What Is Earned Income Tax Credit Ireland Web Earned Income Tax Credit Section 472AB of the Taxes Consolidation Act 1997 TCA 1997 was inserted by Finance Act 2015 and applies for the tax year 2016 and subsequent years It provides for a tax credit computed by reference to the standard rate of income tax in respect of an individual s earned income

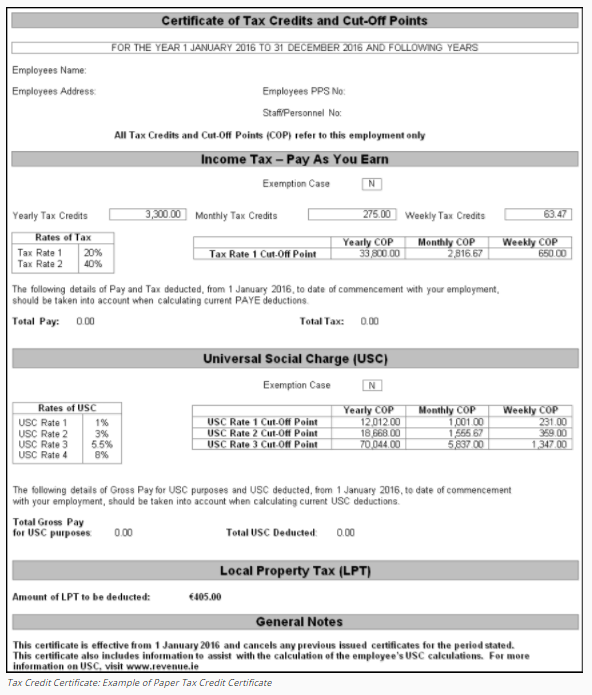

Web Tax credit 2024 2023 Single person 1 875 1 775 Married person or civil partner 3 750 3 550 Employee Tax Credit formerly known as the PAYE tax credit 1 875 1 775 Earned Income tax credit 1 875 1 775 Widowed Parent Tax Credit Bereaved in 2023 Bereaved in 2022 Bereaved in 2021 Bereaved in 2020 Bereaved Web 1 Jan 2024 nbsp 0183 32 Under the Pay As You Earn PAYE system tax credits are spread evenly throughout the year If you are working for the full year your tax credits will be divided into 52 equal weekly amounts if you are paid weekly 26 equal fortnightly amounts if you are paid fortnightly 12 equal monthly amounts if you are paid monthly

