What Is Franking Credits Account Franking credits are essentially a tax rebate paid to investors with shares in Australian companies As the company you have invested in

What is Franking Credit Also known as imputation credit franking credit is a type of tax credit that enables a company to pass on the tax paid at the corporate level to its Franking credits effectively boost the return you receive from your Australian shares If you received 1 000 income from your investment property or interest on a term

What Is Franking Credits Account

What Is Franking Credits Account

https://www.flagshipinvestments.com.au/wp-content/uploads/2021/02/pexels-alesia-kozik-6770610-min-scaled-1.jpg

Company Franking Account

https://bristax.com.au/wp-content/uploads/2023/07/company-franking-account-bristax-tax-accountants-3.webp

What Are Franking Credits HD YouTube

https://i.ytimg.com/vi/cmHXncp8JhM/maxresdefault.jpg

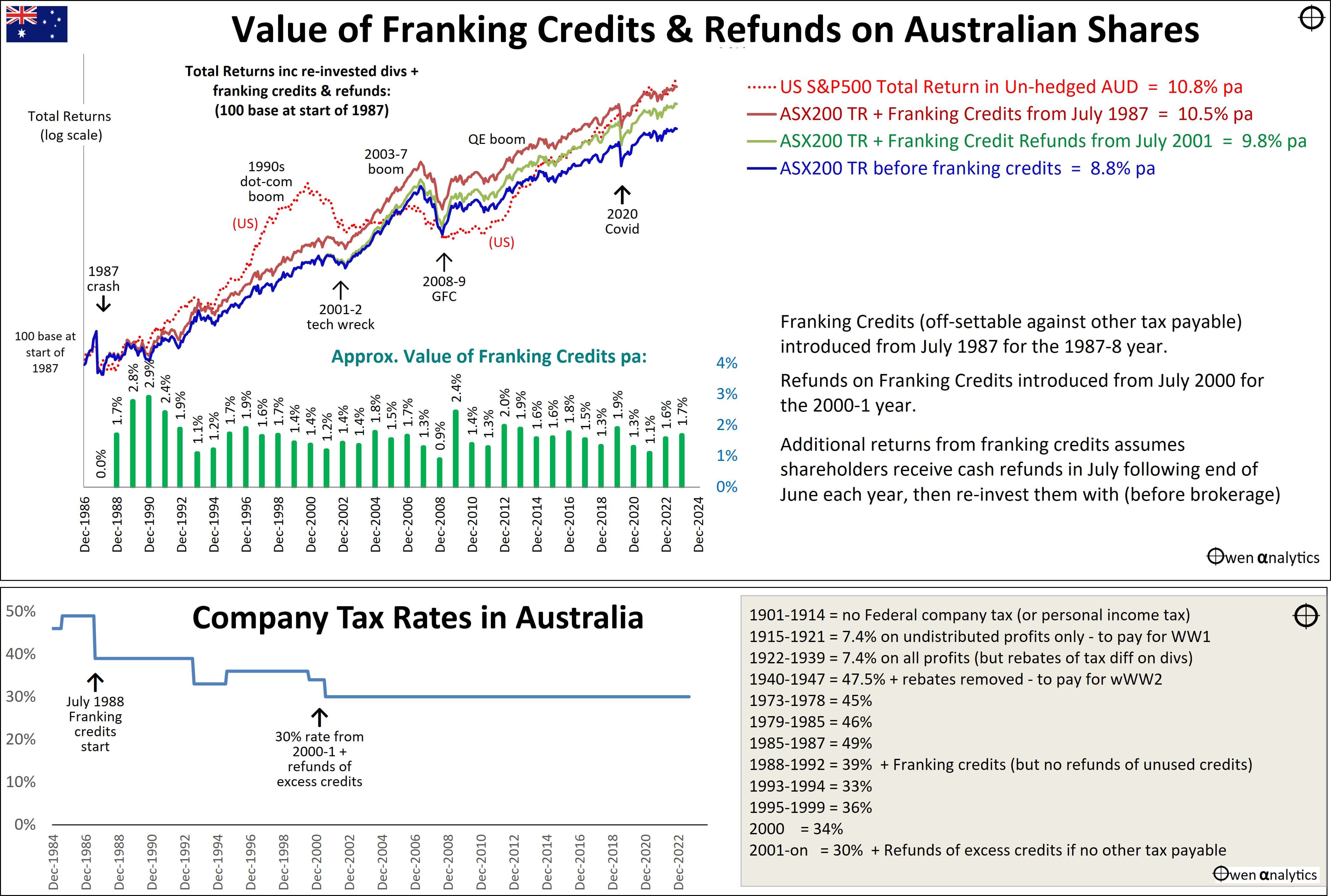

Franking credits represent the tax a company has already paid on any profit it distributes to shareholders as a dividend The credits reduce a shareholder s tax liability at the end of the financial year and can result in an A franking credit also known as an imputation credit represents the tax a business has already paid on its profits in Australia

Franking credits arise for shareholders when certain Australian resident companies pay income tax on their taxable income and distribute their after tax profits by way ATO franking credits explained This Rask Investor Guide explains what Australian Taxation Office ATO franking credits are and how to account for them in your tax return You re reading a free guide from Rask

Download What Is Franking Credits Account

More picture related to What Is Franking Credits Account

Franking Credits 101

https://assets.website-files.com/5dfab795d6da96ad7da843ed/5e1d089773c54c0feec39431_franking.jpeg

