What Is Exempt From Sales Tax In Massachusetts What purchases are exempt from the Massachusetts sales tax While the Massachusetts sales tax of 6 25 applies to most transactions there are certain items that may be exempt from taxation This page discusses various sales tax exemptions in Massachusetts

Request a Motor Vehicle Sales or Use Tax Abatement with MassTaxConnect Pay Sales or Use tax Form ST 6 or Claim an Exemption Form ST 6E with MassTaxConnect You have reached the right spot to learn if items or services purchased in or brought into Massachusetts are taxable 101 1 Organizations Exempt From Sales Tax G L c 64H 6 d and e provide an exemption from sales tax for organizations that are Agencies of the United States sales made directly to the United States Government do not require an exemption certificate Agencies of the Commonwealth of Massachusetts or its political

What Is Exempt From Sales Tax In Massachusetts

What Is Exempt From Sales Tax In Massachusetts

https://www.sanpatricioelectric.org/sites/sanpatricioelectric/files/inline-images/SPEC SALES TAX FORM Example.jpg

Tax Exemption Letter Sample Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/497/332/497332566/large.png

Tx Form Sales Tax Exemption Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/29/382/29382322/large.png

In Massachusetts drop shipments are generally exempt from sales taxes Top Section 2 Taxability of Various Items in Massachusetts This table shows the taxability of various goods and services in Massachusetts If you are interested in the sales tax on vehicle sales see the car sales tax page instead Scroll to view the full table and f Sales of taxable services None of the exempt use provisions of M G L c 64H or M G L c 64I apply to sales of taxable services Therefore a purchaser may not present and a vendor may not accept an exempt use certificate with respect to a sale of a taxable service REGULATORY AUTHORITY

Sales of gas steam electricity and fuel are exempt from tax when the sales are made to certain exempt purchasers such as small businesses governmental organizations and charitable organizations or when sales are made for an exempt use including among others residential use certain industrial uses agricultural use and use Some goods are exempt from sales tax under Massachusetts law Examples include most non prepared food items some clothing and home heating fuels We recommend businesses review the laws and rules put forth by the Massachusetts DOR to stay up to date on which goods are taxable and which are exempt and under what conditions

Download What Is Exempt From Sales Tax In Massachusetts

More picture related to What Is Exempt From Sales Tax In Massachusetts

Tax Exempt Cert 1 Revelation Gardens

https://revelation-gardens.org/wp-content/uploads/2021/04/Tax-Exempt-Cert-1.png

Missouri Sales Tax Exemption Ebenezer Lutheran Church

https://unite-production.s3.amazonaws.com/tenants/ebenezer/pictures/225443/Ebenezer_Tax_Exemption_Certificate.png

