What Is Franking Credit Dividend Etax Online Tax Return 2023 What are the differences between franking credits and fully franked dividends We look at both to help better understand the tax implications

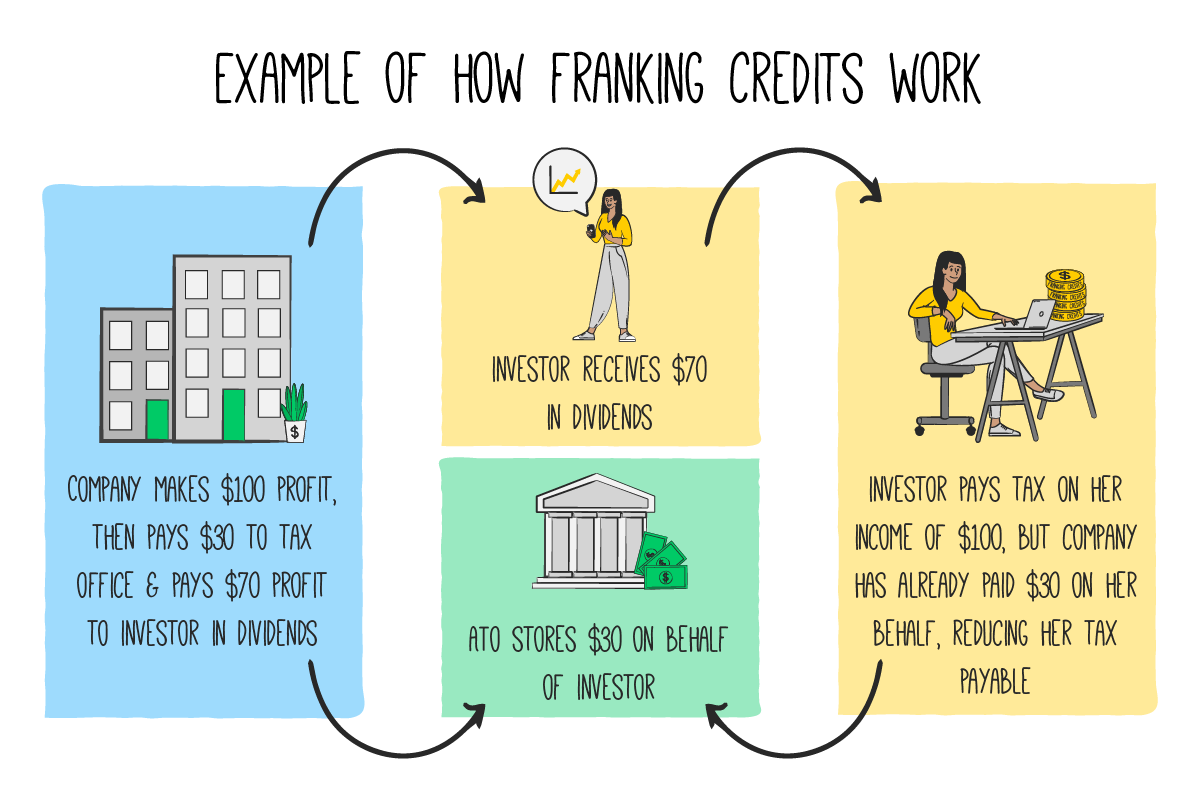

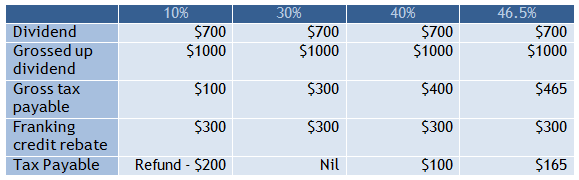

Franked dividends can be fully franked 100 or partially franked less than 100 The formula for calculating a franking credit for a fully franked dividend paying 1 000 by a company whose Franking credits represent the tax a company has already paid on any profit it distributes to shareholders as a dividend The credits reduce a shareholder s tax liability at the end of the financial year and can result in an ATO refund

