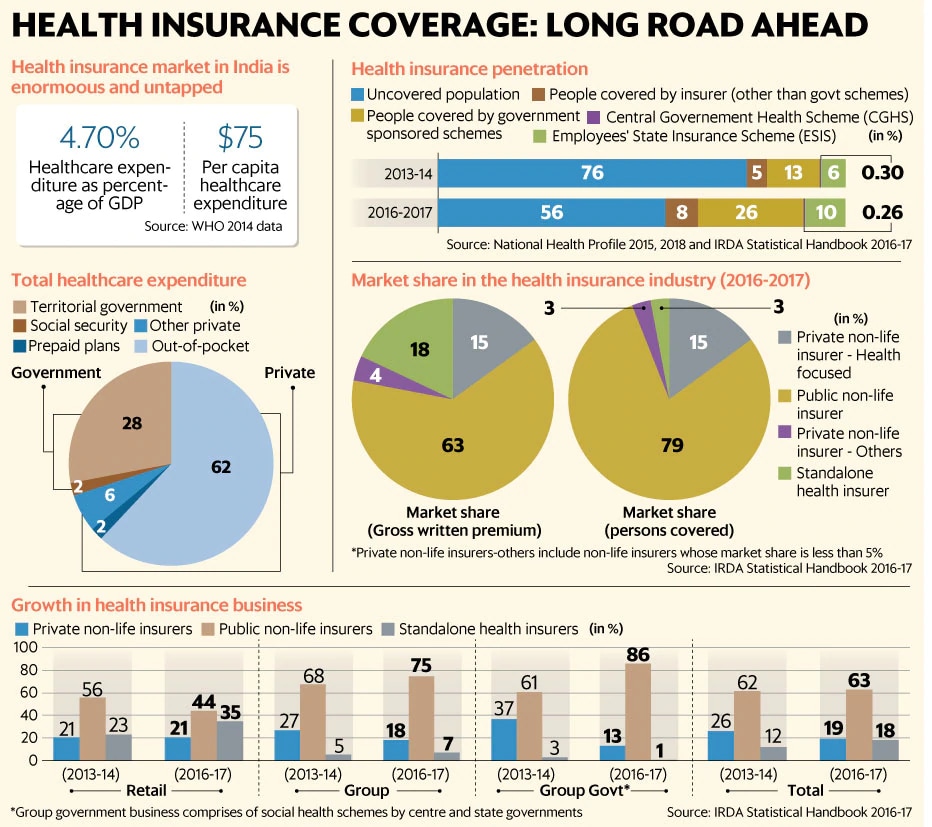

Deduction under section 80D is available basically for two types of payment namely 1 Medical insurance premium including preventive health check up and 2 Medical expenditure Categories of persons qualifying for deduction under section 80D Deduction under section 80D is available to the following categories of persons An How can you claim deduction under section 80D The maximum deduction to be claimed under section 80D depends on how many people are covered under the insurance cover Depending on the taxpayer s family situation and the respective people covered under the policy the limit could be Rs 25 000 Rs 50 000 Rs 75 000 or Rs 1 lakh

Download What Is Deduction Under Section 80d

More picture related to What Is Deduction Under Section 80d

Deductions Under Chapter VIA

https://life.futuregenerali.in/media/5utfvrlk/chapter-via-section.jpg

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

https://i.ytimg.com/vi/Q6z6wI7m9Eo/maxresdefault.jpg

Section 80C Deductions List Save Income Tax With Section 80C Options

https://i.ytimg.com/vi/6nlYwNEIo48/maxresdefault.jpg

Individuals and HUF Hindu Undivided Family can file for a tax claim deduction from taxable income under Section 80D If you pay premiums for health insurance coverage that you your spouse your children or your parents have purchased you will be qualified for a tax deduction under Section 80D Under Section 80D of the Income Tax Act an individual can claim a deduction for the following medical expenses incurred during the financial year Medical insurance premium paid by the taxpayer through any mode of payment other than cash

What is Deduction under section 80D Section 80D of the Income Tax Act allows a deduction to an Individual including non resident individuals or HUF for the amount paid towards medical insurance premiums medical expenditures and preventive health checkups in As clearly indicated by the table under Section 80D you can claim a deduction of up to 25 000 per financial year This limit is applicable on premiums paid towards health insurance that you purchase for yourself your spouse and your dependent children

80D Tax Deduction Under Section 80D On Medical Insurance

https://www.bajajfinservmarkets.in/content/dam/bajajfinserv/banner-website/tax-savings/section-80d.png

Know About Health Insurance Tax Benefits Under Section 80D

https://www.taxhelpdesk.in/wp-content/uploads/2022/04/Know-About-Health-Insurance-Tax-Benefits-Under-Section-80D.png

https://tax2win.in/guide/section-80d-deduction...

Under Section 80DDB the maximum deduction is Rs 1 lakh per dependent Explore Section 80D of the Income Tax Act to understand deductions available for medical and health insurance premiums Learn about eligibility limits and how to maximize your tax benefits for yourself and your family

https://economictimes.indiatimes.com/wealth/tax/...

Section 80D of the Income tax Act 1961 allows an individual to claim deduction from gross taxable income The deduction can be claimed if an individual has paid medical insurance premium during the year for self spouse and dependent children

Section 80D Deduction

80D Tax Deduction Under Section 80D On Medical Insurance

Section 80M Deductions YouTube

Section 80D Deduction Eligibility Deduction Calculation

Whether Section 80C 80D Deduction Can Be Claimed By Filing

Section 80D Deduction Amount Benefits And Eligibility

Section 80D Deduction Amount Benefits And Eligibility

Deductions Under Section 80D Benefits Works Myfinopedia

Deductions Under Section 80D To 80U Legal Suvidha Providers

Section 80D Deduction For Medical Insurance Health Checkups

What Is Deduction Under Section 80d - Deduction under section 80D is available basically for two types of payment namely 1 Medical insurance premium including preventive health check up and 2 Medical expenditure Categories of persons qualifying for deduction under section 80D Deduction under section 80D is available to the following categories of persons An