What Is Fuel Tax Credit Rates Fuel tax credit rates for business Fuel tax credit rates change regularly so it s important to check and apply the correct rate They are indexed twice a year in

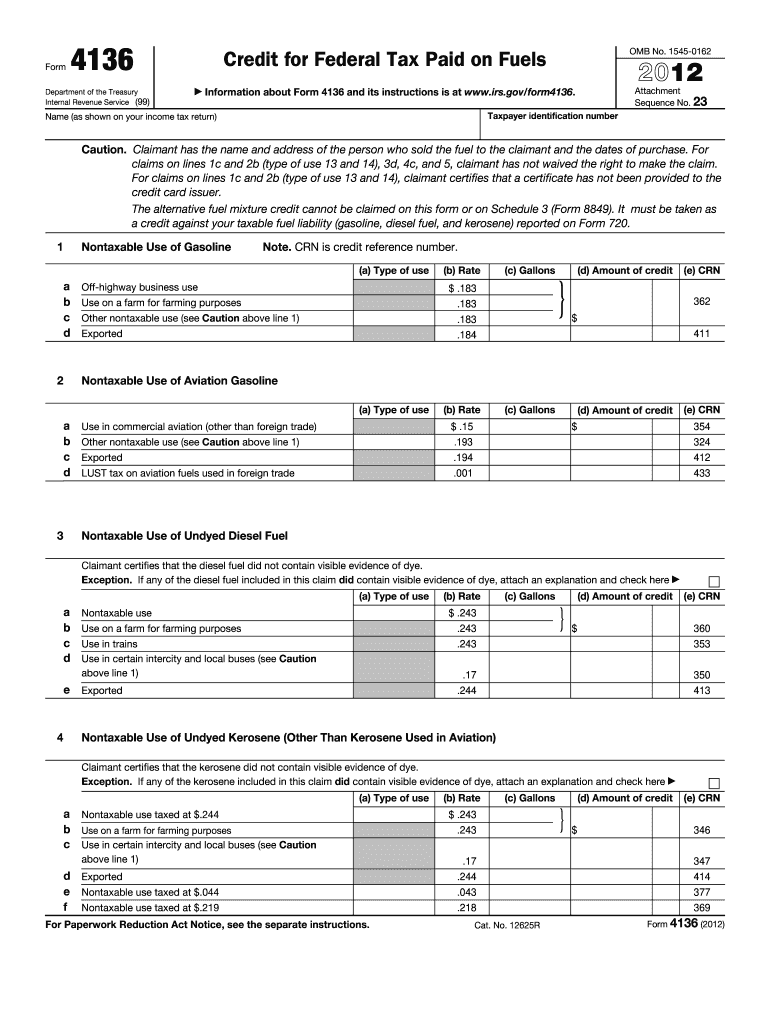

Fuel tax credit rates You need to use the rate that applies on the date you acquired the fuel Table 1 1 February 2023 to 30 June 2023 Table 2 29 September If you claim less than 10 000 in fuel tax credits each year there is a simpler way to calculate your claim through simplified fuel tax credits Check the fuel