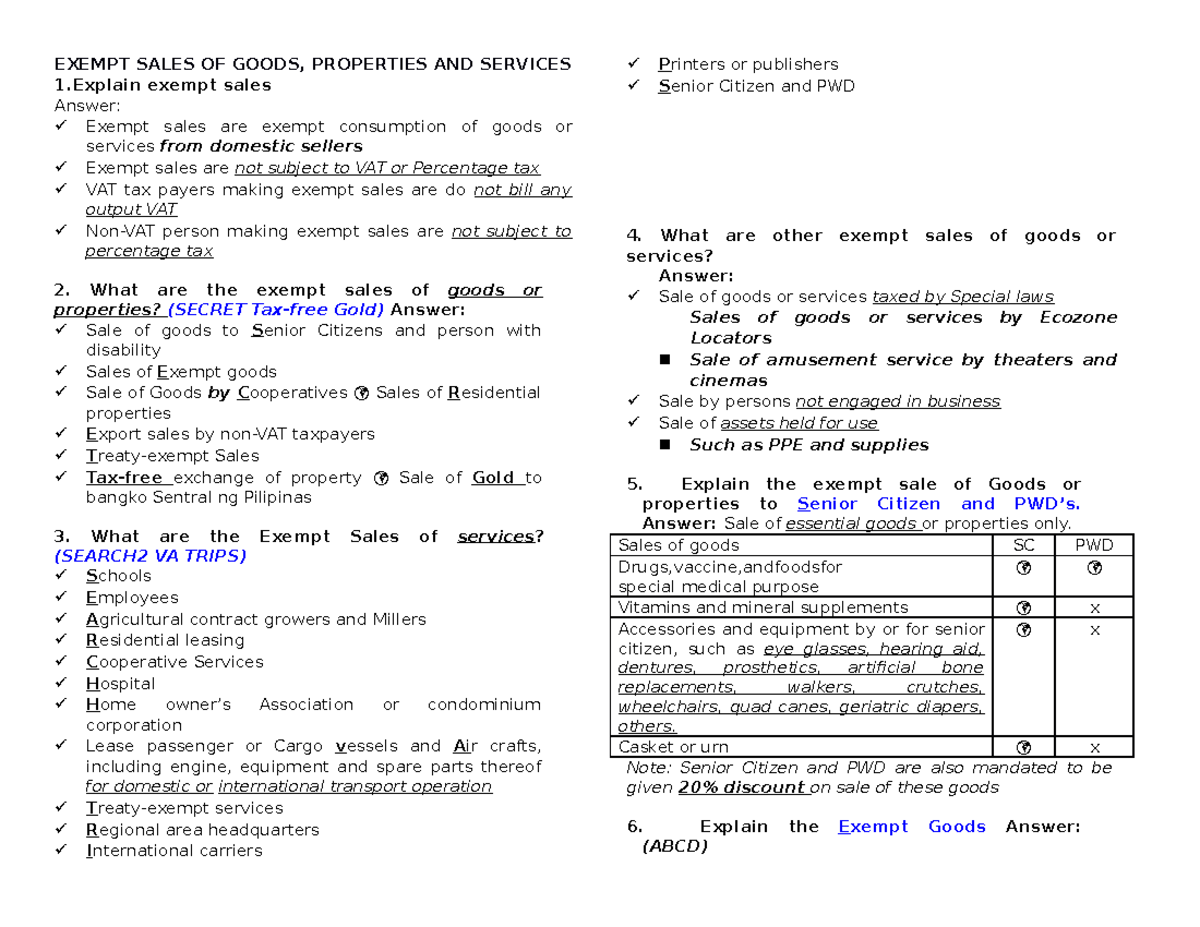

Exempt Sales OF Goods Business Taxation Summary EXEMPT SALES OF

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/31f52bc888044b3f9e0f2d9ccc5e7dbc/thumb_1200_927.png

Apparel and fabric Most clothing is exempt from Massachusetts sales tax However retailers must charge and collect sales tax on items that cost 175 or more For example if a piece of clothing costs 200 the retailer must Clothing Most items that cost less than 175 are exempt from sales tax including everyday shoes and even shoelaces items such as athletic cleats and ski boots however are taxable And for items that cost more

State Sales Tax Rate The Massachusetts state sales tax rate is 6 25 for most tangible personal property and some services This rate applies to the sale of goods and certain services within the state Massachusetts does not have local sales tax rates so the 6 25 rate applies throughout the entire state Filing Frequency 100 or less Annually 101 to 1 200 Quarterly 1 201 or more Monthly Further sales tax payers with more than 150 000 in sales tax liability in prior years must pay advance payments of at least 70 of tax due on or before the 25th of the same month where the sales tax is collected

What Is Exempt From Sales Tax In Florida

https://guestpostblogging.com/wp-content/uploads/2020/10/What-is-Exempt-from-Sales-Tax-in-Florida.jpg

