What Is Homestead Tax Credit A homestead exemption is a legal provision that shields a home from some creditors following the death of a homeowner s

A homestead exemption is a state level tax break that reduces your property tax bill and protects you from creditors Learn who qualifies how to apply and how much you could save on your home The homestead credit limits the amount of assessment increase on which a homeowner will pay property taxes in that tax year on the one property actually used as the owner s

What Is Homestead Tax Credit

What Is Homestead Tax Credit

https://activerain.com/image_store/uploads/1/9/2/1/5/ar129156998451291.jpg

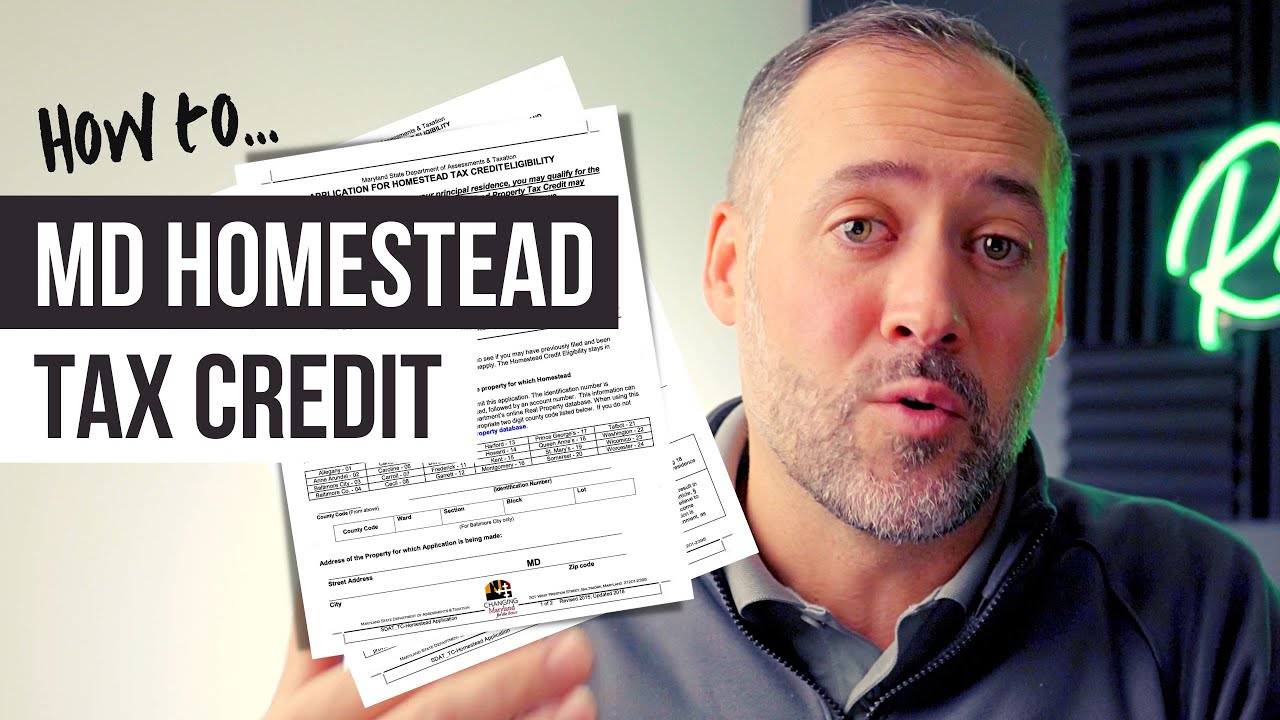

How To Apply For The Maryland Homestead Tax Credit YouTube

https://i.ytimg.com/vi/8wEkBOSzMtc/maxresdefault.jpg

Homestead Tax Credit Johnson County Iowa Homestead Tax Credit YouTube

https://i.ytimg.com/vi/Aucw0OHynR8/maxresdefault.jpg

What is the homestead property tax credit program The homestead property tax credit program is generally a dollar for dollar reduction in your property What Is the Homestead Tax Credit If your home significantly increases in what the state thinks is the value of it the Homestead Tax Credit can protect you from a major