What Is Fuel Tax Credit Rates

What Is Fuel Tax Credit Rates

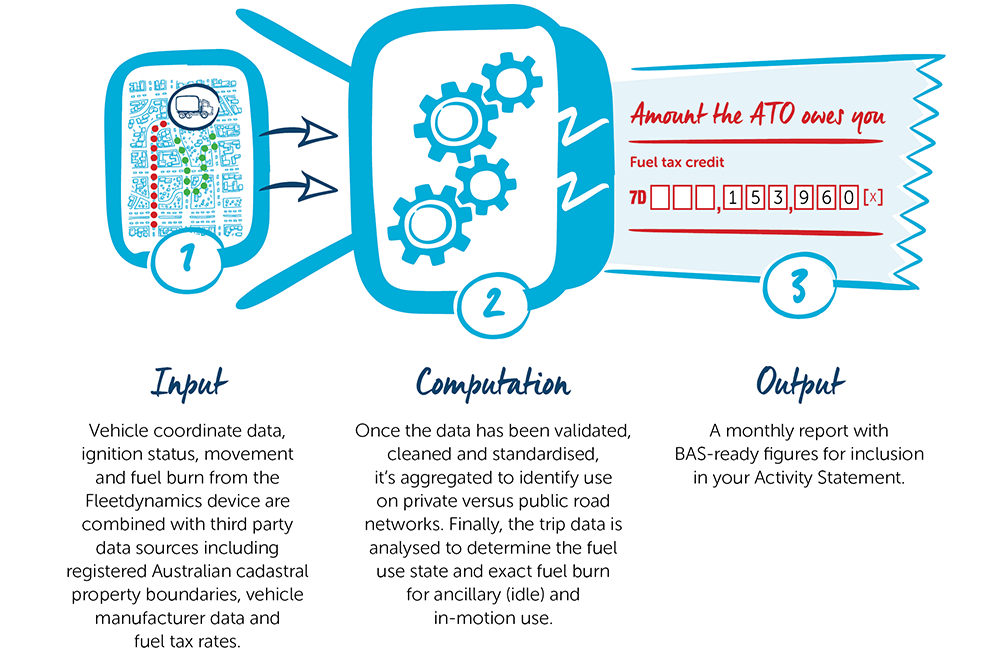

https://www.fleetcare.com.au/Fleetcare/media/Images/Infographic/Fuel-Tax-Credits-Infographic.png?ext=.png

Fuel Tax Credit UPDATED JUNE 2022

https://telematics-australia.com/wp-content/uploads/2020/06/Fuel-Tax-Credits.png

Fuel Tax Credits Explained BOX Advisory Services

https://boxas.com.au/wp-content/uploads/2021/05/Fuel-980x570.jpg

Public Law 117 169 136 Stat 1818 August 16 2022 commonly known as the Inflation Reduction Act retroactively reinstated and extended the following fuel tax credits The fuel tax credit is particularly beneficial for businesses engaged in activities such as transportation agriculture mining construction and manufacturing where fuel

Tax credits are available based on the fuel tax credit rate when you bought the fuel the business activities you are using the fuel for Check if you can 2 1 Fuel Tax Credits Rate 2 2 Fuel Tax Claims Under 10 000 3 Fuel Tax Credits And Your Tax Return 4 Key Takeaways What Are Fuel Tax Credits The Australian Tax Office allows you to