What Is Earned Income Tax Credit Ireland

What Is Earned Income Tax Credit Ireland

https://rightsolutioncentre.com/wp-content/uploads/2021/06/P4.png

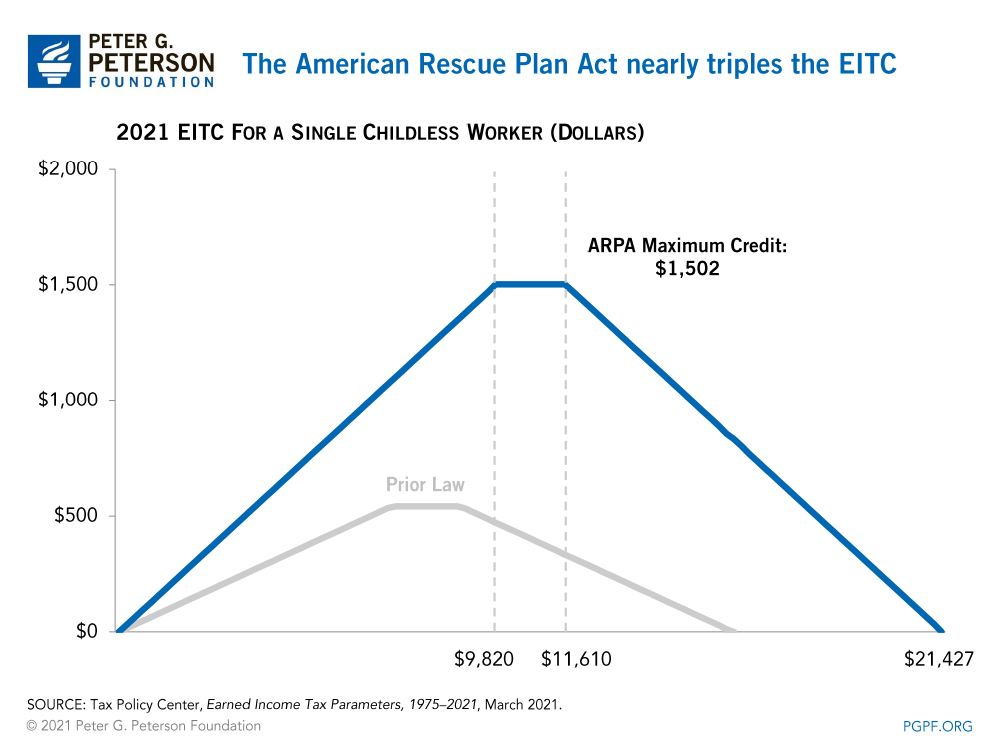

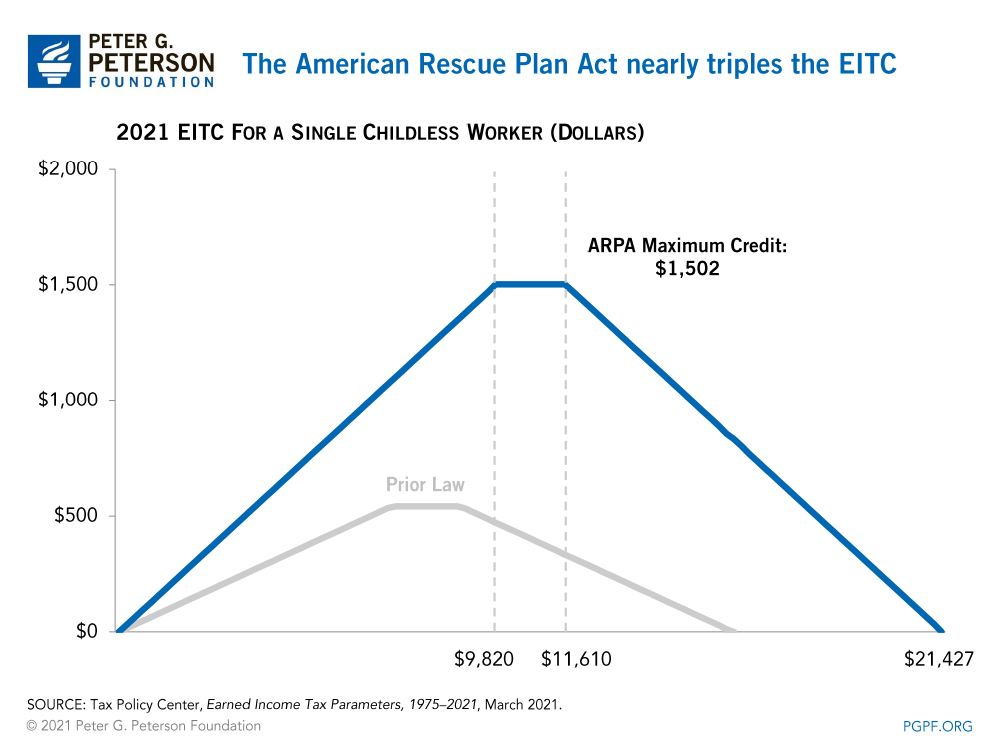

What Is The Earned Income Tax Credit

https://www.pgpf.org/sites/default/files/earned-income-tax-credit-eitc-chart-1.jpg