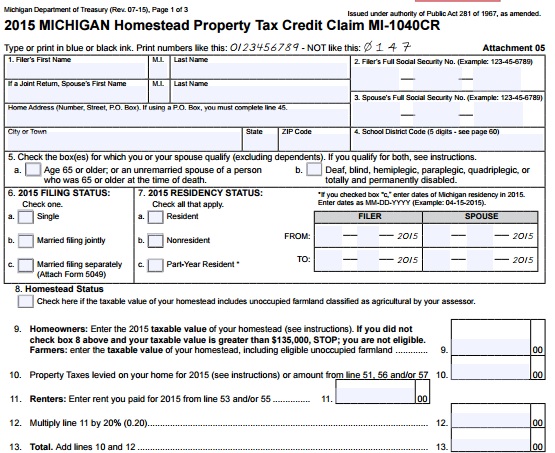

Learn how to claim a property tax credit if you are a qualified homeowner or renter in Michigan Find out the eligibility requirements the amount of the credit and the forms What is the Homestead Property Tax Credit Program To help homeowners deal with large assessment increases on their principal residence state law has established the

Download What Is Homestead Tax Credit

More picture related to What Is Homestead Tax Credit

Guide To The Michigan Homestead Property Tax Credit Action Economics

https://actionecon.com/wp-content/uploads/2016/06/Michigan-Homestead-Property-Tax-Credit.jpg