Download What Is Fuel Tax Credit Rates

More picture related to What Is Fuel Tax Credit Rates

Never Mine The Budget Here s The Fuel Tax Credit Scheme The

https://australiainstitute.org.au/wp-content/uploads/2022/03/table2.png

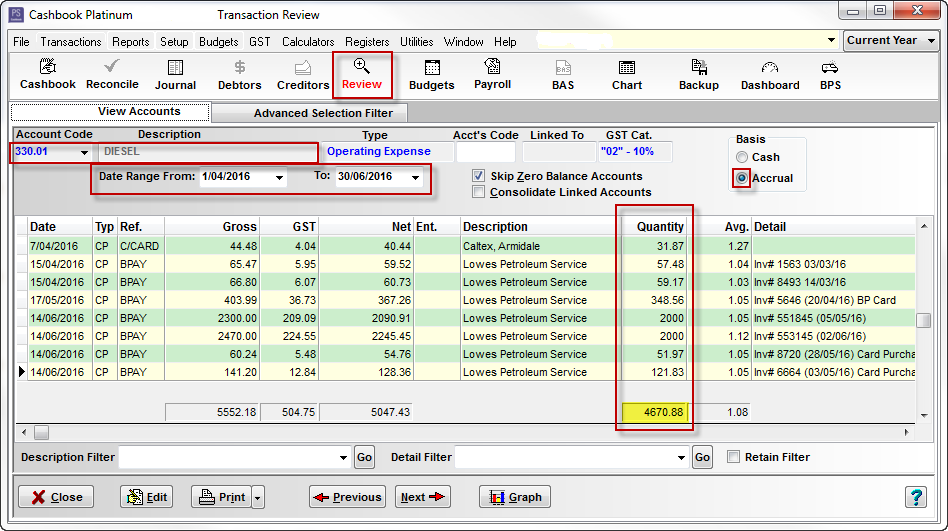

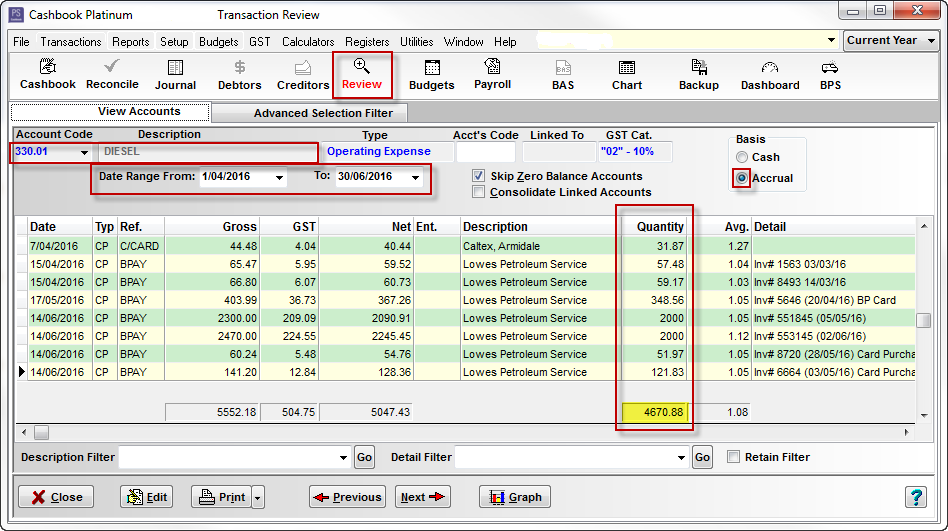

Automatic Fuel Tax Credit Calculation PS Support

https://support.practicalsystems.com.au/Content/Images/Uploads/e1rkatkt.4kr.jpg

Fuel Tax Credit Rates Have Increased Custom Accounting Pty Ltd

https://customaccounting.com.au/wp-content/uploads/2019/02/Fuel-Tax-Credits-have-increased.png

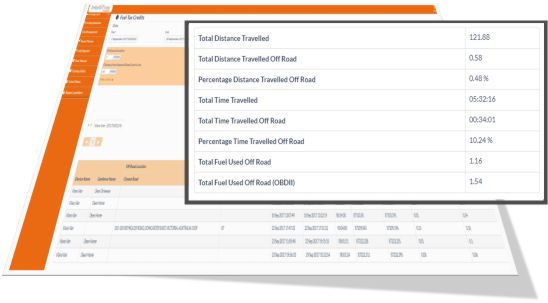

The one most familiar to taxpayers is probably the federal gas tax 18 4 cents gallon as of 2021 which pays for road projects across the country Certain uses The higher rate of fuel tax credits currently up to 42 7 cents per litre can be claimed from the Australian Tax Office ATO whenever your vehicles or equipment are idling driving or operating off a public road Note

Summary The fuel tax credit designed for businesses allows a dollar for dollar reduction in taxable income based on specific fuel costs This incentive Fuel Tax Credits provide businesses with a credit for the fuel tax excise or customs duty that s included in the price of fuel used in machinery plant equipment heavy vehicles

Calculating Fuel Tax Credit Manually PS Support

https://support.practicalsystems.com.au/Content/Images/Uploads/4yoruzmx.g3k.png

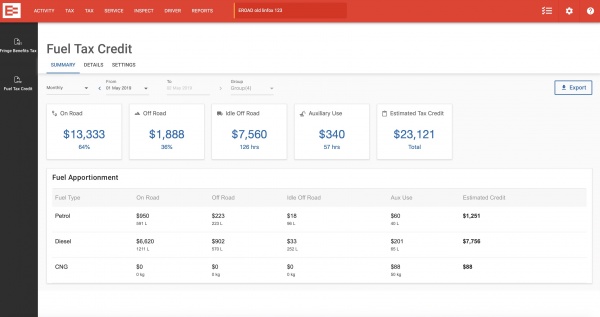

Fuel Tax Credits

https://help.eroad.com/assets/tax/_resampled/resizedimage600317-0519-ERD-AUS-FTC-Summary-Screen.jpg

https://www.ato.gov.au/.../rates-business

Fuel tax credit rates for business Fuel tax credit rates change regularly so it s important to check and apply the correct rate They are indexed twice a year in

https://www.ato.gov.au/businesses-and...

Fuel tax credit rates You need to use the rate that applies on the date you acquired the fuel Table 1 1 February 2023 to 30 June 2023 Table 2 29 September

Fuel Tax Credits Sand Stone

Calculating Fuel Tax Credit Manually PS Support

:max_bytes(150000):strip_icc()/FuelTaxCredit4-3V1-3b25b99dc86b458a877911fb8fea6c80.png)

Fuel Tax Credit Definition

Calculating Fuel Tax Credits Using GPS Tracking Data IntelliTrac

Credit For Federal Tax Paid On Fuels IRS Gov Fill Out And Sign

Fuel Tax Credit Rates Changes For Australian Businesses AFS

Fuel Tax Credit Rates Changes For Australian Businesses AFS

IFTA 400 Q4 4th Quarter 2014 Fuel Tax Rates MCRT IFTA Free Download

Fuel Tax Credit Calculator CairenAbsalat

Be Updated Fuel Tax Credit Rates Have Increased PreCent Services

What Is Fuel Tax Credit Rates - 2 1 Fuel Tax Credits Rate 2 2 Fuel Tax Claims Under 10 000 3 Fuel Tax Credits And Your Tax Return 4 Key Takeaways What Are Fuel Tax Credits The Australian Tax Office allows you to