Earned Income Credit Worksheet Irs

https://i.pinimg.com/originals/aa/af/be/aaafbed0a4b639f5c32ede742b5dd17b.png

Web All PAYE taxpayers are entitled to a tax credit known as the Employee Tax Credit formerly known as the PAYE tax credit This is worth 1 775 in 2023 1 700 in 2022 If you are married and taxed under joint assessment then you and your spouse may both claim an Employee Tax Credit Benefits from employment Web What is the Earned Income Tax Credit all about In Budget 2018 self employed workers in Ireland saw the Earned Income Tax Credit raised from 950 to 1 150 Introduced in January 2016 to help level the playing field between the taxation of the self employed and that of PAYE workers in Ireland the credit is separate to the Employee Tax

Web For 2024 you can claim an Earned Income Tax Credit of 1 875 in 2023 the amount was 1 775 However if you also qualify for the Employee Tax Credit formerly known as the PAYE tax credit the combined value of these credits cannot be greater than the value of the Employee Tax Credit You must keep proper records which include Web 31 Dez 2023 nbsp 0183 32 From tomorrow January 1st 2024 the main tax credits personal employee and earned income will all increase by 100 from 1 775 to 1 875 There are also increases to the Home Carer Tax Credit Single Person Child Carer Tax Credit and Incapacitated Child Tax Credit The Standard Rate Cut Off Point will increase by 2 000

Download What Is Earned Income Tax Credit Ireland

More picture related to What Is Earned Income Tax Credit Ireland

Simple PAYE Taxes Guide Tax Refund Ireland

https://www.taxback.com/resources/blogimages/20171109164002.1510238402600.8c2f559ab8f84cbe048bbc7d250.png

Ireland s Income Tax Distribution Chart Colly tv

https://i1.wp.com/www.colly.tv/wp-content/uploads/income-distribution-ireland.png

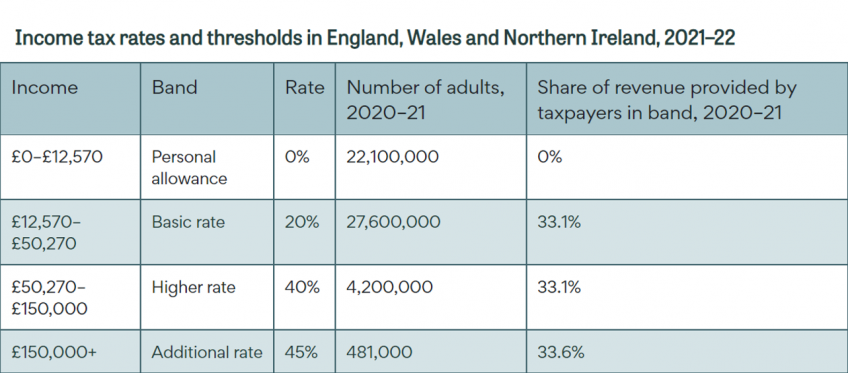

Income Tax Rates And Thresholds In England Wales And Northern Ireland

https://ifs.org.uk/sites/default/files/styles/wysiwyg_full_width_desktop/public/2021-06/Income tax rates and thresholds in England%2C Wales and Northern Ireland%2C 2021–22_0.png?itok=sAe2JxBC

Web 3 Juli 2023 nbsp 0183 32 Income tax relief is available to individuals who are resident in Ireland but who work outside Ireland The relief operates in such a way as to effectively exclude from Irish tax the income arising from a qualifying employment In order to qualify for the relief the individual must hold an employment outside Ireland for a continuous period of at Web Introduction to income tax credits and reliefs Tax reliefs reduce the amount of tax that you have to pay Find out about the different types of income tax relief that apply to your circumstances Housing tax credits and reliefs You can claim tax relief on some housing expenses and income Find out more

Web The Earned Income Tax Credit was introduced from 01 January 2016 and can be claimed by any person who has income from self employment The tax credit is worth 550 for the 2016 tax year and 950 for 2017 You should note however that if you are also entitled to claim the Employee PAYE Tax Credit for 2016 then the maximum tax relief that Web 3 Juli 2023 nbsp 0183 32 These individuals are only liable to income tax if their income is above a specified limit For 2023 the specified limit is EUR 18 000 for an individual who is single widowed and EUR 36 000 for a married couple These limits are increased in respect of dependent children Marginal relief may apply where the individuals total income