What Is Franking Credit Dividend

What Is Franking Credit Dividend

https://www.flagshipinvestments.com.au/wp-content/uploads/2021/02/pexels-alesia-kozik-6770610-min-scaled-1.jpg

What Are Franking Credits and How They Can Help Australian Investors

https://plato.com.au/wp-content/uploads/Screen-Shot-2022-06-02-at-3.23.45-pm.png

/AustralianMoney-3db6a51011624aad8eabec9beaf48966.jpg)

What Are Franking Credits

https://www.investopedia.com/thmb/NsB4wBo9WlsVnNIB2ss7IgTDZbY=/2124x1411/filters:fill(auto,1)/AustralianMoney-3db6a51011624aad8eabec9beaf48966.jpg

The idea behind the tax credit is to help avoid double taxation of dividends Alternatively shareholders can receive franking credits as a tax refund Developed in 1987 franking credits are mainly used in the Australian tax system They were created to eliminate the double taxation imposed on corporate profits Franking Credits Dividend Amount 1 Company Tax rate Dividend amount Here the Dividend amount is the amount paid by the company as dividends The company tax rate refers to the rate which the company is entitled to pay as per the tax bracket

What s a franking credit What s dividend imputation And what s retiree tax Published February 10 2019 2 17pm EST Updated February 10 2019 5 52pm EST Author Peter Martin Visiting Assuming you purchase shares at 1 00 share and a dividend of 10 cents per share is payable each year you ll realise a 10 return on your investment each year you remain a shareholder Australian investors can use their dividend paying shares in

Download What Is Franking Credit Dividend

More picture related to What Is Franking Credit Dividend

What Are Franked Dividends And How Do Franking Credits Work

https://www.etax.com.au/wp-content/uploads/2019/09/Franked-dividends-and-franking-credits.jpg

ETF Tax Distributions DRPs And Franking Credits EVERYTHING Explained

https://www.bestetfs.com.au/wp-content/uploads/2022/07/franking-credits-tax-rask.png

Dividend Franking Credits Explained Man Of Many

https://manofmany.com/wp-content/uploads/2020/07/Franking-Credits.jpg

Franking credits allow Australian investors to claim a rebate from their share dividends and are essentially a rebate to prevent double taxation Franking credits are the amount of company tax that was paid on that dividend The shareholder completes their own personal tax return where they include both the dividend and the franking credit The shareholder receives a

Attached to these dividends will be a franking credit This is not a cash payment to you but is a credit used when you do your tax It reflects the fact that a 30 per cent tax has already been paid on the company profit that is Franked dividends are special kinds of dividends that help investors gain their share of profits from a company while earning tax credits These credits allow them to avoid double taxation and enjoy reduced tax burden

Franking Credits 101

https://assets.website-files.com/5dfab795d6da96ad7da843ed/5e1d089773c54c0feec39431_franking.jpeg

Dividends Payable Accounting Journal Entry

https://wsp-blog-images.s3.amazonaws.com/uploads/2022/04/05175309/Dividends-Payable-Journal-Entry-–-Debit-Credit.jpg

https://www.etax.com.au/franked-dividends-franking-credits

Etax Online Tax Return 2023 What are the differences between franking credits and fully franked dividends We look at both to help better understand the tax implications

https://www.investopedia.com/terms/f/frankeddividend.asp

Franked dividends can be fully franked 100 or partially franked less than 100 The formula for calculating a franking credit for a fully franked dividend paying 1 000 by a company whose

Dividends And Franking Credits Venture Private Advisory

Franking Credits 101

Franked Dividend Meaning Example Vs Unfranked Dividends

Dividend Franking Credits Explained

What The New Dividend Rules Mean For Franking Credits

Dividend Franking Credits Explained

Dividend Franking Credits Explained

BK Partners Your Chartered Accountant SMSF Using Dividend

Dividend Imputation System Franking Credits Explained Calculations

Explained What Are Franking Credits Rask HD YouTube

What Is Franking Credit Dividend - The idea behind the tax credit is to help avoid double taxation of dividends Alternatively shareholders can receive franking credits as a tax refund Developed in 1987 franking credits are mainly used in the Australian tax system They were created to eliminate the double taxation imposed on corporate profits