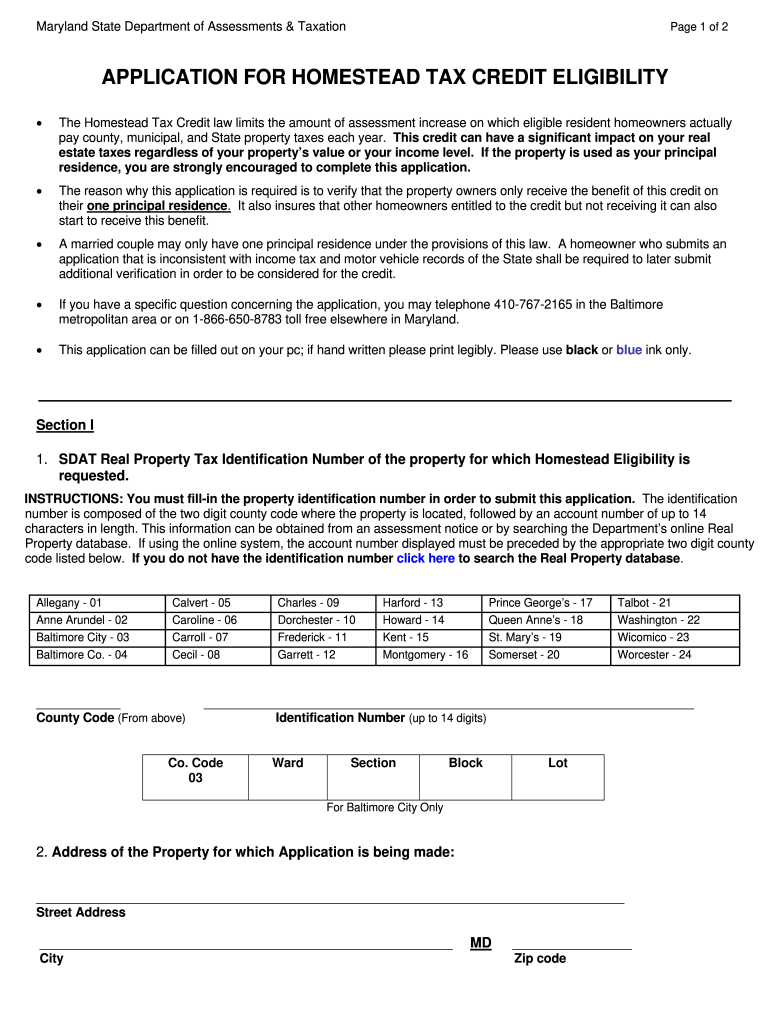

Baltimore City Homestead Tax Credit Form Fill Out And Sign Printable

https://www.signnow.com/preview/0/291/291671/large.png

Homestead Tax Credit Real Property AACD

https://www.arkansasassessment.com/media/1270/homestead.jpg?anchor=center&mode=crop&width=1200&height=600&rnd=131862330590000000

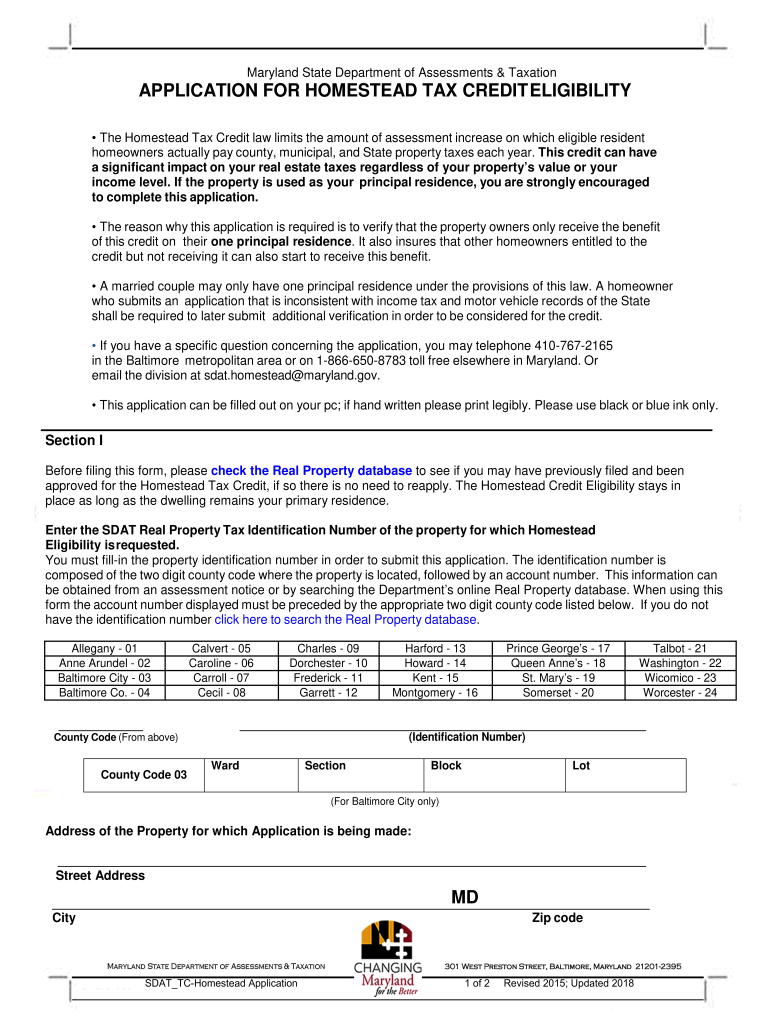

It is a credit applied against the tax due on the portion of the reassessment exceeding 10 from one year to the next The credit is based on the 10 limit for purposes of the State property tax and 10 or less for If you re a homeowner and filing for bankruptcy the homestead exemption can be used to shield your home s equity from creditors who want it as payment for outstanding obligations Simply put