What Is The Earned Income Tax Credit

https://www.pgpf.org/sites/default/files/earned-income-tax-credit-eitc-chart-2.jpg

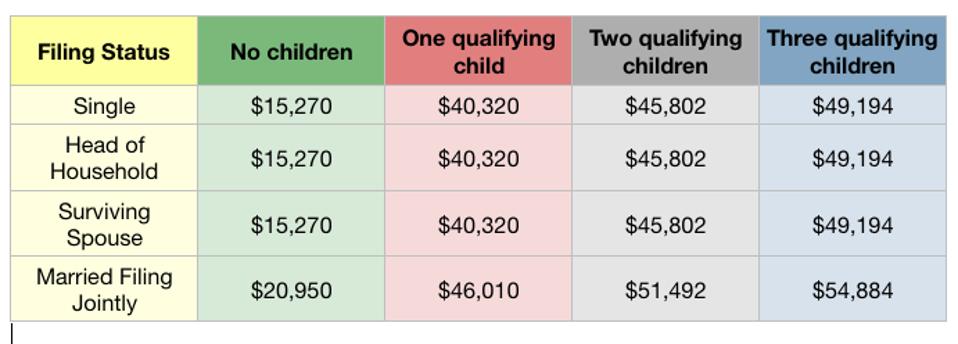

Earned Income Tax Credit EITC Who Qualifies

https://assets-global.website-files.com/600089199ba28edd49ed9587/63ab2cfeb6ed4e84980e9602_5Q05z7zzxkuPsQXDnaB9jShs6SVdcb0uB84DMBeLXFAIZJwwSAmHnQ4a7WbGqdLfxs9kSpNnGo8K3YMonR0wgBTu--Pgkhfuie7pFBG4XhGd3Kj-sMXIsb9rNoZWGXn0fc0IkJZa7T7C3Hhn3f492M_Gdep5jUnJluN29uavkjwe4XzK-GPA4B6nDNjE00CQKNhoDAt7LA.png

https://www.revenue.ie/en/tax-professionals/tdm/income-tax …

Web Earned Income Tax Credit Section 472AB of the Taxes Consolidation Act 1997 TCA 1997 was inserted by Finance Act 2015 and applies for the tax year 2016 and subsequent years It provides for a tax credit computed by reference to the standard rate of income tax in respect of an individual s earned income

https://www.citizensinformation.ie/en/money-and-tax/tax/income-tax...

Web Tax credit 2024 2023 Single person 1 875 1 775 Married person or civil partner 3 750 3 550 Employee Tax Credit formerly known as the PAYE tax credit 1 875 1 775 Earned Income tax credit 1 875 1 775 Widowed Parent Tax Credit Bereaved in 2023 Bereaved in 2022 Bereaved in 2021 Bereaved in 2020 Bereaved

Earned Income Tax Credit Chart INCOBEMAN

What Is The Earned Income Tax Credit

Taxes From A To Z 2019 E Is For Earned Income Tax Credit EITC The

Overview Of The Earned Income Tax Credit On EITC Awareness Day Tax

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

2021 Earned Income Credit For Head Of Household Essentially cyou 2022

What Is Earned Income Credit And Do I Qualify TheStreet

What Is Earned Income Credit And Do I Qualify TheStreet

Irs Poster 1 Earned Income Tax Credit Taxation

Earned Income Credit 2022 Chart Hot Sex Picture

2023 Schedule EIC Form And Instructions Form 1040

What Is Earned Income Tax Credit Ireland - Web 17 Jan 2023 nbsp 0183 32 Revenue will give you a Personal Tax Credit if you are resident in Ireland You may be able to claim additional tax credits depending on your personal circumstances Tax credit amounts for this year are listed in the Tax rates bands and reliefs charts The value of each tax credit for the previous four years are also in this chart