What Is Income Tax Section 10 10d Web 16 Apr 2020 nbsp 0183 32 Exclusions under section 10 10D of the Income Tax Act On the life of another person who is or was the employee of the first

Web 19 Jan 2022 nbsp 0183 32 Clause 10D of section 10 of the Income tax Act 1961 the Act provides for income tax exemption on the sum received under a life insurance policy including Web 27 M 228 rz 2023 nbsp 0183 32 Tax Benefits of Section 10 of Income Tax Act When considering tax benefits of insurance we commonly consider the

What Is Income Tax Section 10 10d

What Is Income Tax Section 10 10d

https://navi.com/blog/wp-content/uploads/2022/01/section-10-of-the-income-tax-act.jpg

Section 10 10D Of Income Tax Act LIP Amount Received From LIP Taxable

https://i.ytimg.com/vi/oea7tKa-_qQ/maxresdefault.jpg

Section 10 10d Meaning Eligibility Exclusions And More

https://housing.com/news/wp-content/uploads/2023/02/What-is-Section-1010D-of-Income-Tax-Act-fe.jpg

Web 19 Okt 2023 nbsp 0183 32 Individuals can claim tax exemption on the sum assured and accrued bonus if any received through their life insurance policy claim under Section 10 10D of the Web 11 Jan 2023 nbsp 0183 32 Section 10 10D Of Income Tax Act Under this section you get an exemption for the income you receive from a life insurance policy or bonus Section 10

Web Section 10 10D of the IT Act 1961 provides tax savings benefits The income amount you receive from your life insurance policy can be exempted from tax under this Web Section 10 10D of Income Tax Act 1961 provides for income tax exemption on the sum received under a life insurance policy including any sum allocated by way of bonus on

Download What Is Income Tax Section 10 10d

More picture related to What Is Income Tax Section 10 10d

Guidelines Under Clause 10D Section 10 Of Income tax Act 1961

https://taxguru.in/wp-content/uploads/2022/01/Guidelines-under-clause-10D-section-10-of-Income-tax-Act-1961.jpg

Section 10 Of Income Tax Act Exemptions Deductions How To Claim

https://www.godigit.com/content/dam/godigit/directportal/en/contenthm/section-10-under-income-tax-act.jpg

Understanding Section 10 10D Of The Income Tax Act

https://margcompusoft.com/m/wp-content/uploads/2023/03/1-27-1024x576.jpg

Web 16 M 228 rz 2023 nbsp 0183 32 Here are the primary provisions under Section 10 10D of Income Tax Act 1961 Tax exemptions are applicable for payouts from life insurance claims Such Web Section 10 10D of the Income Tax Act is an important provision that offers tax benefits to individuals who have purchased life insurance policies The provision is

Web Section 10 10D A life insurance policy provides financial protection to a family after the policyholder s demise It helps the family members meet their financial needs and Web 6 Sept 2023 nbsp 0183 32 Section 10 10D contains regulations that are specific to tax deductions on claims such as maturity and death benefits which include all kinds of bonuses from life

Section 10 Of Income Tax Act Know Section 10 10d Benefits

https://www.maxlifeinsurance.com/content/dam/corporate/images/Tax-Benefits-of-Section-10-10d_3.jpg

Section 10 10D Of The Income Tax Act Benefits And Exemptions Max

https://www.maxlifeinsurance.com/content/dam/corporate/images/10-10d_1.jpg

https://taxguru.in/income-tax/section-10-10…

Web 16 Apr 2020 nbsp 0183 32 Exclusions under section 10 10D of the Income Tax Act On the life of another person who is or was the employee of the first

https://taxguru.in/income-tax/guidelines-clause-10d-section-10-income...

Web 19 Jan 2022 nbsp 0183 32 Clause 10D of section 10 of the Income tax Act 1961 the Act provides for income tax exemption on the sum received under a life insurance policy including

Section 10 Of Income Tax Act Know Section 10 10d Benefits

Section 10 Of Income Tax Act Know Section 10 10d Benefits

CBDT Issued Guidelines Under Clause 10D Section 10 Of The Income Tax

CBDT Issue Guidelines Under Clause 10D Section 10 Of The Income tax

Section 10 Of Income Tax Act Guide To Section 10 IIFL Insurance

Section 10D Of Income Tax Act 1961 Section 10d Income Tax 1961

Section 10D Of Income Tax Act 1961 Section 10d Income Tax 1961

Section 10 10D Income Tax Tax On LIC Policy CA TARIQUE KHICHI

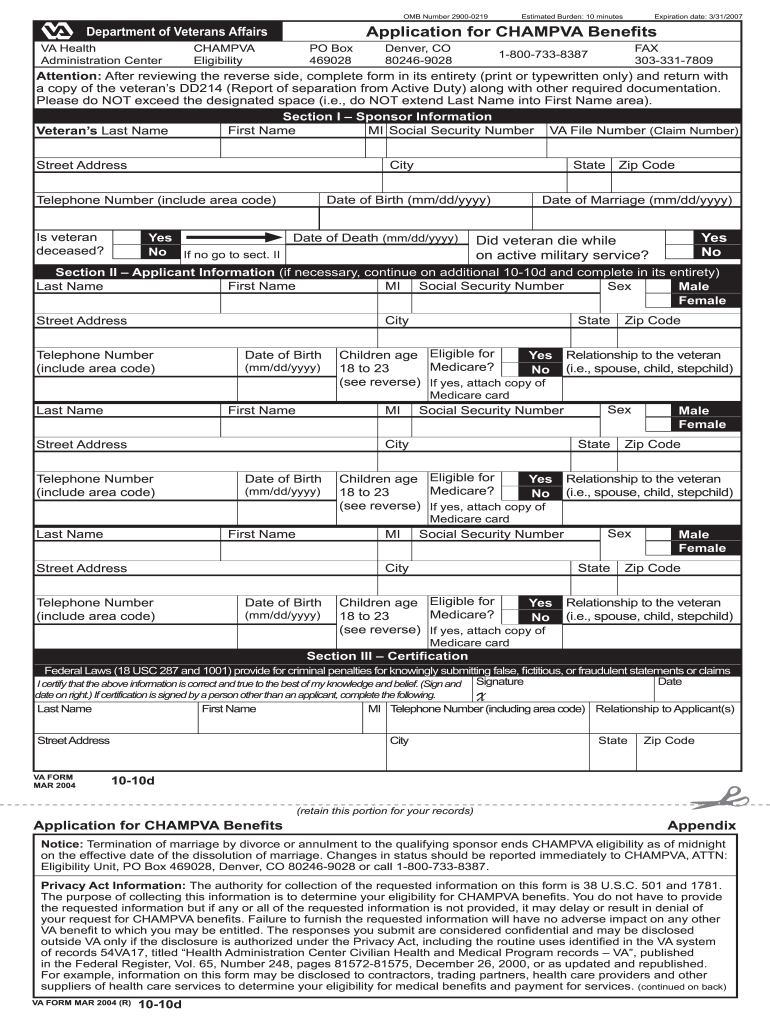

Va Form 10 10d 2020 2022 Fill And Sign Printable Template Online US

Section 10 Of Income Tax Act Everything To Know Moneymint

What Is Income Tax Section 10 10d - Web Section 10 10D of Income Tax Act 1961 provides for income tax exemption on the sum received under a life insurance policy including any sum allocated by way of bonus on