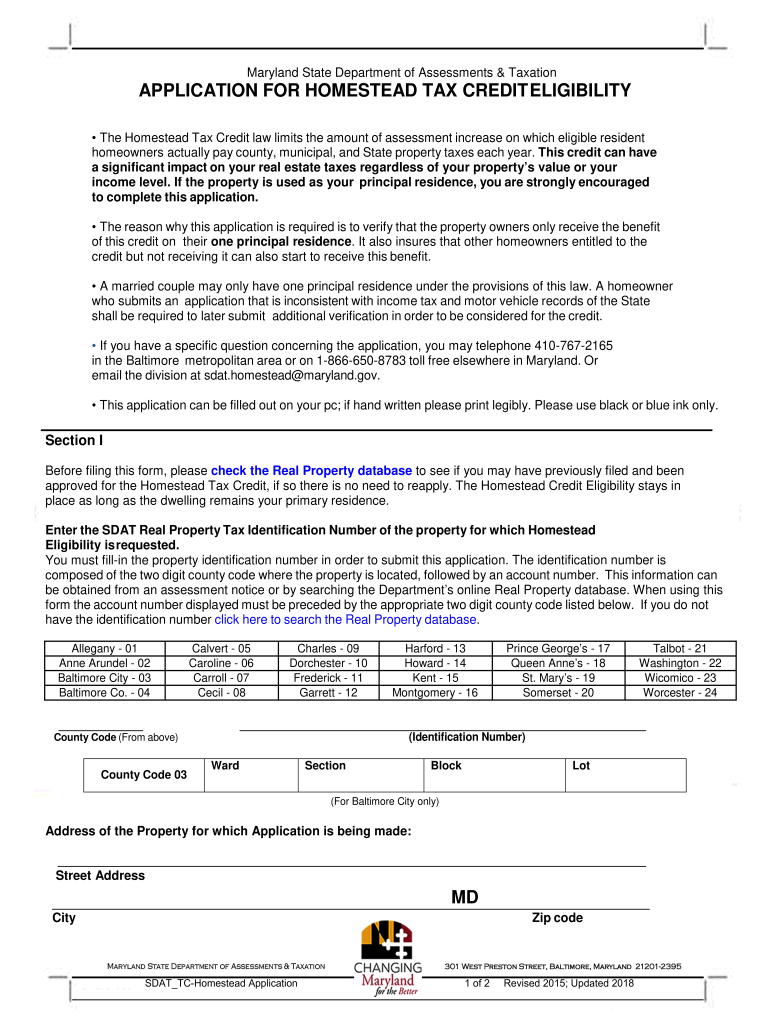

The Homestead Tax Credit Eligibility Application is needed to ensure that homeowners receive the Homestead credit only on their principal residence You can What You Should Know In order to claim the homestead credit you or your spouse must meet certain qualifications including one of the following You or your spouse if

Homestead Tax Credit Maryland Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/463/551/463551018/large.png

Iowa Homestead Tax Credit Morse Real Estate Iowa And Nebraska Real Estate

http://www.morse-re.com/agent_files/homestead-exemption-mre.png

https://www.investopedia.com/terms/h/…

A homestead exemption is a legal provision that shields a home from some creditors following the death of a homeowner s

https://www.lendingtree.com/home/mo…

A homestead exemption is a state level tax break that reduces your property tax bill and protects you from creditors Learn who qualifies how to apply and how much you could save on your home