What Are Franking Credits YouTube

https://i.ytimg.com/vi/fP7eiLle3U8/maxresdefault.jpg

Franking Credits Explained Plus 1 Group

https://plus1group.com.au/wp-content/uploads/2021/10/franking-credit.png

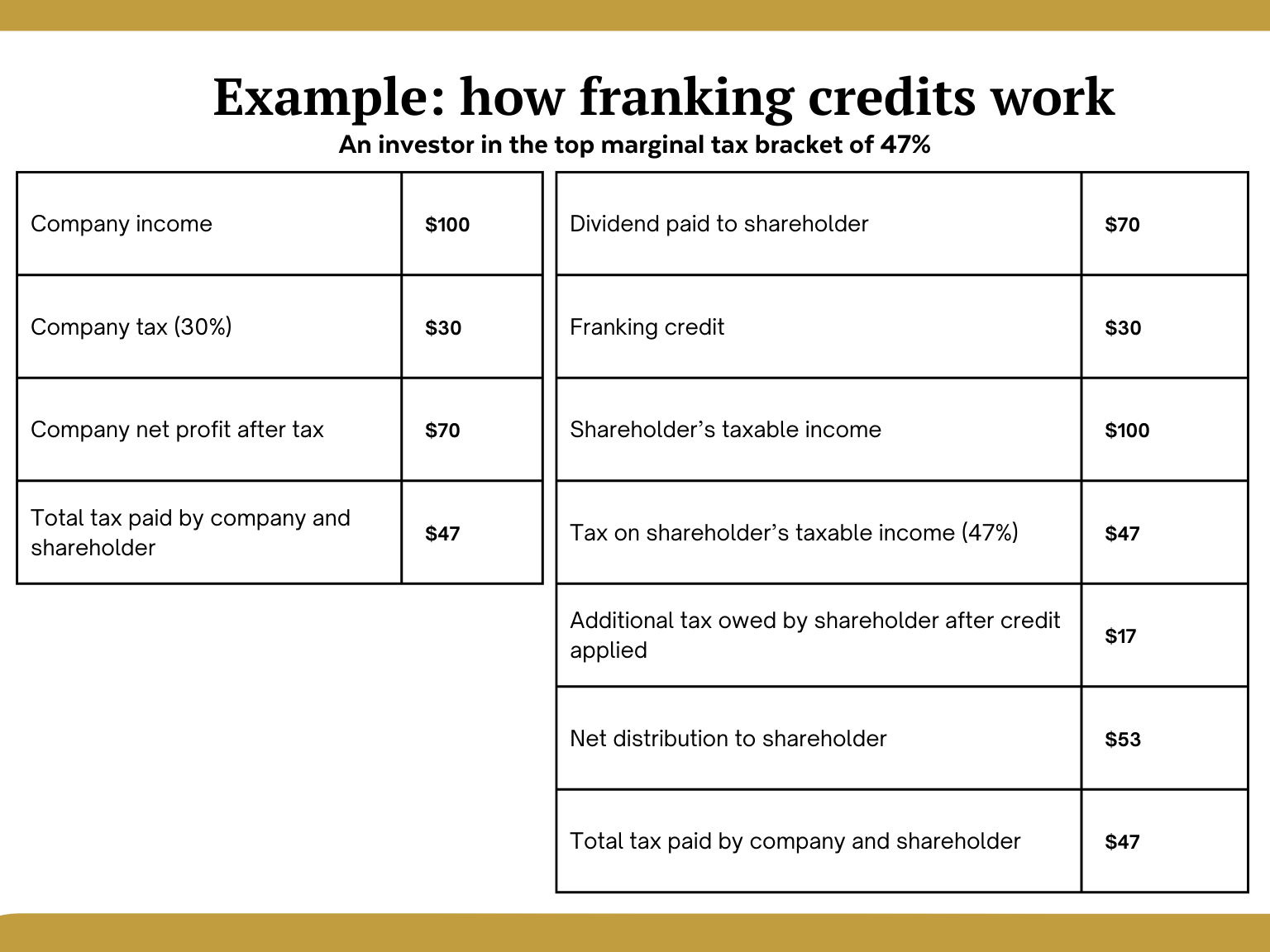

Put simply franking credits are designed to eliminate double taxation on company profits and dividends Here s how franking credits work When an Australian A dividend paid by an Australian company from their after tax profits is called a fully franked and the tax paid by the company on your dividend is known as Franking Credits For instance you have received a

A dividend paid by a company on after tax profits is known as a fully franked dividend The dividend notice a shareholder receives will include an item called franking credits This is Franking credits serve as a tax offset reducing the total income tax you must pay They decrease your tax liability leading to a lower tax bill or a higher refund This feature is

How Do Franking Credits Work For Dividends YouTube

https://i.ytimg.com/vi/fNYl-BUPW3k/maxresdefault.jpg

What Are Franking Credits Australia YouTube

https://i.ytimg.com/vi/BNe57sHuyeo/maxresdefault.jpg

https://www.forbes.com/.../what-are-frankin…

Franking credits are essentially a tax rebate paid to investors with shares in Australian companies As the company you have invested in

https://corporatefinanceinstitute.com/resources/accounting/franking-credit

What is Franking Credit Also known as imputation credit franking credit is a type of tax credit that enables a company to pass on the tax paid at the corporate level to its

What Are Franking Credits Pears Chartered Accountants Blog

How Do Franking Credits Work For Dividends YouTube

IMAP Institute Of Managed Account Professionals Frankly My Dear

What Are Franking Credits And How Do They Work Financial Autonomy

.png)

The Divide nd Of Income How To Invest For Franking Credits Sara

What The Frank Is Online Franking Document Network Services Ltd

What The Frank Is Online Franking Document Network Services Ltd

Time For Facts On Franking Credits The Australia Institute

Franking Credits

What Are Franking Credits And How Do They Work By West Court Family

What Is Franking Credits Account - A franking credit also known as an imputation credit represents the tax a business has already paid on its profits in Australia