Printable Exemption Form From Garnishment Printable Forms Free Online

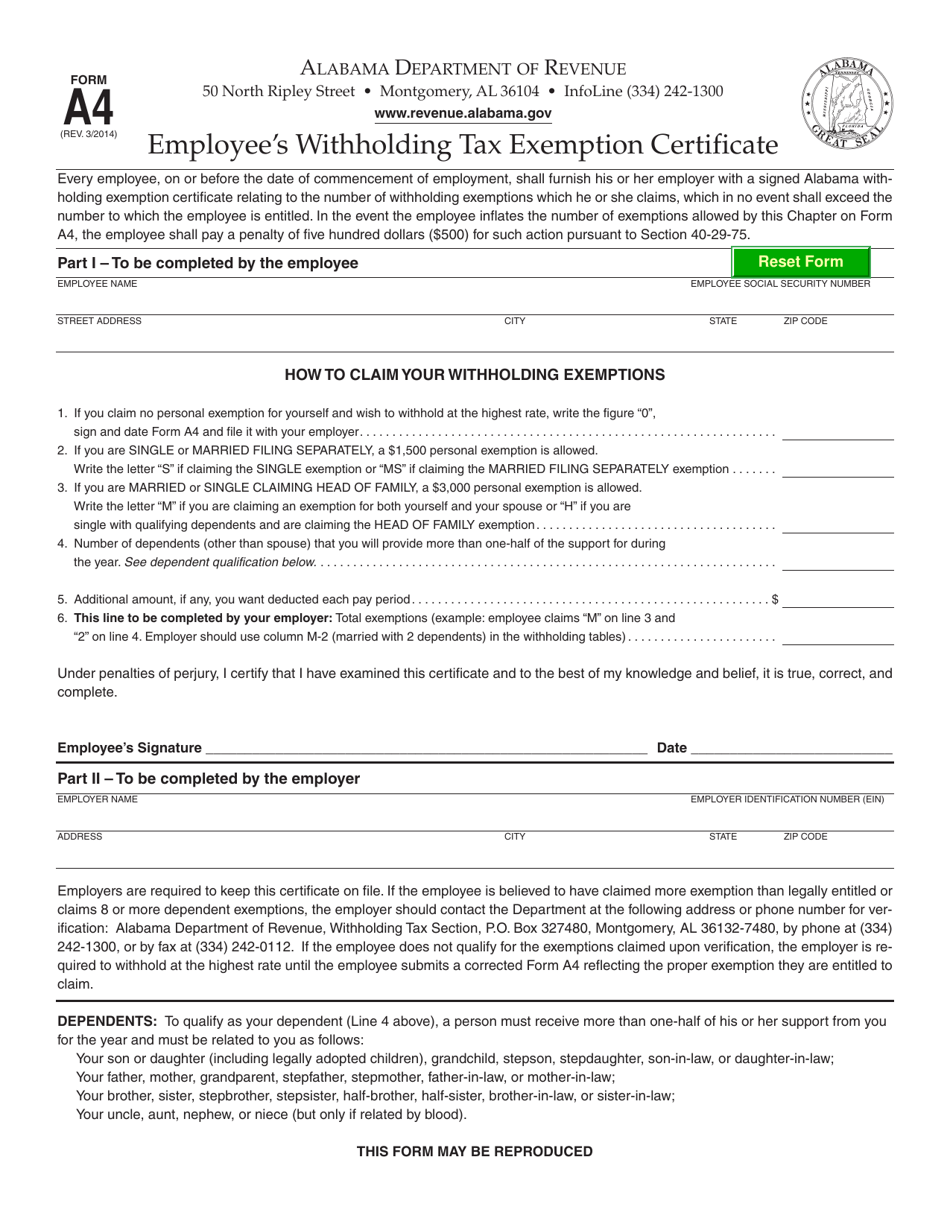

https://data.templateroller.com/pdf_docs_html/1999/19996/1999660/form-a4-employee-s-withholding-tax-exemption-certificate-alabama_print_big.png

https://www.salestaxhandbook.com/massachusetts/sales-tax-exemptions

What purchases are exempt from the Massachusetts sales tax While the Massachusetts sales tax of 6 25 applies to most transactions there are certain items that may be exempt from taxation This page discusses various sales tax exemptions in Massachusetts

https://www.mass.gov/sales-and-use-tax-for-individuals

Request a Motor Vehicle Sales or Use Tax Abatement with MassTaxConnect Pay Sales or Use tax Form ST 6 or Claim an Exemption Form ST 6E with MassTaxConnect You have reached the right spot to learn if items or services purchased in or brought into Massachusetts are taxable

Taxact Online Fillable Tax Forms Printable Forms Free Online

What Is Exempt From Sales Tax In Florida

_0.png)

Map State Sales Taxes And Clothing Exemptions Tax Foundation

What Is A Sales Tax Exemption Certificate In Florida Printable Form

Ca Sales Tax Exemption Certificate Resale Fill Online Printable

Nevada Tax Exemption Fill Online Printable Fillable Blank PdfFiller

Nevada Tax Exemption Fill Online Printable Fillable Blank PdfFiller

State And Local Sales Tax Rates Https taxfoundation publications

Sales Use Tax Exempt Form 2023 North Carolina ExemptForm

Texas Sales Tax Exemption Certificate From The Texas Human Rights

What Is Exempt From Sales Tax In Massachusetts - Massachusetts allows the use of uniform sales tax exemption certificates which are general exemption certificates that can be used across multiple states You can find more info about these uniform certificates at the bottom of this page How to use sales tax exemption certificates in Massachusetts