Homestead Tax Credit Charter Title

Homestead Tax Credit Maryland Form Fill Out And Sign Printable PDF

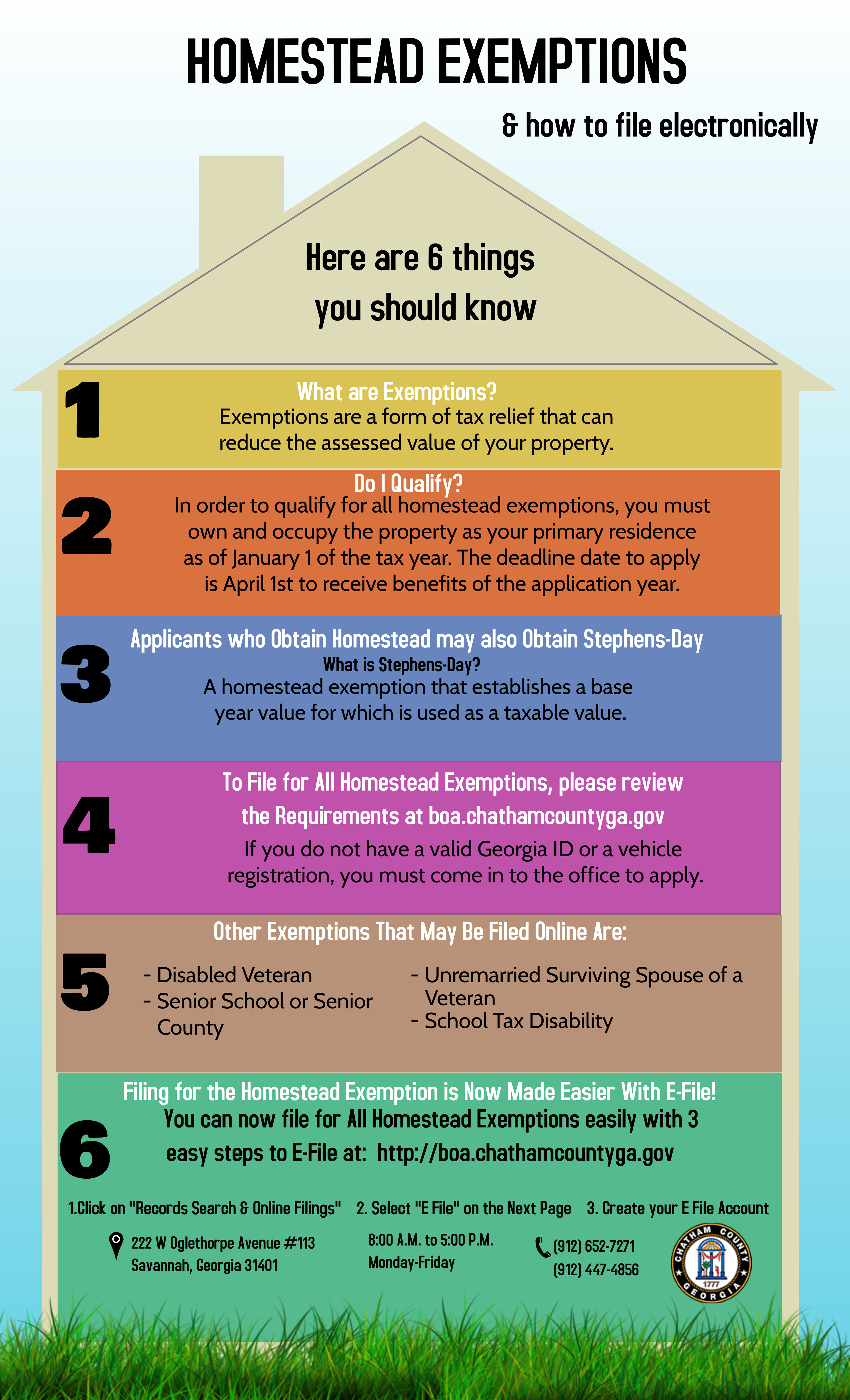

Board Of Assessors Homestead Exemption Electronic Filings

Homestead Tax Credit Frederick Real Estate Frederick Land Home

Homestead Tax Credit In MD 2012

Progressive Charlestown Introducing The Magic Tax Calculator For The

Progressive Charlestown Introducing The Magic Tax Calculator For The

The Maryland Homestead Tax Credit Eligibility Deadline

Texas Homestead Tax Exemption Cedar Park Texas Living

Don t Forget To File Your Homestead Exemption Your Application Must Be

What Is Homestead Tax Credit - What Is the Homestead Tax Credit If your home significantly increases in what the state thinks is the value of it the Homestead Tax Credit can protect you from a major